Amazon claims these workers are not employees, but "contractors," and that firing them does not constitute illegal union busting.

The union, however, described this as "a phony shell game," saying that the contractors "wear Amazon uniforms, follow Amazon rules, and work off Amazon's routing software."

"Amazon calls the shots," read a statement from the union. "They are the employer and everyone knows it."

Last year, a National Labor Relations Board (NLRB) official in Los Angeles agreed that the company had engaged in unfair labor practices when it fired other unionized contractors in California, and determined that they did, in fact, count as employees of Amazon.

At the time, this ruling seemed to provide some clarity as Amazon workers fought to have their union recognized by the company, which has refused to recognize them for years.

This remained the case even after 2024, when more than 10,000 Amazon workers joined the Teamsters and the union launched the largest strike ever against the company right before the holidays, during which they demanded the company negotiate a fair contract that included wage increases and addressed workplace safety issues and illegal union busting.

Outside Amazon's DBK4 facility, which joined the strike last year, the Teamsters and their allies renewed calls for negotiation Monday.

"Amazon is breaking the law and we let the public know it," said Antonio Rosario, a Local 804 member and Teamster organizer.

Latrice Shadae Johnson, a Teamster who works at DBK4, added that "Amazon would be nothing without its workers."

"We're the ones who power their profits. We're the ones who put our health and safety on the line every single day. We're the ones who made them a $2 trillion corporation," said Johnson. "If Amazon thinks we're going to take this lying down, they have another thing coming. Our solidarity is only growing stronger."

That solidarity has come from many corners across New York City, with members of the City Central Labor Council, part of the AFL-CIO, taking part in the rally.

The Teamsters were also joined by democratic socialist state Sen. Kristen Gonzalez (D-59), who defeated the industry-backed cousin of former Queens US Rep. Joe Crowley in 2022.

"I've been in office three years, and every single year I've been right here in this spot because every single year Amazon has done union-busting," Gonzalez said to cheers from the crowd, "It's because they think they are above the law."

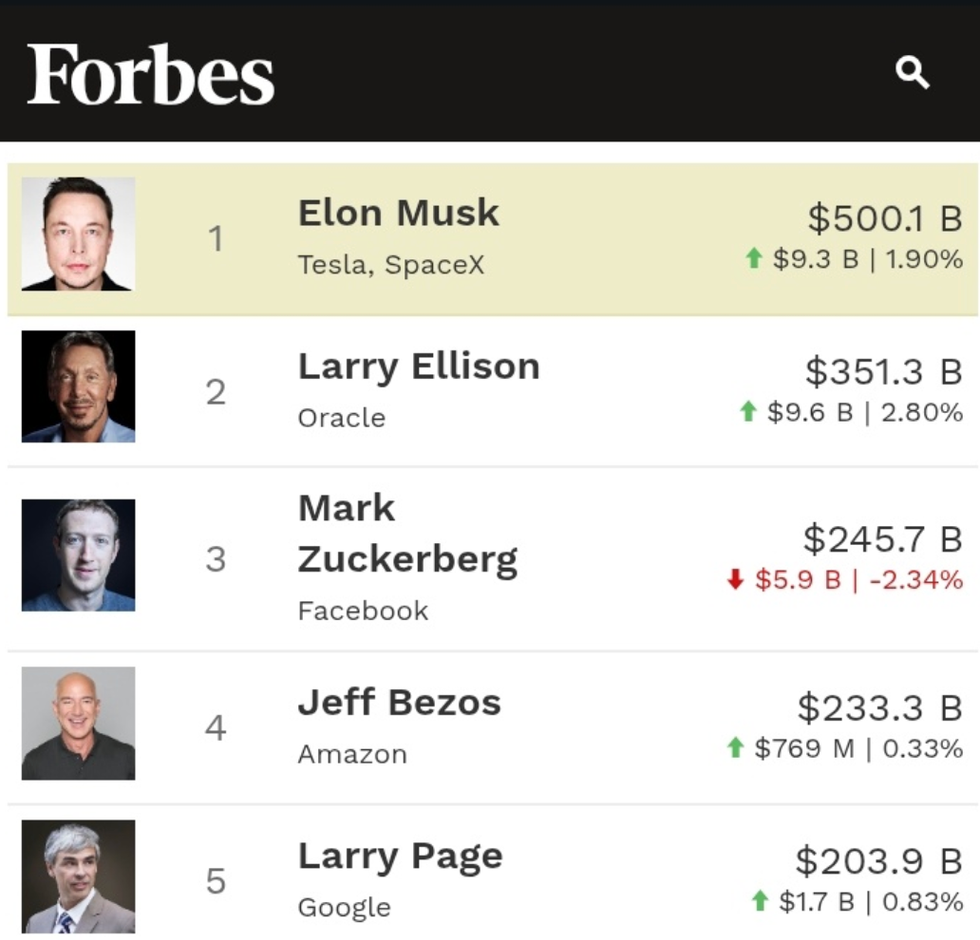

In 2024, Amazon joined a lawsuit filed by Elon Musk's company SpaceX, arguing that the NLRB, which is responsible for adjudicating labor rights violations, is unconstitutional because its members cannot be fired at will by the US President.

Just one week into his term, President Donald Trump fired NLRB member Gwynne Wilcox, effectively crippling the board's ability to rule on union-busting cases.

According to LaborLab, which publishes reports on corporate union busting, "Without a functioning board, companies like Amazon and Tesla can engage in union-busting tactics with impunity, facing no legal consequences for violating workers' rights."

The progressive state assemblyman Zohran Mamdani, currently the frontrunner to be New York City's next mayor, brought national attention to the Teamsters' plight on Monday.

"One of the most powerful corporations in the history of the world is firing unionized drivers in Queens," Mamdani wrote on X. "Solidarity with the Teamsters who rallied today against these unjust layoffs and to demand good faith negotiations."

Several Democratic members of the House of Representatives from New York, including Jerry Nadler and Alexandria Ocasio-Cortez, issued their own statements of solidarity, as did Republican Mike Lawler.

"Any company that denies workers the right to choose [collective] bargaining rights, including Amazon, should be confronted," Lawler said. "Unions are the backbone of this country. They helped build this country. And they damn well will ensure we have a strong and secure country moving forward."

Nadler added that he stood "with Amazon Teamsters as they rally in Queens today to hold Amazon accountable for its unlawful anti-union activity."

"Amazon," he said, "stop union busting and start bargaining a fair contract now!"