All Is Not Lost! Some Battery News to Charge You Up

If the villainy of the fossil fuel industry or the hard work of climate politics are weighing you down, wait until you hear about the future of energy storage on planet Earth.

Given that it’s just possible that 2024 will be a difficult year, I’m committed to occasionally finding good news to parse—for my benefit, if not for yours. Hence today we’re going to talk about batteries, which I realize sounds somewhat spinach-y. But bear with me, and see if you’re not charged up by the end.

In 1900, about a third of cars in America were powered by batteries. But, as a comprehensive new report from the Rocky Mountain Institute makes clear, there was a problem: the energy density—the amount of energy carried per pound—was too low: a car could go 40 or 50 miles on a charge. Gasoline, by contrast, was a great store of energy: you could put 400 or 500 miles worth of it in a tank. True, it was highly flammable, created air pollution, and (as we later found out) raised the temperature of the earth, but energy density carried the day. And really, no one much bothered to try and improve batteries for most of the 20th century until—in Japan and the U.S.—consumer electronics began to create demand. It really wasn’t practical to figure out a gas-powered calculator, and so innovation got to work, eventually sweeping past Duracells and Everreadys to give us batteries (mostly based on lithium) so energy-dense that they began to be practical for cars.

We’ve now reached the point that, last month, a Chinese automaker—he’s sometimes called Asia’s Elon Musk, though that seems like an undeserved insult—drove his company’s flagship model 600 miles on a single charge, besting Tesla’s 405-mile Model S range.

And the point of the RMI report is that this kind of progress is only going to continue, because

Rising energy density keeps unlocking new uses while declining costs enhance affordability and accelerate market uptake. This uptake, in turn, drives further cost reductions and continuous innovation — a cycle of self-perpetuating progress. The result is a domino effect, whereby batteries enter new markets, from country to country and from one sector to the next. Geopolitical tension has brought new players into the markets, speeding up the race to the top.

The pace of change keeps confounding experts, who consistently underestimate the potential and exponential growth of batteries. Defying past predictions, batteries now play a key role in the energy transition and their continued rapid growth signals a seismic shift in the energy system to come.

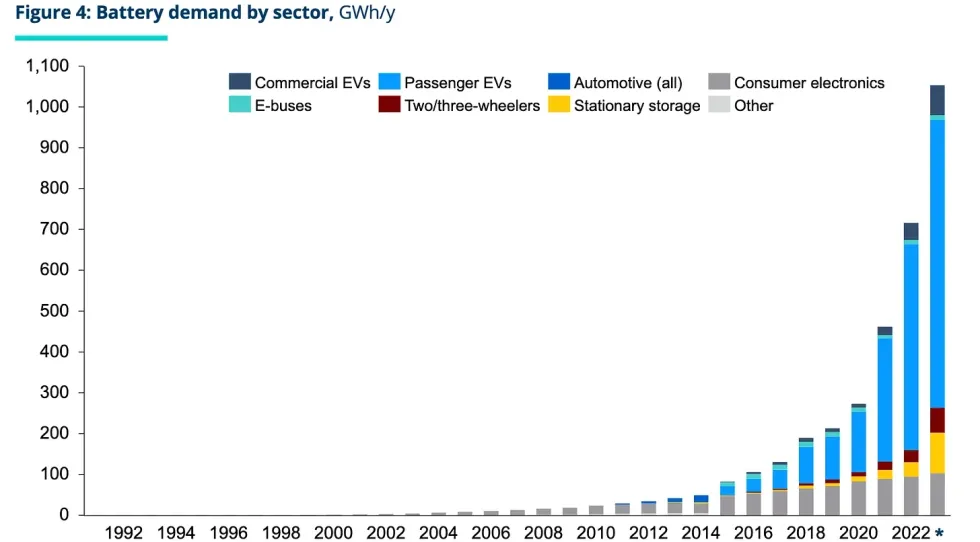

Indeed, as the report makes clear, every time we double battery deployment, we increase the energy density of batteries by 18 percent, and we cut the cost by 19 percent. And there is a lot of doubling going on, as this Bloomberg chart makes clear:

You might have questions. Like...

#Could we possibly build enough factories to produce batteries to meet this demand? And the answer, apparently, is yes. Check this out:

Battery demand grew fast over the past decade, but even so, manufacturing supply has been able to outpace it: demand grew by a factor of 24, yet battery manufacturing capacity went up by a factor of 42. As battery manufacturers are expecting more growth to come, annual manufacturing capacity additions are still rising — today’s annual commissions of new factories are more than 18 times those of just five years ago.

As the prospect of rising demand became apparent, investment markets paid attention and made ample capital available. According to Bloomberg New Energy Finance (BNEF), investment in battery factories to-day ($45 billion in 2022) is considerably higher than investment in solar and wind factories combined ($33 billion).

As capital availability ceased to be the primary limiting factor, the challenge of meeting demand has primarily been an engineering one: factories need time to be built and start operations. Companies are becoming more proficient at building out factories — the first battery gigafactory opened in 2016, and now dozens are under construction. According to Benchmark Minerals, there are now 240 operational gigafactories across the world, and this is set to increase to over 400 by 2030.

In fact, the authors of the RMI report describe this as the most intense industrial buildout since the start of World War II when America converted its manufacturing base to war production. I described that remarkable stretch in an article eight years ago in the New Republic, when there was just one of these gigafactories under construction in the U.S. An engineer named Tom Solomon, who had built a huge Intel chip factory in Arizona helped me with the math. He started by looking at SolarCity, a clean-energy company that is currently building the nation’s biggest solar panel factory in Buffalo. “They’re calling it the giga-factory,” Solomon says, “because the panels it builds will produce one gigawatt worth of solar power every year.” Using the SolarCity plant as a rough yardstick, Solomon calculated that America needs 295 solar factories of a similar size to defeat climate change—roughly six per state—plus a similar effort for wind turbines.

So—this battery effort (which of course allows those solar panels and wind turbines to in effect operate day and night)—is on the right scale. We’re doing gigas.

Another question you could ask is,

#Won’t we run out of the raw materials these batteries require?

Apparently not. As demand has gone up, we’ve found lots of new supplies. Here’s RMI’s take:

In the long term, analysis by the Energy Transitions Commission indicates there are more than sufficient battery mineral resources available for the entire energy transition.Reaching net zero will only take one quarter of today’s lithium, one-third of nickel and a quarter of known cobalt resources.

Moreover, as mineral supply has consistently been under pressure to scale, battery companies have invested heavily in innovation to help alleviate pressure on the mining sector. Innovation in higher battery energy density led to fewer minerals being needed per battery. The growth of the battery-recycling industry will alleviate demand for new mining of minerals. The development of new battery chemistries such as sodium-ion, iron, lithium iron phosphate (LFP) cathodes, and silicon anodes can diversify the demand for minerals.

You can find a similar analysis by Hannah Ritchie here, but in truth this seems almost intutive to me. Almost every day I get new reports from the tech world—here, for instance, is a description of a Scandinavian breakthrough in sodium-ion batteries “based on a hard carbon anode and a Prussian White-based cathode, and is free from lithium, nickel, cobalt and graphite.” Do I know what means exactly? I do not, but I know what it means generally: that lots of people are at work on this problem. And I know that this particulary company is now building a factory in Canada to make a lot of these batteries: more gigas. And I know that a Chinese division of Volkswagen is as of this week offering autos that use sodium-based batteries, albeit of a slightly less exalted design.

The point is that what we’re leveraging now is human intelligence, and that is a remarkable expanding commodity. If you rely on oil, there’s less to be found each year, and it’s harder to find (not impossible, as the frackers have proved, but hard). That’s why the price goes up. But with solar and wind and battery technology, it’s not the commodity but the design that matters, and those are coming constantly—each innovative iteration keeps making these technologies cleaner, more affordable, and more efficient. That’s the useful part of capitalism—and indeed of human nature.

The not-useful part of capitalism—and indeed of human nature—is the part that would happily use slaves to mine cobalt if that pushed profit margins up some. Which is one reason that activists are every bit as useful as engineers, because they push to try and make progress humane. RMI is hopeful that they’ve begun to succeed when it comes to batteries:

Addressing social inequity in the battery value chain, particularly in cobalt mines, has become a priority for the industry. Companies and stakeholders are actively implementing measures to ensure ethical sourcing and fair labor practices. Initiatives include stringent supplier audits to enforce labor standards, investment in technology to trace mineral origins, and partnerships with local communities to improve working conditions and livelihoods. Furthermore, significant efforts are being made to support educational and health programs in mining communities. These actions are complemented by a shift toward sourcing materials from regions with more robust regulatory frameworks, and by investing in alternative battery technologies that reduce reliance on conflict-prone minerals such as cobalt. This multi-pronged approach aims to create a more equitable and sustainable battery value chain, mitigating the social impacts associated with mineral extraction.

I hope very much this is true, because in general renewable energy represents a great step forward for the poorest and most vulnerable people on the planet—not only are they the most exposed to the climate calamity, but nine million die each year from breathing the combustion byproducts of fossil fuel. (That’s one death in five on this planet).

The other reason activists are needed, of course, is that capitalism and human nature don’t make this happen by themselves, at least at the pace that is required to catch up with the physics of global warming. That takes constant political pressure, of the kind that brought us the IRA. As the RMI report puts it

Governments, companies, researchers, and climate advocates will have to unite to drive sustainable and equitable growth in the battery industry. This includes a focus on innovative R&D for sustainable technology and adaptable solutions, supported by government funding and corporate investment. Collaboration is key, with an emphasis on establishing fair supply chains and enhancing transparency, bolstered by standardized regulations to ensure safety, quality, and environmental integrity.

Simultaneously, adopting circular economy principles will be crucial. This involves designing batteries for easier recycling and longer life, promoting the reuse of materials, and supporting infrastructure for efficient recycling processes. Researchers and companies can play a pivotal role in advancing these technologies, while governments can aid by implementing supportive policies and regulations, ensuring a cohesive and sustainable approach across the industry.

To ensure fairness in the battery industry’s growth, policies must equitably distribute costs and benefits, especially in mining regions. Significant investment is needed in local communities and sustainable job creation, such as emphasized by the White House’s commitment to a domestic supply chain for critical minerals.Moreover, a broader understanding of environmental justice impacts is crucial, beyond traditional greenhouse gas and cost analyses, to assess local socioeconomic and environmental effects fully.

We could do this same analysis with solar panels and wind turbines and heat pumps and e-bikes and a bunch of other technologies—and perhaps we will. But I hope this serves to remind you that all is not lost; that while we’re engaged in the sometimes grim task of political change, there are forces at work on the planet that should put—well, a charge into us.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Given that it’s just possible that 2024 will be a difficult year, I’m committed to occasionally finding good news to parse—for my benefit, if not for yours. Hence today we’re going to talk about batteries, which I realize sounds somewhat spinach-y. But bear with me, and see if you’re not charged up by the end.

In 1900, about a third of cars in America were powered by batteries. But, as a comprehensive new report from the Rocky Mountain Institute makes clear, there was a problem: the energy density—the amount of energy carried per pound—was too low: a car could go 40 or 50 miles on a charge. Gasoline, by contrast, was a great store of energy: you could put 400 or 500 miles worth of it in a tank. True, it was highly flammable, created air pollution, and (as we later found out) raised the temperature of the earth, but energy density carried the day. And really, no one much bothered to try and improve batteries for most of the 20th century until—in Japan and the U.S.—consumer electronics began to create demand. It really wasn’t practical to figure out a gas-powered calculator, and so innovation got to work, eventually sweeping past Duracells and Everreadys to give us batteries (mostly based on lithium) so energy-dense that they began to be practical for cars.

We’ve now reached the point that, last month, a Chinese automaker—he’s sometimes called Asia’s Elon Musk, though that seems like an undeserved insult—drove his company’s flagship model 600 miles on a single charge, besting Tesla’s 405-mile Model S range.

And the point of the RMI report is that this kind of progress is only going to continue, because

Rising energy density keeps unlocking new uses while declining costs enhance affordability and accelerate market uptake. This uptake, in turn, drives further cost reductions and continuous innovation — a cycle of self-perpetuating progress. The result is a domino effect, whereby batteries enter new markets, from country to country and from one sector to the next. Geopolitical tension has brought new players into the markets, speeding up the race to the top.

The pace of change keeps confounding experts, who consistently underestimate the potential and exponential growth of batteries. Defying past predictions, batteries now play a key role in the energy transition and their continued rapid growth signals a seismic shift in the energy system to come.

Indeed, as the report makes clear, every time we double battery deployment, we increase the energy density of batteries by 18 percent, and we cut the cost by 19 percent. And there is a lot of doubling going on, as this Bloomberg chart makes clear:

You might have questions. Like...

#Could we possibly build enough factories to produce batteries to meet this demand? And the answer, apparently, is yes. Check this out:

Battery demand grew fast over the past decade, but even so, manufacturing supply has been able to outpace it: demand grew by a factor of 24, yet battery manufacturing capacity went up by a factor of 42. As battery manufacturers are expecting more growth to come, annual manufacturing capacity additions are still rising — today’s annual commissions of new factories are more than 18 times those of just five years ago.

As the prospect of rising demand became apparent, investment markets paid attention and made ample capital available. According to Bloomberg New Energy Finance (BNEF), investment in battery factories to-day ($45 billion in 2022) is considerably higher than investment in solar and wind factories combined ($33 billion).

As capital availability ceased to be the primary limiting factor, the challenge of meeting demand has primarily been an engineering one: factories need time to be built and start operations. Companies are becoming more proficient at building out factories — the first battery gigafactory opened in 2016, and now dozens are under construction. According to Benchmark Minerals, there are now 240 operational gigafactories across the world, and this is set to increase to over 400 by 2030.

In fact, the authors of the RMI report describe this as the most intense industrial buildout since the start of World War II when America converted its manufacturing base to war production. I described that remarkable stretch in an article eight years ago in the New Republic, when there was just one of these gigafactories under construction in the U.S. An engineer named Tom Solomon, who had built a huge Intel chip factory in Arizona helped me with the math. He started by looking at SolarCity, a clean-energy company that is currently building the nation’s biggest solar panel factory in Buffalo. “They’re calling it the giga-factory,” Solomon says, “because the panels it builds will produce one gigawatt worth of solar power every year.” Using the SolarCity plant as a rough yardstick, Solomon calculated that America needs 295 solar factories of a similar size to defeat climate change—roughly six per state—plus a similar effort for wind turbines.

So—this battery effort (which of course allows those solar panels and wind turbines to in effect operate day and night)—is on the right scale. We’re doing gigas.

Another question you could ask is,

#Won’t we run out of the raw materials these batteries require?

Apparently not. As demand has gone up, we’ve found lots of new supplies. Here’s RMI’s take:

In the long term, analysis by the Energy Transitions Commission indicates there are more than sufficient battery mineral resources available for the entire energy transition.Reaching net zero will only take one quarter of today’s lithium, one-third of nickel and a quarter of known cobalt resources.

Moreover, as mineral supply has consistently been under pressure to scale, battery companies have invested heavily in innovation to help alleviate pressure on the mining sector. Innovation in higher battery energy density led to fewer minerals being needed per battery. The growth of the battery-recycling industry will alleviate demand for new mining of minerals. The development of new battery chemistries such as sodium-ion, iron, lithium iron phosphate (LFP) cathodes, and silicon anodes can diversify the demand for minerals.

You can find a similar analysis by Hannah Ritchie here, but in truth this seems almost intutive to me. Almost every day I get new reports from the tech world—here, for instance, is a description of a Scandinavian breakthrough in sodium-ion batteries “based on a hard carbon anode and a Prussian White-based cathode, and is free from lithium, nickel, cobalt and graphite.” Do I know what means exactly? I do not, but I know what it means generally: that lots of people are at work on this problem. And I know that this particulary company is now building a factory in Canada to make a lot of these batteries: more gigas. And I know that a Chinese division of Volkswagen is as of this week offering autos that use sodium-based batteries, albeit of a slightly less exalted design.

The point is that what we’re leveraging now is human intelligence, and that is a remarkable expanding commodity. If you rely on oil, there’s less to be found each year, and it’s harder to find (not impossible, as the frackers have proved, but hard). That’s why the price goes up. But with solar and wind and battery technology, it’s not the commodity but the design that matters, and those are coming constantly—each innovative iteration keeps making these technologies cleaner, more affordable, and more efficient. That’s the useful part of capitalism—and indeed of human nature.

The not-useful part of capitalism—and indeed of human nature—is the part that would happily use slaves to mine cobalt if that pushed profit margins up some. Which is one reason that activists are every bit as useful as engineers, because they push to try and make progress humane. RMI is hopeful that they’ve begun to succeed when it comes to batteries:

Addressing social inequity in the battery value chain, particularly in cobalt mines, has become a priority for the industry. Companies and stakeholders are actively implementing measures to ensure ethical sourcing and fair labor practices. Initiatives include stringent supplier audits to enforce labor standards, investment in technology to trace mineral origins, and partnerships with local communities to improve working conditions and livelihoods. Furthermore, significant efforts are being made to support educational and health programs in mining communities. These actions are complemented by a shift toward sourcing materials from regions with more robust regulatory frameworks, and by investing in alternative battery technologies that reduce reliance on conflict-prone minerals such as cobalt. This multi-pronged approach aims to create a more equitable and sustainable battery value chain, mitigating the social impacts associated with mineral extraction.

I hope very much this is true, because in general renewable energy represents a great step forward for the poorest and most vulnerable people on the planet—not only are they the most exposed to the climate calamity, but nine million die each year from breathing the combustion byproducts of fossil fuel. (That’s one death in five on this planet).

The other reason activists are needed, of course, is that capitalism and human nature don’t make this happen by themselves, at least at the pace that is required to catch up with the physics of global warming. That takes constant political pressure, of the kind that brought us the IRA. As the RMI report puts it

Governments, companies, researchers, and climate advocates will have to unite to drive sustainable and equitable growth in the battery industry. This includes a focus on innovative R&D for sustainable technology and adaptable solutions, supported by government funding and corporate investment. Collaboration is key, with an emphasis on establishing fair supply chains and enhancing transparency, bolstered by standardized regulations to ensure safety, quality, and environmental integrity.

Simultaneously, adopting circular economy principles will be crucial. This involves designing batteries for easier recycling and longer life, promoting the reuse of materials, and supporting infrastructure for efficient recycling processes. Researchers and companies can play a pivotal role in advancing these technologies, while governments can aid by implementing supportive policies and regulations, ensuring a cohesive and sustainable approach across the industry.

To ensure fairness in the battery industry’s growth, policies must equitably distribute costs and benefits, especially in mining regions. Significant investment is needed in local communities and sustainable job creation, such as emphasized by the White House’s commitment to a domestic supply chain for critical minerals.Moreover, a broader understanding of environmental justice impacts is crucial, beyond traditional greenhouse gas and cost analyses, to assess local socioeconomic and environmental effects fully.

We could do this same analysis with solar panels and wind turbines and heat pumps and e-bikes and a bunch of other technologies—and perhaps we will. But I hope this serves to remind you that all is not lost; that while we’re engaged in the sometimes grim task of political change, there are forces at work on the planet that should put—well, a charge into us.

Given that it’s just possible that 2024 will be a difficult year, I’m committed to occasionally finding good news to parse—for my benefit, if not for yours. Hence today we’re going to talk about batteries, which I realize sounds somewhat spinach-y. But bear with me, and see if you’re not charged up by the end.

In 1900, about a third of cars in America were powered by batteries. But, as a comprehensive new report from the Rocky Mountain Institute makes clear, there was a problem: the energy density—the amount of energy carried per pound—was too low: a car could go 40 or 50 miles on a charge. Gasoline, by contrast, was a great store of energy: you could put 400 or 500 miles worth of it in a tank. True, it was highly flammable, created air pollution, and (as we later found out) raised the temperature of the earth, but energy density carried the day. And really, no one much bothered to try and improve batteries for most of the 20th century until—in Japan and the U.S.—consumer electronics began to create demand. It really wasn’t practical to figure out a gas-powered calculator, and so innovation got to work, eventually sweeping past Duracells and Everreadys to give us batteries (mostly based on lithium) so energy-dense that they began to be practical for cars.

We’ve now reached the point that, last month, a Chinese automaker—he’s sometimes called Asia’s Elon Musk, though that seems like an undeserved insult—drove his company’s flagship model 600 miles on a single charge, besting Tesla’s 405-mile Model S range.

And the point of the RMI report is that this kind of progress is only going to continue, because

Rising energy density keeps unlocking new uses while declining costs enhance affordability and accelerate market uptake. This uptake, in turn, drives further cost reductions and continuous innovation — a cycle of self-perpetuating progress. The result is a domino effect, whereby batteries enter new markets, from country to country and from one sector to the next. Geopolitical tension has brought new players into the markets, speeding up the race to the top.

The pace of change keeps confounding experts, who consistently underestimate the potential and exponential growth of batteries. Defying past predictions, batteries now play a key role in the energy transition and their continued rapid growth signals a seismic shift in the energy system to come.

Indeed, as the report makes clear, every time we double battery deployment, we increase the energy density of batteries by 18 percent, and we cut the cost by 19 percent. And there is a lot of doubling going on, as this Bloomberg chart makes clear:

You might have questions. Like...

#Could we possibly build enough factories to produce batteries to meet this demand? And the answer, apparently, is yes. Check this out:

Battery demand grew fast over the past decade, but even so, manufacturing supply has been able to outpace it: demand grew by a factor of 24, yet battery manufacturing capacity went up by a factor of 42. As battery manufacturers are expecting more growth to come, annual manufacturing capacity additions are still rising — today’s annual commissions of new factories are more than 18 times those of just five years ago.

As the prospect of rising demand became apparent, investment markets paid attention and made ample capital available. According to Bloomberg New Energy Finance (BNEF), investment in battery factories to-day ($45 billion in 2022) is considerably higher than investment in solar and wind factories combined ($33 billion).

As capital availability ceased to be the primary limiting factor, the challenge of meeting demand has primarily been an engineering one: factories need time to be built and start operations. Companies are becoming more proficient at building out factories — the first battery gigafactory opened in 2016, and now dozens are under construction. According to Benchmark Minerals, there are now 240 operational gigafactories across the world, and this is set to increase to over 400 by 2030.

In fact, the authors of the RMI report describe this as the most intense industrial buildout since the start of World War II when America converted its manufacturing base to war production. I described that remarkable stretch in an article eight years ago in the New Republic, when there was just one of these gigafactories under construction in the U.S. An engineer named Tom Solomon, who had built a huge Intel chip factory in Arizona helped me with the math. He started by looking at SolarCity, a clean-energy company that is currently building the nation’s biggest solar panel factory in Buffalo. “They’re calling it the giga-factory,” Solomon says, “because the panels it builds will produce one gigawatt worth of solar power every year.” Using the SolarCity plant as a rough yardstick, Solomon calculated that America needs 295 solar factories of a similar size to defeat climate change—roughly six per state—plus a similar effort for wind turbines.

So—this battery effort (which of course allows those solar panels and wind turbines to in effect operate day and night)—is on the right scale. We’re doing gigas.

Another question you could ask is,

#Won’t we run out of the raw materials these batteries require?

Apparently not. As demand has gone up, we’ve found lots of new supplies. Here’s RMI’s take:

In the long term, analysis by the Energy Transitions Commission indicates there are more than sufficient battery mineral resources available for the entire energy transition.Reaching net zero will only take one quarter of today’s lithium, one-third of nickel and a quarter of known cobalt resources.

Moreover, as mineral supply has consistently been under pressure to scale, battery companies have invested heavily in innovation to help alleviate pressure on the mining sector. Innovation in higher battery energy density led to fewer minerals being needed per battery. The growth of the battery-recycling industry will alleviate demand for new mining of minerals. The development of new battery chemistries such as sodium-ion, iron, lithium iron phosphate (LFP) cathodes, and silicon anodes can diversify the demand for minerals.

You can find a similar analysis by Hannah Ritchie here, but in truth this seems almost intutive to me. Almost every day I get new reports from the tech world—here, for instance, is a description of a Scandinavian breakthrough in sodium-ion batteries “based on a hard carbon anode and a Prussian White-based cathode, and is free from lithium, nickel, cobalt and graphite.” Do I know what means exactly? I do not, but I know what it means generally: that lots of people are at work on this problem. And I know that this particulary company is now building a factory in Canada to make a lot of these batteries: more gigas. And I know that a Chinese division of Volkswagen is as of this week offering autos that use sodium-based batteries, albeit of a slightly less exalted design.

The point is that what we’re leveraging now is human intelligence, and that is a remarkable expanding commodity. If you rely on oil, there’s less to be found each year, and it’s harder to find (not impossible, as the frackers have proved, but hard). That’s why the price goes up. But with solar and wind and battery technology, it’s not the commodity but the design that matters, and those are coming constantly—each innovative iteration keeps making these technologies cleaner, more affordable, and more efficient. That’s the useful part of capitalism—and indeed of human nature.

The not-useful part of capitalism—and indeed of human nature—is the part that would happily use slaves to mine cobalt if that pushed profit margins up some. Which is one reason that activists are every bit as useful as engineers, because they push to try and make progress humane. RMI is hopeful that they’ve begun to succeed when it comes to batteries:

Addressing social inequity in the battery value chain, particularly in cobalt mines, has become a priority for the industry. Companies and stakeholders are actively implementing measures to ensure ethical sourcing and fair labor practices. Initiatives include stringent supplier audits to enforce labor standards, investment in technology to trace mineral origins, and partnerships with local communities to improve working conditions and livelihoods. Furthermore, significant efforts are being made to support educational and health programs in mining communities. These actions are complemented by a shift toward sourcing materials from regions with more robust regulatory frameworks, and by investing in alternative battery technologies that reduce reliance on conflict-prone minerals such as cobalt. This multi-pronged approach aims to create a more equitable and sustainable battery value chain, mitigating the social impacts associated with mineral extraction.

I hope very much this is true, because in general renewable energy represents a great step forward for the poorest and most vulnerable people on the planet—not only are they the most exposed to the climate calamity, but nine million die each year from breathing the combustion byproducts of fossil fuel. (That’s one death in five on this planet).

The other reason activists are needed, of course, is that capitalism and human nature don’t make this happen by themselves, at least at the pace that is required to catch up with the physics of global warming. That takes constant political pressure, of the kind that brought us the IRA. As the RMI report puts it

Governments, companies, researchers, and climate advocates will have to unite to drive sustainable and equitable growth in the battery industry. This includes a focus on innovative R&D for sustainable technology and adaptable solutions, supported by government funding and corporate investment. Collaboration is key, with an emphasis on establishing fair supply chains and enhancing transparency, bolstered by standardized regulations to ensure safety, quality, and environmental integrity.

Simultaneously, adopting circular economy principles will be crucial. This involves designing batteries for easier recycling and longer life, promoting the reuse of materials, and supporting infrastructure for efficient recycling processes. Researchers and companies can play a pivotal role in advancing these technologies, while governments can aid by implementing supportive policies and regulations, ensuring a cohesive and sustainable approach across the industry.

To ensure fairness in the battery industry’s growth, policies must equitably distribute costs and benefits, especially in mining regions. Significant investment is needed in local communities and sustainable job creation, such as emphasized by the White House’s commitment to a domestic supply chain for critical minerals.Moreover, a broader understanding of environmental justice impacts is crucial, beyond traditional greenhouse gas and cost analyses, to assess local socioeconomic and environmental effects fully.

We could do this same analysis with solar panels and wind turbines and heat pumps and e-bikes and a bunch of other technologies—and perhaps we will. But I hope this serves to remind you that all is not lost; that while we’re engaged in the sometimes grim task of political change, there are forces at work on the planet that should put—well, a charge into us.