Trump CFPB Moves to Bar States From Wiping Medical Debt Off Credit Reports

One consumer advocate said the effort adds "salt to the wound" as tens of millions of people face healthcare premium spikes that are likely to worsen the nation's medical debt crisis.

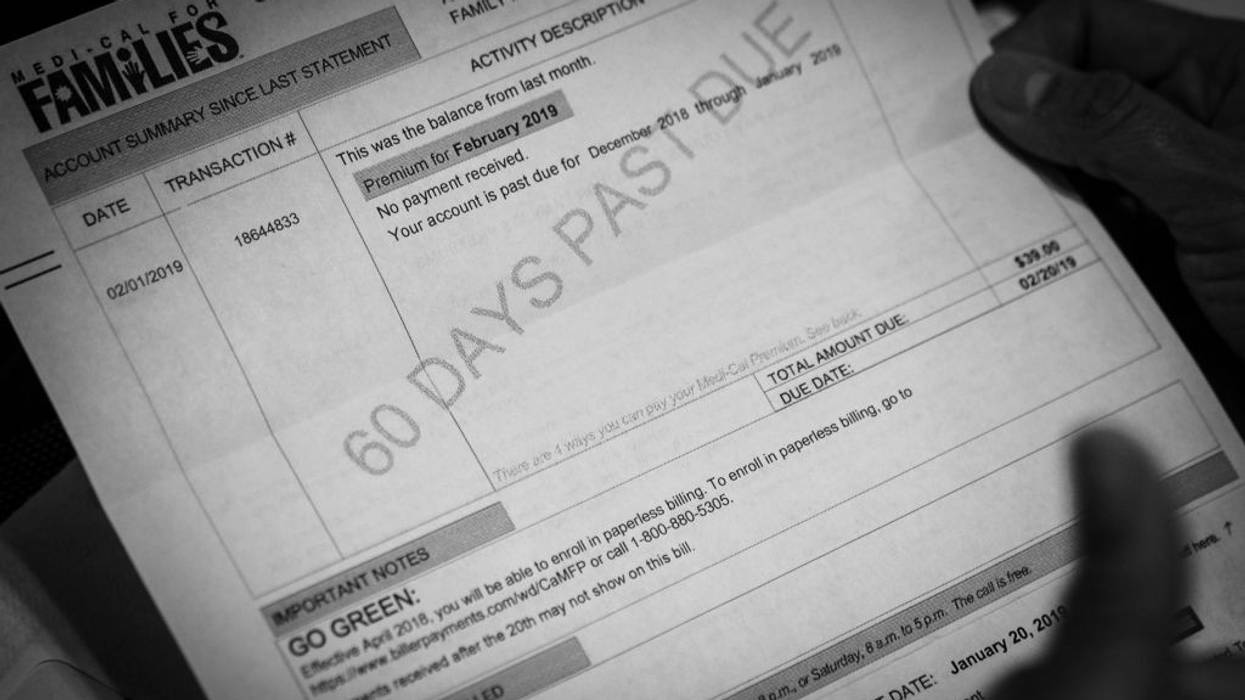

The Trump administration is moving to undercut state-level efforts to wipe medical debt from Americans' credit reports, just as millions across the country are facing massive healthcare premium increases stemming from congressional Republicans' refusal to extend Affordable Care Act subsidies.

On Tuesday, according to reporting by The Lever and Bloomberg Law, the Russell Vought-led Consumer Financial Protection Bureau (CFPB) will publish a nonbinding interpretive rule arguing that federal statute "generally preempts state laws that touch on areas of credit reporting."

The guidance aligns with views expressed by a Trump-appointed federal judge in Texas who, earlier this year, vacated a Biden-era CFPB rule that would have prohibited the inclusion of medical debt on consumer credit reports. The Trump administration, which has repeatedly violated court orders, is complying with the decision.

Medical debt is a growing crisis in the United States: Roughly 14 million adults owe more than $1,000 in medical debt, and an estimated 20% of Americans have medical debt on their credit reports.

Supporters of removing medical debt from credit reports argue it is not a reliable measure of creditworthiness. The Center for Consumer Law & Economic Justice at UC Berkeley notes that "medical debt often reflects the simple misfortune of getting sick unexpectedly and having to face a medical system that is rife with insurance stonewalling, delay, and mistakes."

More than a dozen states—including California, Colorado, and New York—have moved to curb the reporting of medical debt, which accounts for a significant percentage of personal bankruptcies in the US.

The Lever reported that the Trump administration's position that federal law overrides state laws is being echoed "by industry groups to advance their ongoing litigation to overturn the 15 state laws."

"For example," the outlet observed, "the Consumer Data Industry Association, which represents credit reporting companies like Equifax, Experian, and TransUnion, is likewise arguing that federal laws void state-level regulations of their conduct as part of their effort to block Maine's medical debt law."

Chi Chi Wu, an attorney at the National Consumer Law Center, told Bloomberg Law that the Trump CFPB's assault on efforts to remove medical debt from credit reports adds "salt to the wound" as tens of millions of people face surging healthcare premiums.

Writing for MSNBC over the weekend, Century Foundation president Julie Margetta Morgan warned that "the spike in premiums won't just blow an even bigger hole in families' future budgets."

"It will pour gasoline on the already raging fire of medical debt in this country," she added, "and government leaders at all levels are not prepared for it."