SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Insurance companies contribute to the climate crisis through their financial choices, and then expect frontline communities to foot the bill. This must stop.

The Los Angeles area began this year with some of the worst wildfires in its history. Dozens of people were killed and 200,000 were displaced. About 40,000 acres and 12,300 structures, including houses, were burned. The city endured immense emotional and physical damage. Yet, many property owners in the city find themselves with little recourse for financial compensation.

In fact, over the past five years, insurance companies like State Farm, Farmers, Chubb, Liberty Mutual, and Allstate have all refused to renew policies for innumerable homeowners in the Los Angeles area, leaving residents without adequate protection for their homes. By July of 2024, State Farm alone had dropped 1,600 clients residing in the Pacific Palisades ZIP code, where damage from the fires would be some of the worst. Soaring home insurance prices have also forced lower- and middle-income residents to make the impossible decision of refusing insurance for their homes. In the wake of the most recent fires, many are not only left devastated by the destruction of their homes and the uprooting of their lives, but they are also financially stranded in the disaster’s aftermath.

All of these horrible consequences stem from a simple rule that defines much of the home insurance industry’s dealings with the public: Increased risk means increased prices. In more disaster-prone areas, the likelihood of insurance companies having to compensate homeowners is heightened by the prevalence of destructive events, and insurance companies raise premiums to remain profitable and to ensure their financial ability to cover future losses or drop clients altogether. For instance, knowing that California is highly prone to destructive wildfires, insurance companies will deny housing coverage for people in high-risk forest fire areas to avoid paying the high cost of rebuilding thousands of homes should one occur.

As climate organizers encounter a federal government unfriendly to systemic change but have made decent strides in their work with financial institutions, it is clear that targeting the private sector is imperative at this moment.

Rising insurance prices are not isolated to one region, though. Communities across the country from Kentucky to Florida to New York are now facing the brunt end of this crisis. When hurricane Ida hit New York in 2021, damages cost one woman up to $25,000 dollars out of pocket for repairs because Liberty Mutual outright rejected them coverage. This disproportionately affects low-income communities, who will face even more struggle trying to afford to pay for damages that should have been covered by their housing insurance in the first place.

Even considering the fact that the burden often falls on people purchasing insurance for their homes, increased and intensified natural disasters fundamentally have an adverse financial effect on insurance companies by making their services more expensive, which is also often accompanied by reduced coverage. Therefore, you would think that they would address the root cause of this increase in destruction—climate change.

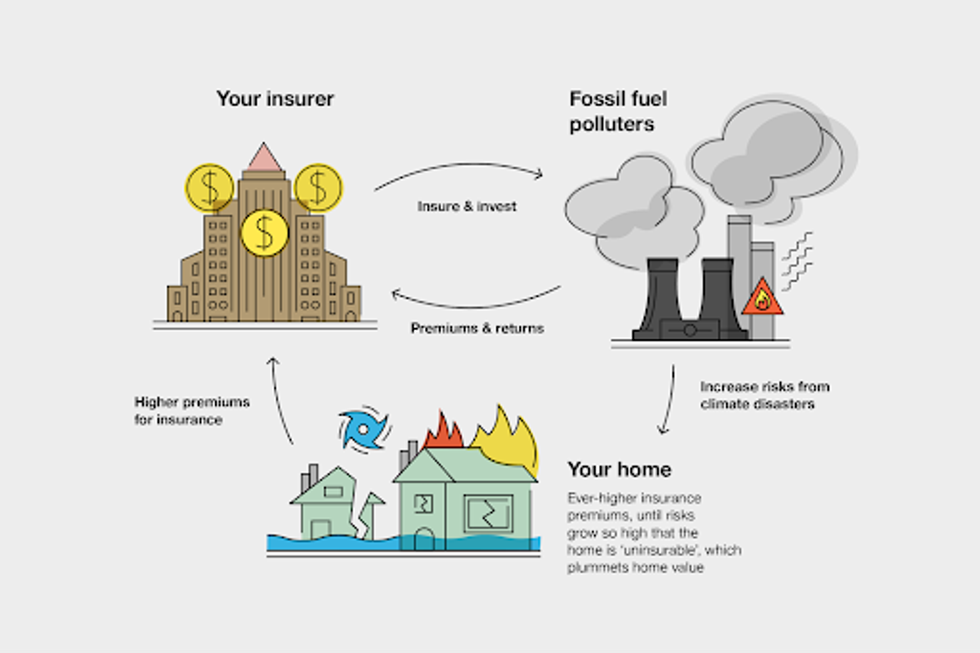

But, many don’t. Everyday, insurance companies like Chubb, Liberty Mutual, and AIG practice hypocrisy, creating a perpetual cycle that expedites climate destruction and inequality. This is accomplished through the underwriting of fossil fuel projects, which is often cheaper for these companies because it allows them to invest and insure something deemed less “risky” that, in the short-term, will make the company more money. Insurance companies continue to underwrite pipelines for transporting fossil fuels and liquefied natural gas (LNG) infrastructure that is often built nearby vulnerable communities. The domestic insurance industry has also invested $582 billion of assets collected through client’s premiums into the fossil fuel industry. Still, climate change, caused by the emission of those exact fossil fuels into the Earth’s atmosphere, further exacerbates and increases the frequency of the (not so) natural disasters that drive up insurance prices. Essentially, these companies contribute to the climate crisis through their financial choices, and then expect frontline communities to foot the bill.

The insurance industry is one of the key pillars of our society’s reliance on fossil fuels alongside the financial institutions that bankroll it and the government agencies that sign off on its expansion. When insurance companies provide coverage for fossil fuel extraction projects, they provide insurance so that in the case of a disaster like a spill or explosion, the extraction project is protected. Without insurance coverage, corporations simply cannot continue building the infrastructure that keeps us hooked on fossil fuels. For example, last year, when Chubb dropped the coverage from the Rio Grande LNG project, AIG stepped right in as an insurer on the initiative. As climate organizers encounter a federal government unfriendly to systemic change but have made decent strides in their work with financial institutions, it is clear that targeting the private sector is imperative at this moment.

Insurance companies, especially, know the risks of climate change and are vulnerable to its effects. A report by the asset manager Conning shows that 91% of insurance executives profess “significant” concern about the climate crisis. This makes efforts to persuade insurance companies on matters of climate particularly salient and realistic during these times—especially when the public wants change. According to one study, 78% of U.S. voters are at least somewhat concerned about rising property insurance costs and 67% percent are concerned about extreme weather events. Most importantly, the vast majority of the population surveyed said that insurance executives are to blame for the aforementioned rising costs and 57% said that these costs should not be passed on to customers.

Although older generations also suffer the difficulties of accessing reliable insurance and figuring out how to pick up their lives after devastating climate disasters, Gen Z is uniquely forced to come of age without the financial expectations and infrastructure that were promised to us as part of the American economic system. Affordable mortgages and insurers that will actually cover us and provide reliable and ethical insurance now seem near-impossible to access for young people, knowing the state of our climate. This has particularly impacted Gen Z because we have grown up in a time where climate disasters are stronger, more frequent, and now something of a regular occurrence. In response to these climate events becoming normal, companies will continue to increasingly deny us housing coverage and proper insurance in hopes of saving money. This calls youth across the country to take action against the hypocrisy of these companies, calling for sustainable insurance that does not fund the fossil fuel industry.

The shift to a fossil fuel-free insurance industry will not be easy, but it is now, more than ever, a necessary step toward ensuring the common good. It is, in fact, the only ethical option on behalf of corporations that are meant to protect people’s livelihoods. As youth, we demand immediate action from the individuals and corporations in power, and to those who refuse to listen to us, we have one question: Who do you expect to pay your premiums in 50 years?

More than half of all Major League Baseball teams are sponsored by companies that are exacerbating the climate emergency and the financial institutions that support them.

Millions of Americans were buoyed by the return of Major League Baseball (MLB) this spring. For the 50% of adults who follow the sport, it can serve as a welcome distraction given the dire news coming out of Washington these days.

But political reality can intrude even on the national pastime. It turns out that at least 17 of the 30 MLB teams are sponsored by companies that are exacerbating the climate crisis and the financial institutions that support them.

It’s called sportswashing, a riff on the term greenwashing. Companies sponsor leagues and teams to present themselves as good corporate citizens, increase visibility, and build public trust. According to a 2021 Nielsen study, 81% of fans completely or somewhat trust companies that underwrite sport teams, second only to the trust they have for friends and family. By sponsoring a team, companies increase the chance that fans will form the same bond with their brand that they have with the team.

Baseball club owners are much more concerned about their bottom line than their sponsors’ climate impacts.

Baseball teams are not alone in their pursuit of petrodollars. At least 35 U.S. pro basketball, football, hockey, and soccer teams have similar sponsorship deals that afford companies a range of promotional perks, from billboards and jersey logos to community outreach projects and facility naming rights, according to a survey conducted last fall by UCLA’s Emmett Institute on Climate Change and the Environment. U.S. sports leagues and teams also partner with banks and insurance companies that invest billions of dollars annually in coal, oil, and gas companies, all to the detriment of public health and the environment.

Most baseball aficionados are likely unaware that their favorite team is going to bat for the very companies and banks that are destroying the climate, but a growing number of fans in New York and Los Angeles are calling out the Mets and Dodgers, demanding that they sever their ties to the fossil fuel industry. And once they know, will fans in other MLB cities remain on the sidelines?

Oil, gas, and coal are largely responsible for the carbon pollution driving up world temperatures and triggering more dangerous extreme weather events. Last year was yet another record hot year, and the last 10 years have been the hottest in nearly 200 years of recordkeeping, according to the World Meteorological Organization. Those warmer temperatures certainly played a role in producing the 27 weather and climate disasters in the United States last year that caused at least $1 billion in damages, one less than the record set in 2023. And just this week, violent storms and tornadoes ripped through a swath of the nation’s midsection in what The Associated Presssaid could be a “record-setting period of deadly weather and flooding.”

Regardless, baseball club owners are much more concerned about their bottom line than their sponsors’ climate impacts. But with today’s annual MBL payrolls averaging $157 million, it is not hard to understand why teams pursue corporate sponsorships.

The team with the highest payroll—the Los Angeles Dodgers at $321 million—has a longtime partnership with Phillips 66, owner of 76 gas stations, whose orange-and-blue logo hovers above both Dodger stadium scoreboards and is scattered throughout the facility. Phillips 66, which also sponsors the St. Louis Cardinals, is among the top 10 U.S. air and surface water polluters in total pounds, according to the 2024 edition of Political Economy Research Institute’s “Top 100 Polluter Indexes,” and the 14th-largest carbon polluter, emitting 30.2 million metric tons in 2022.

Arco, owned by Marathon Petroleum, also advertises in Dodger Stadium. The country’s largest oil refiner with more than 7,000 Marathon and Arco gas stations nationwide, Marathon Petroleum is among the top 20 air, surface water, and carbon polluters in the country, according to PERI’s 2024 report, and the company and its subsidiaries have been fined more than $900 million for federal environmental violations since 2014.

The Findlay, Ohio-based company has been one of the Cleveland Guardians’ major corporate sponsors since 2021, and the team has been wearing Marathon Petroleum’s logo on their sleeves since the summer of 2023. The logo also enjoys prime placement in the Guardians’ ballpark and, as part of the uniform patch agreement, it is featured on the souvenir jerseys given to fans on two game days every season through 2026.

The Guardians are not the only team that has inked an oil patch deal. The Houston Astros (Oxy), Kansas City Royals (QuikTrip gas stations), and Texas Rangers (Energy Transfer) also display oil industry logos on their sleeves.

Both Oxy—Occidental Petroleum’s nickname—and the Astros’ other oil industry sponsor, ConocoPhillips, are headquartered in Houston, home to more than 400 oil and petrochemical facilities and among the 10 worst places in the country for air pollution. Occidental is one of the top 30 U.S. air polluters, 40 surface water polluters, and 60 carbon emitters, releasing 10.5 million metric tons of heat-trapping gases in 2022, according to PERI’s 2024 report. ConocoPhillips, meanwhile, came in 88th in PERI’s top 100 carbon polluters list.

Fossil fuel-based utilities also partner with MLB teams. Detroit’s local electric utility DTE, for instance, sponsors the Tigers. More than 40% of DTE’s electricity comes from coal, another 26% comes from fossil gas, and only 12% comes from wind and solar. Although the company is committed to reducing its reliance on coal over the next decade, it plans to replace it with fossil gas, not renewables.

Seven teams—and the league itself—have commercial tie-ins with financial institutions that have major fossil fuel industry investments.

The Milwaukee Brewers wear Northwestern Mutual patches on their sleeves. As of last year, the insurance company had $12.17 billion invested in 146 fossil fuel companies, including ExxonMobil, Marathon Petroleum, and Shell, according to a 2024 report by the German environmental nonprofit Urgewald. Meanwhile, the Toronto Blue Jays’ patch sponsor, TD Bank, had nearly twice that amount invested in fossil fuels last year. The Toronto-based bank sunk $21.37 billion in 201 fossil fuel companies, including ExxonMobil and Chevron, which, by the way, sponsors the Sacramento Athletics and San Francisco Giants.

The Washington Nationals partner with Geico, which underwrites a mascot race featuring U.S. presidents running around the outfield warning track every home game. Geico is a wholly owned subsidiary of Berkshire Hathaway, a multinational conglomerate that, as of last year, had investments of a whopping $95.8 billion in Chevron, Occidental Petroleum, and six other fossil fuel companies.

The other four teams—the Braves, Diamondbacks, Mets and Pirates—have lucrative, multiyear stadium-naming-rights agreements with oil-soaked banks.

Finally, official MLB sponsors include two insurance companies—the aforementioned Berkshire Hathaway subsidiary Geico and New York Life—that have sizeable fossil fuel portfolios. Last year, New York Life had investments of $11.76 billion in 234 companies, including Duke Energy and the Southern Company.

Last June, United Nations Secretary-General António Guterres castigated coal, oil, and gas companies—dubbing them the “godfathers of climate chaos” for spreading disinformation—and called for a worldwide ban on fossil fuel advertising. He also urged ad agencies to refuse fossil fuel clients and companies to stop taking their ads. So far, more than 1,000 advertising and public relations agencies worldwide have pledged to refuse working for fossil fuel companies, their trade associations, and their front groups.

Major League Baseball is behind the curve, but fans, environmentalists, and public officials in New York and Los Angeles are trying to bring their teams up to speed.

Two years ago, a coalition of groups joined New York City Public Advocate Jumaane Williams to urge Mets owner Steven Cohen to change the name of Citi Field. “Citi doesn’t represent the values of Mets fans or NYC,” Williams wrote in a tweet. “If they refuse to end their toxic relationship with fossil fuels, the Mets should end their partnership with Citi.”

Activists in New York and Los Angeles are hoping that more public officials—and more fans—will step up to the plate and pressure the teams to do the right thing.

Last summer, the groups that led the effort to persuade the Mets to drop Citigroup, including New York Communities for Change, Stop the Money Pipeline, and Climate Defenders, targeted Citigroup directly with their Summer of Heat on Wall Street campaign calling on the company to stop financing fossil fuels altogether.

In Los Angeles, more than 80 public interest groups, scientists, and environmental advocates signed an open letter last August calling on the Dodgers to cut its ties with Phillips 66. “Using tactics such as associating a beloved, trusted brand like the Dodgers with enterprises like 76,” the letter states, “the fossil fuel industry has reinforced deceitful messages that ‘oil is our friend,’ and that ‘climate change isn’t so bad.’” Since then, more than 28,000 Dodger fans have signed the letter, and last week the Sierra Club’s Los Angeles chapter held a rally outside of Dodger Stadium on opening day demanding that owner Mark Walter end his team’s Phillips 66 sponsorship deal.

The campaign has received support from some local public officials. Lisa Kaas Boyle, a former deputy district attorney in Los Angeles County’s environmental crimes division, was quoted in a L.A. Sierra Club press release in January. “Booting Big Oil out of baseball is up to the fans, because team owners won’t take responsibility,” she said. “This isn’t abstract. Bad air quality from wildfires has forced MLB teams to move games, a hurricane ripped the roof off of [Tampa’s] Tropicana Field, and the Dodgers had to give out free water in 103°F heat last summer. It’s almost becoming too hot to watch at Chavez Ravine.”

State Sen. Lena Gonzalez (D-33), a lifelong Dodger fan, also endorsed the campaign. “Continuing to associate these [fossil fuel] corporations with our beloved boys in blue is not in our community or the planet’s best interest,” she recently told the City News Service, a Southern California news agency. “Ending the sponsorship with Phillips 66 would send the message that it’s time to end our embrace of polluting fossil fuels and work together toward a cleaner, greener future.”

Such entreaties, thus far, have been ignored. Both the Mets and the Dodgers have balked at the idea of intentionally walking away from sponsorships worth millions. But activists in New York and Los Angeles are hoping that more public officials—and more fans—will step up to the plate and pressure the teams to do the right thing. As that baseball sage Yogi Berra astutely pointed out, “It ain’t over till it’s over.”

This column was originally posted on Money Trail, a new Substack site co-founded by Elliott Negin.

The insurers that played a role in facilitating the very climate disasters now affecting their former customers have effectively cut and run, leaving the residents and the state holding the bag.

The deadly fires that devastated Los Angeles and displaced hundreds of thousands of people in January have been finally contained, but they left another sort of firestorm in their wake—one raging around the insurance industry and its shrinking coverage of climate risks such as extreme wildfires. Climate change increased the likelihood and severity of the fires—by far some of the most destructive in the city’s history. The blazes killed at least 28 people and destroyed some 16,000 structures over nearly 50,000 acres—an area larger than the city limits of San Francisco. Insured property damage alone is expected to reach as much as $40 billion. The question of who pays looms large.

For at least 50 years, the insurance sector has been aware of the physical risks of climate change and that greenhouse gas emissions, primarily from fossil fuels, are overwhelmingly responsible for rising temperatures. Despite this, U.S. insurance companies have investments of more than $500 billion in fossil fuel-related assets. The underwriting business of major insurers remains heavily focused on the fossil fuel sector, with the top U.S. insurers of fossil fuel businesses earning $5.2 billion from underwriting in 2023.

After decades of pocketing premiums from homeowners and investing significant portions of that money in the fossil fuel industry that drives climate change, private insurers like State Farm and Berkshire Hathaway carved out fire coverage from their policies or pulled out of the California market altogether.

All of California’s home insurance policyholders are the victims of fossil-fueled climate change.

The result: The insurers that played a role in facilitating the very climate disasters now affecting their former customers have effectively cut and run, leaving the residents and the state holding the bag.

Private insurers will escape the full bill, largely because they have shifted their exposure to the most extreme climate risks to California’s insurer of last resort—the FAIR Plan. In abandoning the California home insurance market, or otherwise excluding fire coverage from their policies, private insurance companies effectively pushed the responsibilities of shouldering climate risk back onto the public and protected their own profits. Despite their claims to the contrary, insurance companies, as recently as 2023, generated significant profits on homeowner insurance policies and are still raking in record profits.

The FAIR Plan is now on the brink of insolvency. To fund the shortfall, the California Insurance Commissioner has levied an assessment totaling $1 billion on private insurance companies. However, private insurance companies will pass $500 million of the assessment on to all of California’s insured homeowners.

This $500 million bill is a direct consequence of climate change and the profit-driven insurers who—after pocketing ever-increasing premiums and investing in the fossil fuel sector—have shed policies for homes most vulnerable to climate risks. All of California’s home insurance policyholders are the victims of fossil-fueled climate change.

The destructive force of the LA wildfires is a result of climate change-induced drought, which led to the accumulation of dried-out vegetation and the perfect conditions for extreme wildfires. Unusually strong wind gusts of more than 100 miles per hour spread the fires across LA, scattering flames throughout many of the city’s communities. And it was not just the fires causing damage—climate change intensifies fire smoke, filling the air with hazardous pollutants that harm health.

In California, the frequency and severity of wildfires have increased the cost of disasters, prompting insurers to hike premiums or refuse to renew policies. California’s home insurance rates jumped 48.4% from 2019 to 2024. Twelve major insurers have also restricted homeowners insurance even after being allowed massive rate hikes.

Insurers have justified abandoning California homeowners by citing rising climate risk. Yet, insurance companies are complicit in facilitating climate change through their massive investments in fossil fuel-related assets—including coal, oil, and gas—the primary sources of the greenhouse gases driving climate change.

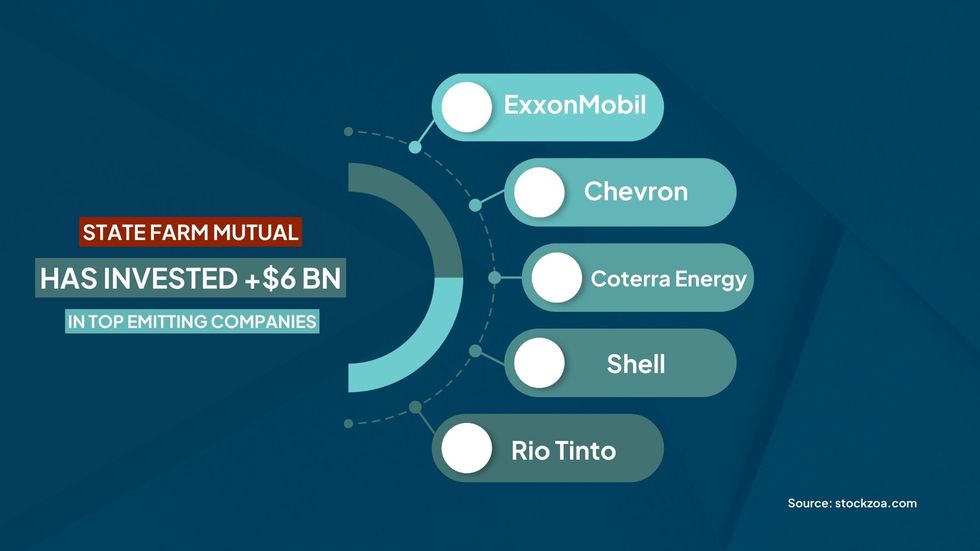

State Farm General (State Farm)—through its parent company, State Farm Mutual—is a major investor in fossil fuels. The company’s investments include more than $6 billion in upstream oil and gas producers ExxonMobil, Chevron, Coterra Energy, and Shell and mining company Rio Tinto. These five companies sit on the list of the top investor-owned entities with the highest historical carbon dioxide emissions. State Farm Mutual also has billions of dollars of investments in fossil-fuel-intensive or dependent industries such as utilities, oil and gas services, and pipeline companies, as well as chemical, steel, and fertilizer manufacturers.

Despite facilitating climate change through its fossil fuel investments, State Farm—the largest property and casualty insurer in California—stated in 2023 that it would not renew 30,000 home insurance policies in the state. The decision was primarily due to the increasing risk of wildfires in California. After an approved rate increase of 20% in December 2023, among other concessions from the California Department of Insurance, State Farm agreed to renew these 30,000 home insurance policies, but only on the condition that the renewed policies exclude fire coverage. State Farm clients had to specifically secure separate fire coverage from the FAIR Plan.

The Pacific Palisades, one of the neighborhoods devastated by the LA Fires, was one of the zip codes abandoned by State Farm. According to California Department of Insurance spokesperson Michael Soller, State Farm dropped about 1,600 policies in Pacific Palisades in July. State Farm also dropped more than 2,000 policies in two other LA zip codes, which include neighborhoods also damaged by the wildfires, such as Brentwood, Calabasas, Hidden Hills, and Monte Nido. The FAIR Plan is now the principal recourse for wildfire coverage for former State Farm policyholders.

Most private insurers are looking to their reinsurer to provide coverage for their losses from the LA Fires. Reinsurance, basically insurance for insurance companies, is a common part of an insurer’s business model as it allows them to shift some of their risk to protect themselves from the most catastrophic events. State Farm’s reinsurer is its parent company—State Farm Mutual. From 2014 to 2023, State Farm paid reinsurance premiums of nearly $2.2 billion but was only reimbursed $0.4 billion—less than 20%—suggesting that the company overpaid for reinsurance. These payments to its parent company, with little return, led to accusations that State Farm was artificially boosting its parent company’s profits.

State Farm Mutual has over $130 billion in surplus available to support its subsidiary. Despite the exorbitant profits of its parent company and well before the LA Fires, in June 2024, State Farm requested a 30% increase in its homeowners insurance rates (on top of the 20% increase it was granted in March of the same year) purportedly to improve its general financial condition. Within days of the LA fires being contained, State Farm again asked its California policyholders to step in and maintain the profits of its parent company. State Farm requested an annual $740 million bailout in the form of an “urgent” 22% increase in State Farm’s home insurance rates, as well as requesting rate hikes of 38% for rental dwellings and 15% for tenants.

Fortunately for California’s consumers, Commissioner Ricardo Lara rejected State Farm’s requested rate increase. And true to form, State Farm is now “considering its options” because the commissioner’s decision “sends a strong message to State Farm General about the support it will receive to collect sufficient premiums in the future”—a barely veiled threat to again abandon California policyholders.

State Farm had already limited its exposure to climate change-induced wildfires and then sought to reduce it further, asking policyholders to take on even more of the remaining risk. All the while, they continue to facilitate climate change and profit from their fossil fuel investments.

As insurance companies pull out of vulnerable areas or raise premiums, many California homeowners are left with no choice but to rely on the FAIR Plan—the state-supported insurer of last resort. The FAIR Plan offers limited coverage at higher rates, making it costly and an inadequate safety net for homeowners abandoned by private insurance companies.

The exit of insurers from the California residential property market has meant that the FAIR Plan’s exposure to wildfire risk has increased exponentially. The FAIR Plan now holds 13,752 policies with more than $23 billion in liability across the residential and commercial sectors in the zip codes affected by the fires.

Insurers should then seek to recoup the costs of covering the damage from climate change-induced severe weather events from fossil fuel companies—not from the individual policyholders or the public at large.

On February 11, 2025, Insurance Commissioner Lara found “that the FAIR Plan is faced with a substantial threat of insolvency due to unprecedented losses” and approved the FAIR Plan’s request to levy an assessment totaling $1 billion on private insurance companies. Before July 2024, insurers operating in California would have been solely required to fund any deficit, paying a fee based on their market share. But a July 2024 regulation allows insurers to shift 50% of the assessment onto the state’s existing policyholders. Homeowners from all over California are being asked to bail out the FAIR Plan, irrespective of the risk profile of their home and neighborhood and the climate risk mitigation or adaptation they have undertaken.

This change in regulation was part of a series of concessions Lara has given to the insurance industry in recent years, including provisions that make it easier for companies to raise premiums and a new rule that allows companies to use forward-looking catastrophe models when setting rates. These new regulations were aimed at convincing insurers to stay in California, but consumer advocates warn that they have the potential to further exacerbate homeowners’ climate-related costs.

Insurance companies facilitate climate change by investing in fossil fuel assets and underwriting fossil fuel projects. However, the primary drivers of climate change are fossil fuels themselves, and it is the companies that produce and sell them that are principally responsible for the climate emergency. Instead of attempting to shift their exposure to California’s householders, insurers should divest from fossil fuel assets and cease underwriting fossil fuel projects. Insurers should then seek to recoup the costs of covering the damage from climate change-induced severe weather events from fossil fuel companies—not from the individual policyholders or the public at large.

A new bill, SB222, introduced into the California legislature, would make it easier to ensure that polluters pay for the climate-driven disasters befalling residents and upending the insurance industry. It specifically directs the FAIR Plan and incentivizes private insurers to pursue the parties responsible for climate change-induced weather events by standing in the shoes of policyholders to recoup the costs of losses, utilizing their right of subrogation. An insurer’s right of subrogation is the right to try to recover the amount of a claim or claims it paid out from another party that caused the insured loss(es).

The draft legislation directs the FAIR Plan to exercise its right of subrogation against “a responsible party for a climate disaster or extreme weather or other events attributable to climate change” if the benefits of subrogation outweigh the costs (as determined by an independent advisory body). If the FAIR Plan’s funds are exhausted and private insurance companies are being assessed, as is the case now, the bill also provides incentives to insurers to exercise the right of subrogation against a “responsible party” for a climate disaster. An insurer’s share of the assessment will be reduced by 10% if the insurer exercises its right of subrogation against a responsible party, but if it does not exercise its right of subrogation against a responsible party, it will be increased by 10%.

Finally, in addition to its right of subrogation, the bill provides that an insurer may seek damages against a responsible party for a climate disaster, extreme weather, or other events attributable to climate change.

Make no mistake: The responsible parties driving climate change are fossil fuel businesses.

SB222 highlights that the real culprit of the climate emergency is the fossil fuel sector. But insurance companies are far from innocent bystanders. By supporting “business as usual” in the fossil fuel sector, insurance companies are facilitating the escalating climate crisis, causing climate change-induced events like the LA fires. When coupled with their representations around protecting policyholders from peril and their justifications for rate hikes and non-renewals, insurers’ conduct violates consumer protection laws and standards.

Insurers must no longer be permitted to invest large portions of premium income in fossil fuel companies and underwrite new oil and gas projects while charging some homeowners more for increased climate risk and simply turning others away. Before any further handouts are given to the insurance industry or any more concessions are made to preserve a profit-driven insurance model that may simply be untenable in the age of climate chaos, insurers must stop fanning the flames.