Presidential candidates Kamala Harris and Donald Trump have put forward a wide range of different tax proposals during this year’s campaign. We have now fully analyzed the distributional impacts of the major proposals of both Vice President Harris and former President Trump in separate analyses (see here for Harris and here for Trump).

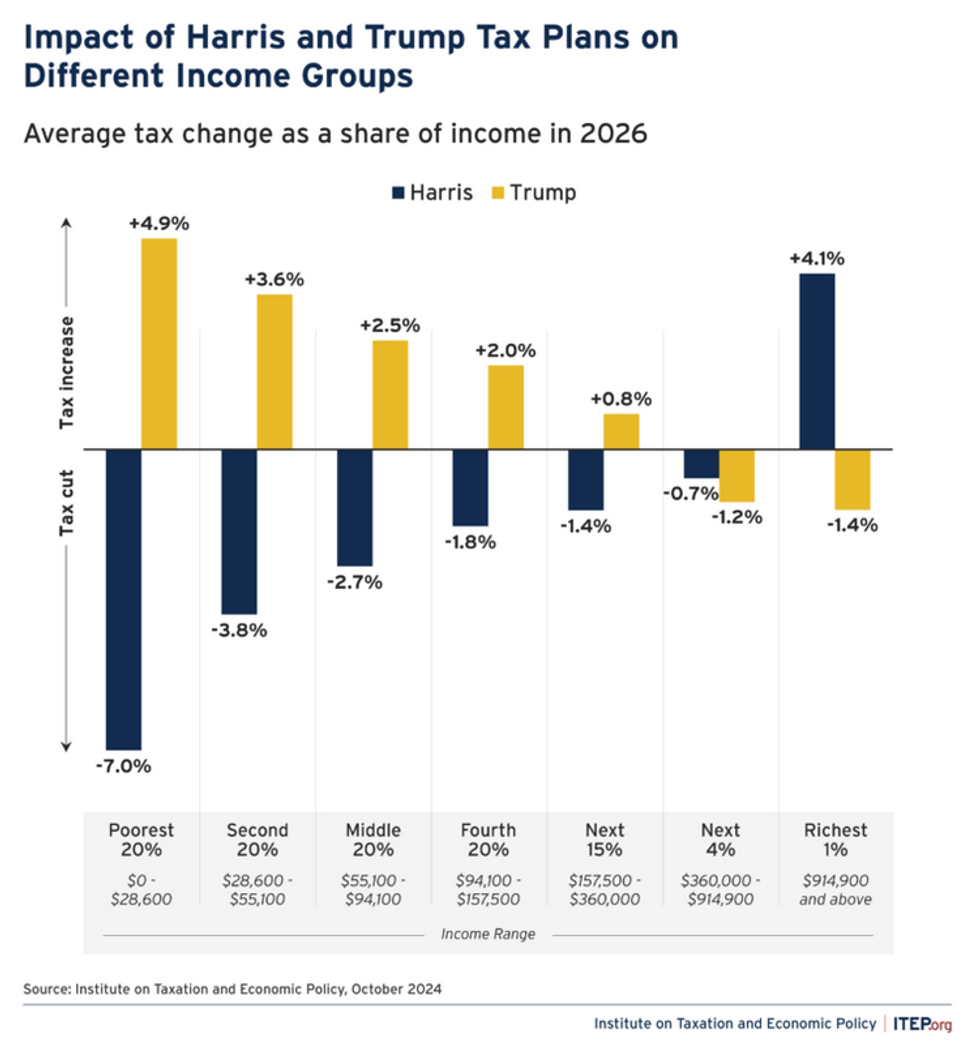

In all, the tax proposals announced by Harris would, on average, lead to a tax cut for all income groups except the richest 1 percent of Americans, while the proposals announced by Trump would, on average, lead to a tax increase for all income groups except the richest 5 percent of Americans.

If the Harris proposals were in effect in 2026, the richest 1 percent – with incomes of $914,900 and above – would receive an average tax increase equal to 4.1 percent of their income. All other income groups would receive tax cuts, including an average tax cut equal to 2.7 percent of income for the middle fifth of Americans – with incomes between $55,100 and $94,100 – and an average tax cut equal to 7 percent of income for the poorest fifth of Americans (those with incomes less than $28,600).

Under the Trump proposals, in 2026 the richest 1 percent would receive an average tax cut equal to 1.2 percent of their income. The next richest 4 percent – with incomes between $360,000 and $914,900 – would receive an average tax cut equal to 1.3 percent of their income. All other income groups would receive tax increases, including an average tax increase equal to 2.1 percent of income for the middle fifth of Americans and an average tax hike equal to 4.8 percent of income for the poorest fifth of Americans.

Average tax changes vary widely between the two candidates’ plans. For example:

- The middle fifth of Americans would receive an average tax cut of $1,980 under Harris’ plan and an average tax increase of $1,530 under Trump’s plan.

- The bottom fifth of Americans would receive an average tax cut of $1,130 under Harris’ plan and an average tax increase of $790 under Trump’s plan.

- The top 1 percent of Americans would receive an average tax increase of $121,460 under Harris’ plan and an average tax cut of $36,320 under Trump’s plan.

Harris tax plan

This analysis examines major tax proposals Harris has explicitly announced and others that are major pieces of President Biden’s tax agenda, which Harris has said she would pursue and which are consistent with her campaign pledges:

- Extending the temporary provisions in the 2017 Trump tax law that will otherwise expire at the end of 2025 fully for those with incomes of less than $400,000 but with strict limits on benefits for those with incomes above $400,000

- Proposals for workers and families related to raising children and obtaining health coverage, assisting service workers and making housing more affordable

- Reforming the taxes that fund Medicare, which would raise taxes on those with incomes of more than $400,000

- Scaling back existing tax breaks on capital gains and dividends for those with incomes of more than $1 million (and in some cases far more)

- Reforming the corporate tax code to scale back recently enacted breaks and long-standing loopholes that have been shown to increase income inequality and racial inequality

Trump tax plan

This analysis also includes all of Trump’s major tax proposals, including:

- Extending the temporary provisions in Trump’s 2017 tax law that will otherwise expire at the end of 2025 (except for the $10,000 cap on State and Local Tax (SALT) deductions, which he recently stated he would not extend)

- Exempting certain types of income from taxes (overtime pay, tips and Social Security benefits)

- Reducing the corporate tax rate from 21 percent to 20 percent and then further reducing it to 15 percent for “companies that make their product in America”

- Repealing tax credits enacted as part of President Biden’s Inflation Reduction Act that provide incentives for the production and use of green energy

- Imposing a new 20 percent tariff on imported goods, with a higher rate of 60 percent for goods from China

For more details on the impact of either of the candidates’ tax proposals, you can read more here: