SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

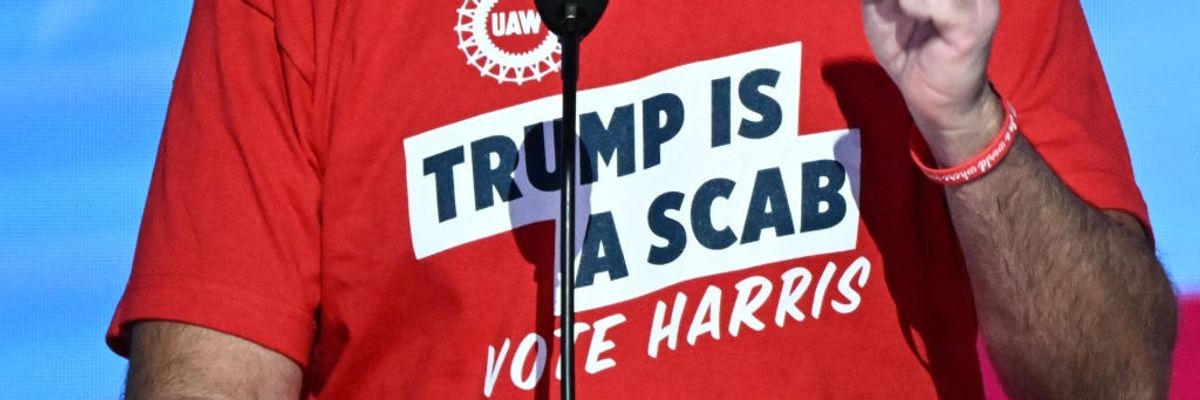

United Automobile Workers (UAW) President Shawn Fain speaks on the first day of the Democratic National Convention (DNC) at the United Center in Chicago, Illinois, on August 19, 2024.

Corporate greed in the form of stock buybacks piled on top of mass layoffs should be a laser focus of the Democratic Party if it wants to win back the nation's working class.

On the first night of the Democratic convention, United Auto Workers president Shawn Fain showed how to build working class support for the Harris-Walz ticket. And it wasn’t his “Donald Trump is a Scab” line and t-shirt.

It was his discussion of corporate power:

“Corporate greed turns blue-collar blood, sweat and tears into Wall Street stock buybacks and CEO jackpots.”

As far as I know, Fain was the only convention speaker who mentioned stock buybacks. He also zeroed in on job instability, as he called out Stellantis for refusing to honor its contract commitment to reopen a plant in Michigan.

And then he called out Trump for gloating over the firing of striking workers—a reference to Trump’s recent interview with Elon Musk, during which Trump said:

Well, you, you’re the greatest cutter. I mean, I look at what you do. You walk in and you just say, “You want to quit?” They go on strike. I won’t mention the name of the company, but they go on strike and you say, “That’s okay. You’re all gone. You’re all gone. So, every one of you is gone,” and you are the greatest. You would be very good.

Fain knows that Trump is not just praising Musk for illegally firing workers who want to organize a union. “Greatest cutter” also refers to the tens of thousands of workers Musk slashed from Twitter’s headcount to reduce costs to cover the debt service of his purchase. Trump showed his true affinity to corporate greed as he relished being with “the greatest cutter,” a man who knows how to get richer by slashing jobs.

Trump showed his true affinity to corporate greed as he relished being with “the greatest cutter,” a man who knows how to get richer by slashing jobs.

Fain also understands the intimate connection between stock buybacks and job insecurity. All too often mass layoffs are used to finance stock buybacks, the corporate method of choice for moving tax-free money into the coffers of Wall Street investors and CEOs. (A stock buyback is a form of stock manipulation. A corporation uses its revenues to buy back its own shares, reducing the number of shares available, thereby raising each share’s price. This increases the value of the stock incentives owed to corporate executives as compensation and to Wall Street investors, who own most of the corporate stock. The increased value is eventually subject to the capital gains tax, which is only owed when the stocks are sold, and is taxed at a lower rate than regular income, including dividends.)

The Democratic Party platform mildly addresses stock buybacks by proposing to raise the tax on them from one percent to four percent. It also comes very close to adopting a proposal I have been hawking over the past year: that tax-payer money awarded through federal contracts (about $700 billion per year) should not be used to lay off taxpayers and finance stock buybacks. The language in the platform states, “Taxpayer money should not be used to pay out dividends, fund stock buybacks, or give raises to executives,” (p 12). Unfortunately, the reference covers only past Covid-19 relief funds and not all federal contracts.

More importantly, the platform does not make the all-important connection between stock buybacks and mass layoffs. In fact, the 91-page platform avoids any mention at all of mass layoffs. Instead, it features “Building a Stronger, Fairer Economy,” which includes “Investing in the Engines of Job Creation.” That’s because it’s easier to talk about providing corporate incentives to create jobs in the future, rather than stopping corporations from slashing jobs to finance stock buybacks right now.

But Fain knows that the working class needs the Democrats to stop financialized mass layoffs. Hardly a day goes by without another corporation announcing layoffs while also engaging in stock buybacks. It’s a disease.

Hardly a day goes by without another corporation announcing layoffs while also engaging in stock buybacks. It’s a disease.

Most importantly Fain is telling the Democrats that job stability is the key to what “the economy” means to working people. In our society, if you don’t have a job, you have next to nothing. Studies show that losing your job is one of the most traumatic experiences anyone can experience. Sure, if you are highly skilled and plugged into elite networks, you can easily if not painlessly find new employment. But if you live in a rural area and a facility shuts down, you and a thousand of your neighbors will be scrambling to land the last jobs at the Dollar Store and Walmart.

It's not too late for the Democrats to attack Trump and Vance with one simple proposal—no compulsory layoffs at any corporation that conducts stock buybacks. If the corporation has the money to return to Wall Street and CEOs, then corporations have more than enough money to fund a program of non-compulsory layoffs. That means reductions in the workforce would only be achieved voluntarily through corporate offers of pay and benefit packages. No one would be forced to leave. In fact, many corporations already use non-compulsory buyouts for their higher-level employees.

Think for a second about how that might work. Some workers, especially those nearing retirement or who have sufficient savings, might jump at the offers. So might those who already were eyeing new careers. But workers in more difficult economic situations would still have their jobs and avoid the painful hardships associated with mass layoffs. This proposal is more than affordable considering the hundreds of billions of dollars that go to stock buybacks each year—$773 billion in 2023 alone. Let’s see some of that go into the pockets of workers, rather than exclusively to executives and shareholders.

This proposal is more than affordable considering the hundreds of billions of dollars that go to stock buybacks each year—$773 billion in 2023 alone.

Trump and Vance, for all their talk about supporting working people, could never support such a program. Their Wall Street backers and corporate sponsors would go bonkers. Their unimaginable wealth was built stripping money out of the system, not investing in it. That leaves the door wide open for the Democrats to follow Fain into the heart of the working class, especially in the all-important states of Michigan, Pennsylvania, and Wisconsin.

But it won’t be easy for many Democrats to break free from the debilitating fatalism that layoffs are just a natural part of capitalism, more like a law of nature that cannot be controlled. It means breaking away from the notion that the unstoppable march of new technologies like AI and trade are the real job killers. They are not. It means waking up to acknowledge what we all sense—corporate greed is destroying job stability, and it’s got to stop.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Les Leopold is the executive director of the Labor Institute and author of the new book, “Wall Street’s War on Workers: How Mass Layoffs and Greed Are Destroying the Working Class and What to Do About It." (2024). Read more of his work on his substack here.

On the first night of the Democratic convention, United Auto Workers president Shawn Fain showed how to build working class support for the Harris-Walz ticket. And it wasn’t his “Donald Trump is a Scab” line and t-shirt.

It was his discussion of corporate power:

“Corporate greed turns blue-collar blood, sweat and tears into Wall Street stock buybacks and CEO jackpots.”

As far as I know, Fain was the only convention speaker who mentioned stock buybacks. He also zeroed in on job instability, as he called out Stellantis for refusing to honor its contract commitment to reopen a plant in Michigan.

And then he called out Trump for gloating over the firing of striking workers—a reference to Trump’s recent interview with Elon Musk, during which Trump said:

Well, you, you’re the greatest cutter. I mean, I look at what you do. You walk in and you just say, “You want to quit?” They go on strike. I won’t mention the name of the company, but they go on strike and you say, “That’s okay. You’re all gone. You’re all gone. So, every one of you is gone,” and you are the greatest. You would be very good.

Fain knows that Trump is not just praising Musk for illegally firing workers who want to organize a union. “Greatest cutter” also refers to the tens of thousands of workers Musk slashed from Twitter’s headcount to reduce costs to cover the debt service of his purchase. Trump showed his true affinity to corporate greed as he relished being with “the greatest cutter,” a man who knows how to get richer by slashing jobs.

Trump showed his true affinity to corporate greed as he relished being with “the greatest cutter,” a man who knows how to get richer by slashing jobs.

Fain also understands the intimate connection between stock buybacks and job insecurity. All too often mass layoffs are used to finance stock buybacks, the corporate method of choice for moving tax-free money into the coffers of Wall Street investors and CEOs. (A stock buyback is a form of stock manipulation. A corporation uses its revenues to buy back its own shares, reducing the number of shares available, thereby raising each share’s price. This increases the value of the stock incentives owed to corporate executives as compensation and to Wall Street investors, who own most of the corporate stock. The increased value is eventually subject to the capital gains tax, which is only owed when the stocks are sold, and is taxed at a lower rate than regular income, including dividends.)

The Democratic Party platform mildly addresses stock buybacks by proposing to raise the tax on them from one percent to four percent. It also comes very close to adopting a proposal I have been hawking over the past year: that tax-payer money awarded through federal contracts (about $700 billion per year) should not be used to lay off taxpayers and finance stock buybacks. The language in the platform states, “Taxpayer money should not be used to pay out dividends, fund stock buybacks, or give raises to executives,” (p 12). Unfortunately, the reference covers only past Covid-19 relief funds and not all federal contracts.

More importantly, the platform does not make the all-important connection between stock buybacks and mass layoffs. In fact, the 91-page platform avoids any mention at all of mass layoffs. Instead, it features “Building a Stronger, Fairer Economy,” which includes “Investing in the Engines of Job Creation.” That’s because it’s easier to talk about providing corporate incentives to create jobs in the future, rather than stopping corporations from slashing jobs to finance stock buybacks right now.

But Fain knows that the working class needs the Democrats to stop financialized mass layoffs. Hardly a day goes by without another corporation announcing layoffs while also engaging in stock buybacks. It’s a disease.

Hardly a day goes by without another corporation announcing layoffs while also engaging in stock buybacks. It’s a disease.

Most importantly Fain is telling the Democrats that job stability is the key to what “the economy” means to working people. In our society, if you don’t have a job, you have next to nothing. Studies show that losing your job is one of the most traumatic experiences anyone can experience. Sure, if you are highly skilled and plugged into elite networks, you can easily if not painlessly find new employment. But if you live in a rural area and a facility shuts down, you and a thousand of your neighbors will be scrambling to land the last jobs at the Dollar Store and Walmart.

It's not too late for the Democrats to attack Trump and Vance with one simple proposal—no compulsory layoffs at any corporation that conducts stock buybacks. If the corporation has the money to return to Wall Street and CEOs, then corporations have more than enough money to fund a program of non-compulsory layoffs. That means reductions in the workforce would only be achieved voluntarily through corporate offers of pay and benefit packages. No one would be forced to leave. In fact, many corporations already use non-compulsory buyouts for their higher-level employees.

Think for a second about how that might work. Some workers, especially those nearing retirement or who have sufficient savings, might jump at the offers. So might those who already were eyeing new careers. But workers in more difficult economic situations would still have their jobs and avoid the painful hardships associated with mass layoffs. This proposal is more than affordable considering the hundreds of billions of dollars that go to stock buybacks each year—$773 billion in 2023 alone. Let’s see some of that go into the pockets of workers, rather than exclusively to executives and shareholders.

This proposal is more than affordable considering the hundreds of billions of dollars that go to stock buybacks each year—$773 billion in 2023 alone.

Trump and Vance, for all their talk about supporting working people, could never support such a program. Their Wall Street backers and corporate sponsors would go bonkers. Their unimaginable wealth was built stripping money out of the system, not investing in it. That leaves the door wide open for the Democrats to follow Fain into the heart of the working class, especially in the all-important states of Michigan, Pennsylvania, and Wisconsin.

But it won’t be easy for many Democrats to break free from the debilitating fatalism that layoffs are just a natural part of capitalism, more like a law of nature that cannot be controlled. It means breaking away from the notion that the unstoppable march of new technologies like AI and trade are the real job killers. They are not. It means waking up to acknowledge what we all sense—corporate greed is destroying job stability, and it’s got to stop.

Les Leopold is the executive director of the Labor Institute and author of the new book, “Wall Street’s War on Workers: How Mass Layoffs and Greed Are Destroying the Working Class and What to Do About It." (2024). Read more of his work on his substack here.

On the first night of the Democratic convention, United Auto Workers president Shawn Fain showed how to build working class support for the Harris-Walz ticket. And it wasn’t his “Donald Trump is a Scab” line and t-shirt.

It was his discussion of corporate power:

“Corporate greed turns blue-collar blood, sweat and tears into Wall Street stock buybacks and CEO jackpots.”

As far as I know, Fain was the only convention speaker who mentioned stock buybacks. He also zeroed in on job instability, as he called out Stellantis for refusing to honor its contract commitment to reopen a plant in Michigan.

And then he called out Trump for gloating over the firing of striking workers—a reference to Trump’s recent interview with Elon Musk, during which Trump said:

Well, you, you’re the greatest cutter. I mean, I look at what you do. You walk in and you just say, “You want to quit?” They go on strike. I won’t mention the name of the company, but they go on strike and you say, “That’s okay. You’re all gone. You’re all gone. So, every one of you is gone,” and you are the greatest. You would be very good.

Fain knows that Trump is not just praising Musk for illegally firing workers who want to organize a union. “Greatest cutter” also refers to the tens of thousands of workers Musk slashed from Twitter’s headcount to reduce costs to cover the debt service of his purchase. Trump showed his true affinity to corporate greed as he relished being with “the greatest cutter,” a man who knows how to get richer by slashing jobs.

Trump showed his true affinity to corporate greed as he relished being with “the greatest cutter,” a man who knows how to get richer by slashing jobs.

Fain also understands the intimate connection between stock buybacks and job insecurity. All too often mass layoffs are used to finance stock buybacks, the corporate method of choice for moving tax-free money into the coffers of Wall Street investors and CEOs. (A stock buyback is a form of stock manipulation. A corporation uses its revenues to buy back its own shares, reducing the number of shares available, thereby raising each share’s price. This increases the value of the stock incentives owed to corporate executives as compensation and to Wall Street investors, who own most of the corporate stock. The increased value is eventually subject to the capital gains tax, which is only owed when the stocks are sold, and is taxed at a lower rate than regular income, including dividends.)

The Democratic Party platform mildly addresses stock buybacks by proposing to raise the tax on them from one percent to four percent. It also comes very close to adopting a proposal I have been hawking over the past year: that tax-payer money awarded through federal contracts (about $700 billion per year) should not be used to lay off taxpayers and finance stock buybacks. The language in the platform states, “Taxpayer money should not be used to pay out dividends, fund stock buybacks, or give raises to executives,” (p 12). Unfortunately, the reference covers only past Covid-19 relief funds and not all federal contracts.

More importantly, the platform does not make the all-important connection between stock buybacks and mass layoffs. In fact, the 91-page platform avoids any mention at all of mass layoffs. Instead, it features “Building a Stronger, Fairer Economy,” which includes “Investing in the Engines of Job Creation.” That’s because it’s easier to talk about providing corporate incentives to create jobs in the future, rather than stopping corporations from slashing jobs to finance stock buybacks right now.

But Fain knows that the working class needs the Democrats to stop financialized mass layoffs. Hardly a day goes by without another corporation announcing layoffs while also engaging in stock buybacks. It’s a disease.

Hardly a day goes by without another corporation announcing layoffs while also engaging in stock buybacks. It’s a disease.

Most importantly Fain is telling the Democrats that job stability is the key to what “the economy” means to working people. In our society, if you don’t have a job, you have next to nothing. Studies show that losing your job is one of the most traumatic experiences anyone can experience. Sure, if you are highly skilled and plugged into elite networks, you can easily if not painlessly find new employment. But if you live in a rural area and a facility shuts down, you and a thousand of your neighbors will be scrambling to land the last jobs at the Dollar Store and Walmart.

It's not too late for the Democrats to attack Trump and Vance with one simple proposal—no compulsory layoffs at any corporation that conducts stock buybacks. If the corporation has the money to return to Wall Street and CEOs, then corporations have more than enough money to fund a program of non-compulsory layoffs. That means reductions in the workforce would only be achieved voluntarily through corporate offers of pay and benefit packages. No one would be forced to leave. In fact, many corporations already use non-compulsory buyouts for their higher-level employees.

Think for a second about how that might work. Some workers, especially those nearing retirement or who have sufficient savings, might jump at the offers. So might those who already were eyeing new careers. But workers in more difficult economic situations would still have their jobs and avoid the painful hardships associated with mass layoffs. This proposal is more than affordable considering the hundreds of billions of dollars that go to stock buybacks each year—$773 billion in 2023 alone. Let’s see some of that go into the pockets of workers, rather than exclusively to executives and shareholders.

This proposal is more than affordable considering the hundreds of billions of dollars that go to stock buybacks each year—$773 billion in 2023 alone.

Trump and Vance, for all their talk about supporting working people, could never support such a program. Their Wall Street backers and corporate sponsors would go bonkers. Their unimaginable wealth was built stripping money out of the system, not investing in it. That leaves the door wide open for the Democrats to follow Fain into the heart of the working class, especially in the all-important states of Michigan, Pennsylvania, and Wisconsin.

But it won’t be easy for many Democrats to break free from the debilitating fatalism that layoffs are just a natural part of capitalism, more like a law of nature that cannot be controlled. It means breaking away from the notion that the unstoppable march of new technologies like AI and trade are the real job killers. They are not. It means waking up to acknowledge what we all sense—corporate greed is destroying job stability, and it’s got to stop.