SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

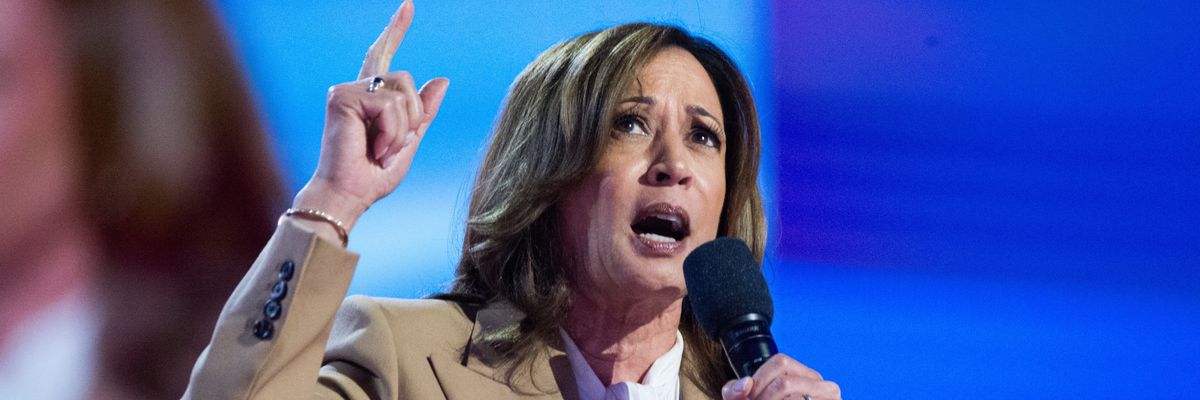

Harris wants to invest in the care economy and has signaled support for raising corporate tax rates, while Trump has been largely silent on care investments and signaled support for more tax cuts at the top.

U.S. Vice President Kamala Harris and former President Donald Trump have starkly different views on taxes and how the tax code can support families.

Harris voices strong support for families through investments in the care economy. She’s vowed to advance paid family leave, affordable childcare, care for disabled or aging family members, and healthcare. This could be funded with a better tax code.

These policies would help all of us care for our families and strengthen our communities. Investing public dollars in care could also narrow racial and gender pay gaps by boosting the pay of care workers—who are mostly women, and many of them women of color.

Strengthening care infrastructure would help us all thrive and make the economy stronger. But we need to collect sufficient revenue to support those transformational policies.

The Trump campaign has been largely silent on care investments. But his campaign has signaled support for more tax cuts at the top. Such cuts would increase inequality and reduce the availability of federal funding to strengthen the care economy.

We saw this in the 2017 tax law that former President Trump signed. It cut taxes for the wealthiest people and corporations, including cutting the effective tax rate for our largest corporations from an average 22% to an average 12.8%. It also preserved loopholes that allow some of the wealthiest corporations to avoid taxes on most—if not all—of their profits.

These tax cuts for the ultra wealthy led to huge losses in federal tax revenue and spiked the national debt, making it harder for the government to fund new investments in priorities that are important to families.

If reelected, Trump has said he wants to slash corporate taxes further—even though some billionaires pay a lower share of their income in taxes than nurses and teachers do.

By contrast, the Biden-Harris administration created a minimum corporate tax so the wealthiest corporations could no longer pay nothing, added a modest tax on stock buybacks, and funded the IRS to better collect taxes from corporations. These policies raised revenue for care investments and other priorities.

Going forward, Harris has signaled support for raising corporate tax rates, which are at historic lows, and closing loopholes.

Harris and Trump also have different priorities on taxes for families. As a senator, Harris championed a tax credit of $6,000 for married couples and $3,000 for single people in her Lift the Middle Class Act. This would have delivered 88% of its benefits to earners under $119,000.

Harris might not promote this specific plan going forward, but it suggests she’d aim to direct benefits to moderate earners instead of the wealthiest. More recently, she’s proposed expanding the Child Tax Credit and adding a $6,000 credit for families with newborns.

By contrast, the tax bill that Trump signed delivered more than half its benefits to the top 5% of households—those with incomes over $263,000. (Like Harris, Trump’s vice presidential nominee, J.D. Vance, has suggested a bigger Child Tax Credit. But Vance has also floated making people without children pay more taxes.)

Taxing the wealthiest and big corporations would support care investments and make our tax code more fair. Strengthening care infrastructure would help us all thrive and make the economy stronger. But we need to collect sufficient revenue to support those transformational policies.

There is strong public support for better care and for fairer taxes. Tax justice advocates should call on both the Harris and Trump campaigns to commit to a fairer tax system—and to use the money it would raise to invest in the childcare, elder care, and healthcare our families need.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

U.S. Vice President Kamala Harris and former President Donald Trump have starkly different views on taxes and how the tax code can support families.

Harris voices strong support for families through investments in the care economy. She’s vowed to advance paid family leave, affordable childcare, care for disabled or aging family members, and healthcare. This could be funded with a better tax code.

These policies would help all of us care for our families and strengthen our communities. Investing public dollars in care could also narrow racial and gender pay gaps by boosting the pay of care workers—who are mostly women, and many of them women of color.

Strengthening care infrastructure would help us all thrive and make the economy stronger. But we need to collect sufficient revenue to support those transformational policies.

The Trump campaign has been largely silent on care investments. But his campaign has signaled support for more tax cuts at the top. Such cuts would increase inequality and reduce the availability of federal funding to strengthen the care economy.

We saw this in the 2017 tax law that former President Trump signed. It cut taxes for the wealthiest people and corporations, including cutting the effective tax rate for our largest corporations from an average 22% to an average 12.8%. It also preserved loopholes that allow some of the wealthiest corporations to avoid taxes on most—if not all—of their profits.

These tax cuts for the ultra wealthy led to huge losses in federal tax revenue and spiked the national debt, making it harder for the government to fund new investments in priorities that are important to families.

If reelected, Trump has said he wants to slash corporate taxes further—even though some billionaires pay a lower share of their income in taxes than nurses and teachers do.

By contrast, the Biden-Harris administration created a minimum corporate tax so the wealthiest corporations could no longer pay nothing, added a modest tax on stock buybacks, and funded the IRS to better collect taxes from corporations. These policies raised revenue for care investments and other priorities.

Going forward, Harris has signaled support for raising corporate tax rates, which are at historic lows, and closing loopholes.

Harris and Trump also have different priorities on taxes for families. As a senator, Harris championed a tax credit of $6,000 for married couples and $3,000 for single people in her Lift the Middle Class Act. This would have delivered 88% of its benefits to earners under $119,000.

Harris might not promote this specific plan going forward, but it suggests she’d aim to direct benefits to moderate earners instead of the wealthiest. More recently, she’s proposed expanding the Child Tax Credit and adding a $6,000 credit for families with newborns.

By contrast, the tax bill that Trump signed delivered more than half its benefits to the top 5% of households—those with incomes over $263,000. (Like Harris, Trump’s vice presidential nominee, J.D. Vance, has suggested a bigger Child Tax Credit. But Vance has also floated making people without children pay more taxes.)

Taxing the wealthiest and big corporations would support care investments and make our tax code more fair. Strengthening care infrastructure would help us all thrive and make the economy stronger. But we need to collect sufficient revenue to support those transformational policies.

There is strong public support for better care and for fairer taxes. Tax justice advocates should call on both the Harris and Trump campaigns to commit to a fairer tax system—and to use the money it would raise to invest in the childcare, elder care, and healthcare our families need.

U.S. Vice President Kamala Harris and former President Donald Trump have starkly different views on taxes and how the tax code can support families.

Harris voices strong support for families through investments in the care economy. She’s vowed to advance paid family leave, affordable childcare, care for disabled or aging family members, and healthcare. This could be funded with a better tax code.

These policies would help all of us care for our families and strengthen our communities. Investing public dollars in care could also narrow racial and gender pay gaps by boosting the pay of care workers—who are mostly women, and many of them women of color.

Strengthening care infrastructure would help us all thrive and make the economy stronger. But we need to collect sufficient revenue to support those transformational policies.

The Trump campaign has been largely silent on care investments. But his campaign has signaled support for more tax cuts at the top. Such cuts would increase inequality and reduce the availability of federal funding to strengthen the care economy.

We saw this in the 2017 tax law that former President Trump signed. It cut taxes for the wealthiest people and corporations, including cutting the effective tax rate for our largest corporations from an average 22% to an average 12.8%. It also preserved loopholes that allow some of the wealthiest corporations to avoid taxes on most—if not all—of their profits.

These tax cuts for the ultra wealthy led to huge losses in federal tax revenue and spiked the national debt, making it harder for the government to fund new investments in priorities that are important to families.

If reelected, Trump has said he wants to slash corporate taxes further—even though some billionaires pay a lower share of their income in taxes than nurses and teachers do.

By contrast, the Biden-Harris administration created a minimum corporate tax so the wealthiest corporations could no longer pay nothing, added a modest tax on stock buybacks, and funded the IRS to better collect taxes from corporations. These policies raised revenue for care investments and other priorities.

Going forward, Harris has signaled support for raising corporate tax rates, which are at historic lows, and closing loopholes.

Harris and Trump also have different priorities on taxes for families. As a senator, Harris championed a tax credit of $6,000 for married couples and $3,000 for single people in her Lift the Middle Class Act. This would have delivered 88% of its benefits to earners under $119,000.

Harris might not promote this specific plan going forward, but it suggests she’d aim to direct benefits to moderate earners instead of the wealthiest. More recently, she’s proposed expanding the Child Tax Credit and adding a $6,000 credit for families with newborns.

By contrast, the tax bill that Trump signed delivered more than half its benefits to the top 5% of households—those with incomes over $263,000. (Like Harris, Trump’s vice presidential nominee, J.D. Vance, has suggested a bigger Child Tax Credit. But Vance has also floated making people without children pay more taxes.)

Taxing the wealthiest and big corporations would support care investments and make our tax code more fair. Strengthening care infrastructure would help us all thrive and make the economy stronger. But we need to collect sufficient revenue to support those transformational policies.

There is strong public support for better care and for fairer taxes. Tax justice advocates should call on both the Harris and Trump campaigns to commit to a fairer tax system—and to use the money it would raise to invest in the childcare, elder care, and healthcare our families need.