April, 28 2023, 02:57pm EDT

While Thorough, Fed Report Refuses To Name Names On SVB Failure

In response to the Federal Reserve releasing a report assessing its regulatory and supervisory failures in the runup to Silicon Valley Bank (SVB)’s collapse, Revolving Door Project Executive Director Jeff Hauser issued the following statement:

“It will take a few days to fully process the Fed’s self-investigation. On an initial read, though, we applaud the report’s thoroughness and the Fed’s willingness to release primary sources and confidential information. That said, one glaring blind spot does jump out: the complete absence of the names ‘Quarles,’ ‘Barr,’ ‘Powell,’ or any other actual member of the Federal Reserve Board of Governors from the main text of the report.”

“The narrative that emerges is that in the years before SVB’s collapse, the Board of Governors began instructing supervisory staff to go much easier on regulated banks, including SVB. The hierarchical nature of the Fed, and unclear delineation of authority between the Board in DC and the Reserve Banks nationwide, meant that Reserve Bank staff often worked alongside, deferred to, and were supervised by Board staff, who answer to the Governors. This substantially shifted overall Fed supervision, including of SVB, in a laissez-faire direction.”

“That’s far from the only factor the report identifies, but it is one that is both entirely within Fed officials’ control, and one which has substantial ripple effects across the other issues — for example, SVB’s inflated grades on supervisory reports for years before the collapse appears to be heavily influenced by the Fed’s laissez-faire culture at the time, and SVB’s artificially high grades on one examination often led to less rigor from supervisory staff on its next examination.”

“If there is a problem coming from the top, an independent, thorough report would have named who at the top is to blame. Readers can strongly infer that former Vice Chair for Supervision Randal Quarles was a major player, and we echo Accountable.US’s calls for him to testify before Congress. But the Vice Chair for Supervision does not manage the staff of the Federal Reserve without the Chair’s approval, meaning Jerome Powell is ultimately responsible. Moreover, Michael Barr himself had eight months in office to reverse course and act on key priorities before the SVB collapse. Why did he not revert supervisory staff to practices at least as stringent and skeptical as under Daniel Tarullo?”

“We raised concerns ahead of the report’s release that its structure — effectively, Barr and Powell investigating themselves — could bias its findings and focus. While we are grateful for the work that evidently went into this report, we reiterate our call for a truly independent investigation conducted by people free to hold the individuals with ultimate responsibility for these regulatory failures accountable: the leaders of the Federal Reserve.”

The Revolving Door Project (RDP) scrutinizes executive branch appointees to ensure they use their office to serve the broad public interest, rather than to entrench corporate power or seek personal advancement.

LATEST NEWS

Sanders Gets GOP Leader to Agree to Work On Medicare Covering Dental, Hearing, and Vision

The exchange on the Senate floor came after the Finance Committee chair blocked passage of the Vermont Independent's bill.

Mar 11, 2025

U.S. Senate Finance Committee Chair Mike Crapo on Tuesday blocked passage of Sen. Bernie Sanders' legislation to expand Medicare to cover dental, hearing, and vision care for tens of millions of American seniors, but the bill's sponsor got the panel leader to publicly agree to further discuss the issue.

Sanders (I-Vt.) took to the Senate floor Tuesday afternoon to ask for unanimous consent to pass the Medicare Dental, Hearing, and Vision Expansion Act, which is spearheaded in the House of Representatives by Congressman Lloyd Doggett (D-Texas).

"In the richest country in the history of the world, it is unacceptable that millions of seniors are unable to read because they can't afford eyeglasses, can't have conversations with their grandchildren because they can't afford hearing aids, and have trouble eating because they can't afford dentures," Sanders said in a statement.

"That should not be happening in the United States of America in the year 2025," he continued. "The time is long overdue for Congress to expand Medicare to include comprehensive coverage for the dental, vision, and hearing care that our seniors desperately need."

After Crapo (R-Idaho) rose to stop the bill from advancing, he and Sanders had a brief exchange in which the Republican agreed to working on achieving the "outcome" of the federal healthcare program covering dental, vision, and hearing.

In Sanders' remarks on the Senate floor about his bill, he sounded the alarm about efforts by President Donald Trump, billionaire Elon Musk, and congressional Republicans to cut government healthcare programs and Social Security.

"Yeah, we have more nuclear weapons than any other country, we have more billionaires than any other country, but we also have one of the highest rates of senior poverty of any country on Earth. We might want to get our priorities right," said Sanders, who has long fought for achieving universal healthcare in the United States via his Medicare for All legislation.

"While my Republican colleagues would like to make massive cuts to Medicaid in order to provide more tax breaks to billionaires, some of us have a better idea," he said. "We think that it makes more sense to substantially improve the lives of our nation's seniors by expanding Medicare to cover dental, vision, and hearing benefits."

To pay for his expansion plan, Sanders calls for ensuring that Medicare pays no more for prescription drugs than the Department of Veterans Affairs and addressing the tens of billions of dollars that privately administered Medicare Advantage plans overcharge the federal government annually.

In a statement about the bill, Doggett highlighted that "this expanded care could help prevent cognitive impairment and dementia, worsened chronic disease, and imbalance leading to falls with deadly consequences. This is an essential step to fulfilling the original promise of Medicare—to assure dignity and health for all."

Welcoming their renewed push for Medicare expansion, Public Citizen healthcare advocate Eagan Kemp declared that "at the same time Trump and his cronies in Congress try to rip healthcare away from millions and push for further privatization of Medicare, Sen. Sanders and Rep. Doggett are showing what one of our top priorities in healthcare should be—improving traditional Medicare."

"The introduction of this legislation is an important step to ensure Medicare enrollees can access the care they need, and we hope that Congress will act quickly to pass these commonsense reforms," Kemp added. "Healthcare is a human right."

Earlier Tuesday, in anticipation of Crapo's committee holding a confirmation hearing for Dr. Mehmet Oz, the former television host Trump has nominated to lead the Centers for Medicare and Medicaid, Public Citizen released a research brief about the hundreds of millions of dollars Medicare Advantage companies have spent on lobbying.

"If Oz is confirmed as the CMS administrator," Kemp warned, "attacks on traditional Medicare are likely to move into overdrive."

Keep ReadingShow Less

Trump Lifts Ukraine Aid Pause After Kyiv Agrees to Cease-Fire Proposal

Ukraine's foreign minister called the endorsement a "step that proves Ukraine is ready to move forward on the path to a just end to the war."

Mar 11, 2025

The Trump administration said Tuesday that it would resume military aid to and intelligence-sharing with Ukraine after that country's leadership endorsed a U.S. proposal for a 30-day cease-fire in the war defending against Russia's three-year invasion and occupation.

The Washington Postreports that U.S., Ukrainian, and Saudi officials met for eight hours on Tuesday in Jeddah, Saudi Arabia. No Russian officials were present at the negotiations.

"We're going to tell them this is what's on the table. Ukraine is ready to stop shooting and start talking," U.S. Secretary of State Marco Rubio said after the meeting. "And now it'll be up to them to say yes or no. If they say no, then we'll unfortunately know what the impediment is to peace here."

Ukraine has agreed to a 30 day ceasefire. Incredible work by Trump team. Now if Russia agrees, Trump may have gotten cease fires in the Middle East and Europe in his first 60 days. Nobel Peace Prize worthy: pic.twitter.com/lYogXVP8wj

— Clay Travis (@ClayTravis) March 11, 2025

White House National Security Adviser Michael Waltz said following the talks that "the Ukrainian delegation today made something very clear, that they share President [Donald] Trump's vision for peace, they share his determination to end the fighting, to end the killing, to end the tragic meat grinder of people."

Ukrainian Foreign Minister Andrii Sybiha called his country's endorsement of the cease-fire proposal a "step that proves Ukraine is ready to move forward on the path to a just end to the war."

"Ukraine is not an obstacle to peace; it is a partner in its restoration," Sybiha added.

U.S. officials said the cease-fire proposal will now be sent to Russia for approval. It is unclear whether Russian President Vladimir Putin will accept the offer.

"The ball is now in their court," Rubio said of the Russians.

Buoyed by Western support but stretched thin and vastly outmanned and outgunned, Ukrainian forces have been struggling to repel Russia's invasion and hold Russian territory they seized in the Kursk region, with an eye toward potential future territorial exchanges.

On Tuesday, Ukrainian forces launched a massive drone attack on Moscow. Three people were reportedly killed and six others were injured when debris struck a meat processing facility.

Tuesday's development marked a dramatic turnaround from just two weeks ago, when Trump and Vice President JD Vance lambasted Ukrainian President Volodymyr Zelenskyy during a highly contentious White House meeting that was followed by a suspension of all U.S. military assistance and intelligence-sharing with Kyiv.

The U.S. has "provided $66.5 billion in military assistance since Russia launched its premeditated, unprovoked, and brutal full-scale invasion of Ukraine on February 24, 2022, and approximately $69.2 billion in military assistance since Russia's initial invasion of Ukraine in 2014," according to a State Department fact sheet dated March 4.

Keep ReadingShow Less

Watchdog Exposes Millions in Medicare Advantage Lobbying Ahead of Dr. Oz Hearing

"If Oz is confirmed as the CMS administrator, attacks on traditional Medicare are likely to move into overdrive," said one advocate, calling to strengthen the program, "not weaken it through further privatization."

Mar 11, 2025

The watchdog group Public Citizen on Tuesday released a research brief about the hundreds of millions of dollars Medicare Advantage companies have spent on lobbying ahead of a U.S. Senate confirmation hearing for Dr. Mehmet Oz.

Oz, a heart surgeon and former television host, is President Donald Trump's nominee to run the Centers for Medicare and Medicaid (CMS)—an agency in the U.S. Department of Health and Human Services, which is led by conspiracy theorist Robert F. Kennedy Jr.

Health experts and others have sounded the alarm about Oz since Trump announceded his nomination in November, with many opponents highlighting the doctor's investments in companies with direct CMS interests and his push to expand Medicare Advantage when he unsuccessfully ran as a Republican to represent Pennsylvania in the U.S. Senate in 2022.

Medicare Advantage is a type of CMS-approved health insurance plan from a private company that seniors can choose for medical coverage instead of government-administered Medicare. Critics often call it a "profit-seeking healthcare scam."

Public Citizen's brief points out that last year, "more than half of all seniors eligible for Medicare were enrolled" in these private plans that "cost taxpayers hundreds of billions of dollars and deliver inferior care compared to traditional Medicare."

"Since their inception in 2003, Medicare Advantage plans are estimated to have cost taxpayers more than $600 billion in overpayments," the document notes. "These overpayments are expected to grow to $1 trillion over the next decade."

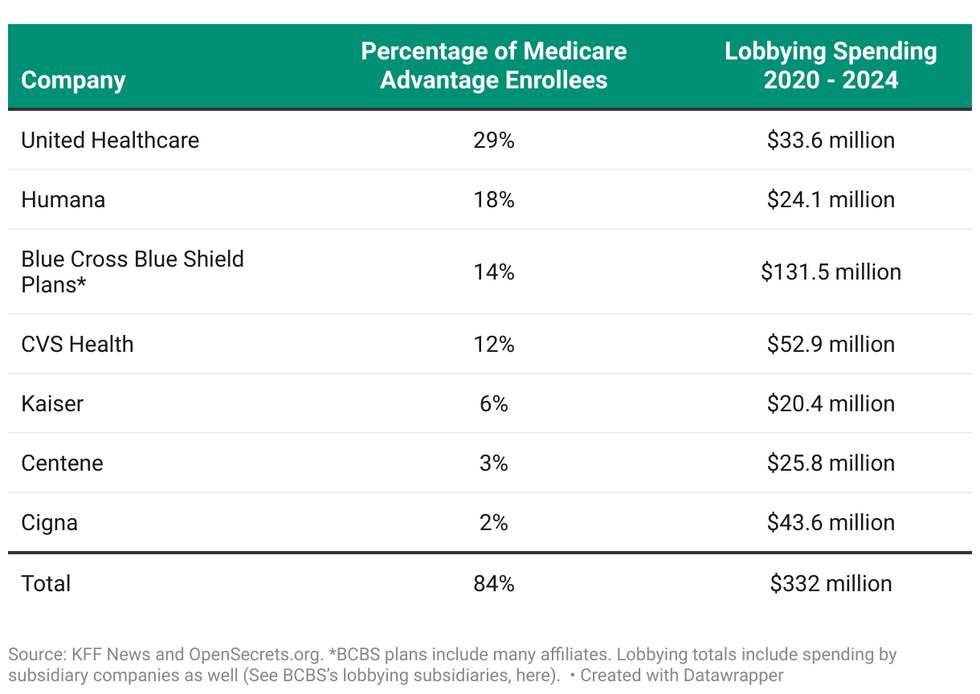

"Just seven companies account for 84% of all Medicare Advantage enrollment," the brief continues. "While lobbying disclosures do not reveal how much is spent on a single issue, disclosures reveal that these seven companies spent more than $330 million combined lobbying on all issues over the last five years, according to data from OpenSecrets."

Those companies are UnitedHealthcare, Humana, Blue Cross Blue Shield, CVS Health, Kaiser, Centene, and Cigna.

Public Citizen found that in 2024, they collectively had 328 lobbyists targeting the federal government, with nearly 70% of them specifically working on Medicare Advantage. Blue Cross had the most lobbyists focused on such plans (99), followed by Humana (33) and UnitedHealth Group (27).

"If Oz is confirmed as the CMS administrator, attacks on traditional Medicare are likely to move into overdrive," Eagan Kemp, a healthcare policy advocate at Public Citizen, warned in a Tuesday statement. "We should strengthen Medicare by improving it and expanding access to it, not weaken it through further privatization."

The Senate Committee on Finance is set to consider Oz on Friday morning. Since Trump returned to the White House in January, the GOP-controlled chamber hasn't blocked any of his nominees.

Keep ReadingShow Less

Most Popular