SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

The SDGs are largely an investment agenda into human capital and infrastructure, yet many developing countries cannot finance these investments at reasonable terms.

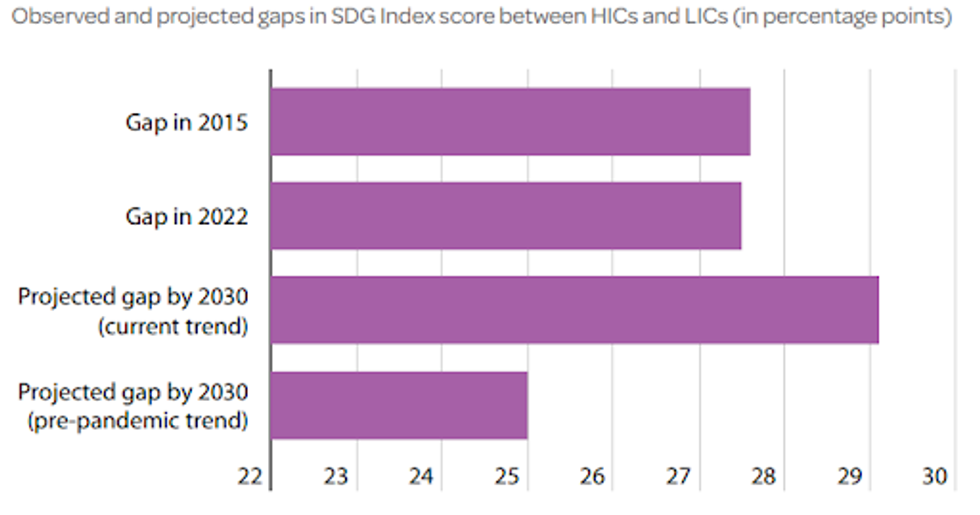

July 2023 was the hottest month ever recorded on Earth. From the rising impacts of climate change evidenced by the deadly wildfires across the world to the growing global inequities, it is clear that we have reached a decisive moment for achieving sustainable development. Furthermore, the gap between rich and poor countries on sustainable development outcomes is at risk of being larger in 2030 than it was in 2015, as highlighted in the 2023 Sustainable Development Report (which includes the SDG Index).

This is largely due to inefficiencies in the international financing system for financing the Sustainable Development Goals (SDGs). To avoid a lost decade for convergence in sustainable development, we need long-term national SDG plans, backed by adequate financing, combined with global and regional cooperation.

The SDGs are largely an investment agenda into human capital and infrastructure, yet many developing countries cannot finance these investments at reasonable terms. The SDG financing gap was recently estimated by the United Nations at $4 trillion (or around 4% of world output). A rather modest amount relative to the size of the global economy, but very large relative to developing countries’ gross domestic product (likely 10-20 % or more). High-income countries managed to mobilize more than $17 trillion in post-Covid-19 recovery at zero or near-zero interest rates. By contrast, many developing countries lack access to capital markets, and even if they have access, they pay higher interest rates and face shorter repayment terms. This is the perfect recipe for getting stuck into liquidity crises, the “poverty trap,” and social unrest.

While it is often argued that the high interest rates faced by developing countries simply compensate for their higher risks of default, this presumption is contradicted by the historical record: The higher interest rates more than compensate for the higher risks of default of developing countries. As documented by Meyer, Reinhart, and Trebesch (2022), the long-term returns on risky sovereign bonds have been far higher than the returns on “safe” United States and United Kingdom securities, even taking into account the episodes of default. In reality, the higher interest rates faced by developing countries reflect two fundamental inefficiencies of the international financial markets:

Access to financing must be linked with SDG gaps and countries’ efforts to achieve sustainable development. There are two crucial levers to increase access to long-term SDG financing in developing countries.

First, sovereign risk-rating agencies and financial institutions at large must capture the growth potential of investing into sustainable development and better understand countries’ SDG efforts. As emphasized by U.N. Secretary-General António Guterres:

The divergence between developed and developing countries is becoming systemic—a recipe for instability, crisis, and forced migration. These imbalances are not a bug, but a feature of the global financial system. They are inbuilt and structural. They are the product of a system that routinely ascribes poor credit ratings to developing economies, starving them of private finance.

Whether it is via sustainability-themed bonds or via significant revisions of credit-risk rating methodologies, the cost of borrowing and maturities must better reflect SDG efforts and commitments in developing countries. There is a clear business case for this. When Benin worked with private financial institutions to issue the first African SDG Bond in July 2021, it managed to mobilize €500 million with a 20-base points greenium (i.e. lower cost of borrowing than its typical sovereign bond) and an average maturity of 12.5 years from the international capital market. New mechanisms, such as new swap lines and the expansion of the IMF Special Drawing Rights, can help increase guarantees and extend lender-of-last-resort protection. Partnerships between private financial institutions, governments, and civil society organizations in the development of long-term pathways and investment frameworks, as well as in the monitoring of policies and impacts, will help reduce risks and increase accountability.

Second, Multilateral Development Banks (MDBs) should operate at a much higher scale. Thanks to their governance system, MDBs—including the World Bank and regional development banks—can borrow and lend to their member countries at lower interest rates. When MDBs borrow on international markets, they offer more guarantees to lenders than individual countries because the loans are guaranteed by all their members. Yet, MDBs operate at a scale which is largely insufficient.

In September 2022, Guterres introduced the SDG Stimulus. As emphasized by Sustainable Development Solutions Network Leadership Council members, the urgent objective of the SDG Stimulus is to address—in practical terms and at scale—the chronic shortfall of international SDG financing facing the low income countries and low-and-middle-income countries, and to ramp up financing flows by at least $500 billion by 2025. The most important component of the stimulus plan is a massive expansion of loans by the MDBs, backed by new rounds of paid-in capital by high-income country members. Unfortunately, the commitment made at the recent Paris Summit for a Global Financing Pact—an overall increase of $200 billion of MDBs’ lending capacity over the next 10 years (at $20 billion per year)—remains vastly insufficient.

At the global level, the SDG financing gap is largely the result of missed investment opportunities caused by an inappropriate financing framework. Moving forward, we must channel a larger share of global savings (currently equivalent to around $28 trillion per year) to activities that promote sustainable development, especially in developing countries. And the notion of risk must be reconsidered to recognize the long-term returns of investing into sustainable development and the cost of inaction.

In any case, greater access to financing from private capital markets, debt relief & restructuration, increased Official Development Assistance, foreign direct investments, and MDB lending must be associated with long-term investment planning, fiscal frameworks, project implementation, financial operations, and relations with partner institutions in developing countries, in order to be able to channel much larger funds into long-term sustainable development.

This year’s United Nations General Assembly and SDG Summit, and the upcoming G20 meeting in India, are important milestones to reform the global financial system and to promote cooperation and pathways for sustainable development.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

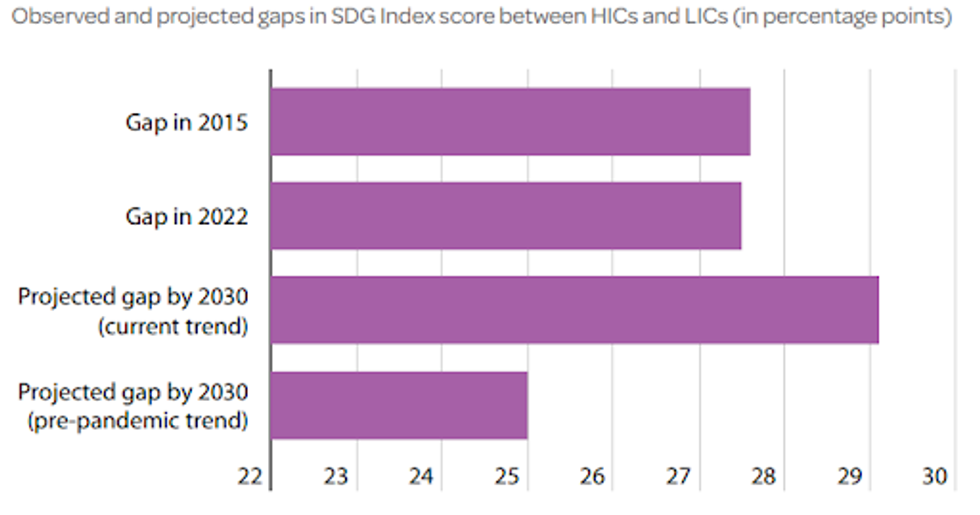

July 2023 was the hottest month ever recorded on Earth. From the rising impacts of climate change evidenced by the deadly wildfires across the world to the growing global inequities, it is clear that we have reached a decisive moment for achieving sustainable development. Furthermore, the gap between rich and poor countries on sustainable development outcomes is at risk of being larger in 2030 than it was in 2015, as highlighted in the 2023 Sustainable Development Report (which includes the SDG Index).

This is largely due to inefficiencies in the international financing system for financing the Sustainable Development Goals (SDGs). To avoid a lost decade for convergence in sustainable development, we need long-term national SDG plans, backed by adequate financing, combined with global and regional cooperation.

The SDGs are largely an investment agenda into human capital and infrastructure, yet many developing countries cannot finance these investments at reasonable terms. The SDG financing gap was recently estimated by the United Nations at $4 trillion (or around 4% of world output). A rather modest amount relative to the size of the global economy, but very large relative to developing countries’ gross domestic product (likely 10-20 % or more). High-income countries managed to mobilize more than $17 trillion in post-Covid-19 recovery at zero or near-zero interest rates. By contrast, many developing countries lack access to capital markets, and even if they have access, they pay higher interest rates and face shorter repayment terms. This is the perfect recipe for getting stuck into liquidity crises, the “poverty trap,” and social unrest.

While it is often argued that the high interest rates faced by developing countries simply compensate for their higher risks of default, this presumption is contradicted by the historical record: The higher interest rates more than compensate for the higher risks of default of developing countries. As documented by Meyer, Reinhart, and Trebesch (2022), the long-term returns on risky sovereign bonds have been far higher than the returns on “safe” United States and United Kingdom securities, even taking into account the episodes of default. In reality, the higher interest rates faced by developing countries reflect two fundamental inefficiencies of the international financial markets:

Access to financing must be linked with SDG gaps and countries’ efforts to achieve sustainable development. There are two crucial levers to increase access to long-term SDG financing in developing countries.

First, sovereign risk-rating agencies and financial institutions at large must capture the growth potential of investing into sustainable development and better understand countries’ SDG efforts. As emphasized by U.N. Secretary-General António Guterres:

The divergence between developed and developing countries is becoming systemic—a recipe for instability, crisis, and forced migration. These imbalances are not a bug, but a feature of the global financial system. They are inbuilt and structural. They are the product of a system that routinely ascribes poor credit ratings to developing economies, starving them of private finance.

Whether it is via sustainability-themed bonds or via significant revisions of credit-risk rating methodologies, the cost of borrowing and maturities must better reflect SDG efforts and commitments in developing countries. There is a clear business case for this. When Benin worked with private financial institutions to issue the first African SDG Bond in July 2021, it managed to mobilize €500 million with a 20-base points greenium (i.e. lower cost of borrowing than its typical sovereign bond) and an average maturity of 12.5 years from the international capital market. New mechanisms, such as new swap lines and the expansion of the IMF Special Drawing Rights, can help increase guarantees and extend lender-of-last-resort protection. Partnerships between private financial institutions, governments, and civil society organizations in the development of long-term pathways and investment frameworks, as well as in the monitoring of policies and impacts, will help reduce risks and increase accountability.

Second, Multilateral Development Banks (MDBs) should operate at a much higher scale. Thanks to their governance system, MDBs—including the World Bank and regional development banks—can borrow and lend to their member countries at lower interest rates. When MDBs borrow on international markets, they offer more guarantees to lenders than individual countries because the loans are guaranteed by all their members. Yet, MDBs operate at a scale which is largely insufficient.

In September 2022, Guterres introduced the SDG Stimulus. As emphasized by Sustainable Development Solutions Network Leadership Council members, the urgent objective of the SDG Stimulus is to address—in practical terms and at scale—the chronic shortfall of international SDG financing facing the low income countries and low-and-middle-income countries, and to ramp up financing flows by at least $500 billion by 2025. The most important component of the stimulus plan is a massive expansion of loans by the MDBs, backed by new rounds of paid-in capital by high-income country members. Unfortunately, the commitment made at the recent Paris Summit for a Global Financing Pact—an overall increase of $200 billion of MDBs’ lending capacity over the next 10 years (at $20 billion per year)—remains vastly insufficient.

At the global level, the SDG financing gap is largely the result of missed investment opportunities caused by an inappropriate financing framework. Moving forward, we must channel a larger share of global savings (currently equivalent to around $28 trillion per year) to activities that promote sustainable development, especially in developing countries. And the notion of risk must be reconsidered to recognize the long-term returns of investing into sustainable development and the cost of inaction.

In any case, greater access to financing from private capital markets, debt relief & restructuration, increased Official Development Assistance, foreign direct investments, and MDB lending must be associated with long-term investment planning, fiscal frameworks, project implementation, financial operations, and relations with partner institutions in developing countries, in order to be able to channel much larger funds into long-term sustainable development.

This year’s United Nations General Assembly and SDG Summit, and the upcoming G20 meeting in India, are important milestones to reform the global financial system and to promote cooperation and pathways for sustainable development.

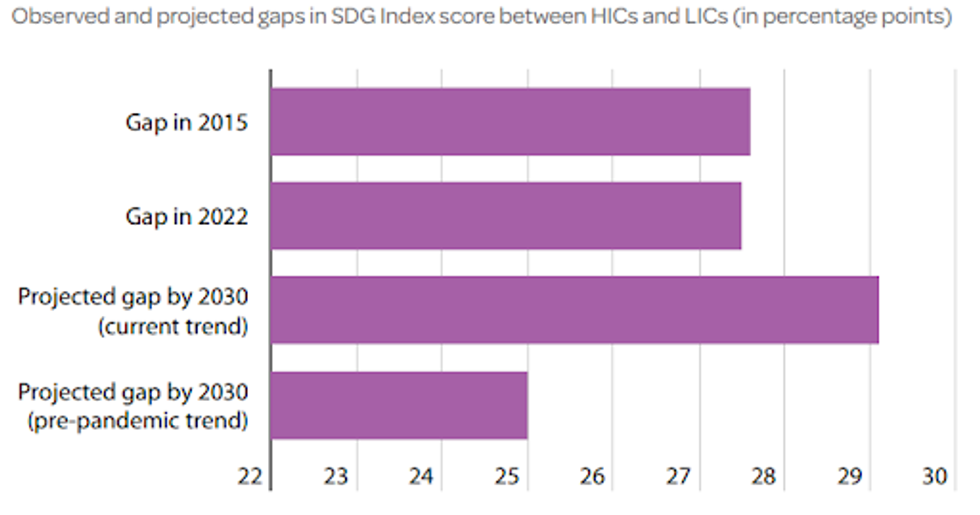

July 2023 was the hottest month ever recorded on Earth. From the rising impacts of climate change evidenced by the deadly wildfires across the world to the growing global inequities, it is clear that we have reached a decisive moment for achieving sustainable development. Furthermore, the gap between rich and poor countries on sustainable development outcomes is at risk of being larger in 2030 than it was in 2015, as highlighted in the 2023 Sustainable Development Report (which includes the SDG Index).

This is largely due to inefficiencies in the international financing system for financing the Sustainable Development Goals (SDGs). To avoid a lost decade for convergence in sustainable development, we need long-term national SDG plans, backed by adequate financing, combined with global and regional cooperation.

The SDGs are largely an investment agenda into human capital and infrastructure, yet many developing countries cannot finance these investments at reasonable terms. The SDG financing gap was recently estimated by the United Nations at $4 trillion (or around 4% of world output). A rather modest amount relative to the size of the global economy, but very large relative to developing countries’ gross domestic product (likely 10-20 % or more). High-income countries managed to mobilize more than $17 trillion in post-Covid-19 recovery at zero or near-zero interest rates. By contrast, many developing countries lack access to capital markets, and even if they have access, they pay higher interest rates and face shorter repayment terms. This is the perfect recipe for getting stuck into liquidity crises, the “poverty trap,” and social unrest.

While it is often argued that the high interest rates faced by developing countries simply compensate for their higher risks of default, this presumption is contradicted by the historical record: The higher interest rates more than compensate for the higher risks of default of developing countries. As documented by Meyer, Reinhart, and Trebesch (2022), the long-term returns on risky sovereign bonds have been far higher than the returns on “safe” United States and United Kingdom securities, even taking into account the episodes of default. In reality, the higher interest rates faced by developing countries reflect two fundamental inefficiencies of the international financial markets:

Access to financing must be linked with SDG gaps and countries’ efforts to achieve sustainable development. There are two crucial levers to increase access to long-term SDG financing in developing countries.

First, sovereign risk-rating agencies and financial institutions at large must capture the growth potential of investing into sustainable development and better understand countries’ SDG efforts. As emphasized by U.N. Secretary-General António Guterres:

The divergence between developed and developing countries is becoming systemic—a recipe for instability, crisis, and forced migration. These imbalances are not a bug, but a feature of the global financial system. They are inbuilt and structural. They are the product of a system that routinely ascribes poor credit ratings to developing economies, starving them of private finance.

Whether it is via sustainability-themed bonds or via significant revisions of credit-risk rating methodologies, the cost of borrowing and maturities must better reflect SDG efforts and commitments in developing countries. There is a clear business case for this. When Benin worked with private financial institutions to issue the first African SDG Bond in July 2021, it managed to mobilize €500 million with a 20-base points greenium (i.e. lower cost of borrowing than its typical sovereign bond) and an average maturity of 12.5 years from the international capital market. New mechanisms, such as new swap lines and the expansion of the IMF Special Drawing Rights, can help increase guarantees and extend lender-of-last-resort protection. Partnerships between private financial institutions, governments, and civil society organizations in the development of long-term pathways and investment frameworks, as well as in the monitoring of policies and impacts, will help reduce risks and increase accountability.

Second, Multilateral Development Banks (MDBs) should operate at a much higher scale. Thanks to their governance system, MDBs—including the World Bank and regional development banks—can borrow and lend to their member countries at lower interest rates. When MDBs borrow on international markets, they offer more guarantees to lenders than individual countries because the loans are guaranteed by all their members. Yet, MDBs operate at a scale which is largely insufficient.

In September 2022, Guterres introduced the SDG Stimulus. As emphasized by Sustainable Development Solutions Network Leadership Council members, the urgent objective of the SDG Stimulus is to address—in practical terms and at scale—the chronic shortfall of international SDG financing facing the low income countries and low-and-middle-income countries, and to ramp up financing flows by at least $500 billion by 2025. The most important component of the stimulus plan is a massive expansion of loans by the MDBs, backed by new rounds of paid-in capital by high-income country members. Unfortunately, the commitment made at the recent Paris Summit for a Global Financing Pact—an overall increase of $200 billion of MDBs’ lending capacity over the next 10 years (at $20 billion per year)—remains vastly insufficient.

At the global level, the SDG financing gap is largely the result of missed investment opportunities caused by an inappropriate financing framework. Moving forward, we must channel a larger share of global savings (currently equivalent to around $28 trillion per year) to activities that promote sustainable development, especially in developing countries. And the notion of risk must be reconsidered to recognize the long-term returns of investing into sustainable development and the cost of inaction.

In any case, greater access to financing from private capital markets, debt relief & restructuration, increased Official Development Assistance, foreign direct investments, and MDB lending must be associated with long-term investment planning, fiscal frameworks, project implementation, financial operations, and relations with partner institutions in developing countries, in order to be able to channel much larger funds into long-term sustainable development.

This year’s United Nations General Assembly and SDG Summit, and the upcoming G20 meeting in India, are important milestones to reform the global financial system and to promote cooperation and pathways for sustainable development.