Why Did Trump Win? Because Democrats Aren't Up In Arms Over Mass Layoffs

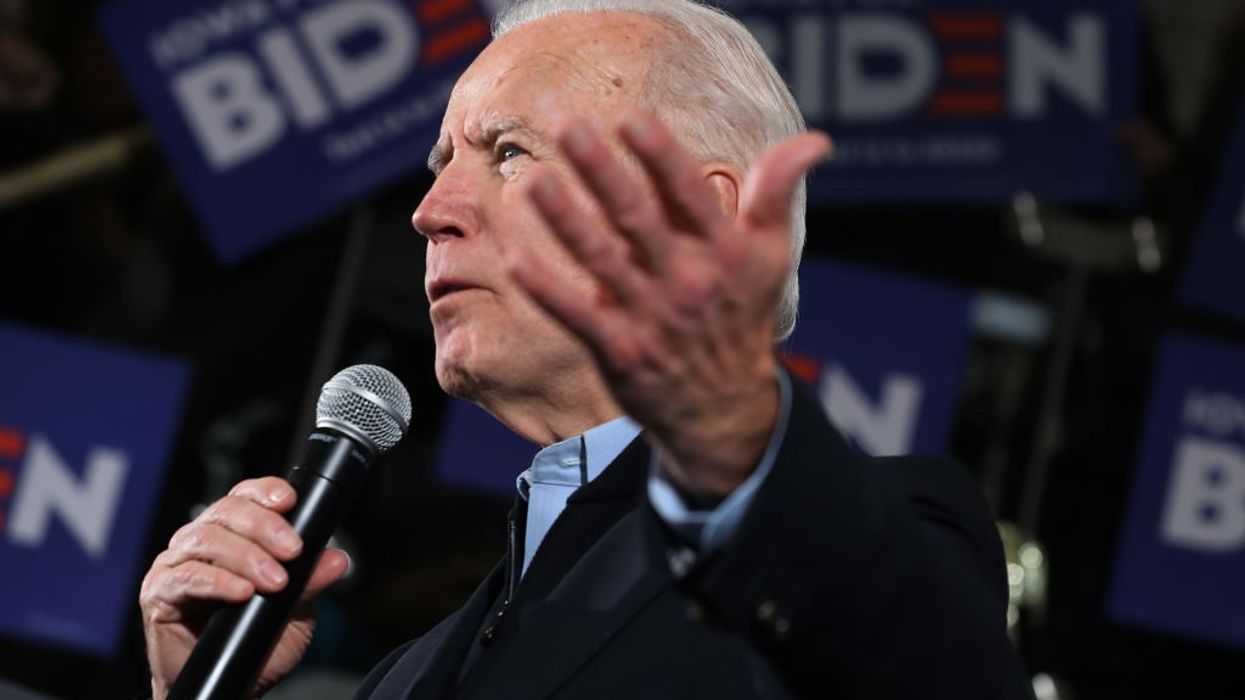

GM just told 1,000 workers they're jobs are gone. But I haven’t heard Joe Biden, Chuck Schumer, Hakeem Jeffries, or any other leading Democrat say a critical word about it.

At the same time Democrats and progressives are justifiably enraged at Trump’s gonzo Cabinet picks, they’re all but mute about corporate America’s continued siphoning of economic gains to the top.

Yet this siphoning has created the stagnant wages and insecure jobs that helped propel Trump into the presidency and give Republicans control over both chambers of Congress.

Trump at least gave workers an explanation for what’s happened to them — although it was a lie: It isn’t undocumented immigrants or the “deep state” or transgender kids or any other Trump bogeyman.

It’s corporate greed.

The most recent example: On Friday, GM announced it was laying off 1,000 workers. These layoffs followed another round of GM layoffs in August, which saw 1,500 jobs cut. The cuts affected both salaried and hourly staff, including some United Auto Workers members.

Why aren’t Democrats, who still control the Senate and presidency, moving more aggressively to outlaw stock buybacks — which were considered illegal stock manipulations before Ronald Reagan’s SEC gave them the green light?

Most of the workers being laid off Friday were notified via email early Friday morning. Some had been working for GM for over thirty years.

GM says it has no choice. It must cut costs.

This is what we hear again and again from corporate America. We’ll be hearing even more of this as Artificial Intelligence takes over white-collar as well as blue-collar jobs.

No choice?

GM is on track for making record profits this year, surpassing its 2022 record profit of $14.5 billion. In the third quarter of 2024 alone, GM made $3.4 billion. That’s a $200 million increase from the same period last year.

GM CEO Mary Barra’s compensation for 2024 is $27.8 million. This includes a base salary of $2.1 million, stock awards of $14.6 million, stock option awards valued at $4.9 million, an “incentive plan” compensation (as if she needed more incentive) of $5.3 million, other payment of $997,392, and perks (personal travel, security, financial counseling, company vehicles, and an executive health plan) valued at $389,005.

The ratio of Barra’s compensation to that of the typical GM employee is estimated to be 303-to-1.

In June, GM announced $6 billion in stock buybacks. This means $6 billion of GM’s record profits will be used to purchase its own shares of stock — thereby boosting share prices (and the portion of Barra’s compensation in stock grants and options) simply because fewer shares of GM stock will be in circulation.

Keep in mind that the richest 1 percent of American hold over half of the value of all shares of stock held by Americans, and the richest 10 percent hold 92 percent.

So, in fact, GM’s savings from axing 1,000 jobs will be transferred into the pockets of wealthy Americans (including GM’s CEO).

Why aren’t Democrats up in arms about this? I haven’t heard Joe Biden, Chuck Schumer, Hakeem Jeffries, or any other leading Democrat say a critical word about GM’s latest move.

Democrats have offered no alternative explanation for what’s happened to average working people or agenda for remedying it. Trump's baseless explanation and agenda are the only ones available. So it’s no surprise that many working Americans voted for Trump on Election Day.

Why isn’t Michigan’s Democratic governor, Gretchen Whitmer — who may be in the running for president in 2028 (assuming we have another election) — accusing GM of sacrificing jobs for profits that are siphoned off to big investors?

Why aren’t Democrats, who still control the Senate and presidency, moving more aggressively to outlaw stock buybacks — which were considered illegal stock manipulations before Ronald Reagan’s SEC gave them the green light?

Why aren’t they demanding that capital gains taxes be increased on the super-wealthy, whose stock gains this year alone have made America’s billionaires 30 percent richer?

Why aren’t they moving to increase corporate taxes on corporations whose ratio of CEO pay to their median workers is more than 50 to 1? And impose even higher taxes if the ratio exceeds 100 to 1? (Senate Budget Committee Chair Sheldon Whitehouse, along with Representatives Barbara Lee and Alexandria Ocasio-Cortez, have introduced just such a bill, but no one knows about it. Why isn’t the Democratic leadership loudly pushing this?)

The lesson of the debacle of the 2024 election is that big corporations and the wealthy have shafted average working Americans, whose wages and jobs have gone nowhere for decades and who are understandably frustrated and angry at what they see as a rigged system.

But Democrats have offered no alternative explanation for what’s happened to average working people or agenda for remedying it. Trump's baseless explanation and agenda are the only ones available. So it’s no surprise that many working Americans voted for Trump on Election Day.

Now Trump and his Republican stooges think they’ve been given a license to blow the system up — initially by appointing a bunch of clowns, conspiracy theorists, and sexual predators to key posts.

It’s important to rail against Trump’s appointments. But unless we attack the sources of the outrage Trump has tapped into, working Americans will continue to go along with whatever Trump and his lapdogs want to do.