"We have been telling financiers and insurers about the destruction and devastation oil and gas projects are causing to our health, communities, and sacred lands for years, yet they continued to enable its unhinged expansion," Juan Mancias, the tribal chair of the Carrizo/Comecrudo Tribe of Texas, said in a statement. "Make no mistake, money made off the extraction of oil and gas is blood money. We are tired of empty promises, we want results. End your support for oil and gas now."

"The insurance industry readily covers polluting pipelines as part of routine business, despite potential costs. However, when it comes to insuring our homes, they either refuse or make it prohibitively expensive."

The protest came days after a report from Insure Our Future, Rainforest Action Network, and Public Citizen revealed that at least 35 insurers are underwriting controversial liquefied natural gas (LNG) export infrastructure along the U.S. Gulf Coast. The insurers, the names of which were obtained via more than 50 Freedom of Information Act requests, include AIG, Tokio Marine, Chubb, and Sompo, the four companies targeted during Tuesday's action.

For example, Sompo and Chubb are two of the insurers behind Rio Grande LNG, a terminal in Brownsville, Texas, that threatens land and sites sacred to the Carrizo/Comecrudo Tribe, which has not given its Free, Prior, and Informed Consent to the project. Protesters delivered a petition to Chubb with more than 345,000 signatures asking it and other insurers to withdraw their support.

"The proposed terminal will support the continued environmental racism in the gulf by perpetuating the displacement, pollution, and physical harm of impacted communities," the petition reads. "It is imperative that the supporting insurance companies listen to Indigenous and impacted communities. And time is running out for transformative action to tackle the climate crisis."

In addition, the new LNG terminals would increase the pollution burden on communities that are already disproportionately exposed to toxins from the region's many petrochemical facilities and harm local ecosystems and wildlife.

"If built, Texas LNG, Rio Grande LNG, and their proposed Rio Bravo Pipeline would destroy our low-income Latine community's way of life," Bekah Hinojosa of South Texas Environmental Justice Network said in the report. "Pollution from these mega LNG/ methane export terminals would destroy the waterways where shrimp lay their eggs and our people fish to feed their families. We're calling on these insurance companies to stop insuring LNG/methane terminals because it's blatant environmental racism."

In terms of global impact, the projects backed by the insurers would emit the same amount of climate-warming emissions every year as 239 coal plants.

"These companies are insuring one of the largest build-outs of fossil fuels in the world, from investment to underwriting, these companies are culpable for providing material support through millions in coverage, while simultaneously abandoning communities in Texas and Louisiana," Mary Lowell of Rainforest Action Network said in a statement.

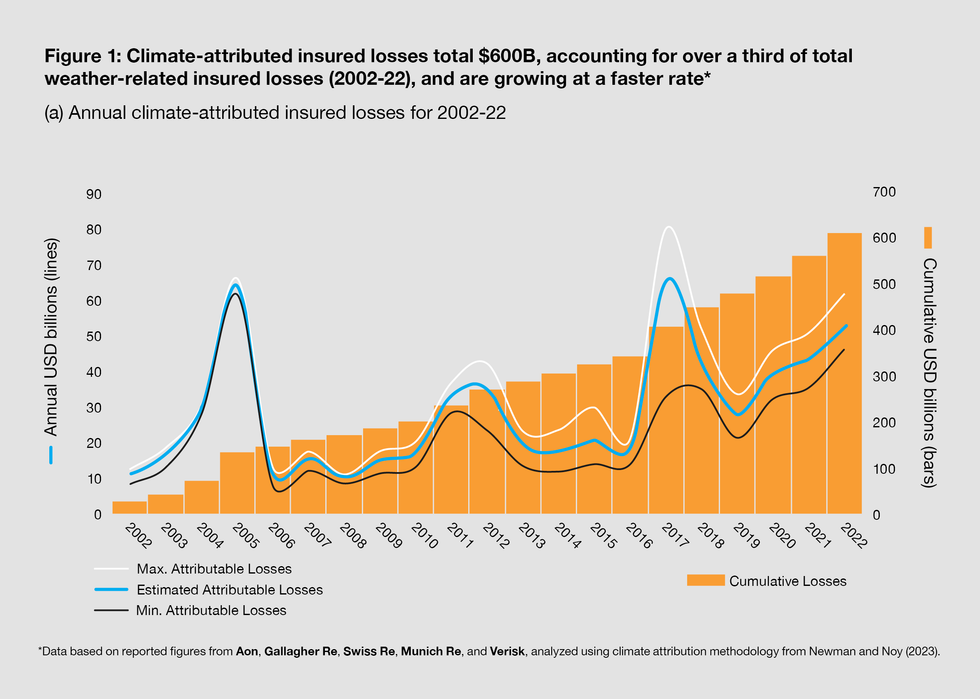

The report and the protest came after climate and frontline advocates in the U.S. succeeded in persuading the Biden administration to pause Department of Energy approvals for new LNG exports while they reassess their decision-making criteria, including climate impacts. Activists note that these projects also cannot move forward without insurance, which gives these companies a pivotal role. At the same time, many insurance companies internally recognize the risks posed by the climate crisis. On Wednesday, reinsurance company Swiss Re calculated that it already costs the U.S. around $97 billion a year.

Tuesday's march included a rally at AIG. The company, along with Chubb, Liberty Mutual, and SCOR, was featured on a majority of the certificates detailed in the report, including those for Louisiana's Cameron LNG and Sabine Pass LNG. At the same time, AIG has stopped backing Louisiana-based businesses amid extreme weather events fueled by the climate crisis.

Many community members exposed to pollution from petrochemical facilities are also exposed to more dangerous storms. Roishetta Ozane, a Louisiana environmental justice leader who founded the Vessel Project for disaster relief, stood in front of AIG explaining how she had survived Hurricanes Laura and Delta, as well as a winter storm and flood in 2021.

"All of these disasters that happened in my community because of these climate-inducing, climate-causing, climate catastrophe-ensuring projects like LNG terminals that are insured by companies like AIG, Chubb, and Tokio Marine," she said.

Another participant, Donna Simbo of New York Communities for Change, said she had survived Hurricane Sandy only to still be living in temporary housing more than 10 years later, with insurance premiums 70% higher.

"The insurance industry readily covers polluting pipelines as part of routine business, despite potential costs," Simbo said. "However, when it comes to insuring our homes, they either refuse or make it prohibitively expensive. Despite acknowledging the risks of climate change, insurance companies have avoided taking their fair share of responsibility."

Beyond New York, actions this week are also planned across the globe including in Colombia, Costa Rica, Congo, France, Germany, India, Indonesia, Japan, Kenya, Nigeria, Pakistan, Peru, Romania, South Korea, Switzerland, the U.K., Uganda, and Tanzania.

Uganda-based activist Hilda Flavia Nakabuye wrote for Common Dreams urging insurers to back away from the East African Crude Oil Pipeline, which would threaten local biodiversity and livelihoods and emit 32.3 million metric tons of carbon pollution each year. While 28 insurers have promised not to back it, several have not, including AIG, Tokio Marine, Chubb, Hiscox, and Lloyd's of London.

"We need all major (re)insurers to rule out supporting such a dangerous new oil pipeline to make sure that it never gets built," Nakabuye said.

To date, not a single global insurer has a policy in line with the Paris agreement goal of limiting global heating to 1.5°C above preindustrial levels, according to Insure Our Future.

"Insurance companies are supposed to be experts at measuring and mitigating risks, yet their ongoing support for oil, gas, and coal expansion is paving the way to a dangerous and devastating future," Isabelle L'Héritier, senior campaigner and lead organizer of the Insure Our Future Global Week of Action, said in a statement.

"Billions of us are living through the catastrophic impacts of brutal wildfires, storms, floods, heatwaves, and droughts which are getting worse every year," L'Héritier continued. "The effects of the climate crisis, from water shortages to rising food prices, are being felt on every continent. Companies like Zurich, AIG, and Tokio Marine have the power to push for a cleaner, safer world for the next generation if they act now. It's time to insure our future, not destruction."

(Photo: Extinction Rebellion)

(Photo: Extinction Rebellion) (Photo: Extinction Rebellion)

(Photo: Extinction Rebellion)