SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

"If Congress wants to wash itself of conflicts of interest it can start by passing a stock trading ban."

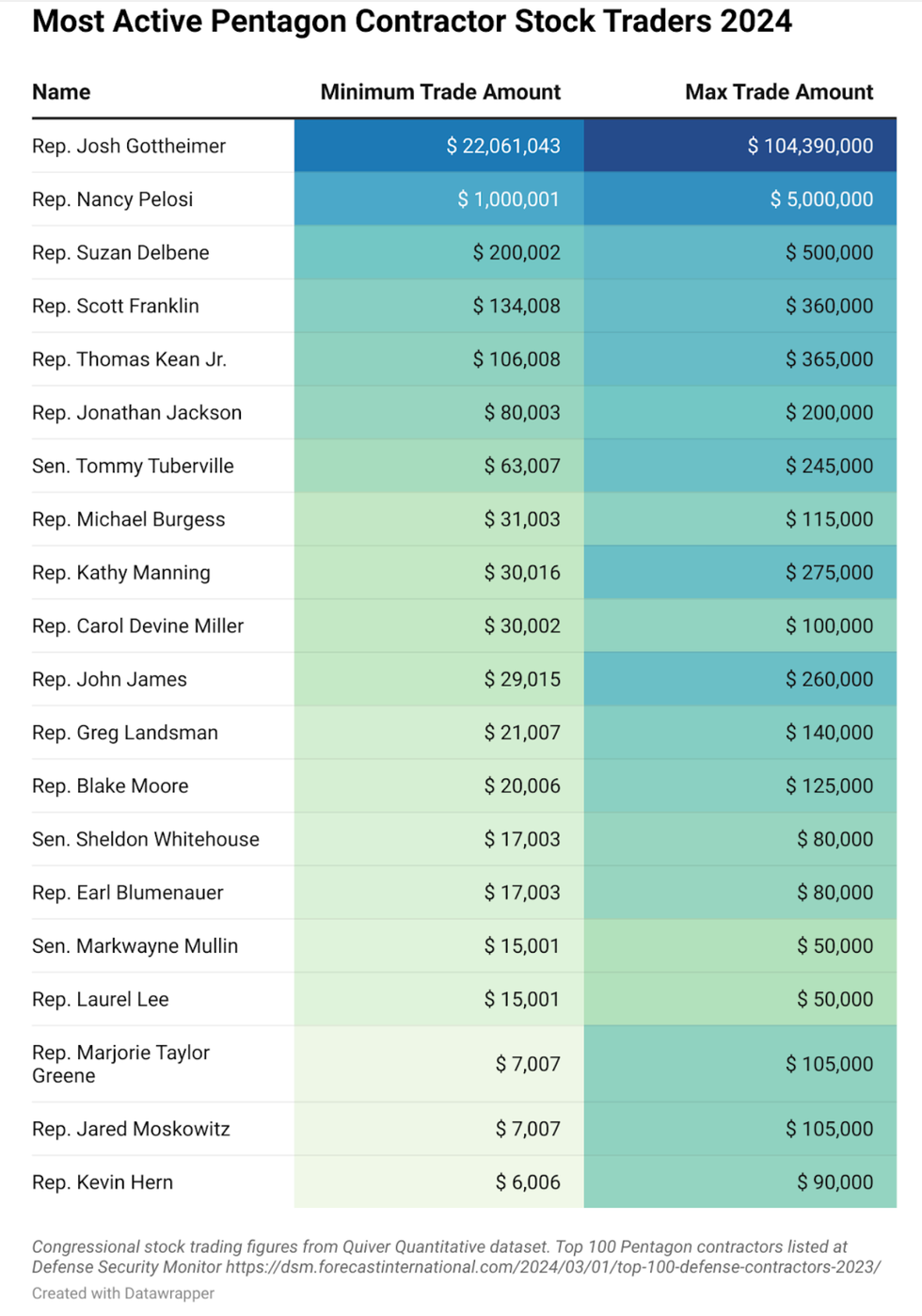

Dozens of U.S. lawmakers and their families bought or sold up to $113 million worth of shares in top Pentagon contractors this year, an analysis published on Wednesday revealed.

The Quincy Institute for Responsible Statecraft found that at least 37 members of Congress and their relatives traded between $24-113 million worth of stock in companies listed on Defense and Security Monitor's Top 100 Defense Contractors index.

As the Quincy Institute noted: "Eight of these members even simultaneously held positions on the Armed Services and Foreign Affairs Committees, the committees overseeing defense policy and foreign relations. Members of Congress that oversee the annual defense bill and are privy to intelligence briefings have an upper hand in predicting future stock prices."

The analysis found that one Democratic congressman accounted for the vast bulk of defense stock trading in 2024.

Rep. Josh Gottheimer of New Jersey traded at least $22 million and as much as $104 million worth of shares in companies on the index, including Microsoft, Northrop Grumman, and IBM. Gottheimer—who said his trades are handled by a third-party firm—sits on both the House Permanent Select Committee on Intelligence and the National Security subcommittee of the Committee on Financial Services.

Next on the list in distant second place is former House Speaker Nancy Pelosi (D-Calif.), who has defended stock trading by lawmakers, and according to Quincy, "sold over $1 million worth of Microsoft stock in late July."

"The timing of Pelosi's Microsoft trades in the past have garnered attention, too; in March 2021, she bought Microsoft call options less than two weeks before the Army announced a $22 billion contract with the software company to supply augmented reality headsets," the analysis states.

"Pelosi had the most profitable 2024 of any lawmaker, netting an estimated $38.6 million from all stock trading activity, according to Quiver Quantitative," the report adds.

Pelosi was followed by Reps. Suzan DelBene (D-Wash.), Scott Franklin (R-Fla.), and Thomas Keane Jr. (R-N.J.).

The Quincy Institute asserted: "If Congress wants to wash itself of conflicts of interest it can start by passing a stock trading ban. The Ending Trading and Holdings in Congressional Stocks Act, or ETHICS Act, would prohibit members of Congress from trading individual stocks."

The ETHICS Act was approved by the Democrat-controlled Senate Committee on Homeland Security and Government Affairs in July. The full Senate—which will be GOP-controlled starting next month—has yet to vote on the bill.

Earlier this month, U.S. President Joe Bide n was applauded by progressive lawmakers for backinga ban on congressional stock trading and asserting that "nobody in the Congress should be able to make money in the stock market while they're in the Congress."

On Monday, Biden signed the $895 billion Servicemember Quality of Life Improvement and National Defense Authorization Act for Fiscal Year 2025. As Sen. Bernie Sanders (I-Vt.) has highlighted, "Of that nearly $1 trillion dollars... about half will go to a handful of hugely profitable defense contractors."

Congresswoman Rashida Tlaib (D-Mich.) decried both the enormity of the military budget, as well as the fact that some of her colleagues have profited from investments in the military-industrial complex.

Tlaib has introduced the Stop Politicians Profiting from War Act, which would ban members of Congress, their spouses, and their dependent children from trading defense stocks or having financial interests in companies that do business with the U.S. Department of Defense.

In 2012, Congress passed the Stop Trading on Congressional Knowledge (STOCK) Act, legislation that has been panned as

weak and ineffective.

"If you want to serve in Congress, don't come here to serve your portfolio, come here to serve the people," said a Democrat leading the effort.

A small, bipartisan group of U.S. senators on Wednesday announced a proposal to ban trading of individual stocks by members of Congress and certain of their immediate family members, drawing praise from watchdog groups.

Sens. Jeff Merkley (D-Ore.), Jon Ossoff (D-Ga.), Gary Peters (D-Mich.), and Josh Hawley (R-Mo.) brought forth the bill, which would tighten rules on holdings of individual stocks and establish what Merkley described as "huge" penalties for noncompliance—the equivalent of a member's monthly salary, or 10% of the value of the improper investment, whichever is greater.

"If you want to serve in Congress, don't come here to serve your portfolio, come here to serve the people," Merkley toldNational Public Radio.

In response to the announced deal, Citizens for Responsibility and Ethics in Washington, a watchdog group, wrote on social media: "Great news. Let's get it done!"

Couldn't agree more 🎉 https://t.co/cDVPkti4Zm

— Citizens for Ethics (@CREWcrew) July 10, 2024

The American public, across the political spectrum, overwhelmingly supports banning stock trading by members of Congress, as a University of Maryland poll showed last year.

Members of Congress have access to a great deal of insider information, or at least publicly unavailable information, that they can use to trade advantageously. They significantly beat the market in 2023, according to a watchdog report.

U.S. lawmakers have hesitated to rein themselves in. Several proposals to restrict the trading have been put forth in recent years, though no bill has made it all that far. Assessing the chance of success at an effort last year, Politicosaid, "Don't hold your breath."

Congress did pass the Stop Trading on Congressional Knowledge (STOCK) Act in 2012, but that law is widely considered weak and ineffective.

Some Democrats tried to push through reforms to the STOCK Act when they controlled both houses of Congress and the presidency in 2022, but they were stymied by the top two House Democrats at the time, then-Speaker Nancy Pelosi (D-Calif.) and then-Majority Leader Steny Hoyer (D-Md.), who expressed opposition to reform of the act.

Pelosi, whose husband Paul Pelosi trades stocks, said during that congressional cycle that the U.S. was a "free-market economy" and members of Congress should be able to "participate in that."

Pelosi was one of the inspirations for what The Washington Post recently called "tongue-in-cheek financial products." The investment vehicles copy the holdings of well-known members of Congress by buying and selling the same stocks they are buying, per public disclosures. Members of Congress can make the disclosures anytime within 45 days of a trade, so the vehicles can't trade along with them in real time. Autopilot, an app, has a popular vehicle called the Pelosi Tracker, according toThe New Yorker.

Attempts at reform haven't fallen on neatly partisan lines—Rep. Matt Gaetz (R-Fl.) and Rep. Alexandria Ocasio-Cortez (D-N.Y.) teamed up last year—but have been largely pushed by Democrats.

Wednesday's announced proposal comes under the same name, the Ending Trading and Holdings in Congressional Stocks (ETHICS) Act, as a bill introduced by Merkley in April 2023. However, if it's the same bill, it appears to have been modified in negotiations with the other three senators, as media descriptions don't seem to match the text of last year's bill.

Hawley's inclusion in the group is notable—last year's bill had gathered the support of 23 senators, but no Republicans. At the time, Hawley criticized ETHICS for being too full of exemptions, and was pushing a similar bill he'd named the PELOSI Act. Ossoff also had his own effort to ban insider trading on Capitol Hill last year.

But now the senators have joined forces.

The newly announced ETHICS Act would require members of Congress, as well as their spouses and dependent children, to divest from holdings in individual stocks and place them in mutual funds. The law would apply to the U.S. president and vice president. It would also establish a publicly searchable database for all disclosures. It would go into effect in 2027, according to media reports.

The Senate Homeland Security and Governmental Affairs committee, chaired by Peters, is scheduled to mark up the bill on July 24.

"Members of Congress should not be allowed to trade stock," said one former congressional candidate. "It's corruption."

A financial watchdog group on Tuesday released its annual report on congressional stock trading, which shows that "Congress blew the market out of the water" in 2023, fueling fresh calls for a ban targeting U.S. lawmakers and their immediate family members.

"Members of Congress shouldn't be allowed to trade stocks of the companies they regulate for the same reasons referees aren't allowed to bet on the games they officiate," Melanie D'Arrigo, a former Democratic congressional candidate who is now executive director of the Campaign for New York Health, said in response to the Unusual Whales report.

Nina Turner, who also previously ran for Congress and is now a senior fellow at the Institute on Race, Power, and Political Economy, agreed. As Turner put it: "Members of Congress should not be allowed to trade stock. It's corruption."

While the Stop Trading on Congressional Knowledge (STOCK) Act of 2012 was intended to ban insider trading by members of Congress, lawmakers are still permitted to buy and sell stocks, even those of companies impacted by their work on Capitol Hill.

Revelations about lawmakers' stock market gains over the past few years, including previous reports from Unusual Whales, have bolstered efforts to pass legislation barring members of Congress, their spouses, and their dependent children from trading individual stocks—such as the Bipartisan Restoring Faith in Government Act introduced in May.

U.S. Congressman Ken Buck (R-Colo.) responded to the latest Unusual Whales report by promoting the Bipartisan Ban on Congressional Stock Ownership Act, which he introduced last year with Reps. Matt Rosendale (R-Mont.) and Pramila Jayapal (D-Wash.), chair of the Congressional Progressive Caucus.

"Members of both parties have misused their influence to buy and trade stocks. This is an issue which hurts all Americans," Buck said Tuesday. "The Bipartisan Ban on Congressional Stock Ownership Act will ensure that Congress is voting to represent their constituents instead of their wallets."

Unusual Whales' new report includes a graph comparing lawmakers' estimated returns for 2023—based on the current stocks in their portfolios—with the SPDR S&P 500 ETF (SPY), an exchange-traded fund that tracks the performance of the S&P 500 Index.

Thirty-two members of Congress—evenly split among Democrats and Republicans—fared better than SPY, which was up 24.81%. Overall, Democratic lawmakers were up 31.18% last year while their GOP colleagues were up 17.99%. At the top was U.S. Rep. Brian Higgins (D-N.Y.) at 238.9%.

Joining him in the top 10 were: Rep. Mark Green (R-Tenn.), 122.2%; Rep. Garret Graves (R-La.), 107.6%; David Rouzer (R-N.C.), 105.6%; Seth Moulton (D-Mass.), 80%; Sen. Ron Wyden (D-Ore.), 78.5%; Rep. John Rutherford (R-Fla.), 69.1%; Sen. Richard Blumenthal (D-Conn.), 68.1%; former House Speaker Nancy Pelosi (D-Calif.), 65.5%; and Pete Sessions (R-Texas), 63.3%.

"Numerous members in Congress traded war stocks before the Israel-Gaza-Palestine conflict," Unusual Whales noted.

As Common Dreams has reported, after Israel declared war in response to a Hamas-led attack on October 7, the stock of defense companies soared and weapons giants have continued to cash in on the conflict.

Unusual Whales also highlighted that "the banking crisis saw numerous mergers and unusually timed transactions, both by banking executives and politicians."

The person behind Unusual Whales grantedABC News an anonymous interview about such trades back in November:

"One thing people always say is that members are very good at picking stocks, that's often assumed… but to be quite frank, members were also quite good at avoiding losses," he told ABC News in his first television interview.

He pointed ABC News to the collapse of Silicon Valley Bank (SVB) and the regional banking crisis. He tracked trades showing several members of Congress, who sit on the House and Senate committees that regulate the financial industry, who sold SVB and other bank stocks before they experienced their sharpest decline.

"I can't know the intent, if that was what they were aiming to do," he told ABC News. "But many of the members who were trading banking stocks during that time performed very, very well."

In the Tuesday report, Unusual Whales also flagged unusual trades by Pelosi, whose husband is a trader, and Sen. Tommy Tuberville (R-Ala.), "one of the most active traders in Congress."

"We hope this will be our final report, and this report (with the history of our previous research) will be good enough to end the argument about Congress and trading," concluded Unusual Whales, which has also launched a tool so members of the public can track the portfolios of individual lawmakers.

Fox News host Jesse Watters on Tuesday asked U.S. Rep. Marjorie Taylor Greene (R-Ga.) about the report, which shows that she was up 18.6% last year. She responded, "I actually asked my team about that today—why my name was on the list—because I don't even own any stocks and I haven't all of 2023."

"As a matter of fact, we have to report everything, including children who are dependents of ours. And I think what was reported was actually related to my son's account that his father and I had set up for him years ago," added Greene, who shares three children with her ex-husband.

Newsweekreported that a clip of the interview "sparked questions and mockery from social media users, some of whom accused Greene of using her son as an excuse to cover up her own trading."