SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

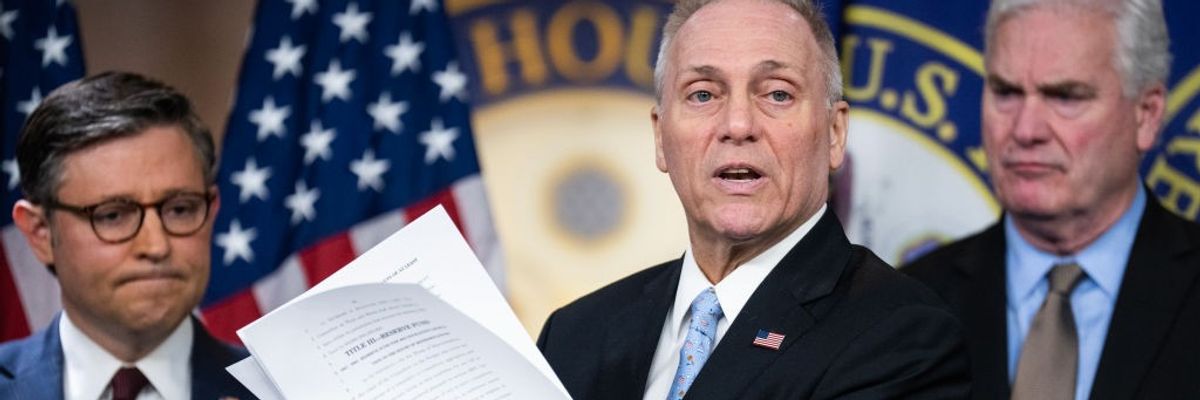

House Majority Leader Steve Scalise (R-La.), center, holds the House Republicans budget during a news conference in the Capitol Visitor Center after a meeting of the conference on Tuesday, February 25, 2025.

Republicans are hiding behind fantastic economic assumptions which they know are false in order to hide the true effects of their agenda—one that raises costs, strips away healthcare, and increases poverty—all in service of giving the super-rich another tax giveaway.

The budget plan that the House is scheduled to consider this week would add to the deficit as it calls on committees to cut $2 trillion primarily from programs that help people secure health coverage, buy groceries, and pay for college to partially offset a $4.5 trillion tax cut, with benefits that are skewed toward the wealthy. Yet the House Budget Committee (HBC) Republicans attempt to hide their plan’s additions to the deficit with unrealistic assumptions of how tax cuts will drive economic growth.

They assert that the economy will grow more than 40 percent faster each year over the coming decade than the Congressional Budget Office (CBO) projects, yielding a ten-year “economic bonus” that would reduce the projected deficit by $2.6 trillion. Their budget math rests on this flawed bonus. Without it, the HBC plan would increase the deficit relative to CBO’s projections, even with its massive spending cuts in Medicaid and SNAP that would take away health care and food from people who are struggling to afford the basics.

This economic bonus is not credible.

CBO projects that real economic growth — growth after considering inflation — will average around 1.8 percent per year from 2026 to 2035. In contrast, the House assumes growth of 2.6 percent a year. This increase is far beyond a typical “rosy scenario” and instead reflects “fantasy math,” as the Committee for a Responsible Federal Budget aptly describes it.

HBC Republicans have defended their assumed growth rate by saying it is below the post-war historical average. But that is misleading. The nation’s labor force grew strongly in the post-war years, particularly as the baby boomers reached working age and because women joined the labor force in large numbers. Today, the baby boomers are retiring, and current population growth depends on immigration, which the Trump Administration is seeking to curb.

Republicans point to the extension of the expiring provisions of the 2017 tax cuts as a key driver of their assumed additional growth. But CBO comes to a much different conclusion. In its baseline projection, CBO assumes the tax cuts expire as scheduled and concludes that “the expiration of the individual income tax provisions of the 2017 tax act does not significantly affect CBO’s projections of real GDP.”

That means that extending the expiring tax cuts, as the Republicans propose, would similarly have little effect on economic growth. Overall, CBO has found that the positive economic effects of the tax cuts alone were quite modest, and that their high cost (which increases federal borrowing and leads to lower private investment) offsets any resulting economic growth. Thus, even if the costs of the tax cuts were completely offset, the economic bonus would be only a small fraction of what HBC Republicans claim. To the extent the program cuts harm investments in the future — economic support and good health care for children, education at all levels, medical and scientific research, infrastructure maintenance and development — those cuts work against better sustainable economic growth.

CBO is not alone in its findings. Economists at a range of other institutions — such as the Joint Tax Committee, Tax Foundation, Tax Policy Center, Penn-Wharton Budget Model, Yale Budget Lab, and American Enterprise Institute — have also examined the economic effects of extending the 2017 tax cuts. None came up with estimates anywhere near those assumed by the House plan.

The House Republicans point to other Trump Administration actions as further rationale for their economic assumptions, such as spending cuts, deregulation, and increasing production of fossil fuels. But their views of the impact of the Administration’s policies on the economy are one-sided, ignoring its policies that are likely to slow growth. For instance, the Administration’s policy of mass deportations and restrictions on new lawful immigration will dampen labor force growth. Analysts estimate that immigration will fall from 3 million in 2024 to 500,000 in 2026.

Similarly, the Trump Administration’s tariff policy could increase prices, possibly by 1.7 to 2.1 percent, and lower economic growth as much as 1.0 percentage point, according to recent estimates by the Yale Budget Lab.

In the end, the assumed economic bonus is a pure gimmick that House Republicans are using to try hide the true effects of their agenda that raises costs, takes health care away from people, increases poverty and hardship, worsens inequality, and increases the deficit.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The budget plan that the House is scheduled to consider this week would add to the deficit as it calls on committees to cut $2 trillion primarily from programs that help people secure health coverage, buy groceries, and pay for college to partially offset a $4.5 trillion tax cut, with benefits that are skewed toward the wealthy. Yet the House Budget Committee (HBC) Republicans attempt to hide their plan’s additions to the deficit with unrealistic assumptions of how tax cuts will drive economic growth.

They assert that the economy will grow more than 40 percent faster each year over the coming decade than the Congressional Budget Office (CBO) projects, yielding a ten-year “economic bonus” that would reduce the projected deficit by $2.6 trillion. Their budget math rests on this flawed bonus. Without it, the HBC plan would increase the deficit relative to CBO’s projections, even with its massive spending cuts in Medicaid and SNAP that would take away health care and food from people who are struggling to afford the basics.

This economic bonus is not credible.

CBO projects that real economic growth — growth after considering inflation — will average around 1.8 percent per year from 2026 to 2035. In contrast, the House assumes growth of 2.6 percent a year. This increase is far beyond a typical “rosy scenario” and instead reflects “fantasy math,” as the Committee for a Responsible Federal Budget aptly describes it.

HBC Republicans have defended their assumed growth rate by saying it is below the post-war historical average. But that is misleading. The nation’s labor force grew strongly in the post-war years, particularly as the baby boomers reached working age and because women joined the labor force in large numbers. Today, the baby boomers are retiring, and current population growth depends on immigration, which the Trump Administration is seeking to curb.

Republicans point to the extension of the expiring provisions of the 2017 tax cuts as a key driver of their assumed additional growth. But CBO comes to a much different conclusion. In its baseline projection, CBO assumes the tax cuts expire as scheduled and concludes that “the expiration of the individual income tax provisions of the 2017 tax act does not significantly affect CBO’s projections of real GDP.”

That means that extending the expiring tax cuts, as the Republicans propose, would similarly have little effect on economic growth. Overall, CBO has found that the positive economic effects of the tax cuts alone were quite modest, and that their high cost (which increases federal borrowing and leads to lower private investment) offsets any resulting economic growth. Thus, even if the costs of the tax cuts were completely offset, the economic bonus would be only a small fraction of what HBC Republicans claim. To the extent the program cuts harm investments in the future — economic support and good health care for children, education at all levels, medical and scientific research, infrastructure maintenance and development — those cuts work against better sustainable economic growth.

CBO is not alone in its findings. Economists at a range of other institutions — such as the Joint Tax Committee, Tax Foundation, Tax Policy Center, Penn-Wharton Budget Model, Yale Budget Lab, and American Enterprise Institute — have also examined the economic effects of extending the 2017 tax cuts. None came up with estimates anywhere near those assumed by the House plan.

The House Republicans point to other Trump Administration actions as further rationale for their economic assumptions, such as spending cuts, deregulation, and increasing production of fossil fuels. But their views of the impact of the Administration’s policies on the economy are one-sided, ignoring its policies that are likely to slow growth. For instance, the Administration’s policy of mass deportations and restrictions on new lawful immigration will dampen labor force growth. Analysts estimate that immigration will fall from 3 million in 2024 to 500,000 in 2026.

Similarly, the Trump Administration’s tariff policy could increase prices, possibly by 1.7 to 2.1 percent, and lower economic growth as much as 1.0 percentage point, according to recent estimates by the Yale Budget Lab.

In the end, the assumed economic bonus is a pure gimmick that House Republicans are using to try hide the true effects of their agenda that raises costs, takes health care away from people, increases poverty and hardship, worsens inequality, and increases the deficit.

The budget plan that the House is scheduled to consider this week would add to the deficit as it calls on committees to cut $2 trillion primarily from programs that help people secure health coverage, buy groceries, and pay for college to partially offset a $4.5 trillion tax cut, with benefits that are skewed toward the wealthy. Yet the House Budget Committee (HBC) Republicans attempt to hide their plan’s additions to the deficit with unrealistic assumptions of how tax cuts will drive economic growth.

They assert that the economy will grow more than 40 percent faster each year over the coming decade than the Congressional Budget Office (CBO) projects, yielding a ten-year “economic bonus” that would reduce the projected deficit by $2.6 trillion. Their budget math rests on this flawed bonus. Without it, the HBC plan would increase the deficit relative to CBO’s projections, even with its massive spending cuts in Medicaid and SNAP that would take away health care and food from people who are struggling to afford the basics.

This economic bonus is not credible.

CBO projects that real economic growth — growth after considering inflation — will average around 1.8 percent per year from 2026 to 2035. In contrast, the House assumes growth of 2.6 percent a year. This increase is far beyond a typical “rosy scenario” and instead reflects “fantasy math,” as the Committee for a Responsible Federal Budget aptly describes it.

HBC Republicans have defended their assumed growth rate by saying it is below the post-war historical average. But that is misleading. The nation’s labor force grew strongly in the post-war years, particularly as the baby boomers reached working age and because women joined the labor force in large numbers. Today, the baby boomers are retiring, and current population growth depends on immigration, which the Trump Administration is seeking to curb.

Republicans point to the extension of the expiring provisions of the 2017 tax cuts as a key driver of their assumed additional growth. But CBO comes to a much different conclusion. In its baseline projection, CBO assumes the tax cuts expire as scheduled and concludes that “the expiration of the individual income tax provisions of the 2017 tax act does not significantly affect CBO’s projections of real GDP.”

That means that extending the expiring tax cuts, as the Republicans propose, would similarly have little effect on economic growth. Overall, CBO has found that the positive economic effects of the tax cuts alone were quite modest, and that their high cost (which increases federal borrowing and leads to lower private investment) offsets any resulting economic growth. Thus, even if the costs of the tax cuts were completely offset, the economic bonus would be only a small fraction of what HBC Republicans claim. To the extent the program cuts harm investments in the future — economic support and good health care for children, education at all levels, medical and scientific research, infrastructure maintenance and development — those cuts work against better sustainable economic growth.

CBO is not alone in its findings. Economists at a range of other institutions — such as the Joint Tax Committee, Tax Foundation, Tax Policy Center, Penn-Wharton Budget Model, Yale Budget Lab, and American Enterprise Institute — have also examined the economic effects of extending the 2017 tax cuts. None came up with estimates anywhere near those assumed by the House plan.

The House Republicans point to other Trump Administration actions as further rationale for their economic assumptions, such as spending cuts, deregulation, and increasing production of fossil fuels. But their views of the impact of the Administration’s policies on the economy are one-sided, ignoring its policies that are likely to slow growth. For instance, the Administration’s policy of mass deportations and restrictions on new lawful immigration will dampen labor force growth. Analysts estimate that immigration will fall from 3 million in 2024 to 500,000 in 2026.

Similarly, the Trump Administration’s tariff policy could increase prices, possibly by 1.7 to 2.1 percent, and lower economic growth as much as 1.0 percentage point, according to recent estimates by the Yale Budget Lab.

In the end, the assumed economic bonus is a pure gimmick that House Republicans are using to try hide the true effects of their agenda that raises costs, takes health care away from people, increases poverty and hardship, worsens inequality, and increases the deficit.