SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Insurance companies contribute to the climate crisis through their financial choices, and then expect frontline communities to foot the bill. This must stop.

The Los Angeles area began this year with some of the worst wildfires in its history. Dozens of people were killed and 200,000 were displaced. About 40,000 acres and 12,300 structures, including houses, were burned. The city endured immense emotional and physical damage. Yet, many property owners in the city find themselves with little recourse for financial compensation.

In fact, over the past five years, insurance companies like State Farm, Farmers, Chubb, Liberty Mutual, and Allstate have all refused to renew policies for innumerable homeowners in the Los Angeles area, leaving residents without adequate protection for their homes. By July of 2024, State Farm alone had dropped 1,600 clients residing in the Pacific Palisades ZIP code, where damage from the fires would be some of the worst. Soaring home insurance prices have also forced lower- and middle-income residents to make the impossible decision of refusing insurance for their homes. In the wake of the most recent fires, many are not only left devastated by the destruction of their homes and the uprooting of their lives, but they are also financially stranded in the disaster’s aftermath.

All of these horrible consequences stem from a simple rule that defines much of the home insurance industry’s dealings with the public: Increased risk means increased prices. In more disaster-prone areas, the likelihood of insurance companies having to compensate homeowners is heightened by the prevalence of destructive events, and insurance companies raise premiums to remain profitable and to ensure their financial ability to cover future losses or drop clients altogether. For instance, knowing that California is highly prone to destructive wildfires, insurance companies will deny housing coverage for people in high-risk forest fire areas to avoid paying the high cost of rebuilding thousands of homes should one occur.

As climate organizers encounter a federal government unfriendly to systemic change but have made decent strides in their work with financial institutions, it is clear that targeting the private sector is imperative at this moment.

Rising insurance prices are not isolated to one region, though. Communities across the country from Kentucky to Florida to New York are now facing the brunt end of this crisis. When hurricane Ida hit New York in 2021, damages cost one woman up to $25,000 dollars out of pocket for repairs because Liberty Mutual outright rejected them coverage. This disproportionately affects low-income communities, who will face even more struggle trying to afford to pay for damages that should have been covered by their housing insurance in the first place.

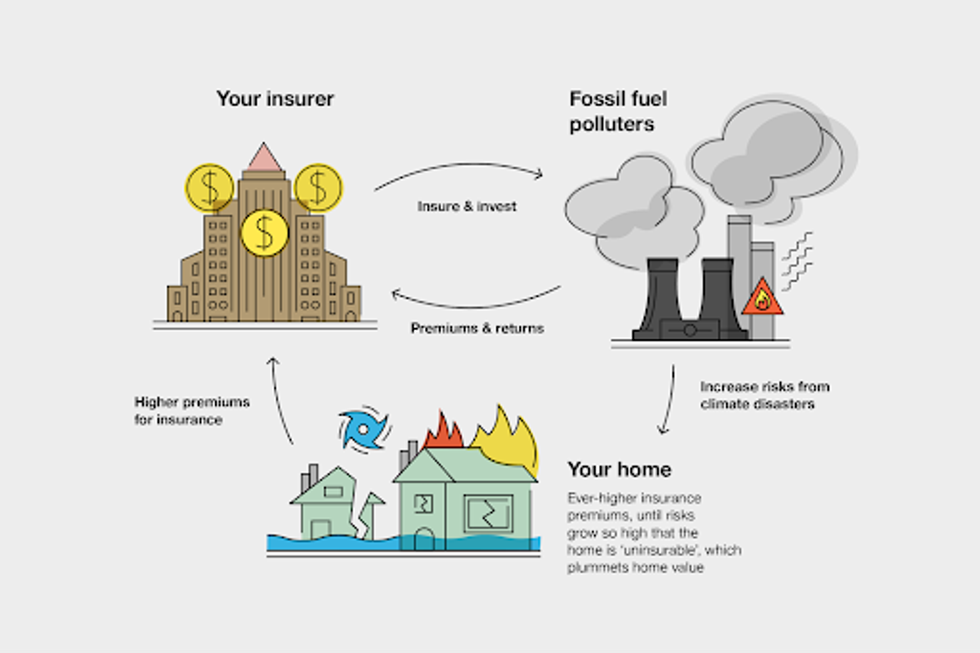

Even considering the fact that the burden often falls on people purchasing insurance for their homes, increased and intensified natural disasters fundamentally have an adverse financial effect on insurance companies by making their services more expensive, which is also often accompanied by reduced coverage. Therefore, you would think that they would address the root cause of this increase in destruction—climate change.

But, many don’t. Everyday, insurance companies like Chubb, Liberty Mutual, and AIG practice hypocrisy, creating a perpetual cycle that expedites climate destruction and inequality. This is accomplished through the underwriting of fossil fuel projects, which is often cheaper for these companies because it allows them to invest and insure something deemed less “risky” that, in the short-term, will make the company more money. Insurance companies continue to underwrite pipelines for transporting fossil fuels and liquefied natural gas (LNG) infrastructure that is often built nearby vulnerable communities. The domestic insurance industry has also invested $582 billion of assets collected through client’s premiums into the fossil fuel industry. Still, climate change, caused by the emission of those exact fossil fuels into the Earth’s atmosphere, further exacerbates and increases the frequency of the (not so) natural disasters that drive up insurance prices. Essentially, these companies contribute to the climate crisis through their financial choices, and then expect frontline communities to foot the bill.

The insurance industry is one of the key pillars of our society’s reliance on fossil fuels alongside the financial institutions that bankroll it and the government agencies that sign off on its expansion. When insurance companies provide coverage for fossil fuel extraction projects, they provide insurance so that in the case of a disaster like a spill or explosion, the extraction project is protected. Without insurance coverage, corporations simply cannot continue building the infrastructure that keeps us hooked on fossil fuels. For example, last year, when Chubb dropped the coverage from the Rio Grande LNG project, AIG stepped right in as an insurer on the initiative. As climate organizers encounter a federal government unfriendly to systemic change but have made decent strides in their work with financial institutions, it is clear that targeting the private sector is imperative at this moment.

Insurance companies, especially, know the risks of climate change and are vulnerable to its effects. A report by the asset manager Conning shows that 91% of insurance executives profess “significant” concern about the climate crisis. This makes efforts to persuade insurance companies on matters of climate particularly salient and realistic during these times—especially when the public wants change. According to one study, 78% of U.S. voters are at least somewhat concerned about rising property insurance costs and 67% percent are concerned about extreme weather events. Most importantly, the vast majority of the population surveyed said that insurance executives are to blame for the aforementioned rising costs and 57% said that these costs should not be passed on to customers.

Although older generations also suffer the difficulties of accessing reliable insurance and figuring out how to pick up their lives after devastating climate disasters, Gen Z is uniquely forced to come of age without the financial expectations and infrastructure that were promised to us as part of the American economic system. Affordable mortgages and insurers that will actually cover us and provide reliable and ethical insurance now seem near-impossible to access for young people, knowing the state of our climate. This has particularly impacted Gen Z because we have grown up in a time where climate disasters are stronger, more frequent, and now something of a regular occurrence. In response to these climate events becoming normal, companies will continue to increasingly deny us housing coverage and proper insurance in hopes of saving money. This calls youth across the country to take action against the hypocrisy of these companies, calling for sustainable insurance that does not fund the fossil fuel industry.

The shift to a fossil fuel-free insurance industry will not be easy, but it is now, more than ever, a necessary step toward ensuring the common good. It is, in fact, the only ethical option on behalf of corporations that are meant to protect people’s livelihoods. As youth, we demand immediate action from the individuals and corporations in power, and to those who refuse to listen to us, we have one question: Who do you expect to pay your premiums in 50 years?

The insurers that played a role in facilitating the very climate disasters now affecting their former customers have effectively cut and run, leaving the residents and the state holding the bag.

The deadly fires that devastated Los Angeles and displaced hundreds of thousands of people in January have been finally contained, but they left another sort of firestorm in their wake—one raging around the insurance industry and its shrinking coverage of climate risks such as extreme wildfires. Climate change increased the likelihood and severity of the fires—by far some of the most destructive in the city’s history. The blazes killed at least 28 people and destroyed some 16,000 structures over nearly 50,000 acres—an area larger than the city limits of San Francisco. Insured property damage alone is expected to reach as much as $40 billion. The question of who pays looms large.

For at least 50 years, the insurance sector has been aware of the physical risks of climate change and that greenhouse gas emissions, primarily from fossil fuels, are overwhelmingly responsible for rising temperatures. Despite this, U.S. insurance companies have investments of more than $500 billion in fossil fuel-related assets. The underwriting business of major insurers remains heavily focused on the fossil fuel sector, with the top U.S. insurers of fossil fuel businesses earning $5.2 billion from underwriting in 2023.

After decades of pocketing premiums from homeowners and investing significant portions of that money in the fossil fuel industry that drives climate change, private insurers like State Farm and Berkshire Hathaway carved out fire coverage from their policies or pulled out of the California market altogether.

All of California’s home insurance policyholders are the victims of fossil-fueled climate change.

The result: The insurers that played a role in facilitating the very climate disasters now affecting their former customers have effectively cut and run, leaving the residents and the state holding the bag.

Private insurers will escape the full bill, largely because they have shifted their exposure to the most extreme climate risks to California’s insurer of last resort—the FAIR Plan. In abandoning the California home insurance market, or otherwise excluding fire coverage from their policies, private insurance companies effectively pushed the responsibilities of shouldering climate risk back onto the public and protected their own profits. Despite their claims to the contrary, insurance companies, as recently as 2023, generated significant profits on homeowner insurance policies and are still raking in record profits.

The FAIR Plan is now on the brink of insolvency. To fund the shortfall, the California Insurance Commissioner has levied an assessment totaling $1 billion on private insurance companies. However, private insurance companies will pass $500 million of the assessment on to all of California’s insured homeowners.

This $500 million bill is a direct consequence of climate change and the profit-driven insurers who—after pocketing ever-increasing premiums and investing in the fossil fuel sector—have shed policies for homes most vulnerable to climate risks. All of California’s home insurance policyholders are the victims of fossil-fueled climate change.

The destructive force of the LA wildfires is a result of climate change-induced drought, which led to the accumulation of dried-out vegetation and the perfect conditions for extreme wildfires. Unusually strong wind gusts of more than 100 miles per hour spread the fires across LA, scattering flames throughout many of the city’s communities. And it was not just the fires causing damage—climate change intensifies fire smoke, filling the air with hazardous pollutants that harm health.

In California, the frequency and severity of wildfires have increased the cost of disasters, prompting insurers to hike premiums or refuse to renew policies. California’s home insurance rates jumped 48.4% from 2019 to 2024. Twelve major insurers have also restricted homeowners insurance even after being allowed massive rate hikes.

Insurers have justified abandoning California homeowners by citing rising climate risk. Yet, insurance companies are complicit in facilitating climate change through their massive investments in fossil fuel-related assets—including coal, oil, and gas—the primary sources of the greenhouse gases driving climate change.

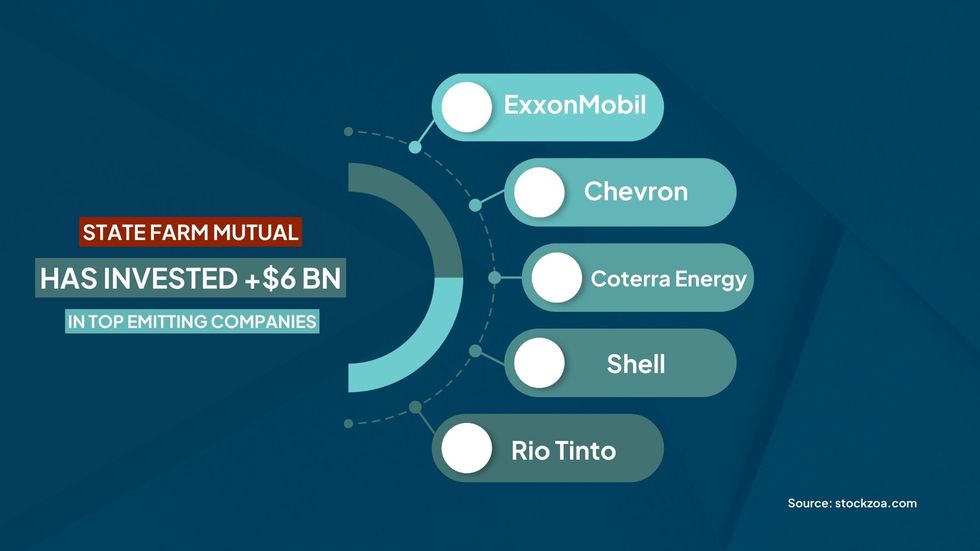

State Farm General (State Farm)—through its parent company, State Farm Mutual—is a major investor in fossil fuels. The company’s investments include more than $6 billion in upstream oil and gas producers ExxonMobil, Chevron, Coterra Energy, and Shell and mining company Rio Tinto. These five companies sit on the list of the top investor-owned entities with the highest historical carbon dioxide emissions. State Farm Mutual also has billions of dollars of investments in fossil-fuel-intensive or dependent industries such as utilities, oil and gas services, and pipeline companies, as well as chemical, steel, and fertilizer manufacturers.

Despite facilitating climate change through its fossil fuel investments, State Farm—the largest property and casualty insurer in California—stated in 2023 that it would not renew 30,000 home insurance policies in the state. The decision was primarily due to the increasing risk of wildfires in California. After an approved rate increase of 20% in December 2023, among other concessions from the California Department of Insurance, State Farm agreed to renew these 30,000 home insurance policies, but only on the condition that the renewed policies exclude fire coverage. State Farm clients had to specifically secure separate fire coverage from the FAIR Plan.

The Pacific Palisades, one of the neighborhoods devastated by the LA Fires, was one of the zip codes abandoned by State Farm. According to California Department of Insurance spokesperson Michael Soller, State Farm dropped about 1,600 policies in Pacific Palisades in July. State Farm also dropped more than 2,000 policies in two other LA zip codes, which include neighborhoods also damaged by the wildfires, such as Brentwood, Calabasas, Hidden Hills, and Monte Nido. The FAIR Plan is now the principal recourse for wildfire coverage for former State Farm policyholders.

Most private insurers are looking to their reinsurer to provide coverage for their losses from the LA Fires. Reinsurance, basically insurance for insurance companies, is a common part of an insurer’s business model as it allows them to shift some of their risk to protect themselves from the most catastrophic events. State Farm’s reinsurer is its parent company—State Farm Mutual. From 2014 to 2023, State Farm paid reinsurance premiums of nearly $2.2 billion but was only reimbursed $0.4 billion—less than 20%—suggesting that the company overpaid for reinsurance. These payments to its parent company, with little return, led to accusations that State Farm was artificially boosting its parent company’s profits.

State Farm Mutual has over $130 billion in surplus available to support its subsidiary. Despite the exorbitant profits of its parent company and well before the LA Fires, in June 2024, State Farm requested a 30% increase in its homeowners insurance rates (on top of the 20% increase it was granted in March of the same year) purportedly to improve its general financial condition. Within days of the LA fires being contained, State Farm again asked its California policyholders to step in and maintain the profits of its parent company. State Farm requested an annual $740 million bailout in the form of an “urgent” 22% increase in State Farm’s home insurance rates, as well as requesting rate hikes of 38% for rental dwellings and 15% for tenants.

Fortunately for California’s consumers, Commissioner Ricardo Lara rejected State Farm’s requested rate increase. And true to form, State Farm is now “considering its options” because the commissioner’s decision “sends a strong message to State Farm General about the support it will receive to collect sufficient premiums in the future”—a barely veiled threat to again abandon California policyholders.

State Farm had already limited its exposure to climate change-induced wildfires and then sought to reduce it further, asking policyholders to take on even more of the remaining risk. All the while, they continue to facilitate climate change and profit from their fossil fuel investments.

As insurance companies pull out of vulnerable areas or raise premiums, many California homeowners are left with no choice but to rely on the FAIR Plan—the state-supported insurer of last resort. The FAIR Plan offers limited coverage at higher rates, making it costly and an inadequate safety net for homeowners abandoned by private insurance companies.

The exit of insurers from the California residential property market has meant that the FAIR Plan’s exposure to wildfire risk has increased exponentially. The FAIR Plan now holds 13,752 policies with more than $23 billion in liability across the residential and commercial sectors in the zip codes affected by the fires.

Insurers should then seek to recoup the costs of covering the damage from climate change-induced severe weather events from fossil fuel companies—not from the individual policyholders or the public at large.

On February 11, 2025, Insurance Commissioner Lara found “that the FAIR Plan is faced with a substantial threat of insolvency due to unprecedented losses” and approved the FAIR Plan’s request to levy an assessment totaling $1 billion on private insurance companies. Before July 2024, insurers operating in California would have been solely required to fund any deficit, paying a fee based on their market share. But a July 2024 regulation allows insurers to shift 50% of the assessment onto the state’s existing policyholders. Homeowners from all over California are being asked to bail out the FAIR Plan, irrespective of the risk profile of their home and neighborhood and the climate risk mitigation or adaptation they have undertaken.

This change in regulation was part of a series of concessions Lara has given to the insurance industry in recent years, including provisions that make it easier for companies to raise premiums and a new rule that allows companies to use forward-looking catastrophe models when setting rates. These new regulations were aimed at convincing insurers to stay in California, but consumer advocates warn that they have the potential to further exacerbate homeowners’ climate-related costs.

Insurance companies facilitate climate change by investing in fossil fuel assets and underwriting fossil fuel projects. However, the primary drivers of climate change are fossil fuels themselves, and it is the companies that produce and sell them that are principally responsible for the climate emergency. Instead of attempting to shift their exposure to California’s householders, insurers should divest from fossil fuel assets and cease underwriting fossil fuel projects. Insurers should then seek to recoup the costs of covering the damage from climate change-induced severe weather events from fossil fuel companies—not from the individual policyholders or the public at large.

A new bill, SB222, introduced into the California legislature, would make it easier to ensure that polluters pay for the climate-driven disasters befalling residents and upending the insurance industry. It specifically directs the FAIR Plan and incentivizes private insurers to pursue the parties responsible for climate change-induced weather events by standing in the shoes of policyholders to recoup the costs of losses, utilizing their right of subrogation. An insurer’s right of subrogation is the right to try to recover the amount of a claim or claims it paid out from another party that caused the insured loss(es).

The draft legislation directs the FAIR Plan to exercise its right of subrogation against “a responsible party for a climate disaster or extreme weather or other events attributable to climate change” if the benefits of subrogation outweigh the costs (as determined by an independent advisory body). If the FAIR Plan’s funds are exhausted and private insurance companies are being assessed, as is the case now, the bill also provides incentives to insurers to exercise the right of subrogation against a “responsible party” for a climate disaster. An insurer’s share of the assessment will be reduced by 10% if the insurer exercises its right of subrogation against a responsible party, but if it does not exercise its right of subrogation against a responsible party, it will be increased by 10%.

Finally, in addition to its right of subrogation, the bill provides that an insurer may seek damages against a responsible party for a climate disaster, extreme weather, or other events attributable to climate change.

Make no mistake: The responsible parties driving climate change are fossil fuel businesses.

SB222 highlights that the real culprit of the climate emergency is the fossil fuel sector. But insurance companies are far from innocent bystanders. By supporting “business as usual” in the fossil fuel sector, insurance companies are facilitating the escalating climate crisis, causing climate change-induced events like the LA fires. When coupled with their representations around protecting policyholders from peril and their justifications for rate hikes and non-renewals, insurers’ conduct violates consumer protection laws and standards.

Insurers must no longer be permitted to invest large portions of premium income in fossil fuel companies and underwrite new oil and gas projects while charging some homeowners more for increased climate risk and simply turning others away. Before any further handouts are given to the insurance industry or any more concessions are made to preserve a profit-driven insurance model that may simply be untenable in the age of climate chaos, insurers must stop fanning the flames.

The four banks that sponsored the FireAid benefit concert were among the world’s largest fossil fuel industry financiers from 2016—when the Paris climate accord went into effect—through 2023.

Stevie Wonder was one of more than two dozen superstars who performed at FireAid, a six-hour benefit concert held late last month to raise money for Los Angeles wildfire victims and, according to event organizers, support “long-term initiatives to prevent future fire disasters throughout Southern California.” Viewed by more than 50 million people around the world, the benefit raised more than $100 million.

Before launching into “Love’s in Need of Love Today,” “Superstition,” and “Higher Ground,” Wonder called for unity in the face of the disaster. “In this world today, we have no time for blaming. We have no time for shaming,” he said. “We need to have prayer and come together as a united people of the world.”

Wonder was likely alluding to the thoroughly debunked lies uttered by then-President-elect Donald Trump, who falsely accused then-President Joe Biden, California Gov. Gavin Newsom, and Los Angeles Mayor Karen Bass of mismanaging resources.

If someone on the FireAid stage had remarked how ironic it was that JPMorgan and Goldman Sachs sponsored the event, 50 million people would have heard about the destructive role they are playing, probably for the first time.

Neither Biden, Newsom, nor Bass were at fault, but with all due respect to Mr. Wonder, it is long past time to blame and shame those who are truly responsible for fueling the climate crisis.

One could of course start with Trump, whose first administration rolled back or dismantled nearly 100 environmental safeguards and who—on day one of his new term—ordered federal agencies to begin gutting protections for the air, water, public lands, and the climate. Republican members of Congress, who have amassed 82% of oil and gas companies’ campaign contributions over the last two decades, are also to blame. And then there’s the fossil fuel industry itself, which was aware of the threat its products pose as early as 1954 but publicly denied the science for decades and funded disinformation campaigns to obstruct and delay government climate action.

Other responsible parties, notably banks and insurance companies, are less obvious. Paradoxically, a handful of them were among FireAid’s corporate sponsors, all of which presumably underwrote the concert to demonstrate their bona fides as caring, public-spirited companies. Joining American Express, Kaiser Permanente, and 20 other corporations were four banks—JPMorgan Chase, Goldman Sachs, UBS, and U.S. Bancorp—and a financial services company—Capital Group—whose investments undermine the concert’s goal of preventing future fire disasters. In fact, the tens of billions of dollars they collectively invest in fossil fuel-related companies annually will make fire disasters in Southern California—and everywhere else—more likely to happen.

The science is clear, regardless of what Donald Trump may claim. Primarily caused by burning fossil fuels, climate change is the “main driver” of an alarming increase in wildfires in the Western United States over the last four decades, according to the findings of a 2021 study in the Proceedings of the National Academy of Sciences (PNAS) sponsored by the National Oceanic and Atmospheric Administration (NOAA).

“During 1984 to 2000, 1.69 million acres burned over 11 states,” NOAA’s PNAS study press release pointed out. “It doubled in size to [approximately] 3.35 million acres during 2001 to 2018. In 2020, the total annual burned area jumped to 8.8 million acres, more than five times of that in 1984 to 2000.”

“Even though wetter and cooler conditions could offer brief respites,” the press release added, “more intense and frequent wildfires and aridification in the Western states will continue with rising temperatures.”

A study published last November in Science Advances found that temperatures out West have indeed continued to rise since NOAA’s 2021 study, causing drought even when the region experienced normal precipitation due to moisture loss from “evaporative demand,” or atmospheric thirst. Once again, researchers predicted more severe, longer-lasting droughts covering wider areas as temperatures increase.

Just two months after the Science Advances study came out, Los Angeles County was engulfed in flames, prompting a multinational team of scientists at World Weather Attribution to produce a quick analysis. They found that, without a doubt, climate change “increased the likelihood of wildfire disaster in highly exposed Los Angeles area.”

The cost of that disaster was astronomical. A preliminary estimate of damages from the LA wildfires by AccuWeather ranged from $250 billion to $275 billion—more than the losses from the entire 2020 U.S. wildfire season. Other analysts estimate that the wildfires will cost insurers anywhere from $10 billion to $40 billion.

The four banks that sponsored FireAid were among the world’s largest fossil fuel industry financiers from 2016—when the Paris climate accord went into effect—through 2023, according to the most recent “Banking on Climate Chaos” annual report, published by a handful of environmental groups in May 2024.

JPMorgan Chase: Although JPMorgan’s investment of $40.8 billion in fossil fuel, utility, and pipeline companies in 2023 was roughly half (in inflation-adjusted dollars) of what it invested in 2016, it is still the largest underwriter of fossil fuel deals. From 2016 through 2023, the bank—the largest in the United States—invested $430.9 billion (in unadjusted dollars), more than any other bank worldwide. Its top client was ExxonMobil, which received $15 billion, more than twice the $6.48 billion the bank poured into TransCanada Pipelines, its second largest investee.

Besides its relatively paltry donation for LA fire victims, JPMorgan is retreating from international efforts addressing the climate crisis.

Goldman Sachs: Goldman Sachs, which invested $184.9 billion from 2016 through 2023, was the 14th largest investor over that eight-year span. Its two biggest clients were the Saudi Arabian Oil Company ($4.38 billion) and Royal Dutch Shell ($3.2 billion). In 2023, Goldman Sachs invested $8.8 billion and was the fourth largest financier of fracking companies.

UBS: The Swiss-based UBS’s investments in fossil fuel-related companies dropped precipitously in 2023 to $8.8 billion, likely due to the bank’s dramatic profit swings, but between 2016 and 2023, it was the world’s 10th largest funder. Over those eight years, it invested $210.7 billion and was the biggest financier of metallurgic coal companies. UBS’s leading investee was Calpine Corporation, the largest U.S. natural gas and geothermal electricity provider, which received nearly $4 billion. Other top clients included Duke Energy ($3.25 billion); Parsley Energy, a natural gas developer ($3.4 billion); and Buckeye Partners, an oil pipeline company ($3 billion).

U.S. Bancorp:U.S. Bancorp—the fifth-largest U.S. bank—was the 28thlargest financier, investing $97.27 billion over the eight years covered by the “Banking on Climate Chaos” report. Among its top investees were Occidental Petroleum ($2.2 billion) and Devon Energy ($1.9 billion). In 2023, U.S. Bancorp invested $12.77 billion and was the ninth biggest financier of fracking companies. (Besides sponsoring FireAid for an undisclosed sum, the company—which has about 200 branches and 4,000 employees in the Los Angeles area—donated a meager $100,000 to the United Way of Greater Los Angeles to help fire victims.)

Capital Group: The fifth financial institution that sponsored FireAid,Capital Group, is one of the world’s largest asset managers. As of May 2024, it held more than $173 billion in shares and bonds in 162 fossil fuel-related companies, including ExxonMobil, Chevron, and Conoco Phillips, according to the 2024 report “Investing in Climate Chaos,” which did not document investments on an annual basis.

JPMorgan, by far the worst of the five financial titans sponsoring FireAid, posed as a good corporate citizen by offering LA fire victims mortgage payment relief and donating $2 million to the American Red Cross, California Community Foundation, and United Way of Greater Los Angeles. But that’s chump change for a bank that posted a record $56.8 billion profit last year, a 19% increase from 2023.

Besides its relatively paltry donation for LA fire victims, JPMorgan is retreating from international efforts addressing the climate crisis. Just days before the bank announced its donation, it announced it was leaving the Net-Zero Banking Alliance, a United Nations-sponsored organization of more than 140 banks from 44 countries that have pledged to align their investments and loans with the goal of attaining net-zero carbon emissions by 2050. A year before, in February 2024, JPMorgan quit Climate Action 100+, a $68-trillion investor organization that advocates for reining in world’s largest corporate carbon emitters to reduce financial risk.

JPMorgan says it left CA 100+ because it hired its own climate risk analysts, but it walked away shortly after the investor group began requiring members to broaden their corporate disclosure and implement climate transition plans, according to ESG Dive, a trade journal. The bank did not cite a reason for leaving the Net-Zero Banking Alliance, but news outlets reported that Republican politicians had been pressuring banks to quit even before Trump, a notorious climate science denier, won the election last November.

A JPMorgan spokesperson promised that the bank would “continue to support the banking and investment needs of our clients who are engaged in energy transition and in decarbonizing different sectors of the economy.” And, to its credit, JPMorgan had already pledged to “finance and facilitate more than $2.5 trillion”—including $1 trillion for renewable energy and other “green initiatives”—by 2030 to “help advance long-term climate solutions and contribute to sustainable development.” In 2023 alone, the company invested $300 billion.

But the company remains the top fossil fuel industry financier and will continue to invest, regardless of the consequences. At a September 2022 congressional hearing, JPMorgan CEO Jamie Dimon, who made $34.5 million that year, was unequivocal. When asked if his company has a policy against funding oil and gas projects, he responded: “Absolutely not. That would be the road to hell for America.” More recently, in April 2024, the company issued a report warning that it will take “decades, or generations, not years” to phase out fossil fuels and hit net-zero targets.

Goldman Sachs, the sixth largest U.S. bank, announced in December 2019 that it would no longer invest in oil development in the Arctic or in thermal coal mines worldwide, a first for a U.S. bank. It also said it would invest $750 billion in sustainability financing, which includes green energy, by 2030.

Environmental groups cheered, but stressed that the bank had a long way to go to align its investments to meet net-zero goals. It still does.

Like his counterpart at JPMorgan, Goldman Sachs CEO David Solomon rejects calls to sever his bank’s ties to the fossil fuel industry. “Traditional energy companies are hugely important to the global economy they are hugely important to Goldman Sachs,” he said in 2023, when he made $31 million, a 24% jump from the previous year. “We are all going to continue to finance traditional companies for a long time.”

Likewise, Goldman Sachs quit CA100+ (last August) and the Net-Zero Banking Alliance (last December). “We have made significant progress in recent years on the firm’s net-zero goals and we look forward to making further progress, including by expanding to additional sectors in the coming months,” the bank said when it departed the alliance. “Our priorities remain to help our clients achieve their sustainability goals and to measure and report on our progress.”

Last year was the hottest on record, beating out the next warmest year—2023. Meanwhile, the 10 warmest years since 1850 have all occurred over the last 10 years. In 2024, global temperatures exceeded the pre-industrial (1850 to 1900) average by 2.63°F (1.46°C), only slightly less than the Paris climate agreement’s ambitious goal of limiting the worldwide temperature increase to less than 1.5°C above pre-industrial levels to avoid the worst consequences of climate change.

The hotter it gets, the more likely such devastating events as the Los Angeles wildfires and Hurricane Helene will be decidedly worse. More neighborhoods will be wiped out. More people will lose their homes. More will die.

Regardless, the world’s largest banks have failed to keep their pledge to support the central aim of the Paris accord, according to a new report by research firm Bloomberg New Energy Finance. BNEF analysts calculated that the ratio of financing green energy and infrastructure relative to financing fossil fuel-related ventures must reach 4 to 1 by 2030 to keep any temperature rise below 1.5°C. Since 2016, BNEF found, banks have invested nearly $6 trillion in fossil fuels but only $3.8 trillion in green energy. That’s a trifling 0.63 to 1 ratio. For every dollar invested in fossil fuels, only 63 cents went to clean energy.

The banking ratio is only slightly better now. In 2023, it was 0.89 to 1, according to BNEF, a minor improvement over 2022, when it was 0.74 to 1. And for all that JPMorgan crows it invests in “green initiatives,” its energy-supply banking ratio in 2023 was a measly 0.80 to 1, and it is doubtful that the bank will start investing four times more in green enterprises than in fossil fuel companies anytime soon.

Regardless, JPMorgan, Goldman Sachs, and the other financial firms that sponsored FireAid and donated to local nonprofits aiding fire victims want to be seen as good guys. They correctly assume that the general public has no idea that their investments are ruining the planet. After all, the mainstream news media rarely, if ever, report on this topic, and the trade press that does is mainly read by industry insiders.

So no matter how heartfelt, Stevie Wonder—a celebrated humanitarian in his own right—was wrong. We should call out the people and corporations responsible for the climate crisis. If someone on the FireAid stage had remarked how ironic it was that JPMorgan and Goldman Sachs sponsored the event, 50 million people would have heard about the destructive role they are playing, probably for the first time. A column like this one, unfortunately, does not have that kind of reach.

This column was originally posted on Money Trail, a new Substack site co-founded by Elliott Negin.