SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

The insurers that played a role in facilitating the very climate disasters now affecting their former customers have effectively cut and run, leaving the residents and the state holding the bag.

The deadly fires that devastated Los Angeles and displaced hundreds of thousands of people in January have been finally contained, but they left another sort of firestorm in their wake—one raging around the insurance industry and its shrinking coverage of climate risks such as extreme wildfires. Climate change increased the likelihood and severity of the fires—by far some of the most destructive in the city’s history. The blazes killed at least 28 people and destroyed some 16,000 structures over nearly 50,000 acres—an area larger than the city limits of San Francisco. Insured property damage alone is expected to reach as much as $40 billion. The question of who pays looms large.

For at least 50 years, the insurance sector has been aware of the physical risks of climate change and that greenhouse gas emissions, primarily from fossil fuels, are overwhelmingly responsible for rising temperatures. Despite this, U.S. insurance companies have investments of more than $500 billion in fossil fuel-related assets. The underwriting business of major insurers remains heavily focused on the fossil fuel sector, with the top U.S. insurers of fossil fuel businesses earning $5.2 billion from underwriting in 2023.

After decades of pocketing premiums from homeowners and investing significant portions of that money in the fossil fuel industry that drives climate change, private insurers like State Farm and Berkshire Hathaway carved out fire coverage from their policies or pulled out of the California market altogether.

All of California’s home insurance policyholders are the victims of fossil-fueled climate change.

The result: The insurers that played a role in facilitating the very climate disasters now affecting their former customers have effectively cut and run, leaving the residents and the state holding the bag.

Private insurers will escape the full bill, largely because they have shifted their exposure to the most extreme climate risks to California’s insurer of last resort—the FAIR Plan. In abandoning the California home insurance market, or otherwise excluding fire coverage from their policies, private insurance companies effectively pushed the responsibilities of shouldering climate risk back onto the public and protected their own profits. Despite their claims to the contrary, insurance companies, as recently as 2023, generated significant profits on homeowner insurance policies and are still raking in record profits.

The FAIR Plan is now on the brink of insolvency. To fund the shortfall, the California Insurance Commissioner has levied an assessment totaling $1 billion on private insurance companies. However, private insurance companies will pass $500 million of the assessment on to all of California’s insured homeowners.

This $500 million bill is a direct consequence of climate change and the profit-driven insurers who—after pocketing ever-increasing premiums and investing in the fossil fuel sector—have shed policies for homes most vulnerable to climate risks. All of California’s home insurance policyholders are the victims of fossil-fueled climate change.

The destructive force of the LA wildfires is a result of climate change-induced drought, which led to the accumulation of dried-out vegetation and the perfect conditions for extreme wildfires. Unusually strong wind gusts of more than 100 miles per hour spread the fires across LA, scattering flames throughout many of the city’s communities. And it was not just the fires causing damage—climate change intensifies fire smoke, filling the air with hazardous pollutants that harm health.

In California, the frequency and severity of wildfires have increased the cost of disasters, prompting insurers to hike premiums or refuse to renew policies. California’s home insurance rates jumped 48.4% from 2019 to 2024. Twelve major insurers have also restricted homeowners insurance even after being allowed massive rate hikes.

Insurers have justified abandoning California homeowners by citing rising climate risk. Yet, insurance companies are complicit in facilitating climate change through their massive investments in fossil fuel-related assets—including coal, oil, and gas—the primary sources of the greenhouse gases driving climate change.

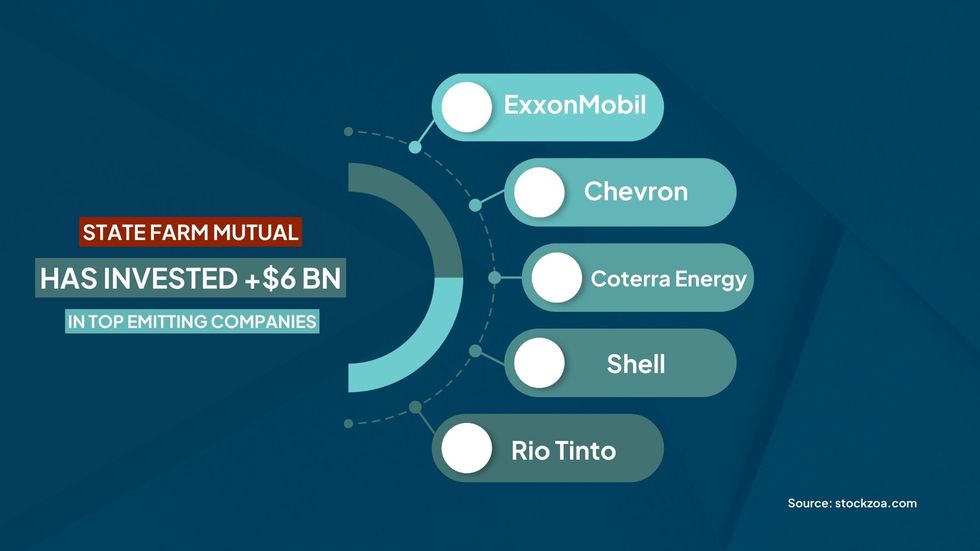

State Farm General (State Farm)—through its parent company, State Farm Mutual—is a major investor in fossil fuels. The company’s investments include more than $6 billion in upstream oil and gas producers ExxonMobil, Chevron, Coterra Energy, and Shell and mining company Rio Tinto. These five companies sit on the list of the top investor-owned entities with the highest historical carbon dioxide emissions. State Farm Mutual also has billions of dollars of investments in fossil-fuel-intensive or dependent industries such as utilities, oil and gas services, and pipeline companies, as well as chemical, steel, and fertilizer manufacturers.

Despite facilitating climate change through its fossil fuel investments, State Farm—the largest property and casualty insurer in California—stated in 2023 that it would not renew 30,000 home insurance policies in the state. The decision was primarily due to the increasing risk of wildfires in California. After an approved rate increase of 20% in December 2023, among other concessions from the California Department of Insurance, State Farm agreed to renew these 30,000 home insurance policies, but only on the condition that the renewed policies exclude fire coverage. State Farm clients had to specifically secure separate fire coverage from the FAIR Plan.

The Pacific Palisades, one of the neighborhoods devastated by the LA Fires, was one of the zip codes abandoned by State Farm. According to California Department of Insurance spokesperson Michael Soller, State Farm dropped about 1,600 policies in Pacific Palisades in July. State Farm also dropped more than 2,000 policies in two other LA zip codes, which include neighborhoods also damaged by the wildfires, such as Brentwood, Calabasas, Hidden Hills, and Monte Nido. The FAIR Plan is now the principal recourse for wildfire coverage for former State Farm policyholders.

Most private insurers are looking to their reinsurer to provide coverage for their losses from the LA Fires. Reinsurance, basically insurance for insurance companies, is a common part of an insurer’s business model as it allows them to shift some of their risk to protect themselves from the most catastrophic events. State Farm’s reinsurer is its parent company—State Farm Mutual. From 2014 to 2023, State Farm paid reinsurance premiums of nearly $2.2 billion but was only reimbursed $0.4 billion—less than 20%—suggesting that the company overpaid for reinsurance. These payments to its parent company, with little return, led to accusations that State Farm was artificially boosting its parent company’s profits.

State Farm Mutual has over $130 billion in surplus available to support its subsidiary. Despite the exorbitant profits of its parent company and well before the LA Fires, in June 2024, State Farm requested a 30% increase in its homeowners insurance rates (on top of the 20% increase it was granted in March of the same year) purportedly to improve its general financial condition. Within days of the LA fires being contained, State Farm again asked its California policyholders to step in and maintain the profits of its parent company. State Farm requested an annual $740 million bailout in the form of an “urgent” 22% increase in State Farm’s home insurance rates, as well as requesting rate hikes of 38% for rental dwellings and 15% for tenants.

Fortunately for California’s consumers, Commissioner Ricardo Lara rejected State Farm’s requested rate increase. And true to form, State Farm is now “considering its options” because the commissioner’s decision “sends a strong message to State Farm General about the support it will receive to collect sufficient premiums in the future”—a barely veiled threat to again abandon California policyholders.

State Farm had already limited its exposure to climate change-induced wildfires and then sought to reduce it further, asking policyholders to take on even more of the remaining risk. All the while, they continue to facilitate climate change and profit from their fossil fuel investments.

As insurance companies pull out of vulnerable areas or raise premiums, many California homeowners are left with no choice but to rely on the FAIR Plan—the state-supported insurer of last resort. The FAIR Plan offers limited coverage at higher rates, making it costly and an inadequate safety net for homeowners abandoned by private insurance companies.

The exit of insurers from the California residential property market has meant that the FAIR Plan’s exposure to wildfire risk has increased exponentially. The FAIR Plan now holds 13,752 policies with more than $23 billion in liability across the residential and commercial sectors in the zip codes affected by the fires.

Insurers should then seek to recoup the costs of covering the damage from climate change-induced severe weather events from fossil fuel companies—not from the individual policyholders or the public at large.

On February 11, 2025, Insurance Commissioner Lara found “that the FAIR Plan is faced with a substantial threat of insolvency due to unprecedented losses” and approved the FAIR Plan’s request to levy an assessment totaling $1 billion on private insurance companies. Before July 2024, insurers operating in California would have been solely required to fund any deficit, paying a fee based on their market share. But a July 2024 regulation allows insurers to shift 50% of the assessment onto the state’s existing policyholders. Homeowners from all over California are being asked to bail out the FAIR Plan, irrespective of the risk profile of their home and neighborhood and the climate risk mitigation or adaptation they have undertaken.

This change in regulation was part of a series of concessions Lara has given to the insurance industry in recent years, including provisions that make it easier for companies to raise premiums and a new rule that allows companies to use forward-looking catastrophe models when setting rates. These new regulations were aimed at convincing insurers to stay in California, but consumer advocates warn that they have the potential to further exacerbate homeowners’ climate-related costs.

Insurance companies facilitate climate change by investing in fossil fuel assets and underwriting fossil fuel projects. However, the primary drivers of climate change are fossil fuels themselves, and it is the companies that produce and sell them that are principally responsible for the climate emergency. Instead of attempting to shift their exposure to California’s householders, insurers should divest from fossil fuel assets and cease underwriting fossil fuel projects. Insurers should then seek to recoup the costs of covering the damage from climate change-induced severe weather events from fossil fuel companies—not from the individual policyholders or the public at large.

A new bill, SB222, introduced into the California legislature, would make it easier to ensure that polluters pay for the climate-driven disasters befalling residents and upending the insurance industry. It specifically directs the FAIR Plan and incentivizes private insurers to pursue the parties responsible for climate change-induced weather events by standing in the shoes of policyholders to recoup the costs of losses, utilizing their right of subrogation. An insurer’s right of subrogation is the right to try to recover the amount of a claim or claims it paid out from another party that caused the insured loss(es).

The draft legislation directs the FAIR Plan to exercise its right of subrogation against “a responsible party for a climate disaster or extreme weather or other events attributable to climate change” if the benefits of subrogation outweigh the costs (as determined by an independent advisory body). If the FAIR Plan’s funds are exhausted and private insurance companies are being assessed, as is the case now, the bill also provides incentives to insurers to exercise the right of subrogation against a “responsible party” for a climate disaster. An insurer’s share of the assessment will be reduced by 10% if the insurer exercises its right of subrogation against a responsible party, but if it does not exercise its right of subrogation against a responsible party, it will be increased by 10%.

Finally, in addition to its right of subrogation, the bill provides that an insurer may seek damages against a responsible party for a climate disaster, extreme weather, or other events attributable to climate change.

Make no mistake: The responsible parties driving climate change are fossil fuel businesses.

SB222 highlights that the real culprit of the climate emergency is the fossil fuel sector. But insurance companies are far from innocent bystanders. By supporting “business as usual” in the fossil fuel sector, insurance companies are facilitating the escalating climate crisis, causing climate change-induced events like the LA fires. When coupled with their representations around protecting policyholders from peril and their justifications for rate hikes and non-renewals, insurers’ conduct violates consumer protection laws and standards.

Insurers must no longer be permitted to invest large portions of premium income in fossil fuel companies and underwrite new oil and gas projects while charging some homeowners more for increased climate risk and simply turning others away. Before any further handouts are given to the insurance industry or any more concessions are made to preserve a profit-driven insurance model that may simply be untenable in the age of climate chaos, insurers must stop fanning the flames.

The head of Consumer Watchdog argued the company is "detouring the rules that protect state consumers from insurance price gouging."

The insurance giant State Farm on Monday asked California state insurance regulators to approve an emergency interim rate hike of 22%, drawing pushback from the nonprofit Consumer Watchdog, which accused the company of not providing the financial data necessary to justify the increase.

"State Farm wants to fill its bank accounts on the backs of California homeowners, some of whose homes are in ashes," said Carmen Balber, Consumer Watchdog's executive director. "Insurance Commissioner [Ricardo] Lara must require State Farm to prove it needs this staggering increase."

Devastating wildfires ravaged the Los Angeles area starting in early January, compounding an already escalating insurance crisis in the state and causing between $35 to $45 billion in insured property losses, according to one estimate. The fires, which are now either out or fully contained, generated over 8,700 claims for State Farm General, the California homeowners insurance affiliate of the firm State Farm Mutual Automobile Insurance Company. The compnay said it has paid over a billion to customers due to the blazes.

State Farm General is the largest insurance group in the state. The firm stopped writing any new policies in May 2023, and last spring the company announced it would not renew plans for tens of thousands of homeowners—though it has said it will renew policies for those impacted by the recent fires in Los Angeles County.

In a letter to the California Department of Insurance, leaders at State Farms General requested that the department take "emergency action to help protect California's fragile insurance market," by allowing interim rate increases of 22% for homeowners, 15% for renters, 15% for condo owners, and 38% for rental dwellings.

"State Farm General's rate filings raise serious questions about its financial condition," department spokesman Gabriel Sanchez said, according to the outlet Insurance Business.

Proposition 103, a measure passed in 1988 which sought to protect consumers from arbitrary insurance rate hikes, requires insurance companies to back up their rate applications with "comprehensive data," according to the California's insurance commissioner.

Consumer Watchdog said that State Farm General is asking for an increase on an interim basis, meaning "without having to prove that it needs that increase, or the impact higher premiums will have on the ability of consumers to afford coverage."

The letter from State Farm General to the department includes an "illustration of State Farm General financial deterioration" as an attachment.

According to Consumer Watchdog, the requested 22% hike on home insurance rates amounts to $740 million a year for the company. The group has called the request a "bailout."

The request comes after State Farm General last summer asked for a 30% rate increase for its homeowners, a 52% rate increase for renters, and a 36% rate increase for condominium owners. In December 2023 it was approved for a 20% increase for homeowners and condominium owners.

The insurance company is "trying to cash in on a terrible tragedy by detouring the rules that protect state consumers from insurance price gouging—at a time when those safeguards are more important than ever," said Balber.

One of the Rams’ corporate sponsors is an affiliate of Shell Oil, one of the worst carbon polluters on the planet.

The NFL was forced to relocate Monday night’s playoff game between the Los Angeles Rams and the Minnesota Vikings to State Farm Stadium in Arizona because the Rams’ home field, SoFi Stadium, is only 10 miles from the Palisades Fire, the largest of six active blazes in the Los Angeles area. Turbocharged by climate change, the fires have killed at least 24 people, burned more than 40,000 acres, destroyed more than 12,300 structures, and displaced tens of thousands of residents.

The day before the game, Rams quarterback Matthew Stafford told reporters that his team was playing for more than just themselves—they were playing for the entire city of Los Angeles. “Every time we suit up, we’re the Los Angeles Rams,” he said. “We play for the people in this community, the people that support us, and this week will be another example of that.”

But the Rams also play for their corporate sponsors, which ironically include Shell Oil Products US, an affiliate of a multinational oil company that bears major responsibility for the conditions that set the stage for Los Angeles’ devastating fires.

Will mounting extreme weather disasters—and stadium damage projections—ever convince the L.A. Rams and other sports teams to sever their ties to the very companies responsible for the climate crisis?

The Rams are not alone in their choice of partnerships. More than 60 U.S. pro sports teams and at least three leagues have lucrative sponsorship deals with oil companies and electric and gas utilities that afford the companies a range of promotional perks, from building signage to uniform logos to facility naming rights, according to a survey conducted last fall by UCLA’s Emmett Institute on Climate Change and the Environment. Likewise, sports teams and leagues partner with banks and insurance companies that invest billions of dollars in coal, oil and gas companies, all to the detriment of public health and the environment.

With annual payrolls running as high as $240 million in the NFL, $300 million in the MLB, and $200 million in the NBA, it is not hard to understand why teams pursue corporate sponsorships.

Companies, meanwhile, sponsor teams and leagues to increase visibility and build public trust. According to a 2021 Nielsen “Trust in Advertising” study, 81 percent of consumers completely or somewhat trust brands that sponsor sport teams, second only to the trust they have for friends and family. By sponsoring a team, corporations increase the chance that fans will form the same bond with their brand that they have with the team.

Oil companies, gas and electric utilities, and the banks and insurance companies that finance them have yet another rationale for aligning with a team or a league: to distract the public from their unethical practices and portray themselves as public-spirited, good corporate citizens. It’s called sportswashing, a riff on the term greenwashing.

When Bank of America—which invested $33.68 billion in fossil fuel companies in 2023 alone—signed on as an official sponsor of the FIFA World Cup last year, the company’s chief marketing officer explained how it works. “The World Cup is religious for the fans, it’s an entirely different beast,” he said. “It allows us a very powerful place for the emotional connections to build the brand.” Having a strong brand, he added, can provide a “halo effect” for a company.

The Rams and Shell have been partners since 2018, but in October 2023 the Rams announced that the company signed a multiyear contract for an undisclosed sum to be the “exclusive fuel sponsor” of the team, SoFi Stadium and Hollywood Park, the mixed-use, under-construction district surrounding the stadium that is owned and operated by Rams CEO Stan Kroenke. Shell now offers gasoline discounts on game days and collaborates with the three organizations on community initiatives on health, STEAM (science, technology, engineering, the arts and mathematics) education, sustainability and other issues.

The Rams could not have picked a more inappropriate partner (except, perhaps, ExxonMobil). Shell a cosponsor of community health projects? It’s one of the top 20 air polluters in the country. A supporter of STEAM education? The first initial of that acronym stands for “science,” but Shell is still funding climate science disinformation, even though it was aware of the threat its products pose as far back as the 1950s. And a promoter of sustainability? Historically the company is the fourth-biggest investor-owned carbon polluter and the second-biggest since 2016, when the Paris climate agreement to cut emissions was signed.

In 2020, the company did adopt a number of goals to achieve net-zero emissions by 2050. Since then, however, it has backtracked, reneging on its pledge to cut oil production 1 to 2 percent annually through 2030, weakening its target of reducing emissions from 25 to 40 percent by 2030 to only 20 to 30 percent, and completely abandoning its goal of lowering the total “net carbon intensity” of its products (the emissions per unit of energy) 45 percent by 2035 due to “uncertainty in the pace of change in the energy transition.”

The Rams are not the only U.S. pro team, nor the only team in California, enabling sportswashing. Chevron sponsors the Los Angeles FC soccer team, Sacramento Kings and San Francisco Giants; Arco, owned by Marathon Petroleum, sponsors the L.A. Dodgers and Sacramento Kings; NRG Energy, an electric utility that sold off its renewable energy division years ago, sponsors the San Francisco 49ers; and Phillips 66, owner of Union 76 gas stations, also sponsors the Dodgers. Although the two NBA teams in Los Angeles do not have fossil fuel industry-related sponsors, ExxonMobil is an “official marketing partner” of the NBA, WNBA and NBA Development League in the United States and China.

Given California has been plagued by climate change-driven wildfires for years, one would hope that sports teams in the state would reconsider their fossil fuel industry sponsorships. Last August, more than 80 public interest groups, scientists and environmental advocates tried to get the Dodgers to do just that, calling on the team to cut its ties to Phillips 66. “Using tactics such as associating a beloved, trusted brand like the Dodgers with enterprises like [Union] 76,” they wrote in an open letter, “the fossil fuel industry has reinforced deceitful messages that ‘oil is our friend,’ and that ‘climate change isn’t so bad.’” Since it was first posted, more than 22,000 Dodgers fans have added their names to the letter, which urges the team to end its sponsorship deal with the oil company “immediately.” To date, they are still waiting for a response.

California state, county and city governments, meanwhile, are going after the perpetrators in court. Altogether they have launched nine lawsuits against Chevron, ExxonMobil and Shell to hold them accountable for deceiving the public and force them to pay climate change-related damages. The cities filing suit include Imperial Beach, Oakland, Richmond (home to a Chevron refinery), San Francisco and Santa Cruz. Five of the nine lawsuits also name Marathon Petroleum and Philips 66 as defendants.

The UCLA survey only documented the links between pro sports teams and their leagues with oil and utility companies. Banks and insurance companies that finance fossil fuel projects also have sponsorship deals. For example, six of the 12 banks that invested the most in fossil fuel companies since the Paris climate agreement was signed in 2016—Bank of America, Barclays, Citigroup, JPMorgan Chase, Scotiabank and Wells Fargo—have each spent a small fortune on sports facility naming rights. Meanwhile, a review of the 30 NFL stadiums found that at least three are named for an insurance company with significant fossil fuel-related investments. One of those facilities is State Farm Stadium in Glendale, Arizona, where the Rams and Vikings played Monday night. The biggest home and auto insurer in the country, State Farm bought naming rights to the stadium in the fall of 2018 for an undisclosed sum.

Unlike all but one of its competitors, which have significantly cut back their investments in fossil fuel projects, State Farm has dramatically increased them, according to a September 2024 Wall Street Journal investigation. As of last May, the company held $20.6 billion in shares and bonds in 65 fossil fuel companies, including Chevron, ExxonMobil and Shell, according to a 2024 report by Urgewald, a German environmental group.

In May 2023, at the same time it was expanding its fossil fuel industry portfolio, State Farm stopped issuing new homeowner policies in California because of wildfire risks and ballooning construction costs. Less than a year later, it announced that it would not renew 30,000 homeowner policies and 42,000 policies for commercial apartments in the state. Some 1,600 of those policies covered homes in Pacific Palisades, the neighborhood just destroyed by the Palisades Fire.

State Farm’s “2023 Impact Report” states the obvious: “Being a good steward of our environmental resources just makes sense for everyone.” But for the company, that only means cutting its own carbon emissions, reducing waste at its facilities, and promoting paperless options for its customers. What about the impact of the billions of dollars the company invests in major carbon polluters? The report doesn’t mention it.

Hurricanes, snowstorms, and other severe events have forced the NFL to cancel preseason games and postpone and move regular season games in the past. But Monday night’s game in Arizona was the first time the NFL had to relocate a postseason game since 1936, when it moved the championship game between the Green Bay Packers and the Boston Redskins from Boston to New York because of low ticket sales.

What about the impact of the billions of dollars the company invests in major carbon polluters?

Going forward, the NFL and other sports leagues likely will have to move games more often, if not abandon facilities, because of climate change-related extreme weather events. A handful of events over the last two decades may signal what team owners should anticipate. They include:

Several NFL stadiums are especially at risk, according to a report published last October by Climate X, a data analytics company. The report ranks the 30 NFL stadiums based on their vulnerability to such climate hazards as flooding, wildfires, extreme heat and storm surge, and compares projected damage over the next 25 years to each stadium’s current replacement value.

The three stadiums that face the greatest threat? MetLife Stadium, SoFi Stadium and State Farm Stadium, in that order.

The report projects that MetLife Stadium, the New Jersey home of the New York Giants and Jets, will suffer the highest total percentage loss of 184 percent of its current replacement value, with cumulative damages of more than $5.6 billion by 2050 due to its low elevation and exposure to surface flooding and storm surges. (Like State Farm, the MetLife insurance company has major fossil fuel investments. As of May 2024, it held $7.4 billion in stocks and bonds in more than 200 companies, including Chevron, ConocoPhillips, ExxonMobil and Shell.)

SoFi Stadium and State Farm Stadium, meanwhile, are both expected to sustain significant losses due to increased flooding and … wildfires. The Climate X report estimates that SoFi Stadium will incur a cumulative loss of 69 percent of its current replacement value with damages of $4.38 billion by 2050. State Farm Stadium, the third-most vulnerable facility, likely will experience a 39 percent total loss, with $965 million in cumulative damages.

Will mounting extreme weather disasters—and stadium damage projections—ever convince the L.A. Rams and other sports teams to sever their ties to the very companies responsible for the climate crisis?

Last summer, U.N. Secretary-General António Guterres castigated coal, oil and gas companies—which he dubbed the “godfathers of climate chaos”—for spreading disinformation and called for a worldwide ban on fossil fuel advertising. He also urged ad agencies to refuse fossil fuel clients and companies to stop taking their ads. So far, more than 1,000 advertising and public relations agencies worldwide have pledged to refuse working for fossil fuel companies, their trade associations, and their front groups.

It is past time for professional sports teams and leagues to do the same.