During the 2025 tax debate, policymakers have the opportunity to remake the tax code so that it is fairer, works for low- and moderate-income people and families, and advances racial equity.

A key priority should be expanding the Child Tax Credit to benefit the roughly 19 million children shut out from receiving the full credit simply because their families have low incomes. Lawmakers should, at a minimum, reinstate the successful 2021 American Rescue Plan expansion of the Child Tax Credit, including making the full credit available to children in families with low incomes and increasing the maximum amount of the credit to $3,600 for children aged five and younger and $3,000 for children aged 6 to 17, among other changes.

When the expanded credit expired, the number of children experiencing poverty rose substantially, demonstrating that child poverty is created—and can be alleviated —through policy choices.

There has been intensive congressional interest in the Child Tax Credit this year, including the House-passed bipartisan Wyden-Smith expansion, and proposals from congressional Child Tax Credit champions that build on the Rescue Plan.

Under current law, three major design flaws in the Child Tax Credit deny its full benefit to millions of children in low-income families:

- It phases in slowly at $0.15 per dollar of earnings, regardless of the number of children in a family;

- It starts phasing in only after a family has $2,500 in earnings; and

- It caps the credit amount that families with lower incomes can receive as a refund to $1,700 per child (for 2024), less than the $2,000 maximum for children in families with higher incomes. (The 2017 tax law set the limit on the credit refund amount, which is sometimes referred to as a “refundability cap.”)

The credit is also unavailable to 17-year-olds, who typically are still in high school.

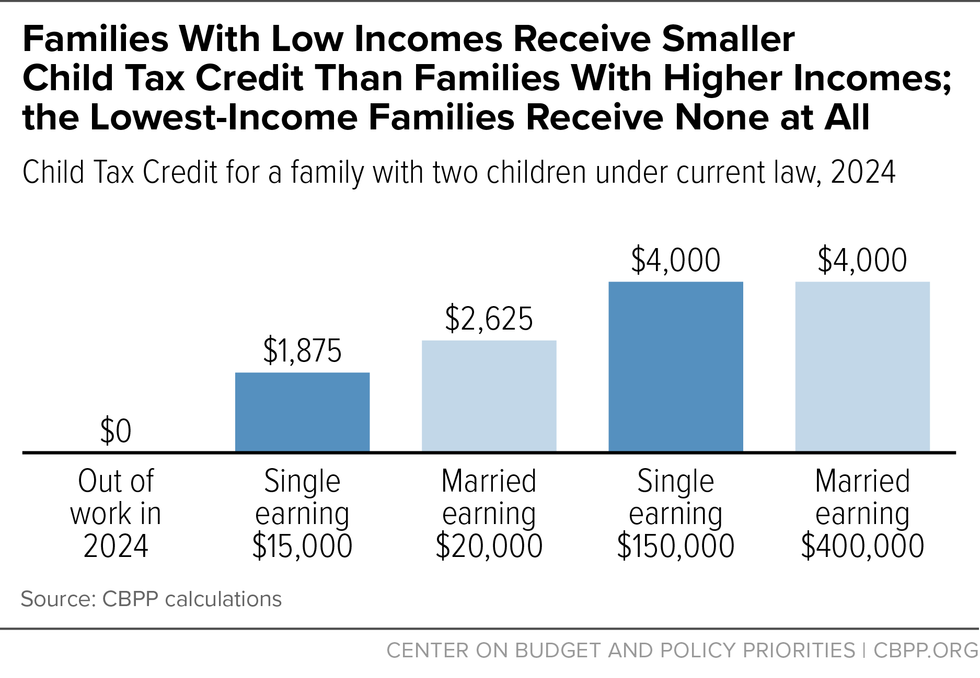

An estimated 1 in 4 children—or roughly 19 million children—got less than the full $2,000-per-child credit or no credit in 2022 because their families’ incomes were too low. (See chart for examples of families at different income levels.) This includes nearly half of Black children, 4 in 10 Native American children, more than 1 in 3 Latino children, and about 1 in 3 children living in rural areas. Their families are overrepresented in low-paying work due to past and present hiring discrimination, inequities in educational and housing opportunities, and other sources of inequality. About 1 in 6 white children, more than 1 in 7 Asian children, and all children in Puerto Rico are also left out of the full credit.

When Congress temporarily expanded the Child Tax Credit in 2021, child poverty plummeted; the credit expansion reduced the number of children living below the poverty line by more than a third. While all racial and ethnic groups saw large reductions in poverty, the percentage point reduction in child poverty was largest for Black, Latino, and Native American children. In passing the American Rescue Plan, Congress extended the Child Tax Credit to all children living in families with low or no income for the first time, and increased the $2,000-per-child credit to $3,600 per child aged 5 and younger, and $3,000 per child aged 6 to 17 (making 17-year-olds eligible for the first time), among other changes.

When the expanded credit expired, the number of children experiencing poverty rose substantially, demonstrating that child poverty is created—and can be alleviated —through policy choices. A 2019 National Academies of Science, Engineering, and Medicine report on reducing child poverty found that “income poverty itself causes negative child outcomes.” A large number of studies have found evidence that additional income can improve children’s outcomes in the short and long term.

If the Rescue Plan version of the Child Tax Credit were in place for 2024, roughly 2.6 million fewer children would live in families with incomes below the poverty line. (See Table 1 at this link for estimates by state.) This includes 959,000 Latino children, 755,000 white children, 654,000 Black children, 79,000 Native American children, and 71,000 Asian children.

Congress should, at a minimum, reinstate the Rescue Plan expansion of the Child Tax Credit.

We’ve seen strong interest in the Child Tax Credit over the last year. Bipartisan tax legislation, which was negotiated by House Ways and Means Chair Jason Smith (R-Mo.) and Senate Finance Committee Chair Ron Wyden (D-Ore.), included a modest, but still important, expansion and passed the House with a large majority in January 2024. That proposal would have increased the Child Tax Credit for an estimated 16 million children in the first year, and lifted some 500,000 children above the poverty line when fully in effect.

Separately, two congressional proposals, Sens. Sherrod Brown (D-Ohio) and Michael Bennet’s (D-Colo.) Working Families Tax Relief Act and Rep. Rosa DeLauro’s (D-Conn.) American Family Act, build on the success of the Rescue Plan’s expanded Child Tax Credit. They make the full credit available to children in families with low incomes, propose larger maximum credit amounts than the Rescue Plan (by adjusting the Rescue Plan maximum credit amounts for inflation), and make additional changes to the credit. Though details differ, both proposals would lift more children above the poverty line over time than reinstating the 2021 Rescue Plan credit due to their larger maximum credit values and other changes. For example, according to a Columbia University analysis, had the American Family Act been in place for 2023 the credit expansion would have lifted an additional 3.6 million children out of poverty compared to current law.

Policymakers in both parties should make expanding the Child Tax Credit a priority in the 2025 tax debate. At minimum they should reinstate the Rescue Plan changes, which would provide an income boost to more than 60 million children in total, including the 19 million children in families with the lowest incomes. (See Table 2 at this link for estimates by state.) Expanding the Child Tax Credit is a proven solution for lifting millions of children above the poverty line and helping to ensure that all children have the resources they need to thrive.