The Washington, D.C.-based Tax Foundation has long functioned as an apologist for America’s deepest pockets. Analysts at the foundation have spent years assuring us that our wealthiest are paying far more than their fair tax share—in the face of a reality that has our richest aggressively growing their share of the wealth all Americans are creating.

This past August, the Biden administration’s Treasury Department commissioned a new study that documented just how little of their wealth America’s richest are actually paying in taxes. Last month, the Tax Foundation responded with a predictable critique. Our super rich, insists this new Tax Foundation analysis, are still today paying “super amounts of taxes.”

But tax data, as the study Treasury officials released last summer shows, tell a far different story.

If Congress does not at some point soon raise what our ultra-rich pay in taxes as a percentage of their wealth, our grandchildren could well be living in a nation where our richest 0.01% hold half our nation’s wealth, quintuple their current share.

This Treasury study—led by an academic team that included the widely respected economists Emmanuel Saez and Gabriel Zucman—spotlighted a wide variety of stats on the incomes America’s 183.7 million taxpayer units reported and the taxes they paid in 2019.

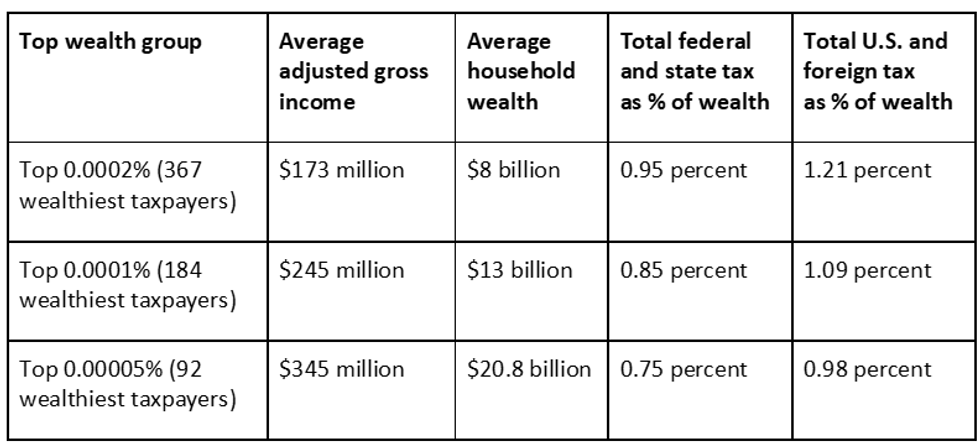

The report devoted special attention to how much in taxes the nation’s most affluent that year paid, breaking these taxpayers down into wealth categories ranging from our richest 10% to our richest 0.001%. To drill down even deeper, the report tapped annual Forbes 400 data to calculate comparable stats for those households that sit at our nation’s even higher wealth summit.

And what did the Treasury report show? At that summit, the nation’s richest 0.0002%—a group that roughly corresponds in size to the Forbes 400—paid in 2019 federal and state taxes the equivalent of less than 1% of their wealth. The richest of America’s rich, the top 0.00005% of taxpayers, paid in federal and state taxes an amount that equaled just 0.75%.

All these rich did, to be sure, pay some foreign taxes as well. But the richest of America’s rich, even after taking these foreign taxes into account, still paid in taxes less than 1% of their wealth, as this charting of the Treasury Department stats shows.

The Tax Foundation’s just-published response to the Treasury data doesn’t dispute the accuracy of any of these figures. The Tax Foundation claims instead that the Treasury report confirms that America’s rich “pay more than one-third of their annual income in federal taxes and more than 45% when state and local taxes are included.”

Indeed, the Tax Foundation adds, the total tax burden on the nation’s super wealthy can, with foreign taxes paid taken into account, run “upwards of 60% of their annual income.”

The key word here: income. The Treasury study, the Tax Foundation charges, “classifies taxpayers according to an estimate of their wealth rather than their income, with the intention of showing that the rich pay very little in taxes.” The rich, the foundation concludes, “are not undertaxed relative to their annual income.”

This Tax Foundation’s claim begs some obvious questions: What yardstick should we use to consider whether our wealthiest are paying an appropriate amount of tax? If our wealthiest, after paying their taxes, are still watching their personal wealth grow at a higher growth rate than the nation’s total wealth, are these wealthy paying their “fair tax share”?

The annual Forbes 400 may be the best place to start our answer to that question. Between 2014 and 2024, the wealth of the Forbes 400 increased from $2.29 trillion to $5.4 trillion. That translates to an annual growth rate of 8.96%, net of taxes and living expenses. Over the same period, America’s total household wealth grew 6.8% annually, increasing from $79.94 trillion to $154.39 trillion.

At those 2014-2024 rates of growth, the share of the nation’s wealth the Forbes 400 holds would double every 35 years. Over the past 42 years, the Forbes 400 share of the nation’s wealth has actually grown at an even faster rate, nearly quadrupling over that four-decade-plus span.

The wealth of our wealthiest has no natural limit. If Congress does not at some point soon raise what our ultra-rich pay in taxes as a percentage of their wealth, our grandchildren could well be living in a nation where our richest 0.01% hold half our nation’s wealth, quintuple their current share.

What level of taxation would be required to stop America’s wealth from concentrating so furiously? To close the gap between the growth rate for the wealth of the richest Americans and our nation’s overall growth in total wealth, current combined federal and state taxes on those at the top would have to rise substantially, at least tripling.

None of these figures should come as a surprise. We’ve known for decades now about the under-taxation of America’s billionaires, a reality that rests on what may be the single most glaring flaw in America’s tax system: “adjusted gross income.” The Internal Revenue Code uses this “AGI” as the starting point for calculating federal income tax due. But “adjusted gross income”—for America’s richest taxpayers—has become and continues to be an entirely meaningless figure.

Consider 2019, the year the Treasury study this past August most closely highlighted. The S&P 500 stock index that year rose 30% between the opening of trading in January and the last trading day in December. For Americans at our nation’s economic summit, that made for a wonderful year. These wealthy derive nearly all their income from their investments.

As we move up the economic scale, the wealth growth of the ultra-rich follows a clear pattern: The economic income—that is, the rate of wealth growth—of the topmost group increases as the size of the group shrinks.

Between 2014 and 2024, for example, the wealth of the 92 richest Americans increased from $1.4 trillion to $3.4 trillion, a jump that translates to an annual growth rate just over 9%. Over that same period, the wealth of remaining 308 in the Forbes 400 grew at a rate of 8.82%. By contrast, in 2019, the average adjusted gross incomes of the top 92 taxpayers and the next 275 taxpayers stood at 1.66% and 3.11% of their average wealth.

In other words, the higher up we go on the wealth ladder, the higher the rate of wealth growth, as we would expect. But adjusted gross income, expressed as a percentage of wealth, decreases. For America’s wealthiest, adjusted gross income bears no relationship to actual economic income. Any estimate of income that places, as the AGI does, the income of the 92 richest Americans at only 1.66% of their wealth rates as essentially useless.

To sharpen this picture even more, consider the increase in tax on America’s wealthiest 367 that would be needed to freeze the increase in their share of our nation’s wealth. Avoiding a further increase in the concentration of the nation’s wealth would require an overall increase in the rate of taxes our top 367 pay to more than 150% of their adjusted gross income. If we limited their overall tax rate to a mere 100% of their adjusted gross income, their share of the country’s wealth would continue to increase.

Where does that leave us? For taxing the rich, we currently rely on an income tax based on adjusted gross income as our primary vehicle. That isn’t working. If we’re going to achieve fair share taxation of the rich, we need to scrap AGI and develop a measure of income that accurately reflects their true economic income. Otherwise, we need to tax wealth directly.