Mamdani is running a very New York-focused election campaign, but one that also speaks to low-income and moderate-income voters across this nation. So many in Donald Trump’s America are now facing the possibility of either losing their healthcare or having healthcare that’s simply far too expensive and doesn’t cover what they need. All too many confront rising housing costs or their inability to purchase a home. All too many are seeing the cost of college reach a level that makes it unaffordable for their children and are now experiencing significant healthcare expenses, whether for young children or elderly sick parents, that have become suffocating.

Here in New York City, poverty is already double the national average. One quarter of New Yorkers don’t have enough money for housing, food, or medical care. Twenty-six percent of children (that’s 420,000 of them!) live in poverty. Of the 900,000 children in the city’s public school system, 154,000 are homeless. (And sadly, each of these sentences should probably have an exclamation point after it!) In the face of such grim realities, Mamdani, among other policies, is calling for a freeze on rents in rent-stabilized apartment buildings in the city; making buses free; offering free childcare for those under the age of five; building significant amounts of new affordable housing; improving protections for tenants; providing price-controlled, city-owned grocery stores as an option; and raising the minimum wage.

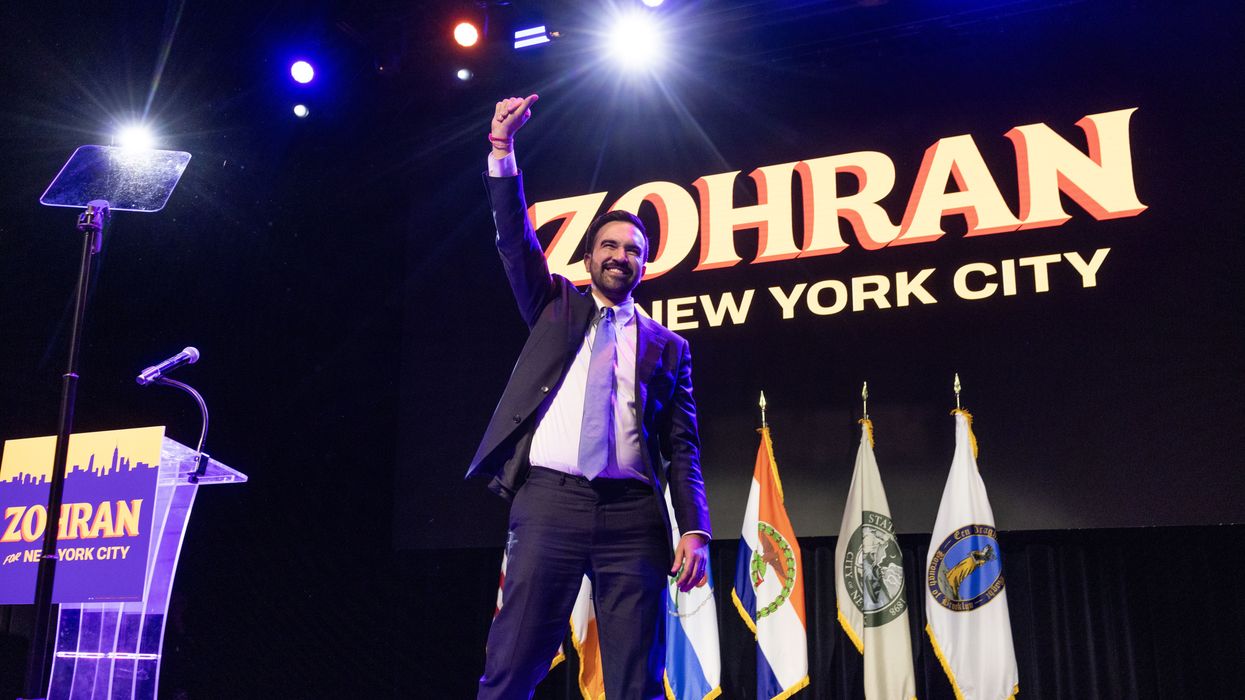

At its most basic, the Mamdani campaign is about affordability and the dignity of working people.

Make no mistake: Zohran Mamdani distinctly represents the “other” in Donald Trump’s universe. In that world, he’s viewed as not White, which is in itself a crime for so many of the president’s supporters. Trump has always been a divider. As the Guardian reported in 2020 in a piece headlined, “The politics of racial division: Trump borrows Nixon’s southern strategy,” the president warned that, if Joe Biden were to replace him as president, the suburbs would be flooded with low-income housing.

He’s backed supporters who have sometimes violently clashed with Black Lives Matter (BLM) protesters across the country. He even refrained from directly condemning the actions of a teenager charged with killing two protesters in Kenosha, Wisconsin, suggesting that he might have been killed if he hadn’t done what he did. He’s also called the BLM movement a “symbol of Hate.”

With such rhetoric, the president is indeed taking a page or two out of the 1960s “southern strategy,” the playbook Republican politicians like President Richard Nixon and Senator Barry Goldwater once used to rally political support among White voters across the South by leveraging racism and White fear of “people of color.” Much of what drives Republican strategists today is figuring out what can be done to slow and mute the browning of America. It’s always important to remember that race is almost invariably a critical issue in the American election process.

The election of Mamdani in New York City would indeed send a message across the country and the world that this — my own city — is a place where immigrants can achieve political office and thrive. It would send a message that an agenda focused on low-income people — promising to provide them with opportunity, access to needed resources, and assistance — is a winning approach. In truth, Mamdani’s platform and agenda could undoubtedly be used to attract large groups of Americans who might indeed upend the political situation in many conservative districts across America. In other words, it — and Mamdani — are a threat.

The election of Mamdani in New York City would indeed send a message across the country and the world that this — my own city — is a place where immigrants can achieve political office and thrive. It would send a message that an agenda focused on low-income people — promising to provide them with opportunity, access to needed resources, and assistance — is a winning approach. In truth, Mamdani’s platform and agenda could undoubtedly be used to attract large groups of Americans who might indeed upend the political situation in many conservative districts across America. In other words, it — and Mamdani — are a threat.

As an observer of the Mamdani campaign, I can’t help reflecting on the civil rights struggle I was engaged in during the 1960s in the South. The challenges were enormous and the dangers great, but we made lasting change possible.

I hear a lot about the number and intensity of the workers in the Mamdani campaign. From my own past experience, I believe that the intensity of those involved in his campaign, the fact that many of them are workers, and their focus on affordability add up to a distinctly winning combination.

Let me now break down the future Mamdani experience as mayor of New York into four categories:

Vision

Zohran Mamdani has what it takes to be a great mayor because he has a vision that speaks to so many sectors of New York’s population, emphasizing as he does the dignity of working people and hope as an active force to put in place meaningful programs for a better future. He articulates a future for this city that is more equitable and will make it so much more livable for so many. As a politician, he’s both an optimist and unafraid to propose big solutions.

Dignity

At its most basic, the Mamdani campaign is about affordability and the dignity of working people. I’ve lived in this city for nearly 60 years and raised my family here. My wife was born here and has lived here her entire life. She was raised by a single father who worked for a fabric company. We managed to build a middle-class life, but right now such a future is anything but a given for so many in a city that has become all too difficult for working people to remain in and create a life worth living.

Make no mistake: Zohran Mamdani distinctly represents the “other” in Donald Trump’s universe.

It’s no small thing that, at this moment in the city’s history, Mamdani has made affordability the central issue of his campaign and suggested that a more affordable New York can be created based on a tax increase on those earning more than a million dollars annually. His focus on the dignity of working people and their families allows his message to have a deep resonance among the population and reach the young, the middle-aged, and the old. His focus is on how New York City can restructure its operations so that it serves us all, not just the well-off and the rich.

Hope

I suspect Zohran Mamdani recognizes that his focus on dignity is also connected to “hope,” and that such hope would be an active force in achieving change. His version of hope isn’t about mere optimism. It’s much broader than that. I was a member of the last generation born into segregation and a Jim Crow system in the American South. During my college days, the most powerful voice for dignity and hope in America was Martin Luther King Jr. He was just 26 years old when he was asked to lead the fight for civil rights and against segregation and Jim Crow in Montgomery, Alabama. Though that fight, in which I was a participant, did indeed seek to end segregation, it was equally about securing a sustainable economic life for Blacks. Indeed, Martin Luther King lost his life fighting for a decent wage for sanitation workers in Memphis, Tennessee.

Zohran Mamdani has been influenced by Dr. King when it comes to his focus on the issues of Dignity and Hope (which should indeed be capitalized in Donald Trump’s America). In a recent interview in the Nation Magazine, responding to a question about how he defines himself, and if he considers himself a democratic socialist, he said, “I think of it often in terms that Dr. King shared decades ago: ‘Call it democracy or call it democratic socialism. But there must be a better distribution of wealth within this country for all God’s Children.’” King believed that hope was not a passive but an active force. As he once said, “We must accept finite disappointment, but never lose infinite hope.”

Inclusiveness and Outreach

I spent 36 years working in the New York City and New York state government, much of that time as the leader or commissioner of agencies impacting the daily lives of citizens. I served under mayors Ed Koch, Mario Cuomo, David Dinkins, Michael Bloomberg, and Bill de Blasio. I was City Personnel Director, Commissioner of Human Rights for the State of New York, and Director of the Bureau of Labor Services. I finished my government service with a 16-year stint as Deputy Fire Commissioner for the Fire Department of New York City. And I know one thing: it’s critical to have vision and purpose if you plan to lead such a city successfully. In addition, a mayor can only put in place big ideas and see them to fruition if he’s connected to all the diverse constituencies and array of institutions that also work daily to reach citizens. In terms of outreach, Governor Mario Cuomo, the father of Andrew Cuomo, once told me that he judged a commissioner by how much time he spent in the community talking and listening to people as opposed to sitting in the office.

New York City has a population of 8.5 million people, which swells each day to more than 15 million, if you include all the commuters and visitors who must be served. With an annual budget of nearly $116 billion, it would be difficult for any mayor to manage. No one can truly be prepared for it, so it’s critical that the mayor selects a group of managers who have the experience and moxie to achieve his or her goals. I’m not concerned about Mamdani’s youth because no one becomes mayor with the singular management skills to confront such a giant budget and the diverse, powerful interest groups within the metropolis. None of those who preceded him, not Koch, Dinkins, Giuliani, Bloomberg, de Blasio, or Adams, could have led the city without the help of a cadre of able managers. Some chose well. Some chose poorly.

It’s critical, though, that if he wins on November 4th, a future Mamdani administration be composed of astute, experienced managers, from first deputy mayor to all the agency heads. And it’s not merely the agency heads who must be capable and well-focused, but all the other managers and deputies within those agencies, too. After all, in New York City, from fiscal crises to snowstorms, sanitation issues to policing, violence in the streets to ethnic tensions, education to housing, union negotiations to potential conflicts with New York State and the federal government, crises erupt on a remarkably regular basis. And don’t forget the more than 210,000 migrants who have arrived in the city since the spring of 2022 in search of an opportunity for a better life. All of that can overwhelm any mayor.

As a result, assuming he wins, Mamdani’s Transition Committee must cast a wide net for the best managers the city has to offer. On the whole, they should be young, yet seasoned. They should be diverse and represent an array of sectors. What he needs are not “yes” personnel but leaders who are themselves astute, critical, and committed to government service. His outreach should be to all races, religions, business areas, and nonprofit groups. As it happens, I’m encouraged by reports in the press of the way he’s already reaching out and I hope he does so in all the years of his mayoralty.

If Mamdani merges a focus on leadership and management with his already clear commitment to expanding affordability, dignity, hope, and opportunity for ever more New Yorkers, then he’ll cement his place in the city’s history and possibly—as Donald Trump grows ever less popular in a distinctly disturbed country—in American history, too.