SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

"We always have had to take matters into our own hands, and we have protected ourselves against enormous companies," one local campaigner said.

Louisiana advocates and their allies are not giving up in their fight to stop the liquefied natural gas buildout that threatens the health and well-being of Gulf Coast communities—not to mention the stability of the global climate—even as the Trump administration doubles down on its commitment to expanding LNG infrastructure.

In a briefing on Tuesday, community members, local advocates, and international campaigners shared how they would continue to push back against Venture Global, an LNG company that has amassed a record of ecosystem destruction and air pollution violations at its currently operating Calcasieu Pass export terminal in Cameron Parish, Louisiana. Despite this, the Trump administration's Department of Energy granted conditional approval for the company’s nearby Calcasieu Pass 2 (CP2), undoing the pause that the outgoing Biden administration had placed on it and other LNG approvals as it considered the public interest ramifications of LNG exports.

Yet Gulf Coast campaigners, who are used to dealing with a lax regulatory environment at the state level, were not defeated.

"Anybody who reports here in Louisiana regularly understands that we've never been protected by our regulatory environment. Never," Anne Rolfes, who directs the Louisiana Bucket Brigade, told reporters. "And so we always have had to take matters into our own hands, and we have protected ourselves against enormous companies."

One key strategy that the Louisiana Bucket Brigade and others have used to get around the regulatory rubber stamping of bad actors is to raise public awareness of how the companies turning coastal Louisiana into a sacrifice zone really operate.

Case in point is Venture Global. Rolfe and John Allaire—a 40-year veteran of the oil and gas industry who lives next door to the Calcasieu Pass terminal—laid out its short but extensive record of environmental violations and unethical business practices.

Even before the original Calcasieu Pass began exporting, in January 2022, it had to clear a space for tankers to access the facility.

"It's understood that this is a volatile fuel to lock into, that you don't want to rely on a fuel that Vladimir Putin and Donald Trump control."

"They pumped hundreds of thousands of cubic yards of black viscous sludge from their marine berth out into the front of the Gulf of Mexico," Allaire said. "And that was the first indication of what was to come with Venture Global."

Since it began operating, the company has added air, noise, and light pollution to the water pollution that has devastated local fisheries.

Allaire has taken hundreds of videos and photos of flaring incidents.

"The light pollution is unbelievable," he said. "At night, I can literally read a book when the flares are going, and I'm over a mile away from their flare stacks."

Allaire's observations are backed up by the official record. In June 2023, the Louisiana Department of Environmental Quality sent Venture Global a compliance order detailing over 2,000 air permit violations from its first 10 months of operation, Allaire said. The company has yet to resolve the complaint, and the state sent them a warning letter in March covering their 2024 and 2025 rule-breaking.

The company also has a history of failing to report its flares and other excess emissions to the Department of Environmental Quality as required by the Clean Air Act.

If they reported and then investigated their violations, "that would enable them to really understand what's happening at their facility so that they could prevent future problems," Rolfe said. "They absolutely aren't doing that."

In March, the Louisiana Bucket Brigade and the Habitat Recovery Project notified Venture Global of intent to sue the company over Clean Air Act violations at its Calcasieu Pass facility.

But the environmental groups aren't the only ones suing Venture Global. The company stretched its commissioning phase—during which it is considered still in the process of establishing itself and can sell its products to the highest bidder rather than honoring its contracts—for three years and three months, beginning normal operations just this April.

"This is absolutely off from the industry norm," Rolfe said.

Now, other major fossil fuel companies, including Shell and BP, are pursuing arbitration claims against Venture Global for breach of contract. Investors have joined a class-action lawsuit against it, saying it violated federal securities law by misrepresenting its prospects.

Yet Venture Global has huge ambitions for the region. In addition to Calcasieu Pass and CP2, it wants to build three other export terminals in coastal Louisiana and more than triple its capacity from 30 million tons per annum (MTPA) of liquid gas—already over a quarter of the 88 MTPA exported by the U.S. exports in 2024—to 104 MTPA.

"As a review, they're flouting the Clean Air Act. They've manipulated the commissioning phase. They're being sued by everybody they've done business with. Is this a company that our country and our state should put such faith in?" Rolfe asked.

She answered her own question: "Of course, our answer is no."

Another strategy the Louisiana Bucket Brigade and their allies seek to employ is to delay Venture Global's ambitions long enough for the economic reality of the LNG boom to catch up with it.

In addition to the approval of CP2, Australian company Woodside announced on Monday that it had approved a Louisiana LNG project worth $17.5 billion. Yet the Institute for Energy Economics and Financial Analysis concluded in April that the massive growth in LNG capacity would exceed dwindling demand within two years.

"It's understood that this is a volatile fuel to lock into, that you don't want to rely on a fuel that Vladimir Putin and Donald Trump control. So people are trying to get off of gas," Rolfe said.

"The economics are going to catch up with them. I just want it to be before they destroy the coast of Louisiana."

This means that LNG companies like Woodside and Venture Global are behaving "like a kid in a candy store," Rolfe continued. "That kid, unchecked, will eat so much, they'll throw up. I think the same is true with this industry. Unchecked, it will do itself harm."

The key is therefore to stall the buildout long enough that many projects become infeasible. This tactic has worked for frontline communities during the first Trump administration, Rolfe said. Through a combination of public pressure, records requests, and legal action, community advocates were able to delay the construction of a plastic plant proposed by the Chinese company Wanhua Chemical U.S. Operation, LLC, which would have released the World War 1-era nerve gas phosgene into the already pollution-burdened St. James Parish.

The economic outlook for the plant had always been "dubious" Rolfe said, and eventually the company gave up on trying to build it.

"They could have gotten approval and gotten on their way within a month. But our suit and then our constant presence and making them table things and so forth, drew it out and let the economics catch up with them," Rolfe said.

Rolfe added that the gas industry has similarly gotten ahead of itself.

"They're greedy, right? They want to grab all the candy they can, and the economics are going to catch up with them. I just want it to be before they destroy the coast of Louisiana."

Another strategy to slow down the building of new LNG facilities like CP2 is to target the one thing, in addition to permits and funds, that they can't move forward without: insurance.

Insurance is one sector in which the economic impact of the climate crisis is already being felt, as Ethan Nuss, senior energy finance campaigner at Rainforest Action Network, explained.

For example, major insurer Chubb earns $1.5 billion a year in premiums from the fossil fuel industry, which was already canceled out early this year with the $1.5 billion in pre-tax losses they took from the Los Angeles wildfires. On a local level, some insurers have pulled out of Louisiana all together to avoid insuring against climate-fueled extreme weather events.

"Once they are really educated about the permit violations and the legal risks and the true risk landscape that they're facing by taking on this client, many of them are very concerned."

"This is not a time to build something like CP2 that would deepen the climate crisis," Nuss said.

Because insurers are on the books for both fossil fuel projects and the damage for climate disasters, and because many of them have climate and human rights policies, they are vulnerable to growing pressure from the climate movement to drop the oil and gas clients costing them so much money.

RAN in February published the names of the major insurers for Venture Global's Calcasieu Pass, which it obtained via a Freedom of Information Act request. These included Chubb subsidiary ACE American Insurance Company, AIG subsidiary National Union Fire Insurance Co., Allianz, Swiss Re, AXA, and Tokio Marine subsidiary Houston Casualty Company.

"That has kicked off a global effort to reach out to those insurers and begin to educate them about what is happening in Southwest Louisiana, the impacts from Calcasieu Pass, and what associated risks they're facing," Nuss said.

As a result of these efforts, Swiss Re has agreed to meet with the fishing community of Southwest Louisiana, to talk about the "devastating impacts on their livelihoods" from Calcasieu Pass' operations.

"Often with these global financial institutions, they aren't fully aware of what's really happening on the ground. That client is maybe just another line on the spreadsheet. But once they really start hearing the stories, once they are really educated about the permit violations and the legal risks and the true risk landscape that they're facing by taking on this client, many of them are very concerned," Nuss said.

Nuss hopes that, once fully informed, insurers would decide any project of Venture Global's is a "very risky business that they don't want to be involved in."

Insurance companies contribute to the climate crisis through their financial choices, and then expect frontline communities to foot the bill. This must stop.

The Los Angeles area began this year with some of the worst wildfires in its history. Dozens of people were killed and 200,000 were displaced. About 40,000 acres and 12,300 structures, including houses, were burned. The city endured immense emotional and physical damage. Yet, many property owners in the city find themselves with little recourse for financial compensation.

In fact, over the past five years, insurance companies like State Farm, Farmers, Chubb, Liberty Mutual, and Allstate have all refused to renew policies for innumerable homeowners in the Los Angeles area, leaving residents without adequate protection for their homes. By July of 2024, State Farm alone had dropped 1,600 clients residing in the Pacific Palisades ZIP code, where damage from the fires would be some of the worst. Soaring home insurance prices have also forced lower- and middle-income residents to make the impossible decision of refusing insurance for their homes. In the wake of the most recent fires, many are not only left devastated by the destruction of their homes and the uprooting of their lives, but they are also financially stranded in the disaster’s aftermath.

All of these horrible consequences stem from a simple rule that defines much of the home insurance industry’s dealings with the public: Increased risk means increased prices. In more disaster-prone areas, the likelihood of insurance companies having to compensate homeowners is heightened by the prevalence of destructive events, and insurance companies raise premiums to remain profitable and to ensure their financial ability to cover future losses or drop clients altogether. For instance, knowing that California is highly prone to destructive wildfires, insurance companies will deny housing coverage for people in high-risk forest fire areas to avoid paying the high cost of rebuilding thousands of homes should one occur.

As climate organizers encounter a federal government unfriendly to systemic change but have made decent strides in their work with financial institutions, it is clear that targeting the private sector is imperative at this moment.

Rising insurance prices are not isolated to one region, though. Communities across the country from Kentucky to Florida to New York are now facing the brunt end of this crisis. When hurricane Ida hit New York in 2021, damages cost one woman up to $25,000 dollars out of pocket for repairs because Liberty Mutual outright rejected them coverage. This disproportionately affects low-income communities, who will face even more struggle trying to afford to pay for damages that should have been covered by their housing insurance in the first place.

Even considering the fact that the burden often falls on people purchasing insurance for their homes, increased and intensified natural disasters fundamentally have an adverse financial effect on insurance companies by making their services more expensive, which is also often accompanied by reduced coverage. Therefore, you would think that they would address the root cause of this increase in destruction—climate change.

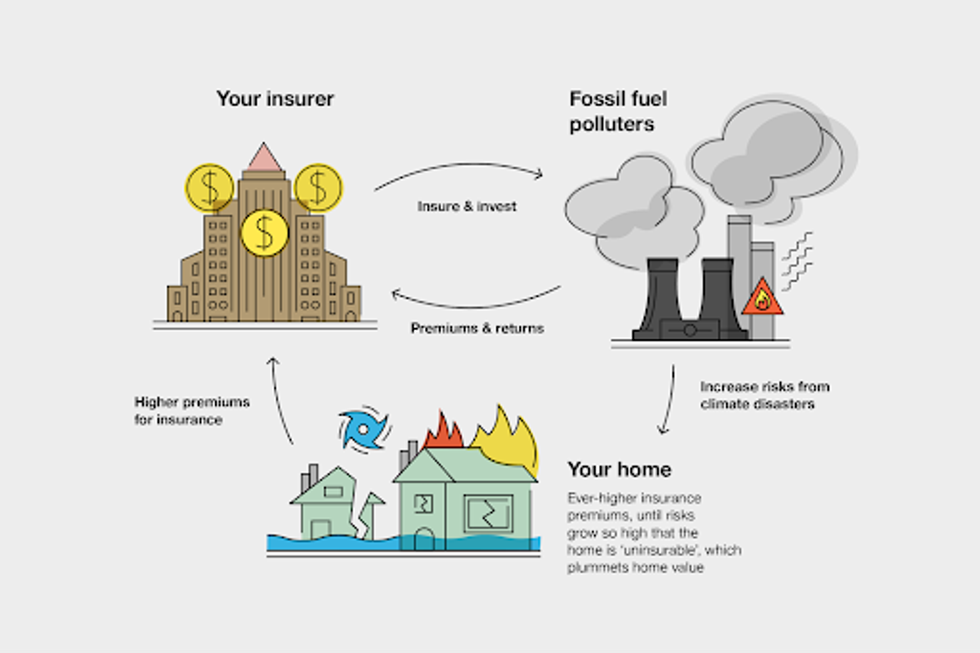

But, many don’t. Everyday, insurance companies like Chubb, Liberty Mutual, and AIG practice hypocrisy, creating a perpetual cycle that expedites climate destruction and inequality. This is accomplished through the underwriting of fossil fuel projects, which is often cheaper for these companies because it allows them to invest and insure something deemed less “risky” that, in the short-term, will make the company more money. Insurance companies continue to underwrite pipelines for transporting fossil fuels and liquefied natural gas (LNG) infrastructure that is often built nearby vulnerable communities. The domestic insurance industry has also invested $582 billion of assets collected through client’s premiums into the fossil fuel industry. Still, climate change, caused by the emission of those exact fossil fuels into the Earth’s atmosphere, further exacerbates and increases the frequency of the (not so) natural disasters that drive up insurance prices. Essentially, these companies contribute to the climate crisis through their financial choices, and then expect frontline communities to foot the bill.

The insurance industry is one of the key pillars of our society’s reliance on fossil fuels alongside the financial institutions that bankroll it and the government agencies that sign off on its expansion. When insurance companies provide coverage for fossil fuel extraction projects, they provide insurance so that in the case of a disaster like a spill or explosion, the extraction project is protected. Without insurance coverage, corporations simply cannot continue building the infrastructure that keeps us hooked on fossil fuels. For example, last year, when Chubb dropped the coverage from the Rio Grande LNG project, AIG stepped right in as an insurer on the initiative. As climate organizers encounter a federal government unfriendly to systemic change but have made decent strides in their work with financial institutions, it is clear that targeting the private sector is imperative at this moment.

Insurance companies, especially, know the risks of climate change and are vulnerable to its effects. A report by the asset manager Conning shows that 91% of insurance executives profess “significant” concern about the climate crisis. This makes efforts to persuade insurance companies on matters of climate particularly salient and realistic during these times—especially when the public wants change. According to one study, 78% of U.S. voters are at least somewhat concerned about rising property insurance costs and 67% percent are concerned about extreme weather events. Most importantly, the vast majority of the population surveyed said that insurance executives are to blame for the aforementioned rising costs and 57% said that these costs should not be passed on to customers.

Although older generations also suffer the difficulties of accessing reliable insurance and figuring out how to pick up their lives after devastating climate disasters, Gen Z is uniquely forced to come of age without the financial expectations and infrastructure that were promised to us as part of the American economic system. Affordable mortgages and insurers that will actually cover us and provide reliable and ethical insurance now seem near-impossible to access for young people, knowing the state of our climate. This has particularly impacted Gen Z because we have grown up in a time where climate disasters are stronger, more frequent, and now something of a regular occurrence. In response to these climate events becoming normal, companies will continue to increasingly deny us housing coverage and proper insurance in hopes of saving money. This calls youth across the country to take action against the hypocrisy of these companies, calling for sustainable insurance that does not fund the fossil fuel industry.

The shift to a fossil fuel-free insurance industry will not be easy, but it is now, more than ever, a necessary step toward ensuring the common good. It is, in fact, the only ethical option on behalf of corporations that are meant to protect people’s livelihoods. As youth, we demand immediate action from the individuals and corporations in power, and to those who refuse to listen to us, we have one question: Who do you expect to pay your premiums in 50 years?

If humanity stays on current course, warns top insurer, the "financial sector as we know it ceases to function. And with it, capitalism as we know it ceases to be viable."

A veteran financial consultant and insurance executive is warning his fellow capitalists that their commitment to profits and market supremacy is endangering the economic system to which they adhere and that if corrective actions are not taken capitalism itself will soon be consumed by the financial and social costs of a planet being cooked by the burning of fossil fuels.

According to GüntherThallinger, a former top executive at Germany's branch of the consulting giant McKinsey & Company and currently a board member of Allianz SE, one of the largest insurance companies in the world, the climate crisis is on a path to destroy capitalism as we know it.

"We are fast approaching temperature levels—1.5C, 2C, 3C—where insurers will no longer be able to offer coverage for many" of the risks associated with the climate crisis, Thallinger writes in a recent post highlighted Thursday by The Guardian.

"Meanwhile in the real world—a capitalist declares that capitalism is no longer sustainable..."

With "entire regions becoming uninsurable," he continues, the soaring costs of rebuilding and the insecurity of investments "threaten the very foundation of the financial sector," which he describes as " a climate-induced credit crunch" that will reverberate across national economies and globally.

"This applies not only to housing, but to infrastructure, transportation, agriculture, and industry," he warns. "The economic value of entire regions—coastal, arid, wildfire-prone—will begin to vanish from financial ledgers. Markets will reprice rapidly and brutally. This is what a climate-driven market failure looks like."

Commenting on the Guardian's coverage of Thallinger's declaration, Dan Taylor, a senior lecturer in social and political thought at the Open University, said, "Meanwhile in the real world—a capitalist declares that capitalism is no longer sustainable..."

While climate scientists, experts, and activists for decades have issued warning after warning of the threats posed by the burning of coal, oil, and gas and humanity's consumption of products derived from fossil fuels, the insurance industry has been the arm of capitalism most attuned to the lurking dangers.

"Here go the radical leftist insurance companies again," said David Abernathy, professor of global studies at Warren Wilson College, in a caustic response to Thallinger's latest warnings.

Despite their understanding of the threat, however, the world's insurers have primarily aimed to have it both ways, participating in the carnage by continuing to insure fossil fuel projects and underwriting expansion of the industry while increasingly attempting to offset their exposure to financial losses by changing policy agreements and lobbying governments for ever-increasing protections and preferable regulatory conditions.

In the post, self-published to LinkedIn last week, Thallinger—who has over many years lobbied for a more sustainable form of capitalism and led calls for a net-zero framework for corporations and industries—warned of the growing stress put on the insurance market worldwide by extreme weather events—including storms, floods, and fires—that ultimately will undermine the ability of markets to function or governments to keep pace with the costs:

There is no way to "adapt" to temperatures beyond human tolerance. There is limited adaptation to megafires, other than not building near forests. Whole cities built on flood plains cannot simply pick up and move uphill. And as temperatures continue to rise, adaptation itself becomes economically unviable.

Once we reach 3°C of warming, the situation locks in. Atmospheric energy at this level will persist for 100+ years due to carbon cycle inertia and the absence of scalable industrial carbon removal technologies. There is no known pathway to return to pre-2°C conditions. (See: IPCC AR6, 2023; NASA Earth Observatory: "The Long-Term Warming Commitment")

At that point, risk cannot be transferred (no insurance), risk cannot be absorbed (no public capacity), and risk cannot be adapted to (physical limits exceeded). That means no more mortgages, no new real estate development, no long-term investment, no financial stability. The financial sector as we know it ceases to function. And with it, capitalism as we know it ceases to be viable.

In an interview earlier this year, Thallinger explained that failure to act on the crisis of a rapidly warming planet is not just perilous for humanity and natural systems but doesn't make sense from an economic standpoint.

"The cost of inaction is higher than the cost of transformation and adaptation," Thallinger said in February. "Extreme heat, storms, wildfires, floods, and billions in economic damage occur each year. In 2024, insured natural catastrophe losses surpassed $140 billion, marking the fifth straight year above $100 billion."

"Transitioning to a net-zero economy is not just about sustainability," he continued, "it is a financial and operational necessity to avoid a future where climate shocks outpace our ability to recover, straining governments, businesses, and households. Without decisive action, we risk crossing a threshold where adaptation is no longer possible, and the costs—human and financial—become unimaginable."

Thallinger's solution to the crisis is not to subvert the capitalist system by transitioning the world to an economic system based on shared resources, communal ownership, or a more enlightened egalitarian response. Instead, he proposes that a "reformed" capitalism is the solution, writing, "Capitalism must now solve this existential threat."

Calling for a reduction of emissions and a rapid scale-up of green energy technologies is the path forward, he argues, asking readers to understand "this is not about saving the planet," but rather "saving the conditions under which markets, finance, and civilization itself can continue to operate."

This disconnect was not lost on astute observers, including Antía Casted, a senior researcher at the Sir Michael Marmot Institute of Health Equity, who suggested concern over Thallinger's prescription.

"It would be fine if [the climate crisis] destroyed civilization and maintained capitalism," Casted noted. "They just need to find a way for capitalism to work without people."