SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

But there's a solution: The recently introduced Tax Excessive CEO Pay Act would base the CEO-worker pay ratio on five-year averages of the total compensation for a firm’s highest-paid executive and median worker.

In his first interview since becoming the leader of the Catholic Church, Pope Leo XIV fielded a question about the polarization that is tearing societies apart around the world.

A significant factor, he said, is the “continuously wider gap between the income levels of the working class and the money that the wealthiest receive.”

Pope Leo appears to be particularly baffled by the Tesla pay package that could turn Elon Musk into the world’s first trillionaire.

“What does that mean and what’s that about?” the Pope asked. “If that is the only thing that has value anymore, then we’re in big trouble.”

We are indeed in big trouble. But we are not without solutions.

Sen. Bernie Sanders (I-Vt.) and Rep. Rashida Tlaib (D-Mich.) are spearheading an effort behind one particularly promising solution: hefty tax hikes on companies with huge gaps between their CEO and median worker pay.

Their recently introduced Tax Excessive CEO Pay Act would base the CEO-worker pay ratio on five-year averages of the total compensation for a firm’s highest-paid executive and median worker. The tax increases would start at 0.5 percentage points on companies with gaps of 50 to 1 and top out at five percentage points on firms that pay their CEO more than 500 times median worker pay.

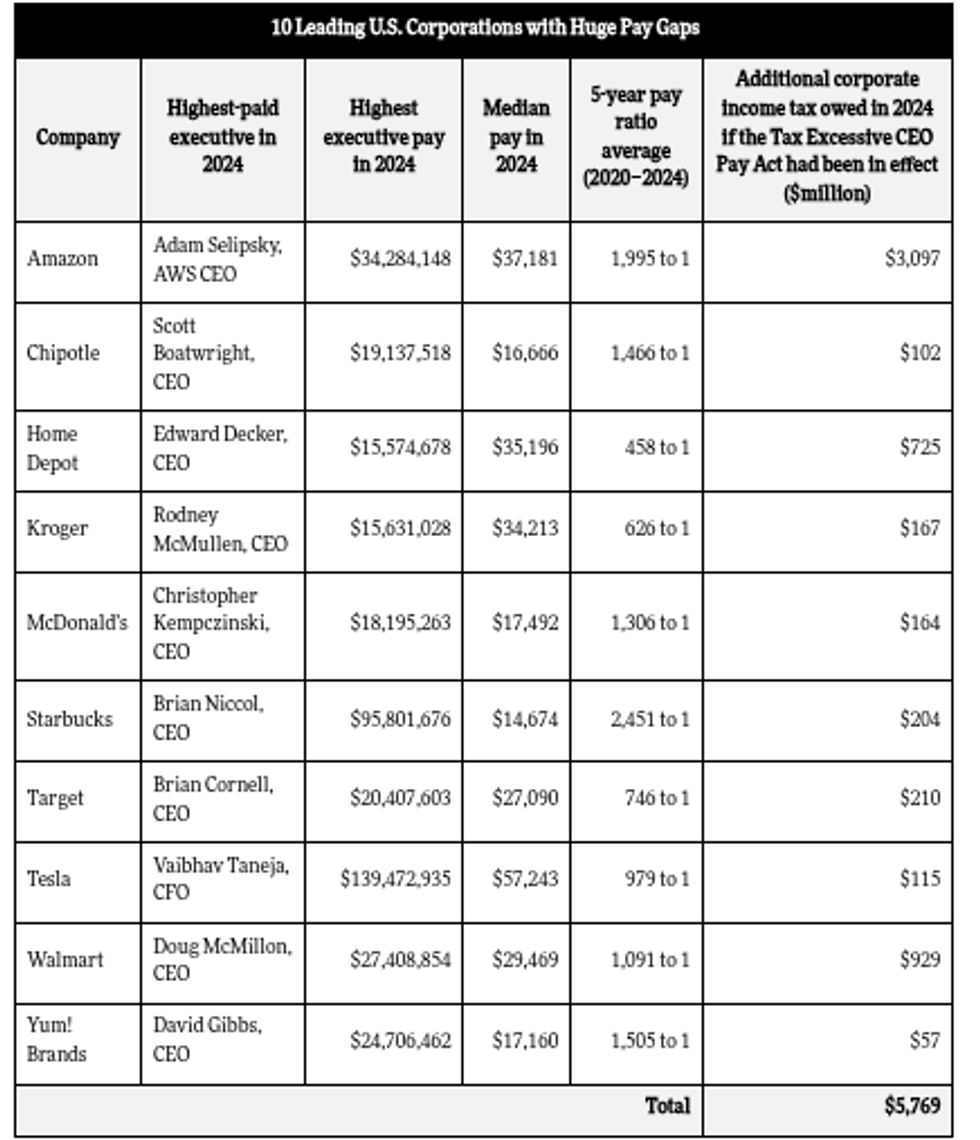

How much might specific companies owe under the bill if they refuse to narrow their gaps? At the Institute for Policy Studies, we ran the numbers on 10 leading US corporations with large pay ratios. We found, for example, that Walmart, with a five-year average pay gap of 1,091 to 1, would have owed as much as $929 million in extra federal taxes in 2024 if this legislation had been in effect.

Amazon, with an even wider gap of 1,995 to 1 and higher profits, would’ve owed as much as an additional $3.1 billion last year.

Home Depot would have owed as much as $725 million more in 2024 taxes under this legislation. Like most of these companies, the home improvement giant can’t claim to be short on cash. Over the past six years, they’ve blown nearly $38 billion on stock buybacks, a maneuver that artificially inflates a CEO’s stock-based pay. With the money the firm spent on stock buybacks, Home Depot could’ve given every one of their 470,100 employees six annual $13,423 bonuses.

Sen. Sanders pointed out that if Elon Musk receives the full $975 billion compensation package that Tesla’s board has proposed, Tesla could owe up to $100 billion more in taxes over the next decade under this legislation.

“The Pope is exactly right,” wrote Sanders in a social media post. “No society can survive when one man becomes a trillionaire while the vast majority struggle to just survive—trying to put food on the table, pay rent, and afford healthcare. We can and must do better.”

“Working people are sick and tired of corporate greed,” Rep. Tlaib added in a press release. “It’s disgraceful that corporations continue to rake in record profits by exploiting the labor of their workers. Every worker deserves a living wage and human dignity on the job.”

Additional original co-sponsors of the Tax Excessive CEO Pay Act include: Sens. Elizabeth Warren (D-Mass.), Chris Van Hollen (D-Md.), Peter Welch (D-Vt.), Ed Markey (D-Mass.), and 22 members of the House of Representatives.

Polling suggests that Americans across the political spectrum would support the bill. One 2024 survey, for instance, found that 80% of likely voters favor a tax hike on corporations that pay their CEOs more than 50 times more than what they pay their median employees. Large majorities in every political group gave the idea the thumbs up, including 89% of Democrats, 77% of Independents, and 71% of Republicans.

In these hyperpolarized times, Americans of diverse backgrounds, faiths, and political perspectives seem to share enormous common ground on at least one problem facing our nation: the extreme economic divides within our country’s largest corporations.

Pope Leo appears to be particularly baffled by the Tesla pay package that could turn Elon Musk into the world’s first trillionaire.

“What does that mean and what’s that about?” the Pope asked. “If that is the only thing that has value anymore, then we’re in big trouble.”

We are indeed in big trouble. But we are not without solutions.

Sen. Bernie Sanders (I-Vt.) and Rep. Rashida Tlaib (D-Mich.) are spearheading an effort behind one particularly promising solution: hefty tax hikes on companies with huge gaps between their CEO and median worker pay.

Their recently introduced Tax Excessive CEO Pay Act would base the CEO-worker pay ratio on five-year averages of the total compensation for a firm’s highest-paid executive and median worker. The tax increases would start at 0.5 percentage points on companies with gaps of 50 to 1 and top out at five percentage points on firms that pay their CEO more than 500 times median worker pay.

How much might specific companies owe under the bill if they refuse to narrow their gaps? At the Institute for Policy Studies, we ran the numbers on 10 leading US corporations with large pay ratios. We found, for example, that Walmart, with a five-year average pay gap of 1,091 to 1, would have owed as much as $929 million in extra federal taxes in 2024 if this legislation had been in effect.

Amazon, with an even wider gap of 1,995 to 1 and higher profits, would’ve owed as much as an additional $3.1 billion last year.

Home Depot would have owed as much as $725 million more in 2024 taxes under this legislation. Like most of these companies, the home improvement giant can’t claim to be short on cash. Over the past six years, they’ve blown nearly $38 billion on stock buybacks, a maneuver that artificially inflates a CEO’s stock-based pay. With the money the firm spent on stock buybacks, Home Depot could’ve given every one of their 470,100 employees six annual $13,423 bonuses.

Sen. Sanders pointed out that if Elon Musk receives the full $975 billion compensation package that Tesla’s board has proposed, Tesla could owe up to $100 billion more in taxes over the next decade under this legislation.

“The Pope is exactly right,” wrote Sanders in a social media post. “No society can survive when one man becomes a trillionaire while the vast majority struggle to just survive—trying to put food on the table, pay rent, and afford healthcare. We can and must do better.”

“Working people are sick and tired of corporate greed,” Rep. Tlaib added in a press release. “It’s disgraceful that corporations continue to rake in record profits by exploiting the labor of their workers. Every worker deserves a living wage and human dignity on the job.”

Additional original co-sponsors of the Tax Excessive CEO Pay Act include: Sens. Elizabeth Warren (D-Mass.), Chris Van Hollen (D-Md.), Peter Welch (D-Vt.), Ed Markey (D-Mass.), and 22 members of the House of Representatives.

Polling suggests that Americans across the political spectrum would support the bill. One 2024 survey, for instance, found that 80% of likely voters favor a tax hike on corporations that pay their CEOs more than 50 times more than what they pay their median employees. Large majorities in every political group gave the idea the thumbs up, including 89% of Democrats, 77% of Independents, and 71% of Republicans.

In these hyperpolarized times, Americans of diverse backgrounds, faiths, and political perspectives seem to share enormous common ground on at least one problem facing our nation: the extreme economic divides within our country’s largest corporations.

"At a time of record-breaking income and wealth inequality, we must demand that the wealthiest people and most profitable corporations in America finally pay their fair share of taxes," said Sen. Bernie Sanders.

With the world's richest person, Tesla CEO and Republican megadonor Elon Musk, on the cusp of becoming the first trillionaire on the planet, two leading progressive lawmakers are calling on Congress to pass a bill to "rein in the obscene salaries of America's top executives."

Sen. Bernie Sanders (I-Vt.) and Rep. Rashida Tlaib (D-Mich.) on Monday introduced the Tax Excessive CEO Pay Act with the aim of raising taxes on companies that pay their executives more than 50 times their workers' wages.

The legislation would impose penalties starting at 0.5 percentage points for companies with CEO-to-worker pay ratios between 50-to-1 and 100-to-1. Firms where executives make more than 500 times their workers' pay would be forced to pay the highest rate.

The bill would also require the US Treasury Department to crack down on tax avoidance, including schemes that disguise pay disparities by outsourcing jobs to contractors.

Sanders said that exorbitant CEO pay and massive pay gaps at corporations are intolerable "while 60% of Americans live paycheck to paycheck and millions work longer hours for lower wages."

"It is unacceptable that the CEOs of the largest low-wage corporations make more than 630 times what their average workers make," said the senator, who has been criss-crossing the country this year with his Fighting Oligarchy Tour, galvanizing people in red and blue districts against wealth inequality, political corruption, and corporate power.

"This is not only morally obscene, but also insane economic policy," said Sanders. "At a time of record-breaking income and wealth inequality, we must demand that the wealthiest people and most profitable corporations in America finally pay their fair share of taxes and treat all employees with the respect and dignity they deserve. That’s precisely what this legislation begins to do."

The proposal would raise an estimated $150 billion over a decade if tech giants, Wall Street firms, and other large corporations continue their current compensation patterns, and Sanders and Tlaib noted that the largest companies in the US would have paid billions of dollars more in taxes last year had the legislation been in effect.

JPMorgan Chase would have paid $2.38 billion in taxes, while Google would have paid $2.16 billion and Walmart would have paid $929 million.

With 62% of Republican voters and 75% of Democrats supporting a cap on CEO pay relative to worker salaries, the legislation would likely be well received by Americans across the political spectrum—but Republican lawmakers have shown little to no interest in confronting the pay gap, ensuring fair wages for workers, or reining in excessive executive compensation.

With the current CEO-employee pay gap, CEOs at the 350 largest publicly owned firms make 290 times more than the average pay of a typical worker at their companies, with the gap much larger at some corporations.

The median Walmart worker made $29,469 in 2024, while CEO Doug McMillon took home $27.4 million—a 930-to-1 gap.

The median Starbucks worker would have to work for more than 6,000 years to earn the pay CEO Brian Niccol took home in 2024.

"Working people are sick and tired of corporate greed," said Tlaib. “It’s disgraceful that corporations continue to rake in record profits by exploiting the labor of their workers. Every worker deserves a living wage and human dignity on the job."

"It’s time," she added, "to make the rich pay their fair share.”

Tlaib and Sanders introduced the legislation as Pope Leo spoke out against exorbitant CEO pay in his first interview since taking the helm of the Catholic Church, reserving particular condemnation for Musk, for whom the Tesla board proposed a $1 trillion pay package if he grows the company by eightfold over the next decade.

“CEOs that 60 years ago might have been making four to six times more than what the workers are receiving... it’s [now] 600 times more than the average workers are receiving,” the pope told the Catholic outlet Crux.

“Yesterday, the news that Elon Musk is going to be the first trillionaire in the world: What does that mean and what’s that about?" he added. "If that is the only thing that has value anymore, then we’re in big trouble.”

Sanders said Monday that the pope "is exactly right."

"No society can survive when one man becomes a trillionaire while the vast majority struggle to just survive—trying to put food on the table, pay rent, and afford healthcare," said Sanders. "We can and must do better."

The report found that seven of America's biggest healthcare companies have collectively dodged $34 billion in taxes as a result of Trump's 2017 tax law while making patient care worse.

President Donald Trump's tax policies have allowed the healthcare industry to rake in "sick profits" by avoiding tens of billions of dollars in taxes and lowering the quality of care for patients, according to a report out Wednesday.

The report, by the advocacy groups Americans for Tax Fairness and Community Catalyst, found that "seven of America's biggest healthcare corporations have dodged over $34 billion in collective taxes since the enactment of the 2017 Trump-GOP tax law that Republicans recently succeeded in extending."

The study examined four health insurance companies—Centene, Cigna, Elevance (formerly Anthem), and Humana; two for-profit hospital chains—HCA Holdings and Universal Health Services; and the CVS Healthcare pharmacy conglomerate.

It found that these companies' average profits increased by 75%, from around $21 billion before the tax bill to about $35 billion afterward, and yet their federal tax rate was about the same.

This was primarily due to the 2017 law's slashing of the corporate tax rate from 35% to 21%, a change that was cheered on by the healthcare industry and continued with this year's GOP tax legislation. The legislation also loosened many tax loopholes and made it easier to move profits to offshore tax shelters.

The report found that Cigna, for instance, saved an estimated $181 million in taxes on the $2.5 billion it held in offshore accounts before the law took effect.

The law's supporters, including those in the healthcare industry, argued that lowering corporate taxes would allow companies to increase wages and provide better services to patients. But the report found that "healthcare corporations failed to use their tax savings to lower costs for customers or meaningfully boost worker pay."

Instead, they used those windfalls primarily to increase shareholder payouts through stock buybacks and dividends and to give fat bonuses to their top executives.

Stock buybacks increased by 42% after the law passed, with Centene purchasing an astonishing average of 20 times more of its own shares in the years following its enactment than in the years before. During the first seven years of the law, dividends for shareholders increased by 133% to an average of $5.6 billion.

Pay for the seven companies' half-dozen top executives increased by a combined $100 million, 42%, on average. This is compared to the $14,000 pay increase that the average employee at these companies received over the same period, which is a much more modest increase of 24%.

And contrary to claims that lower taxes would allow companies to improve coverage or patient care, the opposite has occurred.

While data is scarce, the rate of denied insurance claims is believed to have risen since the law went into effect.

The four major insurers' Medicare Advantage plans were found to frequently deny claims improperly. In the case of Centene, 93% of its denials for prior authorizations were overturned once patients appealed them, which indicates that they may have been improper. The others were not much better: 86% of Cigna's denials were overturned, along with 71% for Elevance/Anthem, and 65% for Humana.

The report said that such high rates of denials being overturned raise "questions about whether Medicare Advantage plans are complying with their coverage obligations or just reflexively saying 'no' in the hopes there will be no appeal."

Salespeople for the Cigna-owned company EviCore, which insurers hire to review claims, have even boasted that they help companies reduce their costs by increasing denials by 15%, part of a model that ProPublica has called the "denials for dollars business." Their investigation in 2024 found that insurers have used EviCore to evaluate whether to pay for coverage for over 100 million people.

And while paying tens of millions to their executives, both HCA and Universal Health Services—which each saved around $5.5 billion from Trump's tax law—have been repeatedly accused of overbilling patients while treating them in horrendous conditions.

"Congress should demand both more in tax revenue and better patient care from these highly profitable corporations," Americans for Tax Fairness said in a statement. "Healthcare corporation profitability should not come before quality of patient care. In healthcare, more than almost any other industry, the search for ever higher earnings threatens the wellbeing and lives of the American people."