SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

"If the 4.8% fall in S&P 500 futures at the Asian opening isn't reversed, then it's on course for its worst three-day selloff since the Black Monday crash of October 1987."

U.S. President Donald Trump late Sunday openly embraced the global chaos sparked by his sweeping tariffs, careening headlong into a potentially catastrophic trade war as worldwide financial markets plummeted and American retirees began to panic.

In a post on his social media platform, Trump declared that his tariffs are "already in effect, and a beautiful thing to behold."

"Some day people will realize that Tariffs, for the United States of America, are a very beautiful thing!" Trump wrote as recent retirees and people near retirement expressed fear and astonishment at the swift damage the president's policy decisions have done to their investment accounts.

One retiree, a 68-year-old former occupational health worker in New Jersey, toldNBC News that she is "just kind of stunned, and with so much money in the market, we just sort of have to hope we have enough time to recover."

"What we've been doing is trying to enjoy the time that we have, but you want to be able to make it last," the retiree, identified as Paula, said on Friday. "I have no confidence here."

Trump's post doubling down on his tariff regime came as Asian markets cratered and U.S. stock futures opened bright red, signaling that Monday will bring another broad sell-off in equities. One of Trump's top economic advisers claimed in a Sunday interview that the president is not intentionally crashing the stock market, even as Trump—returning from a weekend golf outing in Florida—characterized the tariffs as "medicine."

"I don't want anything to go down," the president said. "But sometimes you have to take medicine to fix something."

Bloomberg's John Authers wrote early Sunday that "if the 4.8% fall in S&P 500 futures at the Asian opening isn't reversed, then it's on course for its worst three-day selloff since the Black Monday crash of October 1987."

Though the stock market and the economy are not synonymous, economist Josh Bivens recently noted that they are currently "mirroring each other: Stock market weakness is reflecting broader economic weakness."

"While the stock market isn't the economy, the stock market declines we have seen in recent weeks are genuinely worrying," wrote Bivens, the chief economist at the Economic Policy Institute. "They are a symptom of much larger dysfunctional macroeconomic policy that will likely soon start showing up in higher unemployment and slower wage growth for the vast majority."

From the highest offices in politics to the smallest janitorial offices, older Americans are delaying retirement for a host of reasons from pride to financial precarity to a fear of being left behind.

The Washington Post headline reads: “A big problem for young workers: 70- and 80-year-olds who won’t retire.” For the first time in history, reports Aden Barton, five generations are competing in the same workforce. His article laments a “demographic traffic jam” at the apexes of various employment pyramids, making it ever harder for young people “to launch their careers and get promoted” in their chosen professions. In fact, actual professors (full-time and tenure-track ones, presumably, rather than part-timers like me) are Exhibit A in his analysis. “In academia, for instance,” as he puts it, “young professionals now spend years in fellowships and postdoctoral programs waiting for professor jobs to open.”

I’ve written before about how this works in the academic world, describing college and graduate school education as a classic pyramid scheme. Those who got in early got the big payoff—job security, a book-lined office, summers off, and a “sabbatical” every seven years (a concept rooted in the Jewish understanding of the sabbath as a holy time of rest). Those who came late to the party, however, have ended up in seemingly endless post-doctoral programs, if they’re lucky, and if not, as members of the part-time teaching corps.

For the most part, I’m sympathetic to Barton’s argument. There are too many people who are old and in the way at the top of various professional institutions—including our government (where an 81-year-old, under immense pressure, just reluctantly decided not to try for a second term as president, while a 77-year-old is still stubbornly running for that same office). But I think Barton misses an important point when he claims that “older workers are postponing retirement… because they simply don’t want to quit.” That may be true for high earners in white-collar jobs, but many other people continue working because they simply can’t afford to stop. Research described in Forbes magazine a few years ago showed that more than one-fifth of workers over age 55 were then among the working poor. The figure rose to 26% for women of that age, and 30% for women 65 and older. In other words, if you’re still working in your old age, the older you are, the more likely it is that you’re poor.

Older workers also tend to be over-represented in certain low-paying employment arenas like housecleaning and home and personal healthcare. As Teresa Ghilarducci reported in that Forbes article:

Nearly one-third of home health and personal care workers are 55 or older. Another large category of workers employing a disproportionate share of older workers is maids and housekeeping cleaners, 29% of whom are 55 or older and 54% of whom are working poor. And older workers make up 34% of another hard job: janitorial services, about half of whom are working poor. (For a benchmark, 23% of all workers are 55 and up.)

We used to worry about “children having children.” Maybe now we should be more concerned about old people taking care of old people.

Why are so many older workers struggling with poverty? It doesn’t take a doctorate in sociology to figure this one out. People who can afford to retire have that option for a couple of reasons. Either they’ve worked in high-salary, non-physical jobs that come with benefits like 401(k) accounts and gold-plated health insurance. Or they’ve been lucky enough to be represented by unions that fight for their members’ retirement benefits.

However, according to the Pension Rights Center, a nonprofit organization working to expand financial security for retirees, just under half of those working in the private (non-governmental) sector have no employment-based retirement plan at all. They have only Social Security to depend on, which provides the average retiree with a measly $17,634 per year, or not much more than you’d earn working full-time at the current federal minimum wage, which has been stuck at $7.25 an hour since 2009. Worse yet, if you’ve worked at such low-paying jobs your entire life, you face multiple obstacles to a comfortable old age: pay too meager to allow you to save for retirement; lower Social Security benefits, because they’re based on your lifetime earnings; and, most likely, a body battered by decades of hard work.

Many millions of Americans in such situations work well past the retirement age, not because they “simply don’t want to quit,” but because they just can’t afford to do so.

It’s autumn in an even-numbered year, which means I’m once again in Reno, Nevada, working on an electoral campaign, alongside canvassers from UNITE-HERE, the hospitality industry union. This is my fourth stint in Washoe County, this time as the training coordinator for folks from Seed the Vote, the volunteer wing of this year’s political campaign. It’s no exaggeration to say that, in 2022, UNITE-HERE and Seed the Vote saved the Senate for the Democrats, reelecting Catherine Cortez Masto by fewer than 8,000 votes—all of them here in Washoe County.

This is a presidential year, so we’re door-knocking for Vice President Kamala Harris, along with Jacky Rosen, who’s running for reelection to Nevada’s other Senate seat.

Government, especially at the federal level, is clearly an arena where (to invert the pyramid metaphor) too many old people are clogging up the bottom of the funnel.

When I agreed to return to Reno, it was with a heavy heart. In my household, we’d taken to calling the effort to reelect Joe Biden “the death march.” The prospect of a contest between two elderly white men, the oldest ever to run for president, both of whom would be well over 80 by the time they finished a four-year term, was deeply depressing. While defeating Donald Trump was—and remains—an existential fight, a Biden-Trump contest was going to be hard for me to face.

Despite his age, Joe Biden has been an effective president in the domestic arena. (His refusal to take any meaningful action to restrain the Israeli military in Gaza is another story.) He made good use of Democratic strength in Congress to pass important legislation like the Inflation Reduction Act. That kitchen-sink law achieved many things, including potentially reducing this country’s greenhouse gas emissions by 40% by 2030, allowing Medicare to negotiate drug prices directly with pharmaceutical companies (while putting a $2,000 annual cap on Medicare recipients’ outlays for drugs), and lowering the price of “Obamacare” premiums for many people.

Still, Biden’s advanced age made him a “terrible, horrible, no good, very bad” candidate for president. Admittedly, a win for 59-year-old Kamala Harris in Nevada won’t be a walk in the park, but neither will it be the death march I’d envisioned.

Government, especially at the federal level, is clearly an arena where (to invert the pyramid metaphor) too many old people are clogging up the bottom of the funnel. Some of them, like House Speaker emerita Nancy Pelosi (D-Calif.), remain in full possession of their considerable faculties. She’s also had the grace to pass the torch of Democratic leadership in the House to the very able (and much younger) Hakeem Jeffries, representing the 8th district of New York. Others, like former California Senator Dianne Feinstein, held on, to paraphrase Rudyard Kipling, long after they were gone. Had my own great heroine Ruth Bader Ginsberg had the grace to retire while Barack Obama was still president, we wouldn’t today be living under a Supreme Court with a six-to-three right-wing majority.

What about the situation closer to home? Have I also wedged myself into the bottom of the funnel, preventing the free flow of younger, more vigorous people? Or, to put the question differently, when is it my turn to retire?

I haven’t lived out the past three stints in Reno alone. My partner and I have always done them together, spending several months here working 18 hours a day, seven days a week. That’s what a campaign is, and it takes a lot out of you. I’m now 72 years old, while my partner is five years older. She was prepared to come to Reno again when we thought the contest would be Trump versus Biden. Once we knew that Harris would replace him, however, my partner felt enormous relief. Harris’ chances of beating Trump are—thank God—significantly better than Biden’s were. “I would have done it when it was the death march,” she told me, “but now I can be retired.”

Even when people’s material needs are met, as is the case for the luckiest retirees in this country, they can suffer profound loneliness and an unsettling disconnection from the social structures in which meaningful human activity takes place.

Until Harris stepped up, neither of us could imagine avoiding the battle to keep Trump and his woman-hating, hard-right vice presidential pick out of office. We couldn’t face a Trump victory knowing we’d done nothing to prevent it. But now my 77-year-old partner feels differently. She’s at peace with retirement in a way that, I must admit, I still find hard to imagine for myself.

I haven’t taught a college class since the spring semester of 2021. For the last few years, I’ve been telling people, “I’m sort of retired.” The truth is that while you’re part of the vast army of contingent, part-time faculty who teach the majority of college courses, it’s hard to know when you’re retired. There’s no retirement party and no “emerita” status for part-timers. Your name simply disappears from the year’s teaching roster, while your employment status remains in a strange kind of limbo.

Admittedly, I’ve already passed a few landmarks on the road to retirement. At 65, I went on Medicare (thank you, LBJ!), though I held out until I reached 70 before maximizing my Social Security benefits. But I find it very hard to admit to anyone (even possibly myself) that I’m actually retired, at least when it comes to working for pay.

For almost two decades I could explain who I am this way: “I teach ethics at the University of San Francisco.” But now I have to tell people, “I’m not teaching anymore,” before rushing to add, “but I’m still working with my union.” And it’s true. I’m part of a “kitchen cabinet” that offers advice to the younger people leading my part-time faculty union. I also serve on our contract negotiations team and have a small gig with my statewide union, the California Federation of Teachers. But this year I chose not to run for the policy board (our local’s decision-making body), because I think those positions should go to people who are still actually teaching.

Those small pieces of work are almost enough to banish the shame I’d feel acknowledging that I’m already in some sense retired. I suspect my aversion to admitting that I don’t work for pay anymore has two sources: a family that prized professional work as a key to life satisfaction and—despite my well-developed critique of capitalism—a continuing infection with the productivity virus: the belief that a person’s value can only be measured in hours of “productive” labor.

Under capitalism, a person who has no work—compensated or otherwise—can easily end up marginalized and excluded from meaningful participation in society. The political philosopher Iris Marion Young considered marginalization one of the most ominous forms of oppression in a liberal society. “Marginals,” she wrote, “are people the system of labor cannot or will not use,” a dangerous condition under which a “whole category of people is expelled from useful participation in social life and thus potentially subjected to severe material deprivation and even extermination.”

Even when people’s material needs are met, as is the case for the luckiest retirees in this country, they can suffer profound loneliness and an unsettling disconnection from the social structures in which meaningful human activity takes place. I suspect it’s the fear of this kind of disconnection that keeps me from acknowledging that I might one day actually retire.

The other fear that keeps me working with my union, joining political campaigns, and writing articles like this one is the fear of the larger threats we humans face. We live in an age of catastrophes, present or potential. These include the possible annihilation of democratic systems in this country, the potential annihilation of whole peoples (Palestinians, for example, or Sudanese), or indeed, the annihilation of our species, whether quickly in a nuclear war or more slowly through the agonizing effects of climate change.

But even in such an age, I suspect that it’s time for many of my generation to trust those coming up behind us and pass the torch. They may not be ready, but neither were most of us when someone shoved that cone of flame into our hands.

Still, if I can bring myself to let go and trust those coming after me, then maybe I’ll be ready to embrace the idea behind one of my favorite Spanish words. In that language, you can say, “I’m retired” (“retirada”), and it literally means “pulled back” from life. But in Spanish, I can also joyfully call myself “jubilada,” a usage that (like “sabbatical”) also draws on a practice found in the Hebrew scriptures, the tradition of the jubilee, the sabbath of sabbaths, the time of emancipation of the enslaved, of debt relief, and the return of the land to those who work it.

Maybe it’s time to proudly accept not my retirement, but my future jubilation. But not quite yet. We still have an election to win.

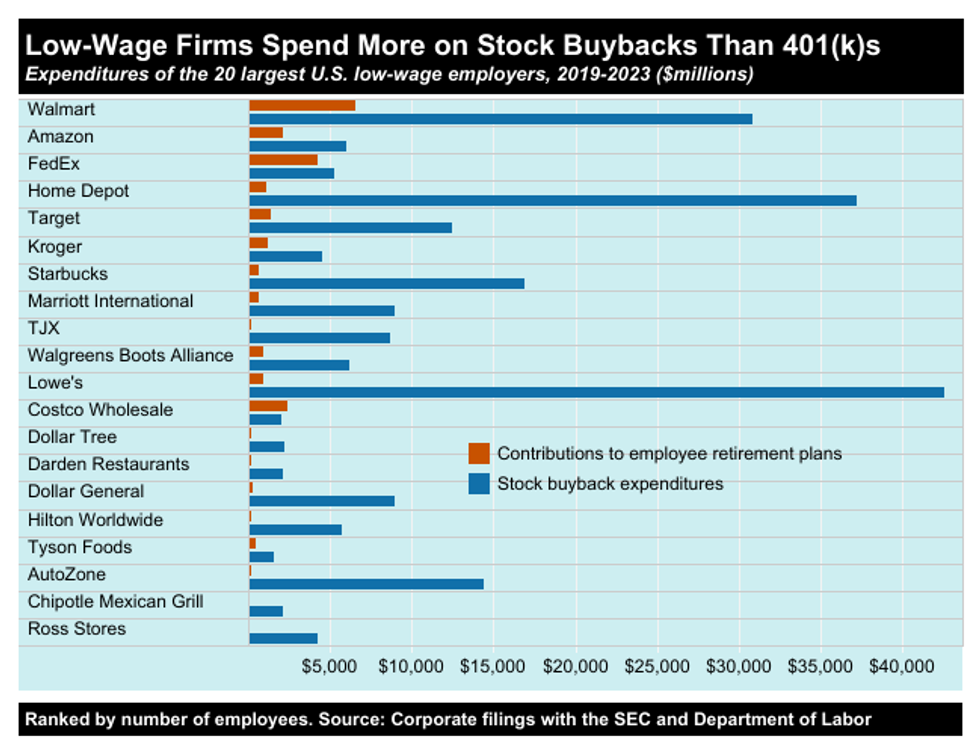

One-hundred S&P 500 firms with the lowest median wages, a group we’ve dubbed the “Low-Wage 100,” blew $522 billion over the past five years on stock buybacks.

The Lowe’s home improvement store spent $43 billion on stock buybacks over the past five years. With that sum, the big box chain could’ve given each of its 285,000 employees a $30,000 bonus every year between 2019 and 2023.

The extra cash would’ve meant a lot to Lowe’s workers—half of whom make less than $33,000 per year. Meanwhile, the retailer’s CEO, Marvin Ellison, raked in $18 million in 2023.

The evidence is stark. CEOs of leading U.S. corporations are focused on short-term windfalls for themselves and wealthy shareholders rather than on long-term prosperity for their workers—or their companies.

Another sign of Lowe’s skewed priorities? The company plowed nearly five times as much cash into buybacks as it invested in long-term capital expenditures like store improvements and technology upgrades over the past five years.

Lowe’s ranks as an extreme example of a corporate model focused on pumping up CEO pay at the expense of workers and long-term investment. But such skewed priorities are actually the norm among America’s leading low-wage corporations.

This year’s edition of the annual Institute for Policy Studies Executive Excess report finds that the 100 S&P 500 firms with the lowest median wages, a group we’ve dubbed the “Low-Wage 100,” blew $522 billion over the past five years on stock buybacks. Nearly half of these companies spent more on this once-illegal financial maneuver than they spent on capital investment vital to long-term competitiveness.

Why the fixation on buybacks? This is a CEO pay-inflating financial scam, pure and simple. When companies repurchase their own shares, they artificially boost share prices and the value of the stock-based compensation that makes up about 80% of CEO pay. An SEC investigation confirmed that CEOs regularly time the sale of their personal stock holdings to cash in on the price surge that typically follows a buyback announcement.

Our Executive Excess report also looks at low-wage corporations’ expenditures on employee retirement security. The answer? Peanuts, compared to their buyback outlays.

The country’s 20 largest low-wage employers spent nine times as much on stock buybacks as on worker retirement plan contributions over the past five years. Many of these firms boast of their “generous” matching benefits, typically a dollar-for-dollar match of 401(k) contributions up to 4% of salary. But matching is meaningless for workers who earn so little they can’t afford to set aside anything for what should be their “golden years.”

Take Chipotle, for instance. The Mexican fast food chain spent over $2 billion on stock buybacks over the past five years—48 times as much as the firm contributed to employee retirement plans. Meanwhile, 92% of Chipotle workers who are eligible to participate in the company’s 401(k) have zero balances. That’s hardly surprising, since the chain’s median annual pay is just $16,595.

The evidence is stark. CEOs of leading U.S. corporations are focused on short-term windfalls for themselves and wealthy shareholders rather than on long-term prosperity for their workers—or their companies.

As UAW President Shawn Fain put it in his primetime DNC convention speech: “Corporate greed turns blue-collar blood, sweat, and tears into Wall Street stock buybacks and CEO jackpots.”

Public outrage over CEO shakedowns helped the UAW win strong new contracts last year with the Big Three automakers. Support for policy solutions is growing as well. The Democratic Party platform calls for quadrupling a new tax on stock buybacks. And a recent poll shows huge majority support among Democrats, Republicans, and Independents alike for proposed tax hikes on corporations with huge CEO-worker pay gaps. The Executive Excess 2024 report offers an extensive menu of additional commonsense CEO pay reforms.

It’s important to remember that it hasn’t always been this way. Forty years ago, big company CEO pay was only about 40 times higher than worker pay—not several hundreds of times higher, as is typical today. And just 20 years ago, most big companies spent very little on stock buybacks. At Lowe’s, for example, buyback outlays between 2000 and 2004 were exactly zero.

Corporate America’s perverse fixation on enriching those at the top is bad for workers and bad for the economy. With pressure from below, we can change that.