SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Sixty-six-year-old retiree John Allaire stands in front of the Seapeak Magellan liquefied natural gas (LNG) tanker and Venture Global Calcasieu Pass LNG export terminal in Cameron, Louisiana, on September 29, 2022.

Between fueling the climate crisis, local pollution, and higher energy costs for ordinary families, it’s clear that the LNG export boom is bad news for everyone except the gas companies.

While the U.S. bakes during a summer of record-breaking heat, President Joe Biden’s broken campaign promises to rein in fossil fuels are looking worse and worse. Biden still has a chance to reverse course and be the climate champion we need—but time is running short.

Here’s what should be at the top of Biden’s to-do list: putting an end to the surge of liquefied methane gas (LNG) exports flowing from the Gulf Coast. He can start by denying permits to Venture Global’s proposed CP2 terminal which are due for a decision later this year.

Over the past decade, the U.S. has become the world’s largest oil and gas driller. Despite what the oil and gas industry would like you to believe, this increase in production has not led to lower energy costs for everyday people. In fact, despite ever increasing production, 2022 saw soaring prices for gasoline and household energy use.

These oil and gas companies appear more interested in raking in billions in profits and authorizing massive raises for their CEOs instead of lowering costs for you and I. And nowadays much of that new production is shipped directly overseas.

The Ukraine crisis has led to both a surge of LNG shipments from the U.S. to Europe (to replace Russian pipeline gas) and a rash of new export terminals along the Gulf Coast. Recent Greenpeace International (GPI) research debunked the gas industry’s claim that new terminal projects are necessary to address the short-term energy crunch in Europe. Instead, GPI researchers argue that current energy needs could be met with existing gas infrastructure and that much of the new proposed infrastructure would do nothing to meet the short term energy needs. Any new terminals would only lock-in future greenhouse gas emissions and make the next crisis worse.

For too long, the DOE’s review has simply rubber-stamped energy exports, but the time when we can allow unchecked expansion of oil and gas is long past.

Currently there are seven operating LNG export terminals plus several that are under construction. Since the Ukraine crisis began, three more projects—Venture Global’s Plaquemines LNG, Sempra’s Port Arthur LNG, and NextDecade’s Rio Grande LNG—got the green light to begin building, although none will start shipping LNG for several years.

And there are still more projects in the pipeline. The next export terminal jockeying to get regulatory approval from the Biden administration is Venture Global’s CP2 project, which is seeking permits from both FERC and the Department of Energy (DOE).

Venture Global LNG is one such company that may be angling to leverage this moment of crisis into massive profits. Although most people have probably never heard of them, Venture Global is quickly becoming one of the biggest fossil fuel players in the U.S. The privately held company was founded by Robert Pender and Michael Sabel in 2013. Today, Venture Global operates Calcasieu Pass LNG (located near the outlet of Lake Calcasieu in Cameron Parish, Louisiana,) and is building Plaquemines LNG along the Mississippi River south of New Orleans. Calcasieu Pass has the capacity to liquefy and ship 12 million tonnes of LNG per year, and once it is built, Plaquemines could export 24 million tonnes per year.

If approved and built, the CP2 project would be located next door to Calcasieu Pass and would add a capacity of 20 million tonnes per year. Also in the planning stage is the Delta LNG project, located along the Mississippi River. If all four projects are built, Venture Global could become the U.S.’s largest LNG exporter, shipping over 70 million tonnes overseas every year for decades to come.

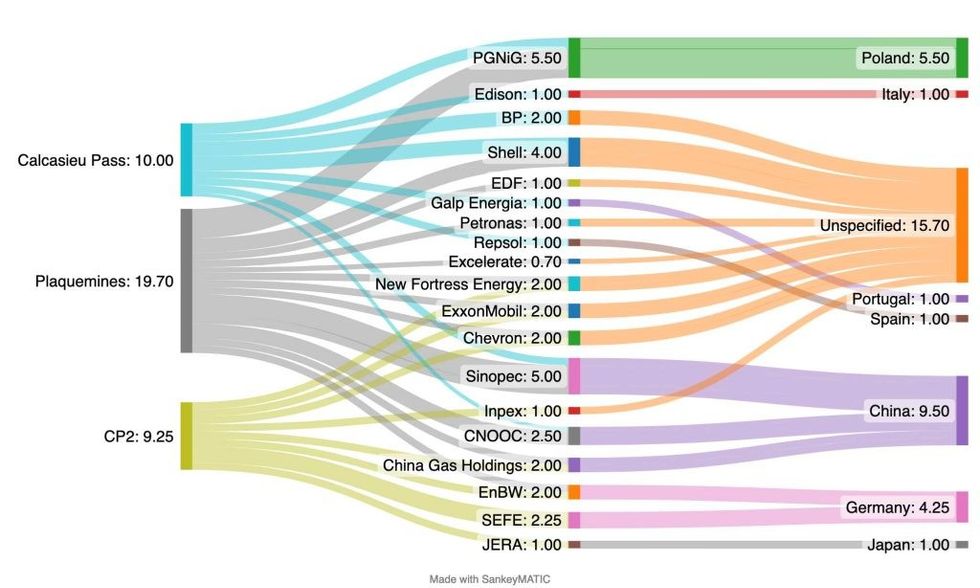

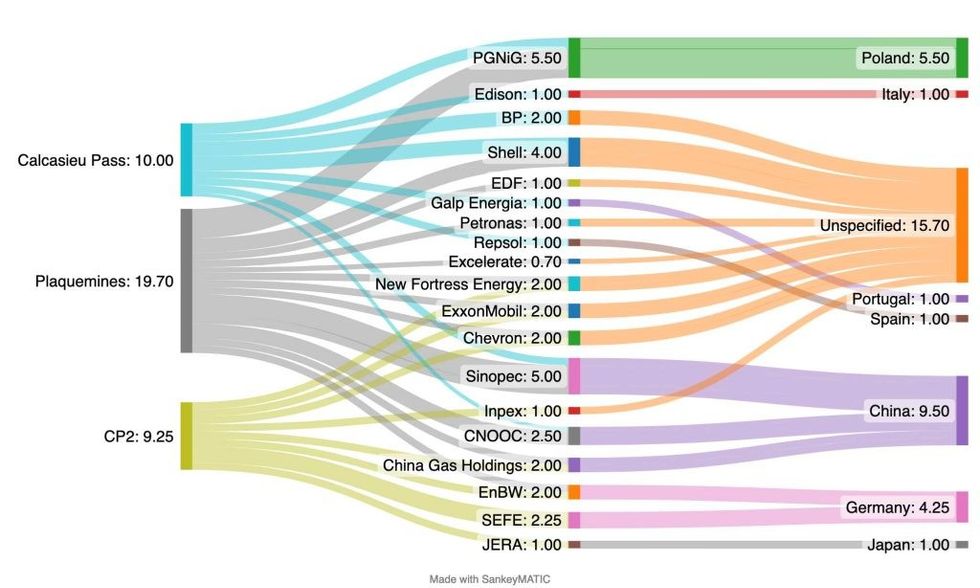

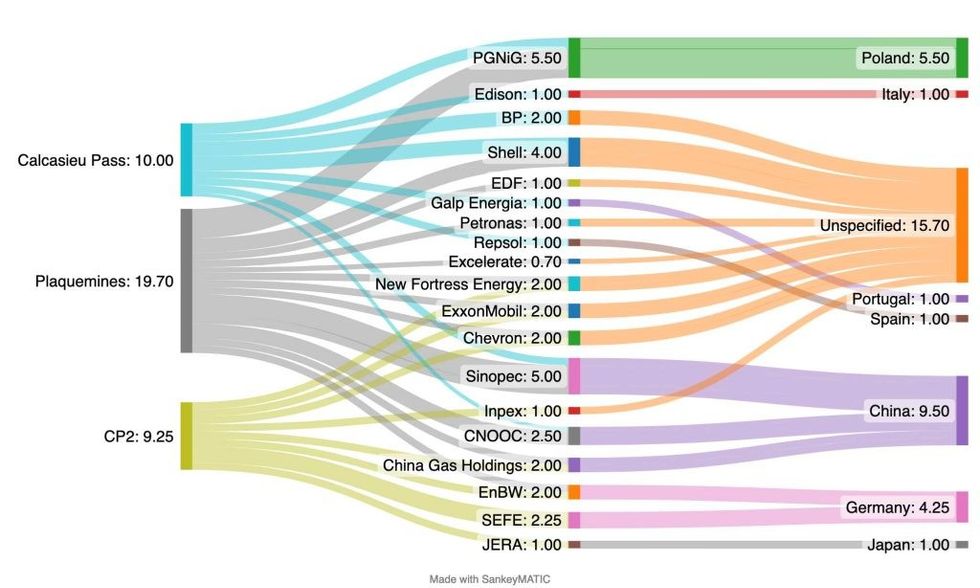

The key to financing export terminals is to sign 15-20 year gas purchase agreements, thereby guaranteeing cash flows big enough to cover debt payments. Venture Global is moving fast to sign contracts for CP2’s LNG to secure a financing deal. Recent agreements with Japan’s JERA and Germany’s SEFE bring the contracted total to nearly half of CP2’s full capacity.

Contracted volumes (in million tonnes per annum) from Venture Global LNG export terminals. The middle column shows the buyer and the right-hand column shows the import market. Data: Bloomberg Global LNG Contracts Database.

(Photo: Greenpeace)

The figure above shows the destinations of Venture Global’s currently signed supply contracts for each terminal. The middle column shows the purchasing company, and the right-hand column indicates the ultimate import market. “Unspecified” contracts are often with gas traders such as Shell or BP, who can deliver their LNG cargoes to the highest bidder.

Not only is Venture Global’s gas expansion inconsistent with climate limits, its LNG terminals—and the pipelines, compressors, and gas wells that feed them—could create air and water pollution that could put local communities at risk. Reports by the Louisiana Bucket Brigade have documented a consistent problem with gas flaring from Calcasieu Pass, potential under-reporting of accidents, and other concerns. In late June, the Louisiana Department of Environmental Quality issued a compliance order for the facility. A Greenpeace USA exposé also found that some important certification tests were carried out partially remotely and in record fast time.

Despite all this, Venture Global received $184 million in tax breaks from the state of Louisiana.

Between fueling the climate crisis, local pollution, and higher energy costs for ordinary families, it’s clear that the LNG export boom is bad news for everyone except the gas companies.

Although CP2 recently received its environmental approval from FERC, the Biden administration still has the authority to determine whether CP2’s exports are in the “public interest.” The Natural Gas Act allows LNG exports to non-free trade countries unless they violate the “public interest,” and tasks the DOE with determining what exactly that means. DOE recently declined to update its public interest guidelines that date back to 1984, but argued that it can review permits on a case-by-case basis.

For too long, the DOE’s review has simply rubber-stamped energy exports, but the time when we can allow unchecked expansion of oil and gas is long past. CP2 could put the climate, public health, and energy justice at risk—it is not in the public interest and must be rejected.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

While the U.S. bakes during a summer of record-breaking heat, President Joe Biden’s broken campaign promises to rein in fossil fuels are looking worse and worse. Biden still has a chance to reverse course and be the climate champion we need—but time is running short.

Here’s what should be at the top of Biden’s to-do list: putting an end to the surge of liquefied methane gas (LNG) exports flowing from the Gulf Coast. He can start by denying permits to Venture Global’s proposed CP2 terminal which are due for a decision later this year.

Over the past decade, the U.S. has become the world’s largest oil and gas driller. Despite what the oil and gas industry would like you to believe, this increase in production has not led to lower energy costs for everyday people. In fact, despite ever increasing production, 2022 saw soaring prices for gasoline and household energy use.

These oil and gas companies appear more interested in raking in billions in profits and authorizing massive raises for their CEOs instead of lowering costs for you and I. And nowadays much of that new production is shipped directly overseas.

The Ukraine crisis has led to both a surge of LNG shipments from the U.S. to Europe (to replace Russian pipeline gas) and a rash of new export terminals along the Gulf Coast. Recent Greenpeace International (GPI) research debunked the gas industry’s claim that new terminal projects are necessary to address the short-term energy crunch in Europe. Instead, GPI researchers argue that current energy needs could be met with existing gas infrastructure and that much of the new proposed infrastructure would do nothing to meet the short term energy needs. Any new terminals would only lock-in future greenhouse gas emissions and make the next crisis worse.

For too long, the DOE’s review has simply rubber-stamped energy exports, but the time when we can allow unchecked expansion of oil and gas is long past.

Currently there are seven operating LNG export terminals plus several that are under construction. Since the Ukraine crisis began, three more projects—Venture Global’s Plaquemines LNG, Sempra’s Port Arthur LNG, and NextDecade’s Rio Grande LNG—got the green light to begin building, although none will start shipping LNG for several years.

And there are still more projects in the pipeline. The next export terminal jockeying to get regulatory approval from the Biden administration is Venture Global’s CP2 project, which is seeking permits from both FERC and the Department of Energy (DOE).

Venture Global LNG is one such company that may be angling to leverage this moment of crisis into massive profits. Although most people have probably never heard of them, Venture Global is quickly becoming one of the biggest fossil fuel players in the U.S. The privately held company was founded by Robert Pender and Michael Sabel in 2013. Today, Venture Global operates Calcasieu Pass LNG (located near the outlet of Lake Calcasieu in Cameron Parish, Louisiana,) and is building Plaquemines LNG along the Mississippi River south of New Orleans. Calcasieu Pass has the capacity to liquefy and ship 12 million tonnes of LNG per year, and once it is built, Plaquemines could export 24 million tonnes per year.

If approved and built, the CP2 project would be located next door to Calcasieu Pass and would add a capacity of 20 million tonnes per year. Also in the planning stage is the Delta LNG project, located along the Mississippi River. If all four projects are built, Venture Global could become the U.S.’s largest LNG exporter, shipping over 70 million tonnes overseas every year for decades to come.

The key to financing export terminals is to sign 15-20 year gas purchase agreements, thereby guaranteeing cash flows big enough to cover debt payments. Venture Global is moving fast to sign contracts for CP2’s LNG to secure a financing deal. Recent agreements with Japan’s JERA and Germany’s SEFE bring the contracted total to nearly half of CP2’s full capacity.

Contracted volumes (in million tonnes per annum) from Venture Global LNG export terminals. The middle column shows the buyer and the right-hand column shows the import market. Data: Bloomberg Global LNG Contracts Database.

(Photo: Greenpeace)

The figure above shows the destinations of Venture Global’s currently signed supply contracts for each terminal. The middle column shows the purchasing company, and the right-hand column indicates the ultimate import market. “Unspecified” contracts are often with gas traders such as Shell or BP, who can deliver their LNG cargoes to the highest bidder.

Not only is Venture Global’s gas expansion inconsistent with climate limits, its LNG terminals—and the pipelines, compressors, and gas wells that feed them—could create air and water pollution that could put local communities at risk. Reports by the Louisiana Bucket Brigade have documented a consistent problem with gas flaring from Calcasieu Pass, potential under-reporting of accidents, and other concerns. In late June, the Louisiana Department of Environmental Quality issued a compliance order for the facility. A Greenpeace USA exposé also found that some important certification tests were carried out partially remotely and in record fast time.

Despite all this, Venture Global received $184 million in tax breaks from the state of Louisiana.

Between fueling the climate crisis, local pollution, and higher energy costs for ordinary families, it’s clear that the LNG export boom is bad news for everyone except the gas companies.

Although CP2 recently received its environmental approval from FERC, the Biden administration still has the authority to determine whether CP2’s exports are in the “public interest.” The Natural Gas Act allows LNG exports to non-free trade countries unless they violate the “public interest,” and tasks the DOE with determining what exactly that means. DOE recently declined to update its public interest guidelines that date back to 1984, but argued that it can review permits on a case-by-case basis.

For too long, the DOE’s review has simply rubber-stamped energy exports, but the time when we can allow unchecked expansion of oil and gas is long past. CP2 could put the climate, public health, and energy justice at risk—it is not in the public interest and must be rejected.

While the U.S. bakes during a summer of record-breaking heat, President Joe Biden’s broken campaign promises to rein in fossil fuels are looking worse and worse. Biden still has a chance to reverse course and be the climate champion we need—but time is running short.

Here’s what should be at the top of Biden’s to-do list: putting an end to the surge of liquefied methane gas (LNG) exports flowing from the Gulf Coast. He can start by denying permits to Venture Global’s proposed CP2 terminal which are due for a decision later this year.

Over the past decade, the U.S. has become the world’s largest oil and gas driller. Despite what the oil and gas industry would like you to believe, this increase in production has not led to lower energy costs for everyday people. In fact, despite ever increasing production, 2022 saw soaring prices for gasoline and household energy use.

These oil and gas companies appear more interested in raking in billions in profits and authorizing massive raises for their CEOs instead of lowering costs for you and I. And nowadays much of that new production is shipped directly overseas.

The Ukraine crisis has led to both a surge of LNG shipments from the U.S. to Europe (to replace Russian pipeline gas) and a rash of new export terminals along the Gulf Coast. Recent Greenpeace International (GPI) research debunked the gas industry’s claim that new terminal projects are necessary to address the short-term energy crunch in Europe. Instead, GPI researchers argue that current energy needs could be met with existing gas infrastructure and that much of the new proposed infrastructure would do nothing to meet the short term energy needs. Any new terminals would only lock-in future greenhouse gas emissions and make the next crisis worse.

For too long, the DOE’s review has simply rubber-stamped energy exports, but the time when we can allow unchecked expansion of oil and gas is long past.

Currently there are seven operating LNG export terminals plus several that are under construction. Since the Ukraine crisis began, three more projects—Venture Global’s Plaquemines LNG, Sempra’s Port Arthur LNG, and NextDecade’s Rio Grande LNG—got the green light to begin building, although none will start shipping LNG for several years.

And there are still more projects in the pipeline. The next export terminal jockeying to get regulatory approval from the Biden administration is Venture Global’s CP2 project, which is seeking permits from both FERC and the Department of Energy (DOE).

Venture Global LNG is one such company that may be angling to leverage this moment of crisis into massive profits. Although most people have probably never heard of them, Venture Global is quickly becoming one of the biggest fossil fuel players in the U.S. The privately held company was founded by Robert Pender and Michael Sabel in 2013. Today, Venture Global operates Calcasieu Pass LNG (located near the outlet of Lake Calcasieu in Cameron Parish, Louisiana,) and is building Plaquemines LNG along the Mississippi River south of New Orleans. Calcasieu Pass has the capacity to liquefy and ship 12 million tonnes of LNG per year, and once it is built, Plaquemines could export 24 million tonnes per year.

If approved and built, the CP2 project would be located next door to Calcasieu Pass and would add a capacity of 20 million tonnes per year. Also in the planning stage is the Delta LNG project, located along the Mississippi River. If all four projects are built, Venture Global could become the U.S.’s largest LNG exporter, shipping over 70 million tonnes overseas every year for decades to come.

The key to financing export terminals is to sign 15-20 year gas purchase agreements, thereby guaranteeing cash flows big enough to cover debt payments. Venture Global is moving fast to sign contracts for CP2’s LNG to secure a financing deal. Recent agreements with Japan’s JERA and Germany’s SEFE bring the contracted total to nearly half of CP2’s full capacity.

Contracted volumes (in million tonnes per annum) from Venture Global LNG export terminals. The middle column shows the buyer and the right-hand column shows the import market. Data: Bloomberg Global LNG Contracts Database.

(Photo: Greenpeace)

The figure above shows the destinations of Venture Global’s currently signed supply contracts for each terminal. The middle column shows the purchasing company, and the right-hand column indicates the ultimate import market. “Unspecified” contracts are often with gas traders such as Shell or BP, who can deliver their LNG cargoes to the highest bidder.

Not only is Venture Global’s gas expansion inconsistent with climate limits, its LNG terminals—and the pipelines, compressors, and gas wells that feed them—could create air and water pollution that could put local communities at risk. Reports by the Louisiana Bucket Brigade have documented a consistent problem with gas flaring from Calcasieu Pass, potential under-reporting of accidents, and other concerns. In late June, the Louisiana Department of Environmental Quality issued a compliance order for the facility. A Greenpeace USA exposé also found that some important certification tests were carried out partially remotely and in record fast time.

Despite all this, Venture Global received $184 million in tax breaks from the state of Louisiana.

Between fueling the climate crisis, local pollution, and higher energy costs for ordinary families, it’s clear that the LNG export boom is bad news for everyone except the gas companies.

Although CP2 recently received its environmental approval from FERC, the Biden administration still has the authority to determine whether CP2’s exports are in the “public interest.” The Natural Gas Act allows LNG exports to non-free trade countries unless they violate the “public interest,” and tasks the DOE with determining what exactly that means. DOE recently declined to update its public interest guidelines that date back to 1984, but argued that it can review permits on a case-by-case basis.

For too long, the DOE’s review has simply rubber-stamped energy exports, but the time when we can allow unchecked expansion of oil and gas is long past. CP2 could put the climate, public health, and energy justice at risk—it is not in the public interest and must be rejected.