Nina Turner, who also previously ran for Congress and is now a senior fellow at the Institute on Race, Power, and Political Economy, agreed. As Turner put it: "Members of Congress should not be allowed to trade stock. It's corruption."

While the Stop Trading on Congressional Knowledge (STOCK) Act of 2012 was intended to ban insider trading by members of Congress, lawmakers are still permitted to buy and sell stocks, even those of companies

impacted by their work on Capitol Hill.

Revelations about lawmakers' stock market gains over the past few years, including previous reports from Unusual Whales, have bolstered efforts to pass

legislation barring members of Congress, their spouses, and their dependent children from trading individual stocks—such as the Bipartisan Restoring Faith in Government Act introduced in May.

U.S. Congressman Ken Buck (R-Colo.) responded to the latest Unusual Whales report by promoting the Bipartisan Ban on Congressional Stock Ownership Act, which he

introduced last year with Reps. Matt Rosendale (R-Mont.) and Pramila Jayapal (D-Wash.), chair of the Congressional Progressive Caucus.

"Members of both parties have misused their influence to buy and trade stocks. This is an issue which hurts all Americans," Buck

said Tuesday. "The Bipartisan Ban on Congressional Stock Ownership Act will ensure that Congress is voting to represent their constituents instead of their wallets."

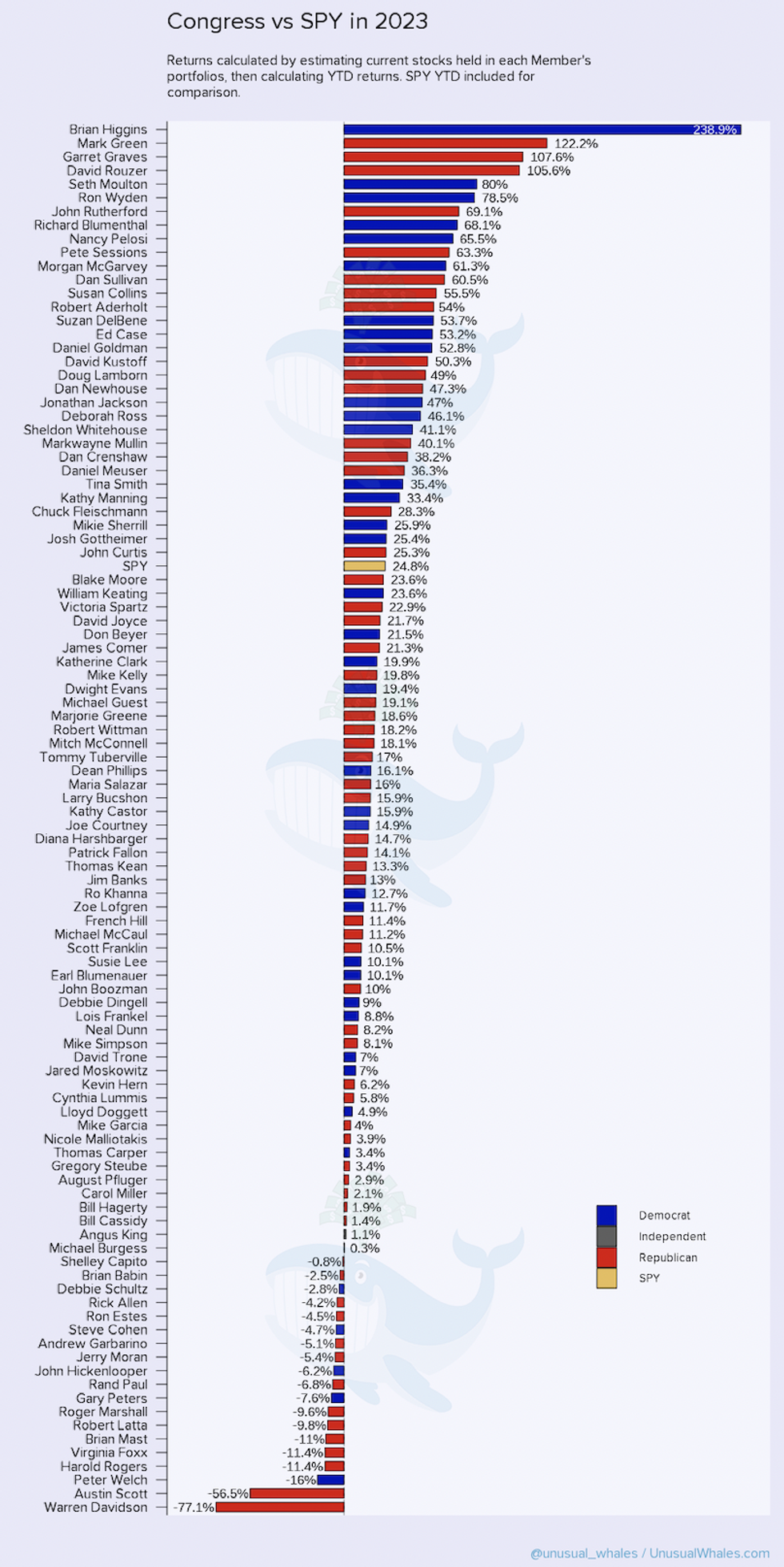

Unusual Whales' new report includes a graph comparing lawmakers' estimated returns for 2023—based on the current stocks in their portfolios—with the SPDR S&P 500 ETF (SPY), an exchange-traded fund that tracks the performance of the S&P 500 Index.

Thirty-two members of Congress—evenly split among Democrats and Republicans—fared better than SPY, which was up 24.81%. Overall, Democratic lawmakers were up 31.18% last year while their GOP colleagues were up 17.99%. At the top was U.S. Rep. Brian Higgins (D-N.Y.) at 238.9%.

Joining him in the top 10 were: Rep. Mark Green (R-Tenn.), 122.2%; Rep. Garret Graves (R-La.), 107.6%; David Rouzer (R-N.C.), 105.6%; Seth Moulton (D-Mass.), 80%; Sen. Ron Wyden (D-Ore.), 78.5%; Rep. John Rutherford (R-Fla.), 69.1%; Sen. Richard Blumenthal (D-Conn.), 68.1%; former House Speaker Nancy Pelosi (D-Calif.), 65.5%; and Pete Sessions (R-Texas), 63.3%.

"Numerous members in Congress traded war stocks before the Israel-Gaza-Palestine conflict," Unusual Whales noted.

As

Common Dreams has reported, after Israel declared war in response to a Hamas-led attack on October 7, the stock of defense companies soared and weapons giants have continued to cash in on the conflict.

Unusual Whales also highlighted that "the banking crisis saw numerous mergers and unusually timed transactions, both by banking executives and politicians."

The person behind Unusual Whales

grantedABC News an anonymous interview about such trades back in November:

"One thing people always say is that members are very good at picking stocks, that's often assumed… but to be quite frank, members were also quite good at avoiding losses," he told

ABC News in his first television interview.

He pointed

ABC News to the collapse of Silicon Valley Bank (SVB) and the regional banking crisis. He tracked trades showing several members of Congress, who sit on the House and Senate committees that regulate the financial industry, who sold SVB and other bank stocks before they experienced their sharpest decline.

"I can't know the intent, if that was what they were aiming to do," he told

ABC News. "But many of the members who were trading banking stocks during that time performed very, very well."

In the Tuesday report, Unusual Whales also flagged unusual trades by Pelosi, whose

husband is a trader, and Sen. Tommy Tuberville (R-Ala.), "one of the most active traders in Congress."

"We hope this will be our final report, and this report (with the history of our previous research) will be good enough to end the argument about Congress and trading," concluded Unusual Whales, which has also launched a

tool so members of the public can track the portfolios of individual lawmakers.

Fox News host Jesse Watters on Tuesday asked U.S. Rep. Marjorie Taylor Greene (R-Ga.) about the report, which shows that she was up 18.6% last year. She responded, "I actually asked my team about that today—why my name was on the list—because I don't even own any stocks and I haven't all of 2023."

"As a matter of fact, we have to report everything, including children who are dependents of ours. And I think what was reported was actually related to my son's account that his father and I had set up for him years ago," added Greene, who shares three children with her ex-husband.

Newsweekreported that a clip of the interview "sparked questions and mockery from social media users, some of whom accused Greene of using her son as an excuse to cover up her own trading."