SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Greenpeace activists block a ship carrying Russian oil on the Baltic Sea with a placard reading, "No money for war!" on March 23, 2022.

Nations should actively advocate for the diversification of energy sources and the establishment of sustainable transportation routes that do not hinge on potential shifts in the geopolitical landscape.

With the ongoing costly Russian war on Ukraine, and Russia's central funding of that war coming from its fossil fuel exports, we examine here those exports specifically on the Black Sea.

Russian energy exports also contribute to catastrophic climate disruption costing trillions, but for those bearing the brunt of their bullets, bombs, and rockets in Ukraine, drying up Russia's war chest is the top priority.

In a strategic move starting December 5, 2022, the European Union implemented a sea route ban on Russian oil imports, reshaping the global oil landscape. Yet, rather than achieving a seamless transition, this embargo has sparked intricate manoeuvres, especially in the Black Sea, casting shadows on the efficacy of sanctions and Europe's energy security.

The E.U.'s embargo to curtail Russia's energy export revenues and support Ukraine in its struggle has triggered seismic shifts in the global oil market. The Black Sea, once a crucial route for Russian oil exports, has become a stage for intricate manoeuvres in energy policy.

Together, the E.U., alongside the United States and G7 counterparts, established a mechanism to cap the price of Russian oil exported to non-sanctioning countries. This mechanism includes a ban on maritime services for the transportation of Russian oil to third countries and insurance for cargo if their price exceeds a specific limit—a "ceiling" or price cap. The E.U. has set this ceiling at $60 per barrel.

Despite the embargo, the trade in oil persists, and the politics and economics of the Black Sea are becoming increasingly pivotal to the region.

This move, aimed at curbing Russia's revenues from energy exports and supporting Ukraine in the ongoing war, has set the stage for a complex dance in energy policy. As a result of the E.U. and G7 embargo on Russian oil imports via sea routes, the Black Sea was transformed into a hub of strategic importance. Despite the restrictions, Russian oil continued to enter the world markets through four key shipping points: Novorossiysk, Taman, Tuapse, and ship-to-ship transfer.

The volumes of transportation through these ports since the embargo indicate that the Black Sea remained a vital channel for Russian oil exports. These manoeuvres, often facilitated by both European and non-European shipowners, caused considerable concern among politicians and experts, as they undermined the effectiveness of the sanctions and raised new questions about the security of Europe's energy supply.

Although the embargo was supposed to stop Russian crude oil exports, they are vulnerable to restrictions, according to the Black Sea News and the Institute for Black Sea Strategic Studies.

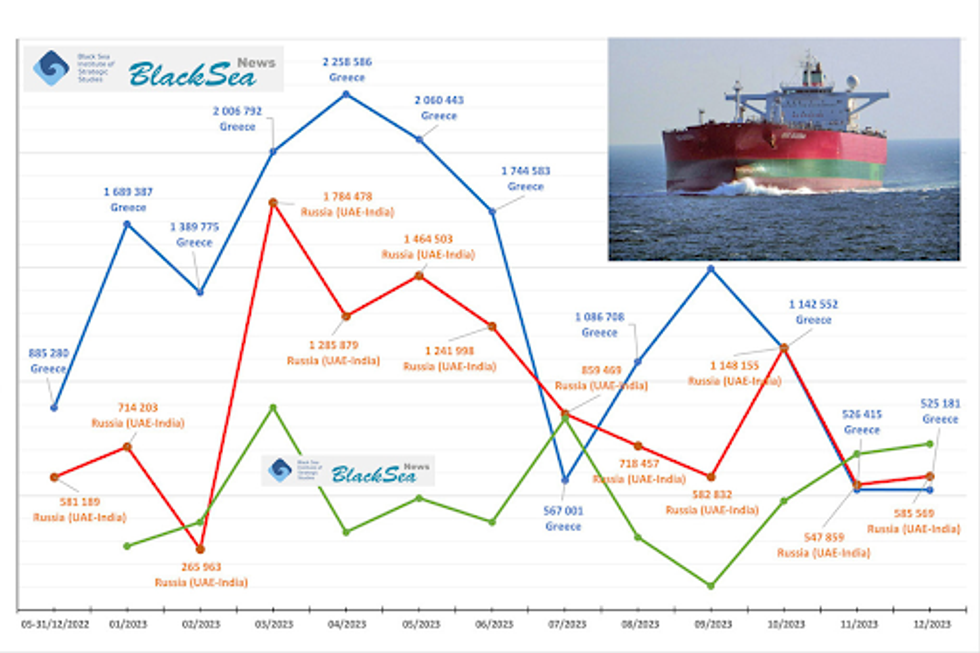

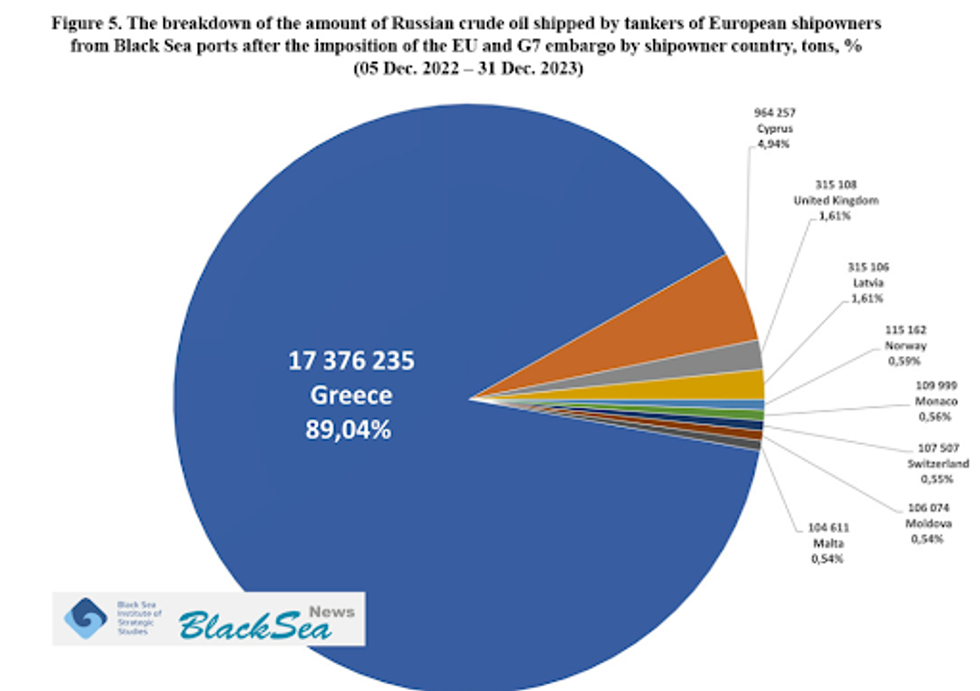

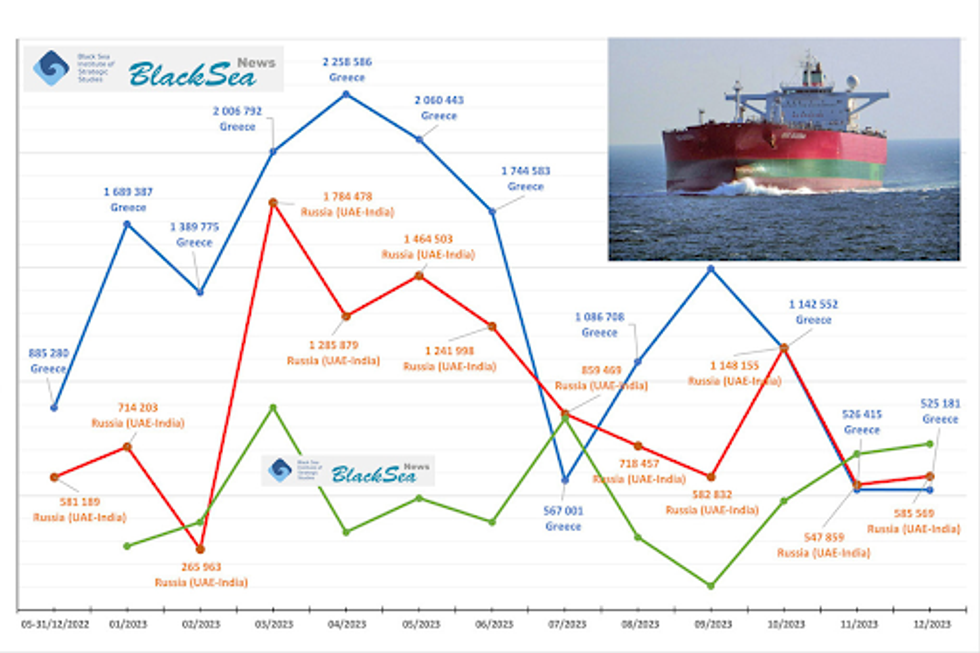

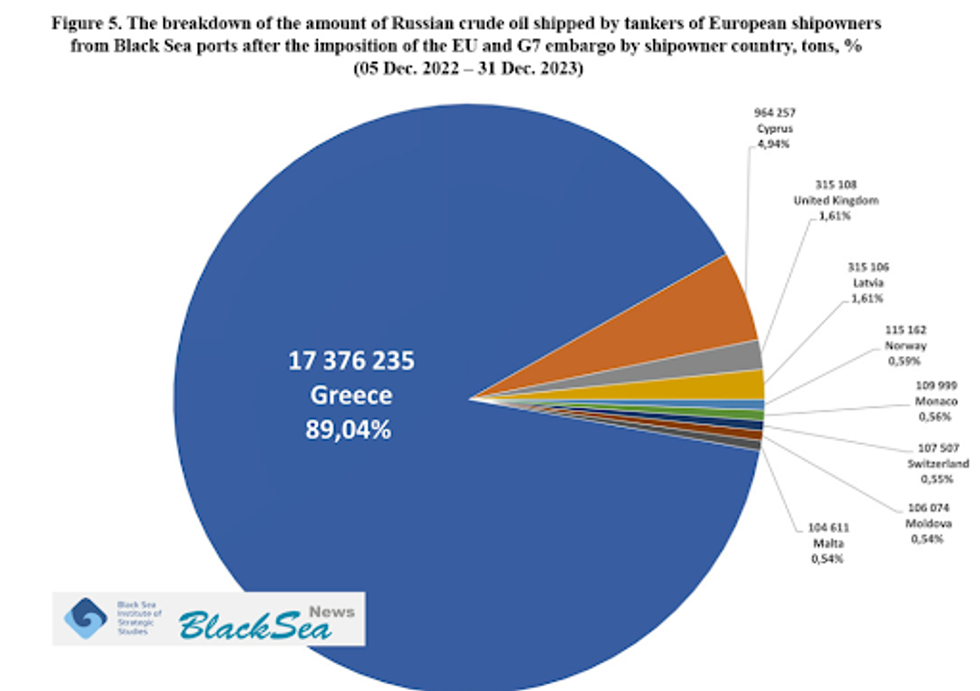

Who transported Russian crude oil from Black Sea ports after the E.U. and G7 embargo was imposed.

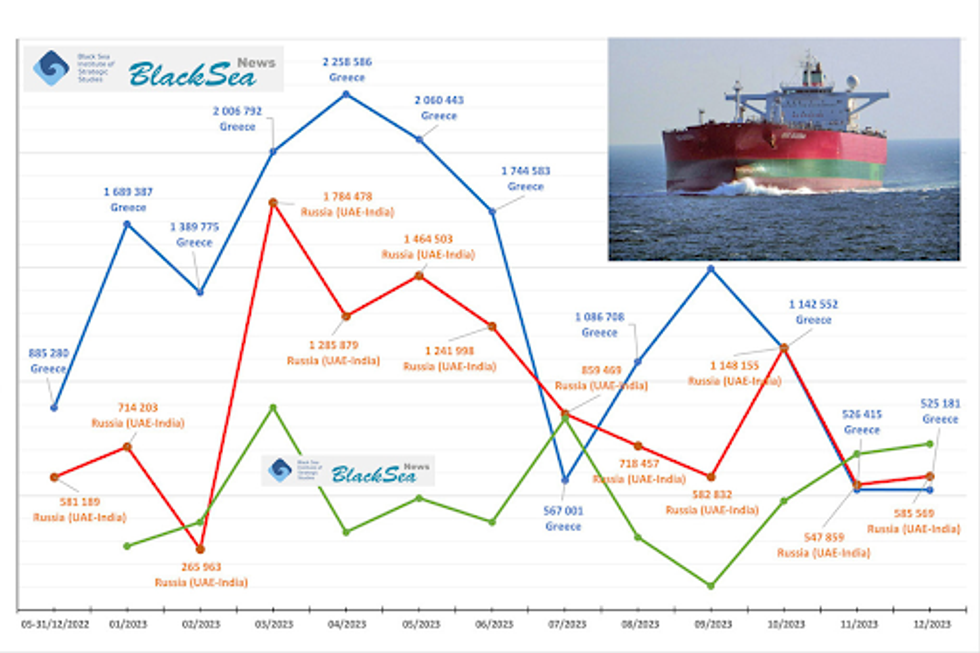

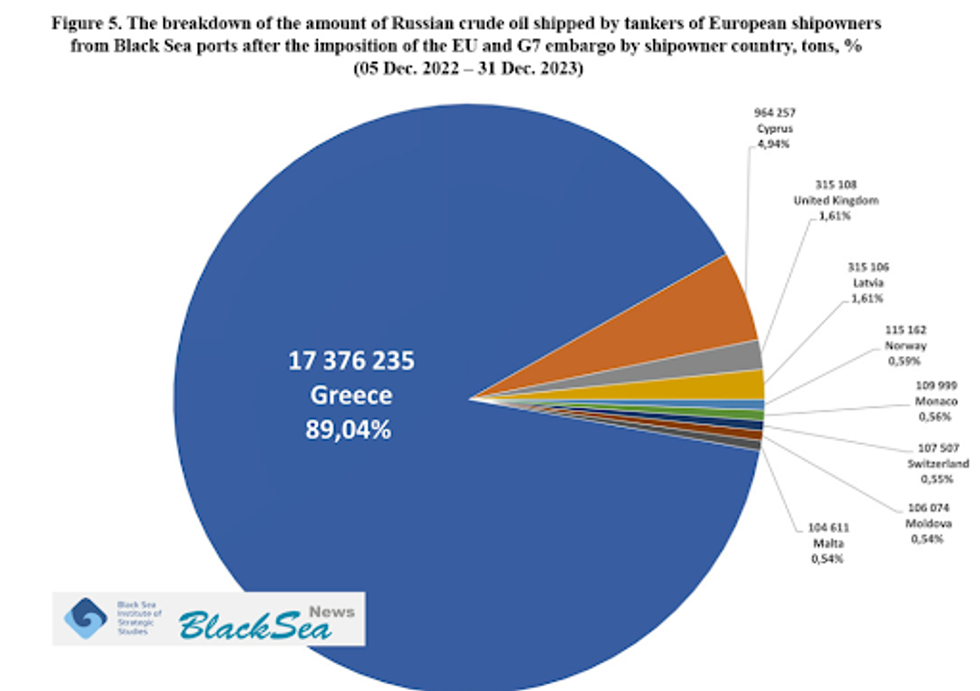

(Image: Black Sea News)

Between December 2022 to December 2023, 47.5 million tons of oil were exported from the Black Sea, of which 41.09%—19.6 million tons—were transported by European shipowners. Even with the restrictions, ships from non-European countries and even from Russia continued to transport oil.

Since March 2023, non-European shipowners have significantly increased their transportation volumes and become major players in the transportation industry. Notably, Greek companies topped the list, transporting 36.53% of oil, followed by Russian companies with 24.77%. After the announcement of the 11th E.U. sanctions package on June 21, 2023, five Greek companies were recognized as sponsors of war. This led to a decrease in the transportation of Greek tankers, but later the figures rose again.

The tendency for Greek companies to be replaced by other shipowners, especially from "flag of convenience" countries and Russia, was noticeable. In 2023, Russian companies once again surged to the forefront, transporting 42% of oil, underscoring the need for vigilant oversight to prevent sanctions circumvention and mitigate geopolitical tensions. Despite the embargo, the trade in oil persists, and the politics and economics of the Black Sea are becoming increasingly pivotal to the region.

The situation involving the transportation of Russian oil through the Black Sea under the E.U. and G7 embargo carries potentially serious consequences for energy security and geopolitical stability. Primarily, it presents a risk of violating sanctions and undermining general political coordination between countries. Actions taken by shipowners to circumvent the sanctions may instigate new economic and political conflicts, escalating tensions in the region and jeopardizing economic stability.

Given this situation, the European Union and the G7 countries must urgently implement measures to ensure compliance with sanctions and fortify the international legal order. Developing a collective strategy that considers all facets of energy security and geopolitical challenges is crucial. Efforts should be directed toward finding effective mechanisms to identify and prevent the circumvention of sanctions, thereby averting violations of international norms and rules.

Moreover, nations should actively advocate for the diversification of energy sources and the establishment of sustainable transportation routes that do not hinge on potential shifts in the geopolitical landscape. This approach will enhance the resilience of the energy sector and diminish susceptibility to external influences. A clean energy buildout will also help meet climate reduction targets and save up to $178 trillion in climate catastrophe costs by 2070 according to The Wall Street Journal.

Given the critical importance of energy security and geopolitical stability, immediate action and collaborative efforts are imperative to ensure a peaceful and stable global energy landscape.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

With the ongoing costly Russian war on Ukraine, and Russia's central funding of that war coming from its fossil fuel exports, we examine here those exports specifically on the Black Sea.

Russian energy exports also contribute to catastrophic climate disruption costing trillions, but for those bearing the brunt of their bullets, bombs, and rockets in Ukraine, drying up Russia's war chest is the top priority.

In a strategic move starting December 5, 2022, the European Union implemented a sea route ban on Russian oil imports, reshaping the global oil landscape. Yet, rather than achieving a seamless transition, this embargo has sparked intricate manoeuvres, especially in the Black Sea, casting shadows on the efficacy of sanctions and Europe's energy security.

The E.U.'s embargo to curtail Russia's energy export revenues and support Ukraine in its struggle has triggered seismic shifts in the global oil market. The Black Sea, once a crucial route for Russian oil exports, has become a stage for intricate manoeuvres in energy policy.

Together, the E.U., alongside the United States and G7 counterparts, established a mechanism to cap the price of Russian oil exported to non-sanctioning countries. This mechanism includes a ban on maritime services for the transportation of Russian oil to third countries and insurance for cargo if their price exceeds a specific limit—a "ceiling" or price cap. The E.U. has set this ceiling at $60 per barrel.

Despite the embargo, the trade in oil persists, and the politics and economics of the Black Sea are becoming increasingly pivotal to the region.

This move, aimed at curbing Russia's revenues from energy exports and supporting Ukraine in the ongoing war, has set the stage for a complex dance in energy policy. As a result of the E.U. and G7 embargo on Russian oil imports via sea routes, the Black Sea was transformed into a hub of strategic importance. Despite the restrictions, Russian oil continued to enter the world markets through four key shipping points: Novorossiysk, Taman, Tuapse, and ship-to-ship transfer.

The volumes of transportation through these ports since the embargo indicate that the Black Sea remained a vital channel for Russian oil exports. These manoeuvres, often facilitated by both European and non-European shipowners, caused considerable concern among politicians and experts, as they undermined the effectiveness of the sanctions and raised new questions about the security of Europe's energy supply.

Although the embargo was supposed to stop Russian crude oil exports, they are vulnerable to restrictions, according to the Black Sea News and the Institute for Black Sea Strategic Studies.

Who transported Russian crude oil from Black Sea ports after the E.U. and G7 embargo was imposed.

(Image: Black Sea News)

Between December 2022 to December 2023, 47.5 million tons of oil were exported from the Black Sea, of which 41.09%—19.6 million tons—were transported by European shipowners. Even with the restrictions, ships from non-European countries and even from Russia continued to transport oil.

Since March 2023, non-European shipowners have significantly increased their transportation volumes and become major players in the transportation industry. Notably, Greek companies topped the list, transporting 36.53% of oil, followed by Russian companies with 24.77%. After the announcement of the 11th E.U. sanctions package on June 21, 2023, five Greek companies were recognized as sponsors of war. This led to a decrease in the transportation of Greek tankers, but later the figures rose again.

The tendency for Greek companies to be replaced by other shipowners, especially from "flag of convenience" countries and Russia, was noticeable. In 2023, Russian companies once again surged to the forefront, transporting 42% of oil, underscoring the need for vigilant oversight to prevent sanctions circumvention and mitigate geopolitical tensions. Despite the embargo, the trade in oil persists, and the politics and economics of the Black Sea are becoming increasingly pivotal to the region.

The situation involving the transportation of Russian oil through the Black Sea under the E.U. and G7 embargo carries potentially serious consequences for energy security and geopolitical stability. Primarily, it presents a risk of violating sanctions and undermining general political coordination between countries. Actions taken by shipowners to circumvent the sanctions may instigate new economic and political conflicts, escalating tensions in the region and jeopardizing economic stability.

Given this situation, the European Union and the G7 countries must urgently implement measures to ensure compliance with sanctions and fortify the international legal order. Developing a collective strategy that considers all facets of energy security and geopolitical challenges is crucial. Efforts should be directed toward finding effective mechanisms to identify and prevent the circumvention of sanctions, thereby averting violations of international norms and rules.

Moreover, nations should actively advocate for the diversification of energy sources and the establishment of sustainable transportation routes that do not hinge on potential shifts in the geopolitical landscape. This approach will enhance the resilience of the energy sector and diminish susceptibility to external influences. A clean energy buildout will also help meet climate reduction targets and save up to $178 trillion in climate catastrophe costs by 2070 according to The Wall Street Journal.

Given the critical importance of energy security and geopolitical stability, immediate action and collaborative efforts are imperative to ensure a peaceful and stable global energy landscape.

With the ongoing costly Russian war on Ukraine, and Russia's central funding of that war coming from its fossil fuel exports, we examine here those exports specifically on the Black Sea.

Russian energy exports also contribute to catastrophic climate disruption costing trillions, but for those bearing the brunt of their bullets, bombs, and rockets in Ukraine, drying up Russia's war chest is the top priority.

In a strategic move starting December 5, 2022, the European Union implemented a sea route ban on Russian oil imports, reshaping the global oil landscape. Yet, rather than achieving a seamless transition, this embargo has sparked intricate manoeuvres, especially in the Black Sea, casting shadows on the efficacy of sanctions and Europe's energy security.

The E.U.'s embargo to curtail Russia's energy export revenues and support Ukraine in its struggle has triggered seismic shifts in the global oil market. The Black Sea, once a crucial route for Russian oil exports, has become a stage for intricate manoeuvres in energy policy.

Together, the E.U., alongside the United States and G7 counterparts, established a mechanism to cap the price of Russian oil exported to non-sanctioning countries. This mechanism includes a ban on maritime services for the transportation of Russian oil to third countries and insurance for cargo if their price exceeds a specific limit—a "ceiling" or price cap. The E.U. has set this ceiling at $60 per barrel.

Despite the embargo, the trade in oil persists, and the politics and economics of the Black Sea are becoming increasingly pivotal to the region.

This move, aimed at curbing Russia's revenues from energy exports and supporting Ukraine in the ongoing war, has set the stage for a complex dance in energy policy. As a result of the E.U. and G7 embargo on Russian oil imports via sea routes, the Black Sea was transformed into a hub of strategic importance. Despite the restrictions, Russian oil continued to enter the world markets through four key shipping points: Novorossiysk, Taman, Tuapse, and ship-to-ship transfer.

The volumes of transportation through these ports since the embargo indicate that the Black Sea remained a vital channel for Russian oil exports. These manoeuvres, often facilitated by both European and non-European shipowners, caused considerable concern among politicians and experts, as they undermined the effectiveness of the sanctions and raised new questions about the security of Europe's energy supply.

Although the embargo was supposed to stop Russian crude oil exports, they are vulnerable to restrictions, according to the Black Sea News and the Institute for Black Sea Strategic Studies.

Who transported Russian crude oil from Black Sea ports after the E.U. and G7 embargo was imposed.

(Image: Black Sea News)

Between December 2022 to December 2023, 47.5 million tons of oil were exported from the Black Sea, of which 41.09%—19.6 million tons—were transported by European shipowners. Even with the restrictions, ships from non-European countries and even from Russia continued to transport oil.

Since March 2023, non-European shipowners have significantly increased their transportation volumes and become major players in the transportation industry. Notably, Greek companies topped the list, transporting 36.53% of oil, followed by Russian companies with 24.77%. After the announcement of the 11th E.U. sanctions package on June 21, 2023, five Greek companies were recognized as sponsors of war. This led to a decrease in the transportation of Greek tankers, but later the figures rose again.

The tendency for Greek companies to be replaced by other shipowners, especially from "flag of convenience" countries and Russia, was noticeable. In 2023, Russian companies once again surged to the forefront, transporting 42% of oil, underscoring the need for vigilant oversight to prevent sanctions circumvention and mitigate geopolitical tensions. Despite the embargo, the trade in oil persists, and the politics and economics of the Black Sea are becoming increasingly pivotal to the region.

The situation involving the transportation of Russian oil through the Black Sea under the E.U. and G7 embargo carries potentially serious consequences for energy security and geopolitical stability. Primarily, it presents a risk of violating sanctions and undermining general political coordination between countries. Actions taken by shipowners to circumvent the sanctions may instigate new economic and political conflicts, escalating tensions in the region and jeopardizing economic stability.

Given this situation, the European Union and the G7 countries must urgently implement measures to ensure compliance with sanctions and fortify the international legal order. Developing a collective strategy that considers all facets of energy security and geopolitical challenges is crucial. Efforts should be directed toward finding effective mechanisms to identify and prevent the circumvention of sanctions, thereby averting violations of international norms and rules.

Moreover, nations should actively advocate for the diversification of energy sources and the establishment of sustainable transportation routes that do not hinge on potential shifts in the geopolitical landscape. This approach will enhance the resilience of the energy sector and diminish susceptibility to external influences. A clean energy buildout will also help meet climate reduction targets and save up to $178 trillion in climate catastrophe costs by 2070 according to The Wall Street Journal.

Given the critical importance of energy security and geopolitical stability, immediate action and collaborative efforts are imperative to ensure a peaceful and stable global energy landscape.