Trump Pick to Replace Lina Khan Vowed to End 'War on Mergers'

"Andrew Ferguson is a corporate shill who opposes banning noncompetes, opposes banning junk fees, and opposes enforcing the Anti-Merger Act," said one antitrust attorney.

President-elect Donald Trump's pick to lead the Federal Trade Commission vowed in his job pitch to end current chair Lina Khan's "war on mergers," a signal to an eager corporate America that the incoming administration intends to be far more lax on antitrust enforcement.

Andrew Ferguson was initially nominated by President Joe Biden to serve as a Republican commissioner on the bipartisan FTC, and his elevation to chair of the commission will not require Senate confirmation.

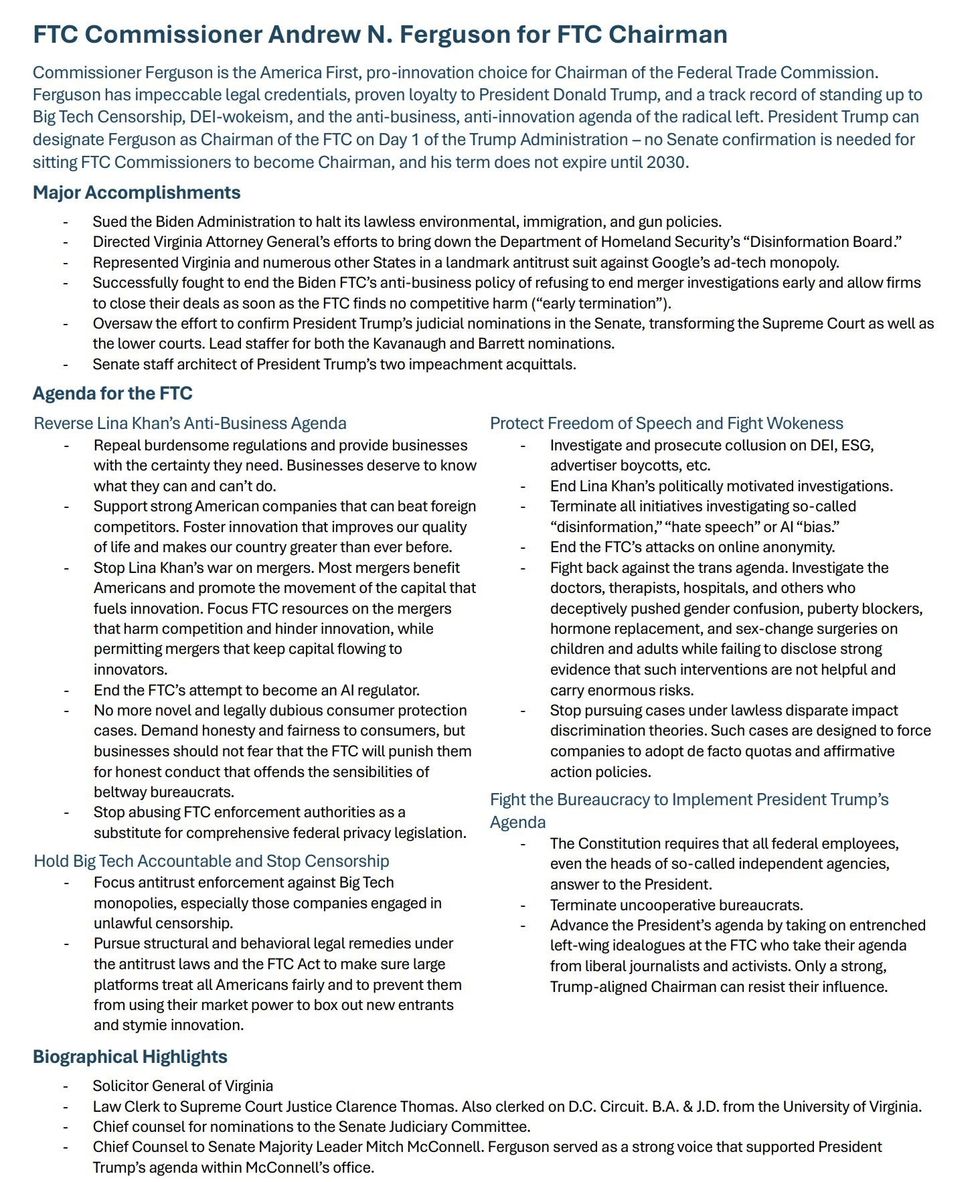

In a one-page document obtained by Punchbowl, Ferguson—who previously worked as chief counsel to Sen. Mitch McConnell (R-Ky.)—pitched himself to Trump's team as the "pro-innovation choice" with "impeccable legal credentials" and "proven loyalty" to the president-elect.

Ferguson's top agenda priority, according to the document, is to "reverse Lina Khan's anti-business agenda" by rolling back "burdensome regulations," stopping her "war on mergers," halting the agency's "attempt to become an AI regulator," and ditching "novel and legally dubious consumer protection cases."

Trump announced Ferguson as the incoming administration's FTC chair as judges in Oregon and Washington state

blocked the proposed merger of Kroger and Albertsons, decisions that one antitrust advocate called a "fantastic culmination of the FTC's work to protect consumers and workers."

According to a recent

report by the American Economic Liberties Project, the Biden administration "brought to trial four times as many billion-dollar merger challenges as Trump-Pence or Obama-Biden enforcers did," thanks to "strong leaders at the FTC" and the Justice Department's Antitrust Division.

In a letter to Ferguson following Trump's announcement on Tuesday, FTC Commissioners Alvaro Bedoya and Rebecca Kelly Slaughter wrote that the document obtained and published by Punchbowl "raises questions" about his priorities at the agency mainly "because of what is not in it."

"Americans pay more for healthcare than anyone else in the developed world, yet they die younger," they wrote. "Medical bills bankrupt people. In fact, this is the main reason Americans go bankrupt. But the document does not mention the cost of healthcare or prescription medicine."

"If there was one takeaway from the election, it was that groceries are too expensive. So is gas," the commissioners continued. "Yet the document does not mention groceries, gas, or the cost of living. While you have said we're entering the 'most pro-worker administration in history,' the document does not mention labor, either. Americans are losing billions of dollars to fraud. Fraudsters are so brazen that they impersonate sitting FTC commissioners to steal money from retirees. The word 'fraud' does not appear in the document."

"The document does propose allowing more mergers, firing civil servants, and fighting something called 'the trans agenda,'" they added. "Is all of that more important than the cost of healthcare and groceries and gasoline? Or fighting fraud?"

As an FTC commissioner, Ferguson voted against rules banning anti-worker noncompete agreements and making it easier for consumers to cancel subscriptions. Ferguson was also the only FTC member to oppose an expansion of a rule to protect consumers from tech support scams that disproportionately impact older Americans.

"Andrew Ferguson is a corporate shill who opposes banning noncompetes, opposes banning junk fees, and opposes enforcing the Anti-Merger Act," said Basel Musharbash, principal attorney at Antimonopoly Counsel. "Appointing him to chair the FTC is an affront to the antitrust laws and a gift to the oligarchs and monopolies bleeding this country dry."