SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

One-hundred S&P 500 firms with the lowest median wages, a group we’ve dubbed the “Low-Wage 100,” blew $522 billion over the past five years on stock buybacks.

The Lowe’s home improvement store spent $43 billion on stock buybacks over the past five years. With that sum, the big box chain could’ve given each of its 285,000 employees a $30,000 bonus every year between 2019 and 2023.

The extra cash would’ve meant a lot to Lowe’s workers—half of whom make less than $33,000 per year. Meanwhile, the retailer’s CEO, Marvin Ellison, raked in $18 million in 2023.

The evidence is stark. CEOs of leading U.S. corporations are focused on short-term windfalls for themselves and wealthy shareholders rather than on long-term prosperity for their workers—or their companies.

Another sign of Lowe’s skewed priorities? The company plowed nearly five times as much cash into buybacks as it invested in long-term capital expenditures like store improvements and technology upgrades over the past five years.

Lowe’s ranks as an extreme example of a corporate model focused on pumping up CEO pay at the expense of workers and long-term investment. But such skewed priorities are actually the norm among America’s leading low-wage corporations.

This year’s edition of the annual Institute for Policy Studies Executive Excess report finds that the 100 S&P 500 firms with the lowest median wages, a group we’ve dubbed the “Low-Wage 100,” blew $522 billion over the past five years on stock buybacks. Nearly half of these companies spent more on this once-illegal financial maneuver than they spent on capital investment vital to long-term competitiveness.

Why the fixation on buybacks? This is a CEO pay-inflating financial scam, pure and simple. When companies repurchase their own shares, they artificially boost share prices and the value of the stock-based compensation that makes up about 80% of CEO pay. An SEC investigation confirmed that CEOs regularly time the sale of their personal stock holdings to cash in on the price surge that typically follows a buyback announcement.

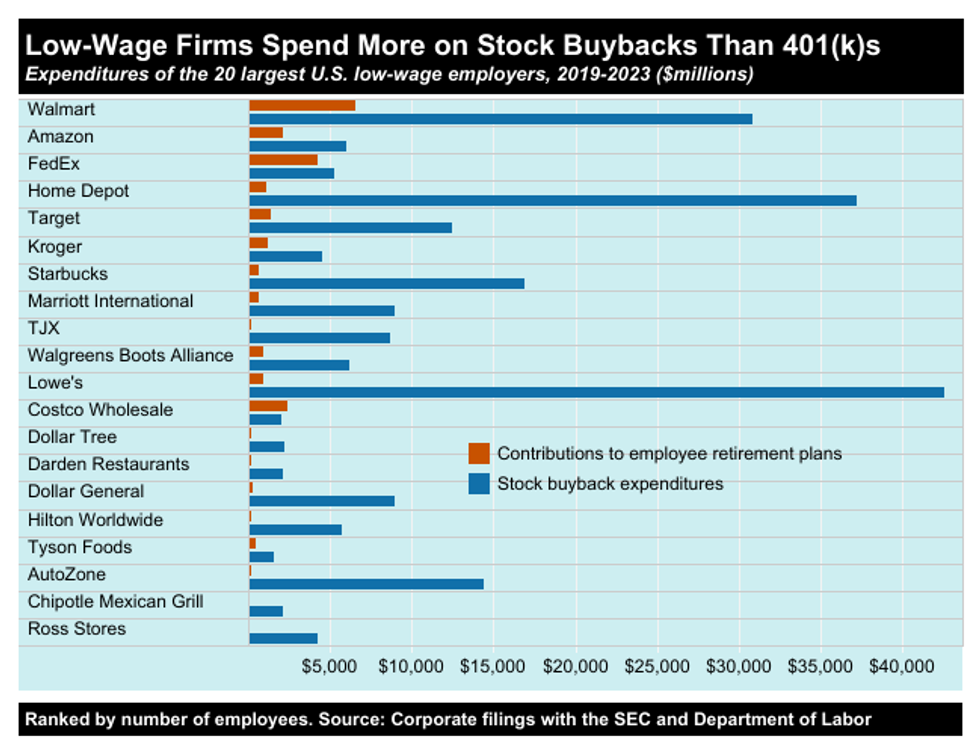

Our Executive Excess report also looks at low-wage corporations’ expenditures on employee retirement security. The answer? Peanuts, compared to their buyback outlays.

The country’s 20 largest low-wage employers spent nine times as much on stock buybacks as on worker retirement plan contributions over the past five years. Many of these firms boast of their “generous” matching benefits, typically a dollar-for-dollar match of 401(k) contributions up to 4% of salary. But matching is meaningless for workers who earn so little they can’t afford to set aside anything for what should be their “golden years.”

Take Chipotle, for instance. The Mexican fast food chain spent over $2 billion on stock buybacks over the past five years—48 times as much as the firm contributed to employee retirement plans. Meanwhile, 92% of Chipotle workers who are eligible to participate in the company’s 401(k) have zero balances. That’s hardly surprising, since the chain’s median annual pay is just $16,595.

The evidence is stark. CEOs of leading U.S. corporations are focused on short-term windfalls for themselves and wealthy shareholders rather than on long-term prosperity for their workers—or their companies.

As UAW President Shawn Fain put it in his primetime DNC convention speech: “Corporate greed turns blue-collar blood, sweat, and tears into Wall Street stock buybacks and CEO jackpots.”

Public outrage over CEO shakedowns helped the UAW win strong new contracts last year with the Big Three automakers. Support for policy solutions is growing as well. The Democratic Party platform calls for quadrupling a new tax on stock buybacks. And a recent poll shows huge majority support among Democrats, Republicans, and Independents alike for proposed tax hikes on corporations with huge CEO-worker pay gaps. The Executive Excess 2024 report offers an extensive menu of additional commonsense CEO pay reforms.

It’s important to remember that it hasn’t always been this way. Forty years ago, big company CEO pay was only about 40 times higher than worker pay—not several hundreds of times higher, as is typical today. And just 20 years ago, most big companies spent very little on stock buybacks. At Lowe’s, for example, buyback outlays between 2000 and 2004 were exactly zero.

Corporate America’s perverse fixation on enriching those at the top is bad for workers and bad for the economy. With pressure from below, we can change that.

CEOs argue they just don’t have the money to hire more workers or pay family-supporting wages. But their actions say something else.

Ever get mad at a delivery driver for bringing your pizza late? I used to. Now I assume it’s late because an overpaid boss is probably making two employees do the job of 10.

What changed? I worked for two years at a company with the kind of chronic understaffing that plagues many of America’s largest retailers and fast food corporations.

My job was to build merchandise displays at Lowe’s, the home improvement chain. I wasn’t supposed to deal directly with customers. But when people asked me for help, I was often the only employee available. So I wound up doing everything from sawing lumber to cutting keys—all the while worrying about finishing my assigned projects.

CEOs say buybacks are a good way to return “excess cash” to shareholders. I’m pretty sure frontline workers could come up with far better ideas for investing those billions

Such understaffing leads to frustration for customers and burnout for employees who have to hustle like mad for a paycheck that barely covers their bills. CEOs argue they just don’t have the money to hire more workers or pay family-supporting wages. But their actions say something else.

A new report by the Institute for Policy Studies shows that Lowe’s spent nearly $35 billion over the past three and a half years on stock buybacks. This is when a company takes money that could go towards worker wages or other productive investments and uses it to artificially inflate the value of their stock—and the value of their CEO’s stock-based pay.

In 2022 alone, Lowe’s spent $14.1 billion on buybacks. That would’ve been enough to give every one of the company’s 301,000 U.S. employees a $46,923 bonus. Instead, a typical Lowe’s worker made less than $30,000.

And the CEO? He’s sitting on company stock worth about $108 million.

Other big retailers aren’t much different. Walmart, Home Depot, Target, Dollar General, and Best Buy all spent more than $5 billion on stock buybacks over the past few years.

CEOs say buybacks are a good way to return “excess cash” to shareholders. I’m pretty sure frontline workers could come up with far better ideas for investing those billions. But nobody’s asking them. None of these big retailers are unionized, meaning their workers have no voice in major decisions affecting their lives.

That’s why a few co-workers and I started organizing at our Lowe’s store in New Orleans in 2022.

We wanted a way to address understaffing, unfair pay, and a lack of grievance protections. We were tired of seeing employees have no recourse after getting fired for showing up a few minutes late for reasons beyond their control, like a broken-down bus or a child-care crisis.

Not surprisingly, the road to organizing the first big box store union has been bumpy. We’re proud that we overcame intense management opposition and gathered enough signatures on a petition to form a union. We also helped pressure Lowe’s to give out some modest raises and bonuses.

But due to a technicality, we had to withdraw our petition. And then, a couple months ago, I was fired in what I believe was retaliation for my pro-union activities. The National Labor Relations Board has already ruled against Starbucks and Amazon for illegally firing union organizers. They are now investigating my firing and several other complaints about Lowe’s labor practices.

The deck is clearly stacked against ordinary workers at big powerful corporations. But we know that every employee contributes to the value of a company—not just the CEO. And we will keep fighting for the respect we deserve.

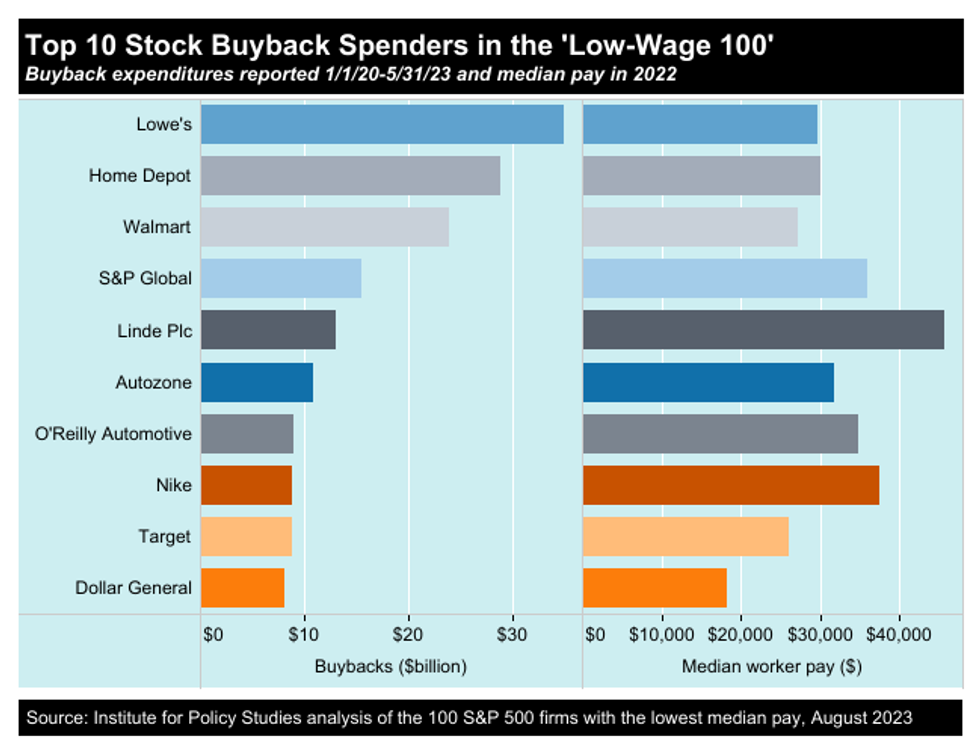

Between January 1, 2020, and May of this year, the 100 S&P 500 corporations with the lowest median worker pay reported a combined $341 billion in stock buyback spending.

In response to strikes and union organizing drives, corporate leaders routinely insist that they simply lack the wherewithal to raise employee pay. And yet top executives seem to have little trouble finding resources for enriching themselves and wealthy shareholders.

In 2021 and 2022, S&P 500 corporations spent record sums on stock buybacks, a maneuver that pumps up stock prices by reducing the supply on the open market. Since stock-based pay makes up the bulk of executive compensation, CEOs reap huge—and completely undeserved—windfalls.

CEOs could watch cat videos all day and still reap huge windfalls through stock buybacks.

A new Institute for Policy Studies report, Executive Excess 2023, reveals how these financial shenanigans have widened disparities at the 100 S&P 500 corporations with the lowest median worker pay, a group we’ve dubbed the “Low-Wage 100.”

Between January 1, 2020, and May of this year, these companies reported a combined $341 billion in stock buyback spending.

Lowe’s led the buybacks list, plowing nearly $35 billion into share repurchases over the past three and a half years. In 2022 alone, Lowe’s spent more than $14 billion on buybacks—enough to give every one of its 301,000 U.S. employees a $46,923 bonus.

The idea that the person in the corner office is hundreds of times more valuable than other employees is a myth—even if that person is not just watching cat videos.

I’m guessing rank-and-file Lowe’s employees, half of whom make less than $30,000 per year, could find more productive uses for that money.

During their stock buyback spree, Low-Wage 100 CEOs’ personal stock holdings increased more than three times as fast as their firms’ median worker pay. At the 65 buyback companies where the same person held the top job between 2019 and 2022, the Low-Wage 100 CEOs’ personal stock holdings soared 33% to an average of $184.7 million. Median pay at these firms rose only 10% to an average of $31,972.

FedEx founder and CEO Frederick Smith has the largest stockpile in the Low-Wage 100. With $3.6 billion in stock buybacks since January 2020, Smith’s personal stock holdings have grown 65% to more than $5 billion. By contrast, median pay for workers at the notoriously anti-union company fell by 20% to $39,177 during this period.

What makes all this even more upsetting? Taxpayers are actually supporting, through federal contracts, the buyback-fueled disparities at FedEx and 50 other Low-Wage 100 firms.

FedEx pocketed $6.2 billion in fiscal years 2020-2023 for mail services for the Veterans Administration and other agencies. The largest federal contractor in the Low-Wage 100 is another company known for union-busting—Amazon. Over the past few years, Amazon has pocketed more than $10 billion in web services deals from Uncle Sam while spending nearly $6 billion repurchasing their shares.

Fortunately, support is growing for solutions to our CEO pay problem.

Before 1982, stock buybacks were viewed as market manipulation and largely banned. President Joe Biden hasn’t yet called for reinstating that ban, but he did rail against buybacks in his State of the Union address this year and called for quadrupling a new 1% excise tax on share repurchases.

The Biden administration is also starting to use federal money going to corporations as a lever for change. In an important first step, the administration is giving preferential treatment in the awarding of new semiconductor manufacturing subsidies to companies that agree to give up buybacks. Now they should extend that policy to all corporations receiving taxpayer money.

Buybacks are not the only trick CEOs can use to inflate their own paychecks. Over my decades of research, I’ve documented how corporate leaders have used myriad shady means to hit personal jackpots, from cooking the books and moving executive bonus goalposts to creating housing bubbles and other reckless financial schemes.

To tackle this systemic problem, policymakers need to go bolder. Executive Excess 2023 offers an extensive menu of CEO pay reforms. One of the most innovative: tax penalties for companies with huge CEO-worker pay gaps. Two major cities—San Francisco and Portland, Oregon—are already generating significant revenue through such taxes. Seattle is now considering a similar approach.

The idea that the person in the corner office is hundreds of times more valuable than other employees is a myth—even if that person is not just watching cat videos. All employees contribute to the profits of a corporation, and our economy would be far healthier if the fruits of our labor were more equitably shared.