SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Aerial view of a home owned by billionaire Darwin Deason in San Diego, California. The 13,000 square-foot, 10 bedroom, 17 bathroom oceanfront mansion named the Sand Castle along the La Jolla coastline was listed for $108 million last year.

Look at what happened in Massachusetts and Washington. Not only did millionaires not flee the states imposing new taxes, but the states became richer.

Increasing taxes on high income earners helped raise revenue without hampering the wealth of the millionaire class in Massachusetts and Washington, according to a new policy brief from the Institute for Policy Studies and State Revenue Alliance.

A common counter to raising taxes on the rich is that they will simply flee their home states to jurisdictions with friendlier tax codes. While some tax migration is inevitable, the wealthy that move to avoid taxes represent a tiny percentage of their own social class. The top one percent are incentivized not to move because of family, social networks and local business knowledge.

Our findings support the case against tax flight: The number of individuals with a net worth of at least seven-figures continued to expand in both Massachusetts and Washington after tax hikes. The millionaire class has grown by 38.6 percent in Massachusetts and 46.9 percent in Washington over the past two years. The seven-figure clubs in those states saw their wealth grow by $580 million and $748 million, respectively.

We have witnessed a counterrevolution over the past 50 years where the nation’s wealth and income has concentrated at an extreme level in the hands of a small but powerful minority.

Not only did millionaires not flee the states imposing new taxes, but the states became richer. The four percent surtax on million-dollar incomes in Massachusetts and the seven percent tax on capital gains of $250,000 or more in Washington State succeeded in raising revenue — $2.2 billion for FY 2024 and $1.2 billion in its first two years of implementation, respectively.

These new resources have been invested in educational programs that support early learning, childcare, and free school lunches and community college. In the case of Massachusetts, some of the revenue collected is earmarked towards public transportation.

That experience contrasts with the failure of the Great Kansas Tax Cut Experiment that began in 2012. The Sunflower State lagged behind its neighbors in a number of economic categories and experienced revenue shortfalls. The experiment was abandoned five years later.

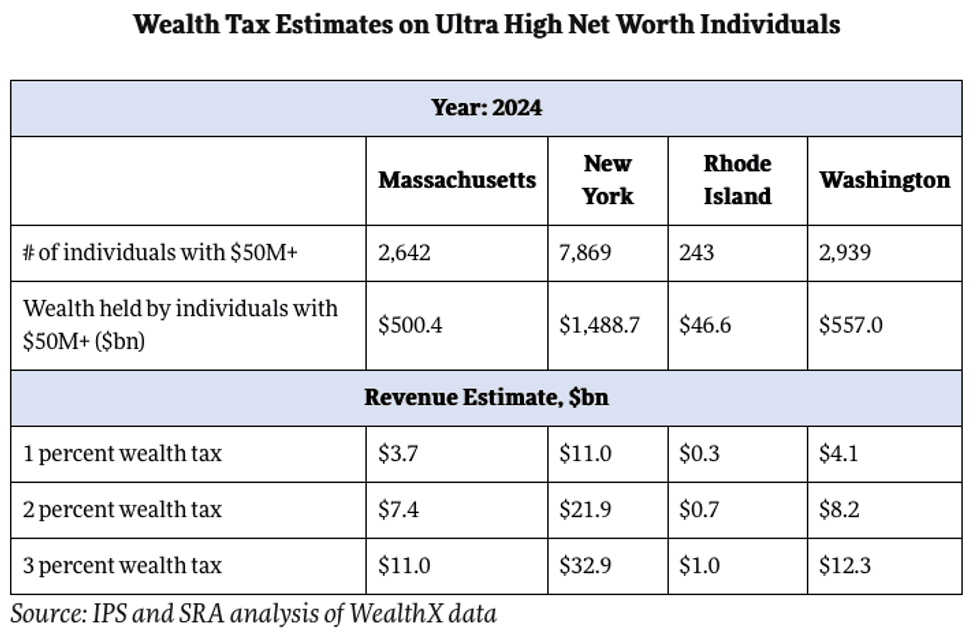

Lastly, the brief looks at the revenue potential of a wealth tax aimed at ultra-high net worth individuals. We identified individuals with $50 million or more in wealth across four states and estimated how much different taxes could raise. These individuals have the liquidity to pay and, as my colleague and former tax attorney Bob Lord has argued, need to have their rate of accumulation curbed.

A two percent wealth tax on this class of ultra-high net worth individuals has the potential to raise $7.4 billion in Massachusetts, $21.9 billion in New York, $700 million in Rhode Island, and $8.2 billion in Washington. This is a significant source of potential revenue that can be invested in a green transition, permanently affordable housing, and universal healthcare.

At the time of writing, legislators in Washington State are awaiting Governor Bob Ferguson’s signature to pass new taxes to help bring down their $16 billion budget deficit. Even a one-time 3% wealth tax could bring down the deficit from $16 billion to $3.7 billion.

We have witnessed a counterrevolution over the past 50 years where the nation’s wealth and income has concentrated at an extreme level in the hands of a small but powerful minority. They use their resources to increase their access to the state, buy up more assets, and squeeze the living standards of the working class. We have the policy tools at our disposal to reverse this trend. Let’s put progressive taxation to work.

|

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Increasing taxes on high income earners helped raise revenue without hampering the wealth of the millionaire class in Massachusetts and Washington, according to a new policy brief from the Institute for Policy Studies and State Revenue Alliance.

A common counter to raising taxes on the rich is that they will simply flee their home states to jurisdictions with friendlier tax codes. While some tax migration is inevitable, the wealthy that move to avoid taxes represent a tiny percentage of their own social class. The top one percent are incentivized not to move because of family, social networks and local business knowledge.

Our findings support the case against tax flight: The number of individuals with a net worth of at least seven-figures continued to expand in both Massachusetts and Washington after tax hikes. The millionaire class has grown by 38.6 percent in Massachusetts and 46.9 percent in Washington over the past two years. The seven-figure clubs in those states saw their wealth grow by $580 million and $748 million, respectively.

We have witnessed a counterrevolution over the past 50 years where the nation’s wealth and income has concentrated at an extreme level in the hands of a small but powerful minority.

Not only did millionaires not flee the states imposing new taxes, but the states became richer. The four percent surtax on million-dollar incomes in Massachusetts and the seven percent tax on capital gains of $250,000 or more in Washington State succeeded in raising revenue — $2.2 billion for FY 2024 and $1.2 billion in its first two years of implementation, respectively.

These new resources have been invested in educational programs that support early learning, childcare, and free school lunches and community college. In the case of Massachusetts, some of the revenue collected is earmarked towards public transportation.

That experience contrasts with the failure of the Great Kansas Tax Cut Experiment that began in 2012. The Sunflower State lagged behind its neighbors in a number of economic categories and experienced revenue shortfalls. The experiment was abandoned five years later.

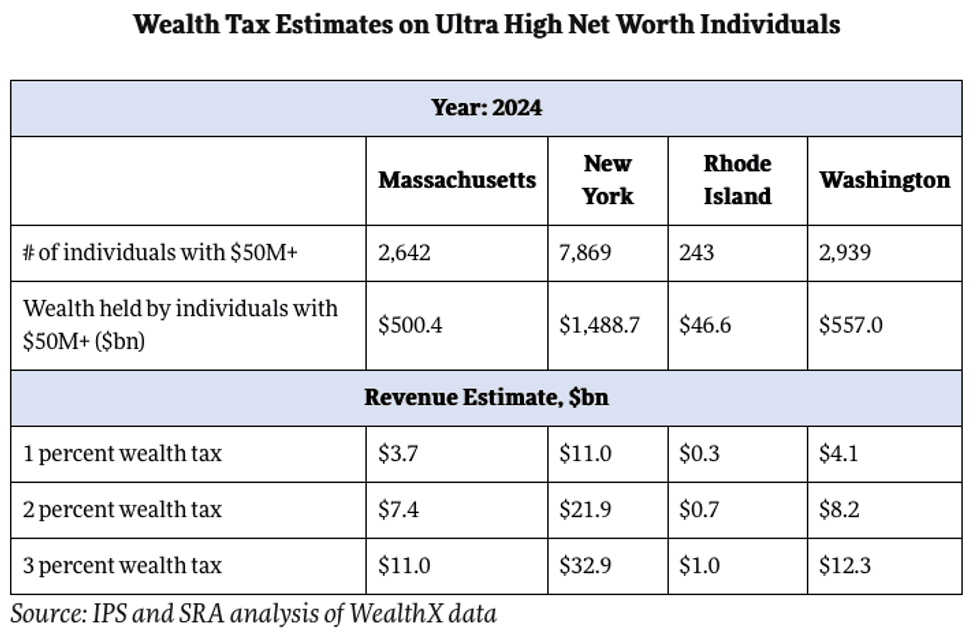

Lastly, the brief looks at the revenue potential of a wealth tax aimed at ultra-high net worth individuals. We identified individuals with $50 million or more in wealth across four states and estimated how much different taxes could raise. These individuals have the liquidity to pay and, as my colleague and former tax attorney Bob Lord has argued, need to have their rate of accumulation curbed.

A two percent wealth tax on this class of ultra-high net worth individuals has the potential to raise $7.4 billion in Massachusetts, $21.9 billion in New York, $700 million in Rhode Island, and $8.2 billion in Washington. This is a significant source of potential revenue that can be invested in a green transition, permanently affordable housing, and universal healthcare.

At the time of writing, legislators in Washington State are awaiting Governor Bob Ferguson’s signature to pass new taxes to help bring down their $16 billion budget deficit. Even a one-time 3% wealth tax could bring down the deficit from $16 billion to $3.7 billion.

We have witnessed a counterrevolution over the past 50 years where the nation’s wealth and income has concentrated at an extreme level in the hands of a small but powerful minority. They use their resources to increase their access to the state, buy up more assets, and squeeze the living standards of the working class. We have the policy tools at our disposal to reverse this trend. Let’s put progressive taxation to work.

Increasing taxes on high income earners helped raise revenue without hampering the wealth of the millionaire class in Massachusetts and Washington, according to a new policy brief from the Institute for Policy Studies and State Revenue Alliance.

A common counter to raising taxes on the rich is that they will simply flee their home states to jurisdictions with friendlier tax codes. While some tax migration is inevitable, the wealthy that move to avoid taxes represent a tiny percentage of their own social class. The top one percent are incentivized not to move because of family, social networks and local business knowledge.

Our findings support the case against tax flight: The number of individuals with a net worth of at least seven-figures continued to expand in both Massachusetts and Washington after tax hikes. The millionaire class has grown by 38.6 percent in Massachusetts and 46.9 percent in Washington over the past two years. The seven-figure clubs in those states saw their wealth grow by $580 million and $748 million, respectively.

We have witnessed a counterrevolution over the past 50 years where the nation’s wealth and income has concentrated at an extreme level in the hands of a small but powerful minority.

Not only did millionaires not flee the states imposing new taxes, but the states became richer. The four percent surtax on million-dollar incomes in Massachusetts and the seven percent tax on capital gains of $250,000 or more in Washington State succeeded in raising revenue — $2.2 billion for FY 2024 and $1.2 billion in its first two years of implementation, respectively.

These new resources have been invested in educational programs that support early learning, childcare, and free school lunches and community college. In the case of Massachusetts, some of the revenue collected is earmarked towards public transportation.

That experience contrasts with the failure of the Great Kansas Tax Cut Experiment that began in 2012. The Sunflower State lagged behind its neighbors in a number of economic categories and experienced revenue shortfalls. The experiment was abandoned five years later.

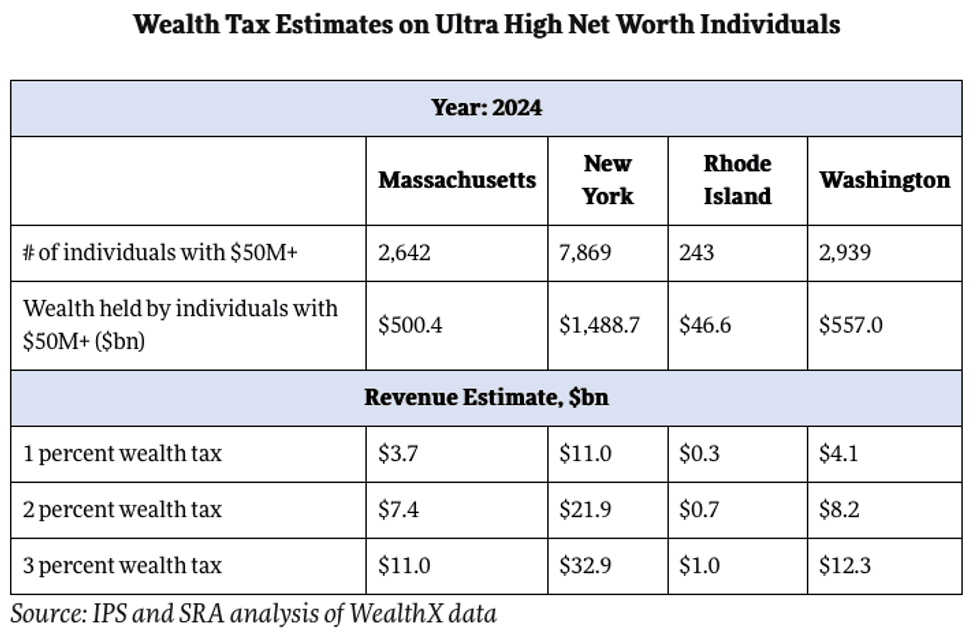

Lastly, the brief looks at the revenue potential of a wealth tax aimed at ultra-high net worth individuals. We identified individuals with $50 million or more in wealth across four states and estimated how much different taxes could raise. These individuals have the liquidity to pay and, as my colleague and former tax attorney Bob Lord has argued, need to have their rate of accumulation curbed.

A two percent wealth tax on this class of ultra-high net worth individuals has the potential to raise $7.4 billion in Massachusetts, $21.9 billion in New York, $700 million in Rhode Island, and $8.2 billion in Washington. This is a significant source of potential revenue that can be invested in a green transition, permanently affordable housing, and universal healthcare.

At the time of writing, legislators in Washington State are awaiting Governor Bob Ferguson’s signature to pass new taxes to help bring down their $16 billion budget deficit. Even a one-time 3% wealth tax could bring down the deficit from $16 billion to $3.7 billion.

We have witnessed a counterrevolution over the past 50 years where the nation’s wealth and income has concentrated at an extreme level in the hands of a small but powerful minority. They use their resources to increase their access to the state, buy up more assets, and squeeze the living standards of the working class. We have the policy tools at our disposal to reverse this trend. Let’s put progressive taxation to work.