'It's a Coup': Musk's DOGE Granted Access to Treasury System That Pays Out Social Security

"I can think of no good reason why political operators who have demonstrated a blatant disregard for the law would need access to these sensitive, mission-critical systems," Sen. Ron Wyden said.

Elon Musk and his team at the Department of Government Efficiency—or DOGE—have been granted access to a sensitive Treasury Department payment system that contains the personal information of every American who receives tax refunds, Medicare, Social Security, and other payments from the government.

Newly approved Treasury Secretary Scott Bessent gave Musk surrogates access to the system late on Friday, five people familiar with the situation toldThe New York Times. Bessent's decision came the same day as news that David Lebryk, a career Treasury official who was acting secretary before Bessent's confirmation, would step down after arguing with DOGE members over access to the system run by the Bureau of Fiscal Service that pays out over $6 trillion a year.

"Sources tell my office that Treasury Secretary Bessent has granted DOGE *full* access to this system," Sen. Ron Wyden (D-Ore.) wrote on social media on Saturday. "Social Security and Medicare benefits, grants, payments to government contractors, including those that compete directly with Musk's own companies. All of it."

"Americans don't want an unelected and unaccountable billionaire dictating what working families can and cannot afford."

Former Labor Secretary Robert Reich also responded with shock to the news: "An unelected billionaire, with no actual congressional authority or governmentt experience, now has access to Treasury payment systems and sensitive information about millions of Americans who receive Social Security checks, tax refunds, and other payments. What could go wrong?"

The news heightens fears that Musk and the Trump administration are attempting to gain authoritarian control over the federal government by ousting or sidelining career civil servants and undermining Congress, which has the constitutional authority to decide how the government should spend its money.

DOGE gained access to the Treasury payment system on the same day that an official at the Office of Personnel Management said that Musk allies had locked career civil servants out of a computer system containing the personal information of federal employees. The news also capped a week in which the Trump administration attempted to freeze all federal grants and loans, a move that has been temporarily blocked by two judges.

Wyden, the ranking member on the Senate Finance Committee, sent a letter demanding answers from Bessent on Friday when reports first emerged that Musk's team had tried to gain access to the system.

"To put it bluntly, these payment systems simply cannot fail, and any politically motivated meddling in them risks severe damage to our country and the economy," Wyden wrote. "I am deeply concerned that following the federal grant and loan freeze earlier this week, these officials associated with Musk may have intended to access these payment systems to illegally withhold payments to any number of programs. I can think of no good reason why political operators who have demonstrated a blatant disregard for the law would need access to these sensitive, mission-critical systems."

Other Democratic lawmakers also voiced concerns on social media about the news.

"Elon Musk, the richest man on Earth, is rooting around in Social Security and Medicare payment systems. He's reaching his hands into our pockets and firing anyone who tries to stop him. This reeks of corruption—it must stop," Rep. Pramila Jayapal (D.-Wash.) wrote.

Sen. Elizabeth Warren (D-Mass.) called the news "alarming' and said that Congress must investigate.

People familiar with the situation told The New York Times that no payments had yet been blocked and that the stated mission of the DOGE team was to review payments, not to stop them. Musk suggested in a social media post on Friday that he was looking for inapropriate expenditures, but also that blocking funds might be appropriate.

"The DOGE team discovered, among other things, that payment approval officers at Treasury were instructed always to approve payments, even to known fraudulent or terrorist groups," he wrote on social media on Friday. "They literally never denied a payment in their entire career. Not even once."

Former Treasury officials told the Times that funds are dispersed by a comparatively small staff who rely on the agencies that earmark the funds to vet them. Don Hammond, who ran the system at the turn of the millennium, also toldThe Wall Street Journal that, while there were certain automatic safeguards in place, it was not the role of Treasury to approve or reject specific payments.

"Legally, if you want to stop a payment from taking place, the place to do that is at the agency level," Hammond said.

Responding to the article on social media on Sunday, Groundwork Collaborative executive director Lindsay Owens wrote: "The Treasury system makes the payments (cuts checks). It doesn't decide who to pay or how much. A little like an employer using a payroll processor. Musk has infiltrated the system to stop payments. It's a coup."

In an op-ed published by MSNBC on Saturday, Owens went into greater detail about her concerns, outlining three reasons why Musk might want access to the Treasury payment system.

- He could use it to stop payments to certain programs in order to work around the courts' block on the administration's spending freeze.

- He could access the list of blacklisted federal contractors in order to boost his own or his friend's companies and harm his competitors. (One of the DOGE allies granted access to the payment system, Tom Krause, is also a Big Tech CEO who leads Cloud Software Group, according to The New York Times.)

- He could use it to reduce Social Security or Medicare payments as part of DOGE's goal of cutting $2 trillion in federal spending.

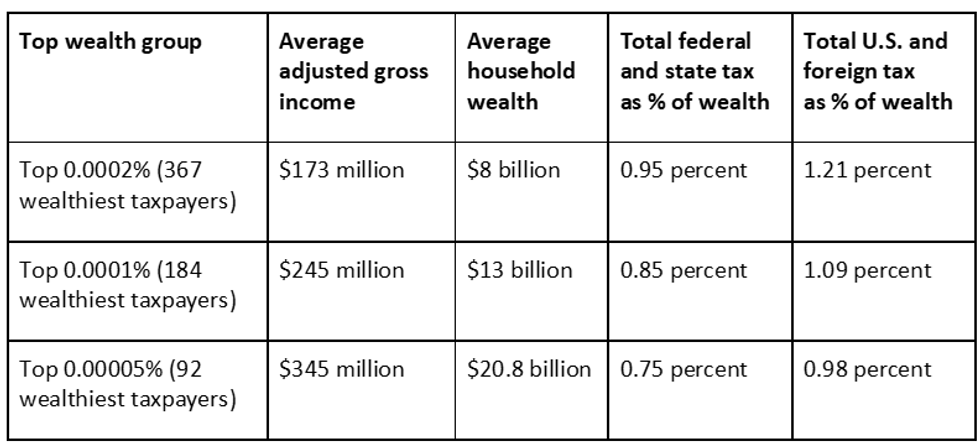

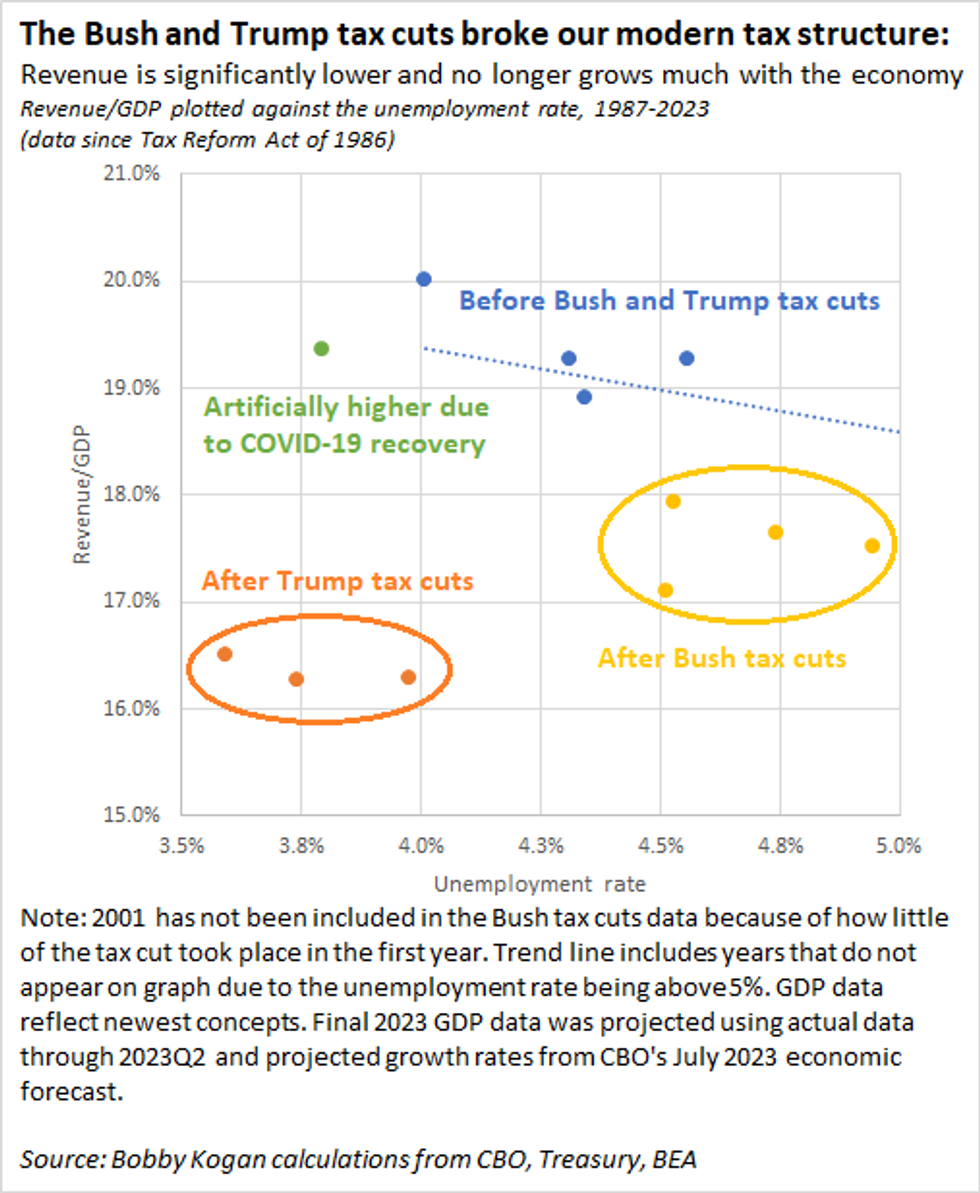

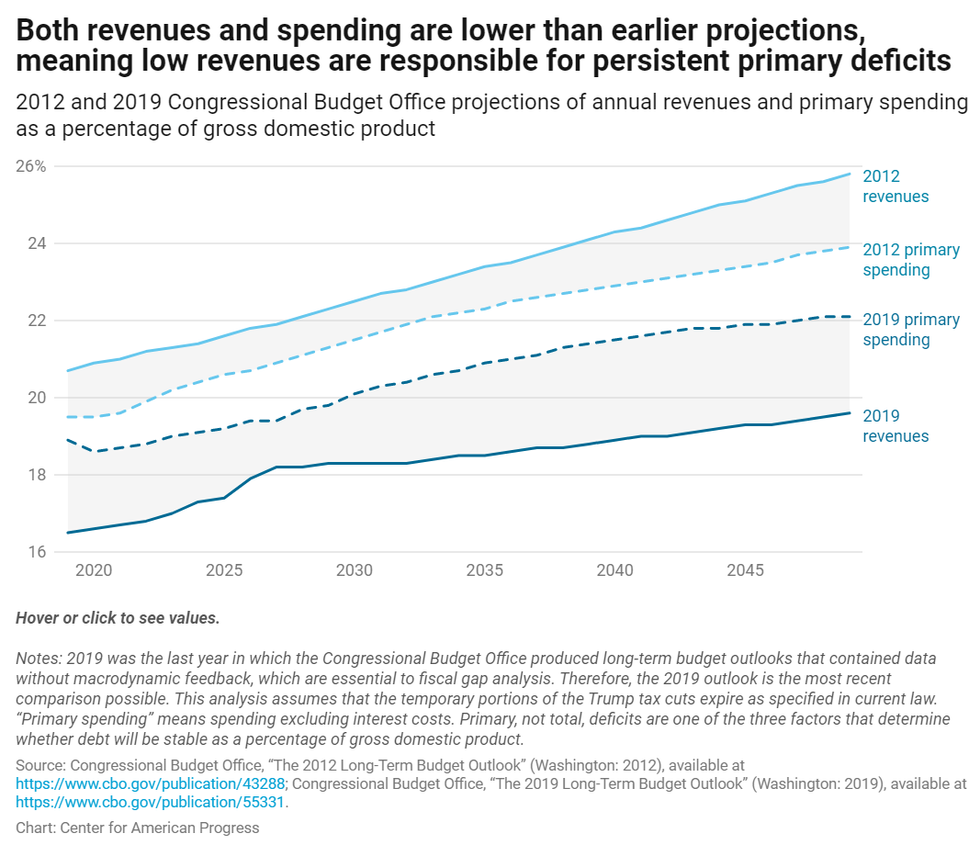

Owens noted hat Musk wasn't "chasing these cuts for their own sake. He's helping congressional Republicans attempt to pay for a new round of tax breaks for corporations and the ultrawealthy—including Musk himself."

"It's nice to believe in a fantasy in which Musk and DOGE work alongside civil servants to improve technology and services for Americans and save a few bucks along the way. But all evidence points to the contrary," Owens continued. "The richest man in the world, whom no one elected to any government position, is seeking unprecedented access to confidential information, including information pertaining to his own business interests, and seems hell-bent on cutting off as much funding as possible for the programs that matter to the rest of us."

Owens pointed to a recent poll finding that only around one-third of Americans approve of DOGE, and that 52% disapprove of Musk.

"Americans don't want an unelected and unaccountable billionaire dictating what working families can and cannot afford," she concluded. "If Musk is going to continue running the government like one of his failed businesses, perhaps someone should force his 'resignation' too."