Khokeyma Reed assembles a watch at the Shinola Watch factory on January 4, 2017 in Detroit, Michigan.

How Dems Can Take Advantage of Trump’s Tariffs to Reverse the Reagan Revolution

As he shatters the neoliberal tariff consensus, Democrats should rise to the occasion and argue for rational, targeted, and gradual tariffs, taking the party back to its pre-1980s positions on trade.

The stürm und drang all over the media this week is about U.S. President-elect Donald Trump, on Monday, doubling down on his tariffs saying that he’d impose across-the-board 25% tariffs on all goods from China, Mexico, and Canada until there’s no more fentanyl or undocumented immigrants and asylum seekers coming into the U.S.

That’s a substantial lift, and if he follows through with the threat (which seems likely, although I’d bet money that he’ll drill lots of holes in those tariffs to satisfy corporate donors) it’ll cause a considerable disruption in American commerce. Those three countries, after all, account for more than 40% of all American trade.

Weirdly, Trump may be doing the Democrats a favor by taking this position, and I don’t mean the possibility that he’ll wreck the economy and thus his party’s chances in 2026 and 2028 (although that’s real, too).

Tariffs can be a good thing for a country, if done right.

Tariff-free trade was a central cornerstone of former President Ronald Reagan’s neoliberal agenda; he and George H.W. Bush wrote the NAFTA agreement that Bill Clinton later signed, for example. I lay this out in considerable detail in The Hidden History of Neoliberalism: How Reaganism Gutted America. Tragically, Bill Clinton and his Larry Sommers/Robert Rubin crew embraced neoliberalism with gusto, putting the final nail in the meaningful use of tariffs to protect American manufacturing and the jobs associated with it.

Democrats like Sens. Bernie Sanders (I-Vt.) and Elizabeth Warren (D-Mass.) have been working for years to pull the Democratic Party back from the neoliberal free trade brink, and if Trump pushes through his tariffs in a big way it may help shatter what’s left of the neoliberal consensus (at least with regard to trade) in the Democratic Party. That would be a Very Good Thing, both for the Party and for the nation.

Tariffs can be a good thing for a country, if done right. People who grew up in the Midwest (like me) know all about tariffs; we learned about them as children (I remember 5th Grade civics!).

Trump, however, did them so badly last time that they backfired, cost us a fortune, and forced the federal government to subsidize Midwestern farmers. Odds are, if he keeps to his current rhetoric, he’ll do the same, and Democrats should be ready with reasonable talking points; this could end up working tremendously to their advantage if they’re willing to embrace reasonable tariffs and other trade protections to bring manufacturing back to the U.S.

So, let’s reexamine how tariffs can work when done right, their role in American history, and why we should be discussing them now without hysterics.

Tariffs are taxes paid to the federal government on imported goods. And, like all taxes, they have two purposes: to raise revenue and to alter behavior. In the case of import tariffs, the second purpose (changing behavior, in this case encouraging entrepreneurs to start manufacturing companies aka factories here in America) is far more important than the first.

It all began here in America when General Henry Knox rode up to Mount Vernon in the late summer of 1789 to tell George Washington that Congress had just elected him as the first president of the United States. Washington took the news, and had two requests for his old friend.

First, he asked Knox to let folks know he’d be delayed by a few days because he wanted to say goodbye to his mother, who was elderly and ailing (turned out, it was the last time he saw her alive).

Second, Washington asked General Knox to ride all the way up to Connecticut to visit Daniel Hinsdale, a man who’d been secretly manufacturing black-market American-made fine men’s clothing in defiance of British law for decades. Knox took Washington’s measurements and then, a month later, brought to New York (where the swearing-in took place on what is now Wall Street) a fine American-made suit, which Washington proudly wore. (The suit was brown; the black suit of his later, famous painting was British formal wear.)

This incident highlighted the manufacturing crisis facing our new nation, and Washington was acutely aware of it.

The British, for two centuries, had been extracting wealth from the American colonies by forbidding us from manufacturing everything from fine clothing (thus Hinsdale’s illegal business) to weaponry to sophisticated machinery: All such items had to be imported from British manufacturers. We sold England cheap raw cotton, for example, and they forced us to buy back expensive fine cotton clothing manufactured on the looms of British cities. (Homespun was still legal in the colonies.)

They also forced us to buy tea—then the primary American beverage—from the East India Company, an outrage that led directly to the Boston Tea Party of 1773, which arguably kicked off the American Revolution. Thus, when Washington came into office, the first challenge he faced was how to build an American manufacturing base that wasn’t dependent on British imports.

Thirteen years before Washington’s inauguration, British economist Adam Smith had made worldwide headlines with his bestselling 1776 book An Inquiry into the Nature and Causes of the Wealth of Nations, proposing that the main thing that made a country rich was independence in manufacturing.

The process of converting raw materials of little value into finished products with a high value (manufacturing) was, to Smith’s mind, the best and only practical way a nation could grow wealthy without overseas conquest and plunder.

A tree limb laying on the forest floor, for example, had no monetary value, but when labor and the tool of a knife were applied to it and it was turned into an axe-handle—a process called manufacturing—it now had a value that could be passed down through generations.

Smith called that wealth. That axe-handle became part of the aggregate wealth of the entire nation, and even if it was sold overseas that wealth would still remain here because its value was simply converted into currency which stayed in America.

This understanding led President Washington to commission his Treasury Secretary, Alexander Hamilton, to propose to Congress in 1791 an 11-step Report on the Subject of Manufactures, also known as The American Plan.

At the core of Hamilton’s plan were protective tariffs on goods that were then being imported but could be easily made in the USA. The tariffs would increase the price of the imported goods so much that they’d encourage American entrepreneurs to start factories to make the same things here.

(Hamilton’s plan also included government subsidies for companies that wanted to move manufacturing to the U.S., federal subsidies for the development of new technologies, a massive investment in infrastructure [particularly roads and water-power systems] to support industry, and a requirement that the U.S. government purchase only American-made products whenever possible.)

Within two decades, Congress and the Washington, Adams, and Jefferson administrations had put nearly all of Hamilton’s plan into effect, and major parts of it stood all the way up until Reagan’s neoliberal revolution kicked off in 1981.

Today, you’ll search for hours to find a single made-in-America product in most big-box stores.

Hamilton’s plan was such a successful and important part of how America became the wealthiest nation on Earth, and produced so much revenue, that virtually 100% of the cost of operating our federal government—from our founding until the Civil War—came from tariffs. The salary of every president from George Washington to Abraham Lincoln was paid by tariffs (some were domestic interstate tariffs, like on alcohol), as was the salary of every federal official and the cost of everything else the federal government did.

Fully two-thirds of federal government revenue came from tariffs from the end of the Civil War until the World War I era and the 1913 passage of the 16th Amendment (the income tax); a third of federal government revenue came from tariffs between WWI and WWII.

Today, however, it is under 2%.

Prior to Reagan, American manufacturing—kept on this continent by the force of tariffs—was at the core of the American Dream, with good union manufacturing jobs offering stability and prosperity to a growing American middle class from the 19th century until the 1990s. Tariffs also made America the technological leader of the entire planet.

The concept was simple: If a product could be made for $70 with cheap Chinese labor, but cost $100 to make with U.S. labor, we’d put a $30 tariff on it to equalize the labor costs. Ditto if overseas manufacturing was subsidized by governments or by a lack of expensive pollution controls or worker safety protections: we’d match those cost advantages with tariffs.

There was still a heck of a lot of trade going on in the world when tariffs were common. As late as 1975, our imports and exports were pretty much in balance (we had a $12 billion surplus).

And then came the neoliberal sales pitch of the 1980s, as I lay out in detail in The Hidden History of Neoliberalism: How Reaganism Gutted America.

If only we could get rid of those nasty tariffs—we had over 20,000 categories of products with specified tariffs—by reducing them to zero or very, very low numbers, Reagan, Bush, and Clinton told us, then American consumers would benefit because big retailers like Walmart could buy products made with cheap labor from overseas instead of from higher-paid American workers. Prices, in other words, would be lower for consumers.

The result has been the shuttering of over 70,000 U.S. factories and the loss of around 8 million good often-unionized manufacturing jobs. It typically takes companies between one and two decades to shift manufacturing overseas, given how large a logistical operation it involves, and reversing the process will probably also take a decade or two.

Entire regions of America were wiped out, producing a swath of our country now referred to as the “rust belt.” The situation was compounded by the Bush administration’s and the Supreme Court’s hostility to union rights.

Since Reagan’s “free trade” we’ve had nothing but annual trade deficits, each representing trillions in American worker’s wealth that’s been shifted to overseas manufacturing countries.

Sam Walton’s autobiography, titled Made in America, epitomized the situation prior to Reaganism when Walmart stores had big “100% Made In America” banners hanging over their front doors. Today, you’ll search for hours to find a single made-in-America product in most big-box stores.

How do we bring back tariffs and how do we avoid a trade war disaster like Trump caused during his first presidency?

Around that same time, another rationale for corporations seeking cheap labor and easy pollution regulations overseas began to take hold in the minds of the neoliberal intelligentsia: “Free trade,” they said, was so magical it could even bring about world peace!

The argument was simple, the neoliberals told us: History showed, they said, that countries that traded heavily with each other rarely went to war with each other. The example most often cited was that no two countries with MacDonald’s burger outlets had ever, at that time, gone to war (although they have since: see Russia and Ukraine).

Thomas Friedman jumped into the act at the end of the 20th century, promoting the MacDonalds’ Peace Theory and the transfer of American manufacturing overseas with his now-discredited 1999 book The Lexus and the Olive Tree.

Its impact, along with major campaigns encouraging “free trade” funded by American industrial and retail giants and their billionaire owners, echoed across American manufacturing and foreign policy for the next 20 years, as America continued to hemorrhage jobs along with the middle class “American Dream” wealth that accompanied them.

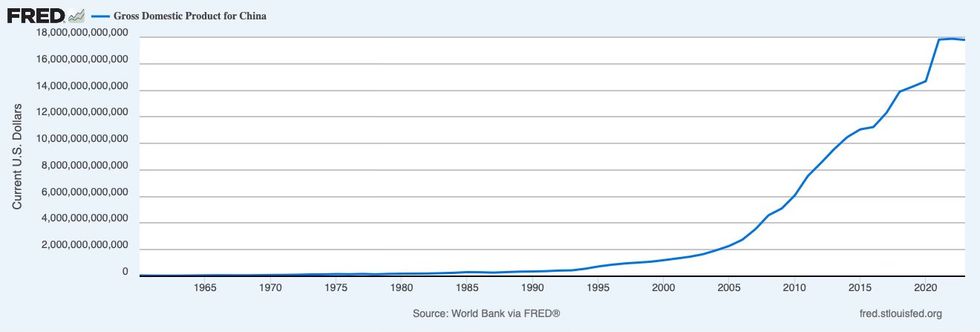

As a vast proportion of American manufacturing shifted to China, that nation—just like Hamilton predicted and proved with the U.S.—underwent the most rapid transformation from Third World poverty to First World affluence in the history of the world.

All because the “wealth” of America was transferred to China every time a cash-register rang at Walmart, an Apple Store, or in pretty much any other American retail outlet. And continues to this day.

So, how do we bring back tariffs and how do we avoid a trade war disaster like Trump caused during his first presidency?

The main goal of an import tariff is to encourage Americans to buy the products of domestic—rather than foreign—manufacturing. For that to work, companies that may consider investing billions in factories here in the U.S. need to know that the tariffs aren’t just a whim or election stunt like they were with Trump, but will be around for the coming years or even decades necessary to recover their initial billion-dollar investments in new manufacturing facilities.

Just because Trump was conceptually right about tariffs (but terribly wrong in how he executed them) doesn’t mean Democrats should freak out at any mention of them.

Tariffs also need to be brought in on an item-by-item basis, organically, with each imported item that we want to put a tariff onto examined for the tariff’s impact, both on domestic inflation and international relations.

We really have no need to put a tariff on, for example, imported artwork from Mexico or moose-skin jackets from Canada; there’s no competing domestic industry here. It’s why Trump’s proposed “across-the-board” tariffs are so stupid.

But the manufacture of cars, steel, chips, computers, toys, clothes, pharmaceuticals, and hundreds of other products and categories of goods can be brought back to the U.S. by appropriate tariffs, introduced gradually and predictably, done in a way that allows both foreign companies and U.S. entrepreneurs to adjust without major disruptions.

There’s also a national security aspect to this. Right now, it’s nearly impossible for the U.S. to manufacture a battleship or advanced aircraft without parts from overseas. Because tariffs had kept virtually all manufacturing here in the U.S. prior to WWII, shifting to a war-based manufacturing economy in the 1940s, before Reagan’s neoliberal “reforms,” was easy. Today it would be extremely difficult.

On top of that, we no longer make most therapeutic drugs here in America. China makes many of the raw ingredients for the drugs we use here, and most pharmaceuticals used in America are manufactured there and in India.

One result is that often drugs we take are contaminated because they’re made in plants outside the U.S.; an old friend got cancer from taking a drug contaminated by a toxic chemical, and my father got bladder cancer from taking a drug contaminated in India with N-nitrosodimethylamine (NDMA).

Also alarming, if we got into a serious conflict with China (for example) and they cut us off from all their manufactured goods, our economy would collapse overnight and we’d find it very, very difficult to manufacture some of our most important weaponry and telecommunications equipment. Not to mention the crisis of a massive drug shortage.

Thus, tariffs have to be put into place intelligently; after all, we’re reversing a neoliberal free trade process that took 44 years to get as bad as it is today.

We don’t want to start trade wars—like Trump did the first time with his tariff stunt and is threatening to do again in January—or wipe out people in poor countries (like Bangladesh or Malaysia, where much of our clothing is made), but we do want the “wealth of [our] nation” to be built and kept here.

We do this by having Congress openly discuss and debate tariffs, apply them gradually, and accompany them with supports for the poorer parts of the world that may be harmed by them, assisting them in developing sustainable domestic industries to replace their export losses.

This is not a radical idea.

China uses tariffs (and dozens of other trade restrictions) to protect its domestic industries. The European Union imposes tariffs on agricultural products to protect its farmers (averaging around 11.4%) as well as industrial goods (averaging around 4.1%). Some industries, like dairy products (38.4% E.U. tariffs) and confectionery products (24.6%), have asked for and gotten even higher E.U. tariffs to keep them viable domestically.

And, of course, that’s how America became the richest country in the world, and the loss of tariffs is a major part of why our standard of living has slipped so badly over these past 44 years of our neoliberal Reaganism experiment. Our wealth, along with our manufacturing and jobs, was simply shipped overseas—and now we must begin the process of bringing it back home.

Democrats know this, even if they’re unwilling to talk about it. The Biden administration took some good steps in this direction by imposing or maintaining multiple tariffs, and they’re already increased American prosperity, particularly for working people.

President Joe Biden increased tariffs on steel and aluminum products from 7.5% to 25% this year; tariffs on semiconductors will rise to 50% by 2025; tariffs on electric vehicles (EVs) hit 100% this year; tariffs on lithium-ion EV batteries and magnets for EV motors will go up by 25% by 2026. After the Covid-19 crisis, the Biden administration put a 50% tariff on syringes and needles to jump-start domestic production, and personal protective equipment (PPE) tariffs went up 25%.

This is not a black-and-white issue. Yes, tariffs are a tax and, until domestic manufacturing replaces foreign imports, they’re a tax that’s mostly passed along to consumers, resulting in higher prices for goods.

But when done right and gradually, those higher prices open the door for American companies to again become competitive, to manufacture goods here—and thus keep our jobs and our “wealth” here—while raising the wages and standard of living of American workers and people around the world.

Just because Trump was conceptually right about tariffs (but terribly wrong in how he executed them) doesn’t mean Democrats should freak out at any mention of them. They’re an important part—as Alexander Hamilton and George Washington taught us—of creating and maintaining wealth and independence for our nation.

And voters in the Rust Belt states know all this already.

As Trump behaves like a bull in a china shop, ready to slap punitive and politically-motivated tariffs on our top trading partners, expect considerable market and overall economic dislocation; a recession is a probable outcome.

But as he shatters the neoliberal tariff consensus, Democrats should rise to the occasion and argue for rational, targeted, and gradual tariffs, taking the Party back to its pre-1980s positions on trade.

And then they’ll be well positioned to both exploit the issue and rescue the American economy in 2026 and 2028 after Trump’s done his worst.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The stürm und drang all over the media this week is about U.S. President-elect Donald Trump, on Monday, doubling down on his tariffs saying that he’d impose across-the-board 25% tariffs on all goods from China, Mexico, and Canada until there’s no more fentanyl or undocumented immigrants and asylum seekers coming into the U.S.

That’s a substantial lift, and if he follows through with the threat (which seems likely, although I’d bet money that he’ll drill lots of holes in those tariffs to satisfy corporate donors) it’ll cause a considerable disruption in American commerce. Those three countries, after all, account for more than 40% of all American trade.

Weirdly, Trump may be doing the Democrats a favor by taking this position, and I don’t mean the possibility that he’ll wreck the economy and thus his party’s chances in 2026 and 2028 (although that’s real, too).

Tariffs can be a good thing for a country, if done right.

Tariff-free trade was a central cornerstone of former President Ronald Reagan’s neoliberal agenda; he and George H.W. Bush wrote the NAFTA agreement that Bill Clinton later signed, for example. I lay this out in considerable detail in The Hidden History of Neoliberalism: How Reaganism Gutted America. Tragically, Bill Clinton and his Larry Sommers/Robert Rubin crew embraced neoliberalism with gusto, putting the final nail in the meaningful use of tariffs to protect American manufacturing and the jobs associated with it.

Democrats like Sens. Bernie Sanders (I-Vt.) and Elizabeth Warren (D-Mass.) have been working for years to pull the Democratic Party back from the neoliberal free trade brink, and if Trump pushes through his tariffs in a big way it may help shatter what’s left of the neoliberal consensus (at least with regard to trade) in the Democratic Party. That would be a Very Good Thing, both for the Party and for the nation.

Tariffs can be a good thing for a country, if done right. People who grew up in the Midwest (like me) know all about tariffs; we learned about them as children (I remember 5th Grade civics!).

Trump, however, did them so badly last time that they backfired, cost us a fortune, and forced the federal government to subsidize Midwestern farmers. Odds are, if he keeps to his current rhetoric, he’ll do the same, and Democrats should be ready with reasonable talking points; this could end up working tremendously to their advantage if they’re willing to embrace reasonable tariffs and other trade protections to bring manufacturing back to the U.S.

So, let’s reexamine how tariffs can work when done right, their role in American history, and why we should be discussing them now without hysterics.

Tariffs are taxes paid to the federal government on imported goods. And, like all taxes, they have two purposes: to raise revenue and to alter behavior. In the case of import tariffs, the second purpose (changing behavior, in this case encouraging entrepreneurs to start manufacturing companies aka factories here in America) is far more important than the first.

It all began here in America when General Henry Knox rode up to Mount Vernon in the late summer of 1789 to tell George Washington that Congress had just elected him as the first president of the United States. Washington took the news, and had two requests for his old friend.

First, he asked Knox to let folks know he’d be delayed by a few days because he wanted to say goodbye to his mother, who was elderly and ailing (turned out, it was the last time he saw her alive).

Second, Washington asked General Knox to ride all the way up to Connecticut to visit Daniel Hinsdale, a man who’d been secretly manufacturing black-market American-made fine men’s clothing in defiance of British law for decades. Knox took Washington’s measurements and then, a month later, brought to New York (where the swearing-in took place on what is now Wall Street) a fine American-made suit, which Washington proudly wore. (The suit was brown; the black suit of his later, famous painting was British formal wear.)

This incident highlighted the manufacturing crisis facing our new nation, and Washington was acutely aware of it.

The British, for two centuries, had been extracting wealth from the American colonies by forbidding us from manufacturing everything from fine clothing (thus Hinsdale’s illegal business) to weaponry to sophisticated machinery: All such items had to be imported from British manufacturers. We sold England cheap raw cotton, for example, and they forced us to buy back expensive fine cotton clothing manufactured on the looms of British cities. (Homespun was still legal in the colonies.)

They also forced us to buy tea—then the primary American beverage—from the East India Company, an outrage that led directly to the Boston Tea Party of 1773, which arguably kicked off the American Revolution. Thus, when Washington came into office, the first challenge he faced was how to build an American manufacturing base that wasn’t dependent on British imports.

Thirteen years before Washington’s inauguration, British economist Adam Smith had made worldwide headlines with his bestselling 1776 book An Inquiry into the Nature and Causes of the Wealth of Nations, proposing that the main thing that made a country rich was independence in manufacturing.

The process of converting raw materials of little value into finished products with a high value (manufacturing) was, to Smith’s mind, the best and only practical way a nation could grow wealthy without overseas conquest and plunder.

A tree limb laying on the forest floor, for example, had no monetary value, but when labor and the tool of a knife were applied to it and it was turned into an axe-handle—a process called manufacturing—it now had a value that could be passed down through generations.

Smith called that wealth. That axe-handle became part of the aggregate wealth of the entire nation, and even if it was sold overseas that wealth would still remain here because its value was simply converted into currency which stayed in America.

This understanding led President Washington to commission his Treasury Secretary, Alexander Hamilton, to propose to Congress in 1791 an 11-step Report on the Subject of Manufactures, also known as The American Plan.

At the core of Hamilton’s plan were protective tariffs on goods that were then being imported but could be easily made in the USA. The tariffs would increase the price of the imported goods so much that they’d encourage American entrepreneurs to start factories to make the same things here.

(Hamilton’s plan also included government subsidies for companies that wanted to move manufacturing to the U.S., federal subsidies for the development of new technologies, a massive investment in infrastructure [particularly roads and water-power systems] to support industry, and a requirement that the U.S. government purchase only American-made products whenever possible.)

Within two decades, Congress and the Washington, Adams, and Jefferson administrations had put nearly all of Hamilton’s plan into effect, and major parts of it stood all the way up until Reagan’s neoliberal revolution kicked off in 1981.

Today, you’ll search for hours to find a single made-in-America product in most big-box stores.

Hamilton’s plan was such a successful and important part of how America became the wealthiest nation on Earth, and produced so much revenue, that virtually 100% of the cost of operating our federal government—from our founding until the Civil War—came from tariffs. The salary of every president from George Washington to Abraham Lincoln was paid by tariffs (some were domestic interstate tariffs, like on alcohol), as was the salary of every federal official and the cost of everything else the federal government did.

Fully two-thirds of federal government revenue came from tariffs from the end of the Civil War until the World War I era and the 1913 passage of the 16th Amendment (the income tax); a third of federal government revenue came from tariffs between WWI and WWII.

Today, however, it is under 2%.

Prior to Reagan, American manufacturing—kept on this continent by the force of tariffs—was at the core of the American Dream, with good union manufacturing jobs offering stability and prosperity to a growing American middle class from the 19th century until the 1990s. Tariffs also made America the technological leader of the entire planet.

The concept was simple: If a product could be made for $70 with cheap Chinese labor, but cost $100 to make with U.S. labor, we’d put a $30 tariff on it to equalize the labor costs. Ditto if overseas manufacturing was subsidized by governments or by a lack of expensive pollution controls or worker safety protections: we’d match those cost advantages with tariffs.

There was still a heck of a lot of trade going on in the world when tariffs were common. As late as 1975, our imports and exports were pretty much in balance (we had a $12 billion surplus).

And then came the neoliberal sales pitch of the 1980s, as I lay out in detail in The Hidden History of Neoliberalism: How Reaganism Gutted America.

If only we could get rid of those nasty tariffs—we had over 20,000 categories of products with specified tariffs—by reducing them to zero or very, very low numbers, Reagan, Bush, and Clinton told us, then American consumers would benefit because big retailers like Walmart could buy products made with cheap labor from overseas instead of from higher-paid American workers. Prices, in other words, would be lower for consumers.

The result has been the shuttering of over 70,000 U.S. factories and the loss of around 8 million good often-unionized manufacturing jobs. It typically takes companies between one and two decades to shift manufacturing overseas, given how large a logistical operation it involves, and reversing the process will probably also take a decade or two.

Entire regions of America were wiped out, producing a swath of our country now referred to as the “rust belt.” The situation was compounded by the Bush administration’s and the Supreme Court’s hostility to union rights.

Since Reagan’s “free trade” we’ve had nothing but annual trade deficits, each representing trillions in American worker’s wealth that’s been shifted to overseas manufacturing countries.

Sam Walton’s autobiography, titled Made in America, epitomized the situation prior to Reaganism when Walmart stores had big “100% Made In America” banners hanging over their front doors. Today, you’ll search for hours to find a single made-in-America product in most big-box stores.

How do we bring back tariffs and how do we avoid a trade war disaster like Trump caused during his first presidency?

Around that same time, another rationale for corporations seeking cheap labor and easy pollution regulations overseas began to take hold in the minds of the neoliberal intelligentsia: “Free trade,” they said, was so magical it could even bring about world peace!

The argument was simple, the neoliberals told us: History showed, they said, that countries that traded heavily with each other rarely went to war with each other. The example most often cited was that no two countries with MacDonald’s burger outlets had ever, at that time, gone to war (although they have since: see Russia and Ukraine).

Thomas Friedman jumped into the act at the end of the 20th century, promoting the MacDonalds’ Peace Theory and the transfer of American manufacturing overseas with his now-discredited 1999 book The Lexus and the Olive Tree.

Its impact, along with major campaigns encouraging “free trade” funded by American industrial and retail giants and their billionaire owners, echoed across American manufacturing and foreign policy for the next 20 years, as America continued to hemorrhage jobs along with the middle class “American Dream” wealth that accompanied them.

As a vast proportion of American manufacturing shifted to China, that nation—just like Hamilton predicted and proved with the U.S.—underwent the most rapid transformation from Third World poverty to First World affluence in the history of the world.

All because the “wealth” of America was transferred to China every time a cash-register rang at Walmart, an Apple Store, or in pretty much any other American retail outlet. And continues to this day.

So, how do we bring back tariffs and how do we avoid a trade war disaster like Trump caused during his first presidency?

The main goal of an import tariff is to encourage Americans to buy the products of domestic—rather than foreign—manufacturing. For that to work, companies that may consider investing billions in factories here in the U.S. need to know that the tariffs aren’t just a whim or election stunt like they were with Trump, but will be around for the coming years or even decades necessary to recover their initial billion-dollar investments in new manufacturing facilities.

Just because Trump was conceptually right about tariffs (but terribly wrong in how he executed them) doesn’t mean Democrats should freak out at any mention of them.

Tariffs also need to be brought in on an item-by-item basis, organically, with each imported item that we want to put a tariff onto examined for the tariff’s impact, both on domestic inflation and international relations.

We really have no need to put a tariff on, for example, imported artwork from Mexico or moose-skin jackets from Canada; there’s no competing domestic industry here. It’s why Trump’s proposed “across-the-board” tariffs are so stupid.

But the manufacture of cars, steel, chips, computers, toys, clothes, pharmaceuticals, and hundreds of other products and categories of goods can be brought back to the U.S. by appropriate tariffs, introduced gradually and predictably, done in a way that allows both foreign companies and U.S. entrepreneurs to adjust without major disruptions.

There’s also a national security aspect to this. Right now, it’s nearly impossible for the U.S. to manufacture a battleship or advanced aircraft without parts from overseas. Because tariffs had kept virtually all manufacturing here in the U.S. prior to WWII, shifting to a war-based manufacturing economy in the 1940s, before Reagan’s neoliberal “reforms,” was easy. Today it would be extremely difficult.

On top of that, we no longer make most therapeutic drugs here in America. China makes many of the raw ingredients for the drugs we use here, and most pharmaceuticals used in America are manufactured there and in India.

One result is that often drugs we take are contaminated because they’re made in plants outside the U.S.; an old friend got cancer from taking a drug contaminated by a toxic chemical, and my father got bladder cancer from taking a drug contaminated in India with N-nitrosodimethylamine (NDMA).

Also alarming, if we got into a serious conflict with China (for example) and they cut us off from all their manufactured goods, our economy would collapse overnight and we’d find it very, very difficult to manufacture some of our most important weaponry and telecommunications equipment. Not to mention the crisis of a massive drug shortage.

Thus, tariffs have to be put into place intelligently; after all, we’re reversing a neoliberal free trade process that took 44 years to get as bad as it is today.

We don’t want to start trade wars—like Trump did the first time with his tariff stunt and is threatening to do again in January—or wipe out people in poor countries (like Bangladesh or Malaysia, where much of our clothing is made), but we do want the “wealth of [our] nation” to be built and kept here.

We do this by having Congress openly discuss and debate tariffs, apply them gradually, and accompany them with supports for the poorer parts of the world that may be harmed by them, assisting them in developing sustainable domestic industries to replace their export losses.

This is not a radical idea.

China uses tariffs (and dozens of other trade restrictions) to protect its domestic industries. The European Union imposes tariffs on agricultural products to protect its farmers (averaging around 11.4%) as well as industrial goods (averaging around 4.1%). Some industries, like dairy products (38.4% E.U. tariffs) and confectionery products (24.6%), have asked for and gotten even higher E.U. tariffs to keep them viable domestically.

And, of course, that’s how America became the richest country in the world, and the loss of tariffs is a major part of why our standard of living has slipped so badly over these past 44 years of our neoliberal Reaganism experiment. Our wealth, along with our manufacturing and jobs, was simply shipped overseas—and now we must begin the process of bringing it back home.

Democrats know this, even if they’re unwilling to talk about it. The Biden administration took some good steps in this direction by imposing or maintaining multiple tariffs, and they’re already increased American prosperity, particularly for working people.

President Joe Biden increased tariffs on steel and aluminum products from 7.5% to 25% this year; tariffs on semiconductors will rise to 50% by 2025; tariffs on electric vehicles (EVs) hit 100% this year; tariffs on lithium-ion EV batteries and magnets for EV motors will go up by 25% by 2026. After the Covid-19 crisis, the Biden administration put a 50% tariff on syringes and needles to jump-start domestic production, and personal protective equipment (PPE) tariffs went up 25%.

This is not a black-and-white issue. Yes, tariffs are a tax and, until domestic manufacturing replaces foreign imports, they’re a tax that’s mostly passed along to consumers, resulting in higher prices for goods.

But when done right and gradually, those higher prices open the door for American companies to again become competitive, to manufacture goods here—and thus keep our jobs and our “wealth” here—while raising the wages and standard of living of American workers and people around the world.

Just because Trump was conceptually right about tariffs (but terribly wrong in how he executed them) doesn’t mean Democrats should freak out at any mention of them. They’re an important part—as Alexander Hamilton and George Washington taught us—of creating and maintaining wealth and independence for our nation.

And voters in the Rust Belt states know all this already.

As Trump behaves like a bull in a china shop, ready to slap punitive and politically-motivated tariffs on our top trading partners, expect considerable market and overall economic dislocation; a recession is a probable outcome.

But as he shatters the neoliberal tariff consensus, Democrats should rise to the occasion and argue for rational, targeted, and gradual tariffs, taking the Party back to its pre-1980s positions on trade.

And then they’ll be well positioned to both exploit the issue and rescue the American economy in 2026 and 2028 after Trump’s done his worst.

- Self-Styled Working Class Fighter Trump Readies Cabinet Shaped by Billionaires ›

- Study Shows Trump Plan Would Slash Taxes for Richest 5%, Hike Them for Everyone Else ›

- Mexico's Leftist President Rips Trump Tariff Threat ›

- Dems in Congress Vow to Fight 'Inflationary Policies' of Trump ›

- Opinion | Why China Stands to Benefit From Trump's Incoherent Trade Policy | Common Dreams ›

- Opinion | Tariffs Should Be a Scalpel, Not a Sledgehammer | Common Dreams ›

- Opinion | 2028 Will Be Our Last, Best Hope to Propel a Real Leftist to the Top of the Ticket | Common Dreams ›

The stürm und drang all over the media this week is about U.S. President-elect Donald Trump, on Monday, doubling down on his tariffs saying that he’d impose across-the-board 25% tariffs on all goods from China, Mexico, and Canada until there’s no more fentanyl or undocumented immigrants and asylum seekers coming into the U.S.

That’s a substantial lift, and if he follows through with the threat (which seems likely, although I’d bet money that he’ll drill lots of holes in those tariffs to satisfy corporate donors) it’ll cause a considerable disruption in American commerce. Those three countries, after all, account for more than 40% of all American trade.

Weirdly, Trump may be doing the Democrats a favor by taking this position, and I don’t mean the possibility that he’ll wreck the economy and thus his party’s chances in 2026 and 2028 (although that’s real, too).

Tariffs can be a good thing for a country, if done right.

Tariff-free trade was a central cornerstone of former President Ronald Reagan’s neoliberal agenda; he and George H.W. Bush wrote the NAFTA agreement that Bill Clinton later signed, for example. I lay this out in considerable detail in The Hidden History of Neoliberalism: How Reaganism Gutted America. Tragically, Bill Clinton and his Larry Sommers/Robert Rubin crew embraced neoliberalism with gusto, putting the final nail in the meaningful use of tariffs to protect American manufacturing and the jobs associated with it.

Democrats like Sens. Bernie Sanders (I-Vt.) and Elizabeth Warren (D-Mass.) have been working for years to pull the Democratic Party back from the neoliberal free trade brink, and if Trump pushes through his tariffs in a big way it may help shatter what’s left of the neoliberal consensus (at least with regard to trade) in the Democratic Party. That would be a Very Good Thing, both for the Party and for the nation.

Tariffs can be a good thing for a country, if done right. People who grew up in the Midwest (like me) know all about tariffs; we learned about them as children (I remember 5th Grade civics!).

Trump, however, did them so badly last time that they backfired, cost us a fortune, and forced the federal government to subsidize Midwestern farmers. Odds are, if he keeps to his current rhetoric, he’ll do the same, and Democrats should be ready with reasonable talking points; this could end up working tremendously to their advantage if they’re willing to embrace reasonable tariffs and other trade protections to bring manufacturing back to the U.S.

So, let’s reexamine how tariffs can work when done right, their role in American history, and why we should be discussing them now without hysterics.

Tariffs are taxes paid to the federal government on imported goods. And, like all taxes, they have two purposes: to raise revenue and to alter behavior. In the case of import tariffs, the second purpose (changing behavior, in this case encouraging entrepreneurs to start manufacturing companies aka factories here in America) is far more important than the first.

It all began here in America when General Henry Knox rode up to Mount Vernon in the late summer of 1789 to tell George Washington that Congress had just elected him as the first president of the United States. Washington took the news, and had two requests for his old friend.

First, he asked Knox to let folks know he’d be delayed by a few days because he wanted to say goodbye to his mother, who was elderly and ailing (turned out, it was the last time he saw her alive).

Second, Washington asked General Knox to ride all the way up to Connecticut to visit Daniel Hinsdale, a man who’d been secretly manufacturing black-market American-made fine men’s clothing in defiance of British law for decades. Knox took Washington’s measurements and then, a month later, brought to New York (where the swearing-in took place on what is now Wall Street) a fine American-made suit, which Washington proudly wore. (The suit was brown; the black suit of his later, famous painting was British formal wear.)

This incident highlighted the manufacturing crisis facing our new nation, and Washington was acutely aware of it.

The British, for two centuries, had been extracting wealth from the American colonies by forbidding us from manufacturing everything from fine clothing (thus Hinsdale’s illegal business) to weaponry to sophisticated machinery: All such items had to be imported from British manufacturers. We sold England cheap raw cotton, for example, and they forced us to buy back expensive fine cotton clothing manufactured on the looms of British cities. (Homespun was still legal in the colonies.)

They also forced us to buy tea—then the primary American beverage—from the East India Company, an outrage that led directly to the Boston Tea Party of 1773, which arguably kicked off the American Revolution. Thus, when Washington came into office, the first challenge he faced was how to build an American manufacturing base that wasn’t dependent on British imports.

Thirteen years before Washington’s inauguration, British economist Adam Smith had made worldwide headlines with his bestselling 1776 book An Inquiry into the Nature and Causes of the Wealth of Nations, proposing that the main thing that made a country rich was independence in manufacturing.

The process of converting raw materials of little value into finished products with a high value (manufacturing) was, to Smith’s mind, the best and only practical way a nation could grow wealthy without overseas conquest and plunder.

A tree limb laying on the forest floor, for example, had no monetary value, but when labor and the tool of a knife were applied to it and it was turned into an axe-handle—a process called manufacturing—it now had a value that could be passed down through generations.

Smith called that wealth. That axe-handle became part of the aggregate wealth of the entire nation, and even if it was sold overseas that wealth would still remain here because its value was simply converted into currency which stayed in America.

This understanding led President Washington to commission his Treasury Secretary, Alexander Hamilton, to propose to Congress in 1791 an 11-step Report on the Subject of Manufactures, also known as The American Plan.

At the core of Hamilton’s plan were protective tariffs on goods that were then being imported but could be easily made in the USA. The tariffs would increase the price of the imported goods so much that they’d encourage American entrepreneurs to start factories to make the same things here.

(Hamilton’s plan also included government subsidies for companies that wanted to move manufacturing to the U.S., federal subsidies for the development of new technologies, a massive investment in infrastructure [particularly roads and water-power systems] to support industry, and a requirement that the U.S. government purchase only American-made products whenever possible.)

Within two decades, Congress and the Washington, Adams, and Jefferson administrations had put nearly all of Hamilton’s plan into effect, and major parts of it stood all the way up until Reagan’s neoliberal revolution kicked off in 1981.

Today, you’ll search for hours to find a single made-in-America product in most big-box stores.

Hamilton’s plan was such a successful and important part of how America became the wealthiest nation on Earth, and produced so much revenue, that virtually 100% of the cost of operating our federal government—from our founding until the Civil War—came from tariffs. The salary of every president from George Washington to Abraham Lincoln was paid by tariffs (some were domestic interstate tariffs, like on alcohol), as was the salary of every federal official and the cost of everything else the federal government did.

Fully two-thirds of federal government revenue came from tariffs from the end of the Civil War until the World War I era and the 1913 passage of the 16th Amendment (the income tax); a third of federal government revenue came from tariffs between WWI and WWII.

Today, however, it is under 2%.

Prior to Reagan, American manufacturing—kept on this continent by the force of tariffs—was at the core of the American Dream, with good union manufacturing jobs offering stability and prosperity to a growing American middle class from the 19th century until the 1990s. Tariffs also made America the technological leader of the entire planet.

The concept was simple: If a product could be made for $70 with cheap Chinese labor, but cost $100 to make with U.S. labor, we’d put a $30 tariff on it to equalize the labor costs. Ditto if overseas manufacturing was subsidized by governments or by a lack of expensive pollution controls or worker safety protections: we’d match those cost advantages with tariffs.

There was still a heck of a lot of trade going on in the world when tariffs were common. As late as 1975, our imports and exports were pretty much in balance (we had a $12 billion surplus).

And then came the neoliberal sales pitch of the 1980s, as I lay out in detail in The Hidden History of Neoliberalism: How Reaganism Gutted America.

If only we could get rid of those nasty tariffs—we had over 20,000 categories of products with specified tariffs—by reducing them to zero or very, very low numbers, Reagan, Bush, and Clinton told us, then American consumers would benefit because big retailers like Walmart could buy products made with cheap labor from overseas instead of from higher-paid American workers. Prices, in other words, would be lower for consumers.

The result has been the shuttering of over 70,000 U.S. factories and the loss of around 8 million good often-unionized manufacturing jobs. It typically takes companies between one and two decades to shift manufacturing overseas, given how large a logistical operation it involves, and reversing the process will probably also take a decade or two.

Entire regions of America were wiped out, producing a swath of our country now referred to as the “rust belt.” The situation was compounded by the Bush administration’s and the Supreme Court’s hostility to union rights.

Since Reagan’s “free trade” we’ve had nothing but annual trade deficits, each representing trillions in American worker’s wealth that’s been shifted to overseas manufacturing countries.

Sam Walton’s autobiography, titled Made in America, epitomized the situation prior to Reaganism when Walmart stores had big “100% Made In America” banners hanging over their front doors. Today, you’ll search for hours to find a single made-in-America product in most big-box stores.

How do we bring back tariffs and how do we avoid a trade war disaster like Trump caused during his first presidency?

Around that same time, another rationale for corporations seeking cheap labor and easy pollution regulations overseas began to take hold in the minds of the neoliberal intelligentsia: “Free trade,” they said, was so magical it could even bring about world peace!

The argument was simple, the neoliberals told us: History showed, they said, that countries that traded heavily with each other rarely went to war with each other. The example most often cited was that no two countries with MacDonald’s burger outlets had ever, at that time, gone to war (although they have since: see Russia and Ukraine).

Thomas Friedman jumped into the act at the end of the 20th century, promoting the MacDonalds’ Peace Theory and the transfer of American manufacturing overseas with his now-discredited 1999 book The Lexus and the Olive Tree.

Its impact, along with major campaigns encouraging “free trade” funded by American industrial and retail giants and their billionaire owners, echoed across American manufacturing and foreign policy for the next 20 years, as America continued to hemorrhage jobs along with the middle class “American Dream” wealth that accompanied them.

As a vast proportion of American manufacturing shifted to China, that nation—just like Hamilton predicted and proved with the U.S.—underwent the most rapid transformation from Third World poverty to First World affluence in the history of the world.

All because the “wealth” of America was transferred to China every time a cash-register rang at Walmart, an Apple Store, or in pretty much any other American retail outlet. And continues to this day.

So, how do we bring back tariffs and how do we avoid a trade war disaster like Trump caused during his first presidency?

The main goal of an import tariff is to encourage Americans to buy the products of domestic—rather than foreign—manufacturing. For that to work, companies that may consider investing billions in factories here in the U.S. need to know that the tariffs aren’t just a whim or election stunt like they were with Trump, but will be around for the coming years or even decades necessary to recover their initial billion-dollar investments in new manufacturing facilities.

Just because Trump was conceptually right about tariffs (but terribly wrong in how he executed them) doesn’t mean Democrats should freak out at any mention of them.

Tariffs also need to be brought in on an item-by-item basis, organically, with each imported item that we want to put a tariff onto examined for the tariff’s impact, both on domestic inflation and international relations.

We really have no need to put a tariff on, for example, imported artwork from Mexico or moose-skin jackets from Canada; there’s no competing domestic industry here. It’s why Trump’s proposed “across-the-board” tariffs are so stupid.

But the manufacture of cars, steel, chips, computers, toys, clothes, pharmaceuticals, and hundreds of other products and categories of goods can be brought back to the U.S. by appropriate tariffs, introduced gradually and predictably, done in a way that allows both foreign companies and U.S. entrepreneurs to adjust without major disruptions.

There’s also a national security aspect to this. Right now, it’s nearly impossible for the U.S. to manufacture a battleship or advanced aircraft without parts from overseas. Because tariffs had kept virtually all manufacturing here in the U.S. prior to WWII, shifting to a war-based manufacturing economy in the 1940s, before Reagan’s neoliberal “reforms,” was easy. Today it would be extremely difficult.

On top of that, we no longer make most therapeutic drugs here in America. China makes many of the raw ingredients for the drugs we use here, and most pharmaceuticals used in America are manufactured there and in India.

One result is that often drugs we take are contaminated because they’re made in plants outside the U.S.; an old friend got cancer from taking a drug contaminated by a toxic chemical, and my father got bladder cancer from taking a drug contaminated in India with N-nitrosodimethylamine (NDMA).

Also alarming, if we got into a serious conflict with China (for example) and they cut us off from all their manufactured goods, our economy would collapse overnight and we’d find it very, very difficult to manufacture some of our most important weaponry and telecommunications equipment. Not to mention the crisis of a massive drug shortage.

Thus, tariffs have to be put into place intelligently; after all, we’re reversing a neoliberal free trade process that took 44 years to get as bad as it is today.

We don’t want to start trade wars—like Trump did the first time with his tariff stunt and is threatening to do again in January—or wipe out people in poor countries (like Bangladesh or Malaysia, where much of our clothing is made), but we do want the “wealth of [our] nation” to be built and kept here.

We do this by having Congress openly discuss and debate tariffs, apply them gradually, and accompany them with supports for the poorer parts of the world that may be harmed by them, assisting them in developing sustainable domestic industries to replace their export losses.

This is not a radical idea.

China uses tariffs (and dozens of other trade restrictions) to protect its domestic industries. The European Union imposes tariffs on agricultural products to protect its farmers (averaging around 11.4%) as well as industrial goods (averaging around 4.1%). Some industries, like dairy products (38.4% E.U. tariffs) and confectionery products (24.6%), have asked for and gotten even higher E.U. tariffs to keep them viable domestically.

And, of course, that’s how America became the richest country in the world, and the loss of tariffs is a major part of why our standard of living has slipped so badly over these past 44 years of our neoliberal Reaganism experiment. Our wealth, along with our manufacturing and jobs, was simply shipped overseas—and now we must begin the process of bringing it back home.

Democrats know this, even if they’re unwilling to talk about it. The Biden administration took some good steps in this direction by imposing or maintaining multiple tariffs, and they’re already increased American prosperity, particularly for working people.

President Joe Biden increased tariffs on steel and aluminum products from 7.5% to 25% this year; tariffs on semiconductors will rise to 50% by 2025; tariffs on electric vehicles (EVs) hit 100% this year; tariffs on lithium-ion EV batteries and magnets for EV motors will go up by 25% by 2026. After the Covid-19 crisis, the Biden administration put a 50% tariff on syringes and needles to jump-start domestic production, and personal protective equipment (PPE) tariffs went up 25%.

This is not a black-and-white issue. Yes, tariffs are a tax and, until domestic manufacturing replaces foreign imports, they’re a tax that’s mostly passed along to consumers, resulting in higher prices for goods.

But when done right and gradually, those higher prices open the door for American companies to again become competitive, to manufacture goods here—and thus keep our jobs and our “wealth” here—while raising the wages and standard of living of American workers and people around the world.

Just because Trump was conceptually right about tariffs (but terribly wrong in how he executed them) doesn’t mean Democrats should freak out at any mention of them. They’re an important part—as Alexander Hamilton and George Washington taught us—of creating and maintaining wealth and independence for our nation.

And voters in the Rust Belt states know all this already.

As Trump behaves like a bull in a china shop, ready to slap punitive and politically-motivated tariffs on our top trading partners, expect considerable market and overall economic dislocation; a recession is a probable outcome.

But as he shatters the neoliberal tariff consensus, Democrats should rise to the occasion and argue for rational, targeted, and gradual tariffs, taking the Party back to its pre-1980s positions on trade.

And then they’ll be well positioned to both exploit the issue and rescue the American economy in 2026 and 2028 after Trump’s done his worst.

- Self-Styled Working Class Fighter Trump Readies Cabinet Shaped by Billionaires ›

- Study Shows Trump Plan Would Slash Taxes for Richest 5%, Hike Them for Everyone Else ›

- Mexico's Leftist President Rips Trump Tariff Threat ›

- Dems in Congress Vow to Fight 'Inflationary Policies' of Trump ›

- Opinion | Why China Stands to Benefit From Trump's Incoherent Trade Policy | Common Dreams ›

- Opinion | Tariffs Should Be a Scalpel, Not a Sledgehammer | Common Dreams ›

- Opinion | 2028 Will Be Our Last, Best Hope to Propel a Real Leftist to the Top of the Ticket | Common Dreams ›