SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

"Poverty is a policy choice," Rep. Rashida Tlaib argued. "The End Child Poverty Act will create a universal child assistance program and ensure that every child has the resources they need to reach their full potential."

A trio of progressive U.S. lawmakers on Thursday reintroduced legislation that advocates say would slash the nation's child poverty rate by nearly two-thirds.

Reps. Rashida Tlaib (D-Mich.), Ilhan Omar (D-Minn.), and Jesús "Chuy" García (D-Ill.) revived the End Child Poverty Act, which was first introduced by Tlaib and then-Rep. Mondaire Jones (D-N.Y.) in February 2022.

If passed and signed into law by President Joe Biden, the legislation would replace the Child Tax Credit (CTC) and the child provisions in the Earned Income Tax Credit with a Universal Child Benefit paying families $393 per month per child.

People's Policy Project, a progressive think tank and one of five organizations supporting the bill, estimates that the legislation would reduce U.S. child poverty by 64% and deep child poverty—defined as living in a household with a total cash income below 50% of its poverty threshold—by 70%.

"Poverty is a policy choice," Tlaib said in a statement. "The End Child Poverty Act will create a universal child assistance program and ensure that every child has the resources they need to reach their full potential."

\u201cPoverty is a policy choice. One in every five children in Michigan lives below the poverty line. I'm introducing the End Child Poverty Act to create a universal child assistance program and ensure that every child has the resources they need to thrive.\nhttps://t.co/4yDToulhkZ\u201d— Congresswoman Rashida Tlaib (@Congresswoman Rashida Tlaib) 1680811184

"The expanded Child Tax Credit lifted 2.9 million children out of poverty and cut child poverty in nearly half, but now that it has expired, too many families are struggling to make ends meet," she added. "In the richest country in the history of the world, no family should have to choose between keeping a roof over their head and putting food on the table to feed their children."

Federal data released last year showed the U.S. child poverty rate nearly halved from 9.7% in 2020 to 5.2% in 2021, thanks largely to the CTC expansion included in the American Rescue Plan pandemic relief package signed by Biden in March 2021. The CTC expansion expired at the end of 2022.

Omar said: "In the midst of a devastating pandemic, President Biden and Democrats in Congress took dramatic action to help families in my district stay afloat—expanding life-changing benefits like Medicaid and SNAP, and expanding the child tax credit to finally benefit the most vulnerable among us. This action alone cut child poverty nearly in half."

\u201cIn the wake of the expanded Child Tax Credit expiring, @RashidaTlaib, @IlhanMN and @ChuyChicago have a new bill to create a universal child benefit\u2014$4,700 a year for every child. Would cut child poverty by nearly 2/3rds.\n\nIt's really good!\nhttps://t.co/XCUMOvuE4o\u201d— Jeremy Slevin (@Jeremy Slevin) 1680809294

"It is a tragedy that we let the child tax credit expansion expire," Omar continued. "I am thrilled that Minnesota plans to expand the state's child tax credit, but Congress must take federal action to address child poverty and help millions of families afford basics like food, rent, childcare, and healthcare."

A fact sheetreleased by Tlaib's office stated that because the program would be universal and include no income phase-ins or phase-outs, children in the U.S. would be "automatically enrolled at birth, and every family would receive a monthly payment for every child they are currently caring for" until the age of 18.

"This universal child benefit proposal would dramatically simplify our nation's child benefit system and provide financial security for all families when they have a child," said Matt Bruenig, founder of the People's Policy Project.

Tlaib contended: "The End Child Poverty Act would cut childhood poverty by nearly two-thirds. It is exactly the type of bold action our party should be championing to finally address child poverty in this country and make sure families aren't going hungry in one of the wealthiest countries in the world."

"It is a tragedy that we let the child tax credit expansion expire."

Noting the "442,000 children living in poverty in Illinois," García said that "this crucial legislation provides financial security for families living paycheck to paycheck."

"We must continue to work towards reducing child poverty," he added, "and ensure every family has the opportunity to thrive in this country."

The reintroduction of the End Child Poverty Act comes a little over a month after 30 million people across the United States had their family's Supplemental Nutrition Assistance Program food benefits slashed, despite high prices driven by corporate greed and inflation and experts' warnings about a looming "hunger cliff."

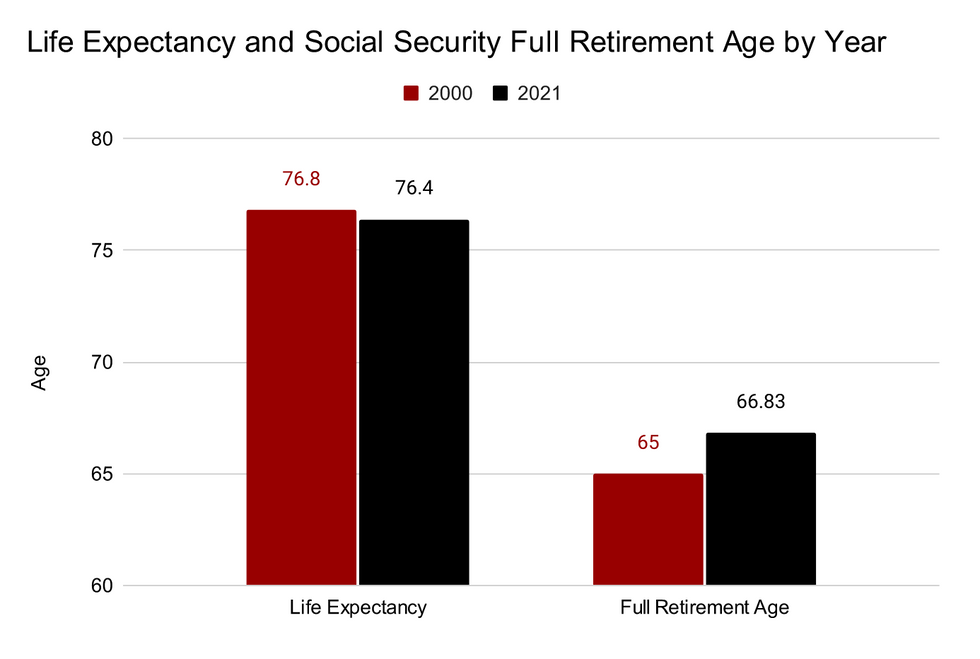

Life expectancy in the U.S. fell during the same period that a Reagan-era law raised the retirement age by two years.

In 1983, just before signing legislation that cut Social Security benefits, then-President Ronald Reagan declared that "we're entering an age when average Americans will live longer and live more productive lives."

But Reagan's assumption of ever-rising life expectancy in the U.S. turned out to be false, according to a new analysis, a fact with painful consequences for those who saw their Social Security benefits pared back thanks to the 1983 law's gradual increase of the full retirement age—the age at which one is eligible for unreduced Social Security payments.

As Conor Smyth wrote Monday for the People's Policy Project, a left-wing think tank, the Social Security Amendments of 1983 hiked the full retirement age "from 65 in 2000 to 67 at the end of 2022."

"What this actually meant was not that the age at which people could retire and start drawing Social Security benefits changed—that remained at 62," Smyth explained. "Instead, by raising what's called the full retirement age (FRA) by two years, the law effectively cut benefit levels across the board, regardless of the age that any particular individual began claiming Social Security benefits. The result is that those retiring at 62 today face a 50% greater penalty for retiring before the change than they would have before 2000."

The 1983 law was an outgrowth of a special presidential commission headed by Alan Greenspan, a right-wing economist who would go on to serve as chair of the Federal Reserve for nearly two decades.

Smyth noted that before final passage of the measure—which cleared the House and Senate with bipartisan support, including from then-Sen. Joe Biden—"a popular argument for raising the retirement age was that life expectancy had increased, so people should work for longer."

"The presumption was that the increase in life expectancy since Social Security's implementation would continue as the retirement age rose. But, in reality, something peculiar happened," Smyth wrote. "Over the same period during which the 1983 law forced the retirement age up from 65 to 67, life expectancy in the U.S. actually declined. In 2000, U.S. life expectancy was 76.8 years. According to data released last December, life expectancy in 2021 was 76.4 years. This was the second consecutive year of significant life expectancy decline."

"That's a drop of 0.4 years over a time span when the FRA rose by nearly two years," Smyth observed. "So not only have Americans seen their benefits cut by an increase in the FRA, they now also face a particularly morbid version of a benefit cut in the form of shorter lives."

The new analysis comes as some congressional Republicans are openly advocating further increases in the retirement age, with one GOP lawmaker recently declaring that people "actually want to work longer."

In a policy agenda released last year, the House Republican Study Committee (RSC) echoed Reagan-era arguments in favor of raising the full retirement age to 70—a change that would cut Social Security benefits across the board at a time when many retirees are struggling to afford basic necessities.

The RSC agenda states that Republican legislation known as the Social Security Reform Act would "continue the gradual increase of the normal retirement age that current law has set in motion at a rate of three months per year until it is increased by three years for those reaching age 62 in 2040, 18 years from now."

"This adjustment," the document claims, "would begin to realign the Social Security full retirement age to account for increases in life expectancy since the program's creation."

President Biden and congressional Democrats have pledged to reject any proposed cuts to Social Security, which Republicans have threatened to pursue in exchange for a deal to raise the debt ceiling.

In addition to urging Biden and Democratic lawmakers to stand firm against Social Security cuts, advocates are calling on the president to embrace a Social Security expansion plan such as the one recently proposed by Sens. Bernie Sanders of Vermont and Elizabeth Warren of Massachusetts, which would fund benefit increases by raising the payroll tax cap so that wealthier Americans contribute a more equal share to the program.

"President Biden campaigned on a promise to expand Social Security's modest benefits, while dedicating more revenue to it. Most Democratic senators and members of the House support that as well. Yet the mainstream media fails to take those proposals seriously," Nancy Altman, president of the advocacy group Social Security Works, wrote in an op-ed for Common Dreams last week.

"If the Biden administration championed an expansion plan, unveiled at a White House event with major stakeholders in attendance," Altman added, "that could not be ignored."

Rep. James Clyburn, the third-ranking Democrat in the House, said Thursday that he would be willing to support Sen. Joe Manchin's proposal to further restrict eligibility for the expanded child tax credit, a program that expired last month thanks in large part to the West Virginia senator's opposition.

In an interview with the Washington Post, Clyburn (D-S.C.) said that during negotiations over Democrats' stalled Build Back Better package, "Manchin made it very clear that he had a problem... not with the child tax credit per se, but he wanted to see it means tested."

"Means testing equals more bureaucracy, red tape, and waste."

"I'm not opposed to that," Clyburn said. "Who would oppose that? So, I would like to see him come forward with a bill for the child tax credit that's means tested. I think it would pass."

In fact, many--including dozens of Clyburn's fellow House Democrats--have voiced opposition to Manchin's demand for a lower income cut-off for the program, which lawmakers and the Biden White House are aiming to revive in some form.

In October, 27 members of the Congressional Progressive Caucus sent a letter to House Speaker Nancy Pelosi (D-Calif.) making the case for universal programs and warning against "complicated methods of means testing that the wealthy and powerful will use to divide us with false narratives about 'makers' and 'takers.'"

Manchin himself has made use of such pernicious narratives, telling colleagues behind closed doors that he believes some parents used the boosted child tax credit payments to buy drugs. Survey data shows parents largely used the monthly checks--up to $300 per child under the age of six and $250 per child between the ages of six and 17--for food and other necessities.

During an appearance on a West Virginia radio show on Thursday, Manchin reiterated his view that any child tax credit expansion Democrats pursue in the future must be "targeted" toward those who "make $75,000 or less" per year. According toAxios, Manchin had previously told the White House that "the child tax credit must include a firm work requirement and family income cap in the $60,000 range."

The expired, poverty-reducing program was already means tested, limiting eligibility to married couples who earned $150,000 or less annually and single parents who earned $75,000 or less.

\u201cThe other way you know Manchin doesn't know what he's talking about is that he wants "means testing" on the extension of the Child Tax Credit, when there is *already means testing* on the current CTC (starting at $75k for single parents/$150k for couples).\u201d— David Dayen (@David Dayen) 1631107111

After the boosted version lapsed at the end of 2021, the child tax credit reverted to its earlier form, which provides annual lump-sum payments but excludes the poorest families.

As Vox's Li Zhou wrote in October, Manchin's mean testing push "overlooks a few problems," including that "means-tested benefits can actually be more expensive to provide, harder to sell politically, and less effective than universal social programs, and they can place both a social stigma and discouraging bureaucratic requirements on Americans in need."

Rep. Alexandria Ocasio-Cortez (D-N.Y.) similarly argued at the time that "means testing equals more bureaucracy, red tape, and waste."

"That's why programs where means testing gets implemented are less popular, not more popular," she added. "It's also why many people who are eligible for means-tested programs still don't get healthcare or help at all--it's too hard."

As Matt Bruenig, founder of the People's Policy Project and a trenchant critic of means testing, put it recently, "There is literally not a single thing that the means-tested approach is better at than the universal approach."

"When understood properly, the means-tested approach costs the exact same amount of money and has a massive list of negatives that the universal approach does not," Bruenig wrote last month. "It is a completely indefensible approach to benefit design."