SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

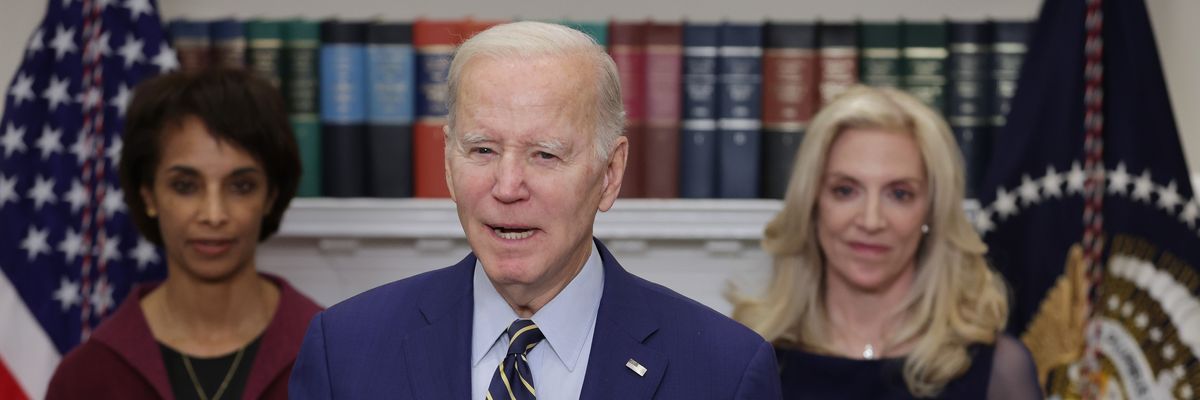

U.S. President Joe Biden delivers remarks on the February jobs report with Council of Economic Advisers Chair Cecilia Rouse and National Economic Council Director Lael Brainard at the White House on March 10, 2023 in Washington, D.C.

If wage growth is now more or less in line with the 2% target, then the Fed can hold off on further rate hikes.

The failure of Silicon Valley Bank on Friday overtook the really big event of the day, the February jobs report. The 311,000 jobs were far more than I had expected. I thought the huge January number was a fluke of seasonal adjustments and unusually good winter weather. For that reason, I expected the February number to be very weak, not because I thought the labor market had crashed, but just as a correction to the high number in January.

I was wrong in a very big way. The January number was obviously real and the economy is still creating jobs at a very rapid clip.

This is somewhat concerning in that there is no way the economy can keep creating jobs at this pace without seeing some serious inflationary pressure, but this is where the other part of the good news story comes in. Wage growth slowed in February. The slower growth in February, combined with a downward revision to the January number, gave us a 3.6% annual rate of wage growth over the last three months.

This pace of wage growth is consistent with the Fed’s 2% inflation target. We had wage growth at this pace through much of 2018 and 2019 even as inflation was coming in slightly under the targeted rate.

I ordinarily would not be cheering slower wage growth, but the reality is that the Fed is determined to bring inflation down towards its target. If wages are growing at a pace that is faster than is consistent with its target, it will keep raising rates, and throwing people out of work, until wage growth slows.

If wage growth is now more or less in line with the 2% target, then the Fed can hold off on further rate hikes. Hopefully, it would then allow the economy to continue to grow with the unemployment rate remaining near 3.5%.

Of course, we do need to see real wage growth and inflation has been running faster than 3.5%. However, there are good reasons for believing that inflation will be slowing in the months ahead. Most importantly, we know that inflation in rents will slow sharply, as private indexes measuring rents of units coming up on the market have showed little or no inflation in recent months. The CPI rent index, which measures the rent of all units (both those that come up on the market and those with a continuing tenant) follows these indices with a lag of 6-12 months.

It is also likely that we will see further drops in many of the supply chain goods, most importantly cars, where temporary shortages sent prices soaring in the pandemic. This will help put downward pressure on inflation in goods, and also services like car repairs, where the cost of goods is a large part of the price.

And, we are also likely to see less inflation in food prices. The wholesale prices of many items, most notably eggs, has fallen sharply in the last couple of months. This should show up in lower prices in stores.

If we have a story where wages are rising at a 3.6% annual rate, and inflation falls to under 2.5%, then we would be seeing a respectable pace of real wage growth. We can hope for better, and also that we continue to see disproportionate growth at the bottom, but low unemployment and modest real wage growth is a pretty good picture.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

The failure of Silicon Valley Bank on Friday overtook the really big event of the day, the February jobs report. The 311,000 jobs were far more than I had expected. I thought the huge January number was a fluke of seasonal adjustments and unusually good winter weather. For that reason, I expected the February number to be very weak, not because I thought the labor market had crashed, but just as a correction to the high number in January.

I was wrong in a very big way. The January number was obviously real and the economy is still creating jobs at a very rapid clip.

This is somewhat concerning in that there is no way the economy can keep creating jobs at this pace without seeing some serious inflationary pressure, but this is where the other part of the good news story comes in. Wage growth slowed in February. The slower growth in February, combined with a downward revision to the January number, gave us a 3.6% annual rate of wage growth over the last three months.

This pace of wage growth is consistent with the Fed’s 2% inflation target. We had wage growth at this pace through much of 2018 and 2019 even as inflation was coming in slightly under the targeted rate.

I ordinarily would not be cheering slower wage growth, but the reality is that the Fed is determined to bring inflation down towards its target. If wages are growing at a pace that is faster than is consistent with its target, it will keep raising rates, and throwing people out of work, until wage growth slows.

If wage growth is now more or less in line with the 2% target, then the Fed can hold off on further rate hikes. Hopefully, it would then allow the economy to continue to grow with the unemployment rate remaining near 3.5%.

Of course, we do need to see real wage growth and inflation has been running faster than 3.5%. However, there are good reasons for believing that inflation will be slowing in the months ahead. Most importantly, we know that inflation in rents will slow sharply, as private indexes measuring rents of units coming up on the market have showed little or no inflation in recent months. The CPI rent index, which measures the rent of all units (both those that come up on the market and those with a continuing tenant) follows these indices with a lag of 6-12 months.

It is also likely that we will see further drops in many of the supply chain goods, most importantly cars, where temporary shortages sent prices soaring in the pandemic. This will help put downward pressure on inflation in goods, and also services like car repairs, where the cost of goods is a large part of the price.

And, we are also likely to see less inflation in food prices. The wholesale prices of many items, most notably eggs, has fallen sharply in the last couple of months. This should show up in lower prices in stores.

If we have a story where wages are rising at a 3.6% annual rate, and inflation falls to under 2.5%, then we would be seeing a respectable pace of real wage growth. We can hope for better, and also that we continue to see disproportionate growth at the bottom, but low unemployment and modest real wage growth is a pretty good picture.

The failure of Silicon Valley Bank on Friday overtook the really big event of the day, the February jobs report. The 311,000 jobs were far more than I had expected. I thought the huge January number was a fluke of seasonal adjustments and unusually good winter weather. For that reason, I expected the February number to be very weak, not because I thought the labor market had crashed, but just as a correction to the high number in January.

I was wrong in a very big way. The January number was obviously real and the economy is still creating jobs at a very rapid clip.

This is somewhat concerning in that there is no way the economy can keep creating jobs at this pace without seeing some serious inflationary pressure, but this is where the other part of the good news story comes in. Wage growth slowed in February. The slower growth in February, combined with a downward revision to the January number, gave us a 3.6% annual rate of wage growth over the last three months.

This pace of wage growth is consistent with the Fed’s 2% inflation target. We had wage growth at this pace through much of 2018 and 2019 even as inflation was coming in slightly under the targeted rate.

I ordinarily would not be cheering slower wage growth, but the reality is that the Fed is determined to bring inflation down towards its target. If wages are growing at a pace that is faster than is consistent with its target, it will keep raising rates, and throwing people out of work, until wage growth slows.

If wage growth is now more or less in line with the 2% target, then the Fed can hold off on further rate hikes. Hopefully, it would then allow the economy to continue to grow with the unemployment rate remaining near 3.5%.

Of course, we do need to see real wage growth and inflation has been running faster than 3.5%. However, there are good reasons for believing that inflation will be slowing in the months ahead. Most importantly, we know that inflation in rents will slow sharply, as private indexes measuring rents of units coming up on the market have showed little or no inflation in recent months. The CPI rent index, which measures the rent of all units (both those that come up on the market and those with a continuing tenant) follows these indices with a lag of 6-12 months.

It is also likely that we will see further drops in many of the supply chain goods, most importantly cars, where temporary shortages sent prices soaring in the pandemic. This will help put downward pressure on inflation in goods, and also services like car repairs, where the cost of goods is a large part of the price.

And, we are also likely to see less inflation in food prices. The wholesale prices of many items, most notably eggs, has fallen sharply in the last couple of months. This should show up in lower prices in stores.

If we have a story where wages are rising at a 3.6% annual rate, and inflation falls to under 2.5%, then we would be seeing a respectable pace of real wage growth. We can hope for better, and also that we continue to see disproportionate growth at the bottom, but low unemployment and modest real wage growth is a pretty good picture.