Wall Street pay v. the minimum wage

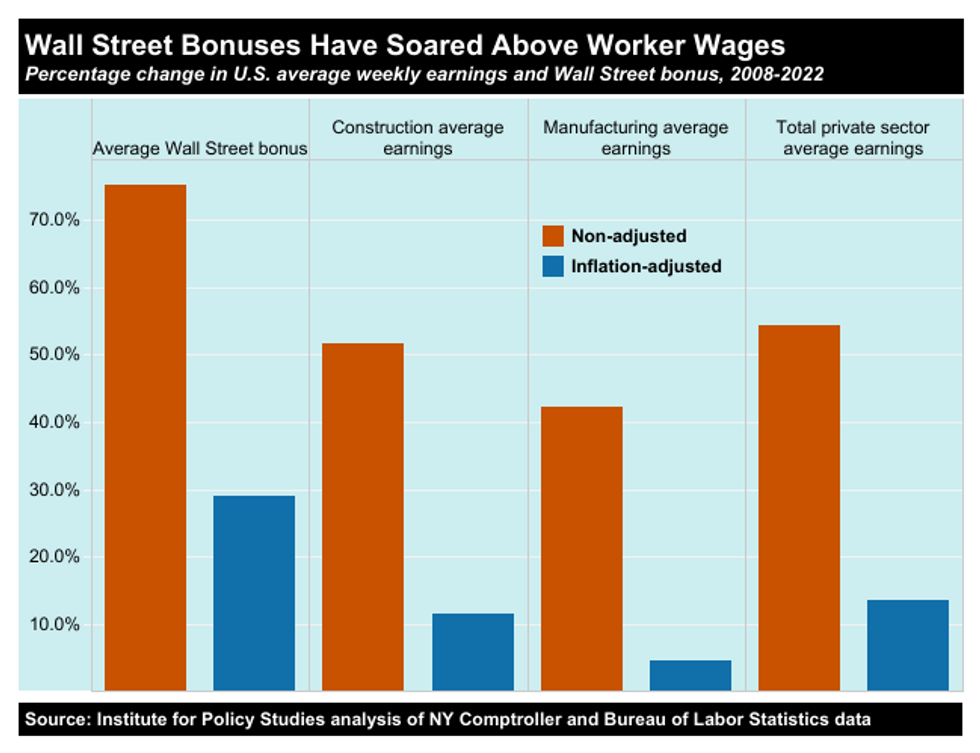

- Since 1985, the first year the comptroller reported bonus data, the average Wall Street bonus has increased 1,165 percent, from $13,970 to $176,700 in 2022 (not adjusted for inflation). If the minimum wage had increased at that rate, it would be worth $42.37 today, instead of $7.25.

- The total bonus pool for 190,800 New York City-based Wall Street employees in 2022 was $33.7 billion — enough to pay for 771,520 jobs that pay $15 per hour with benefits for a year.

- Wall Street bonuses come on top of base salaries, which averaged $516,560 for New York securities industry employees in 2021.

Wall Street bonuses and gender and racial inequality

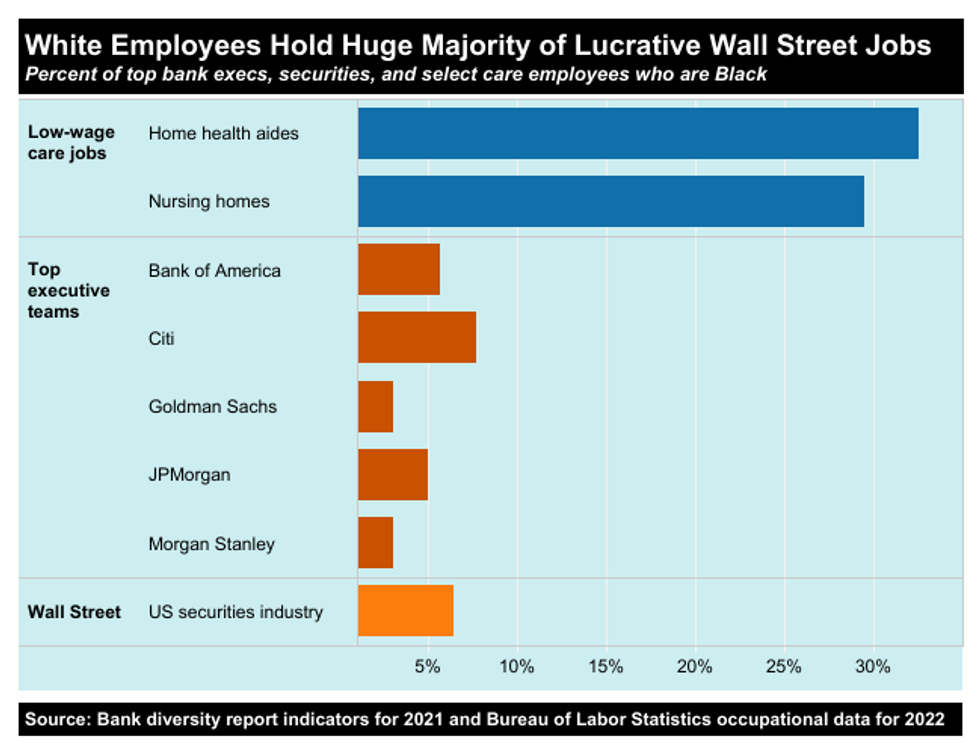

The rapid increase in Wall Street bonuses over the past several decades has contributed to gender and racial inequality, since workers at the low end of the wage scale are disproportionately people of color and women, while the lucrative financial industry is overwhelmingly white and male, particularly at the upper echelons.

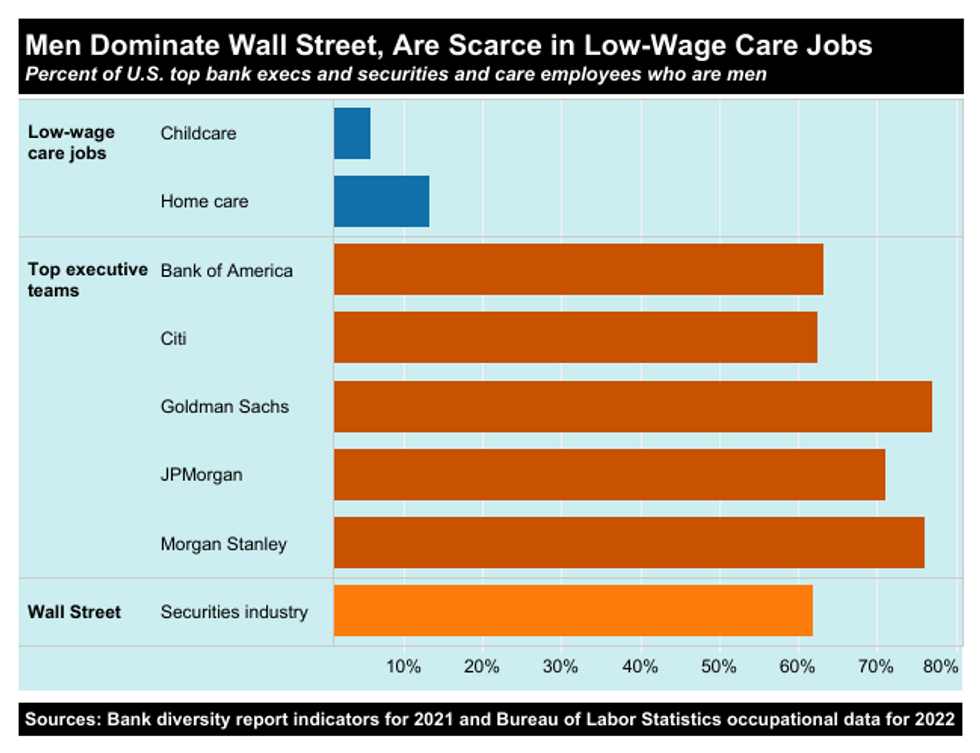

- Nationwide, men make up 62 percent of all securities industry employees but just a tiny fraction of workers who provide care services that are in high demand but continue to be very low paid. Men make up less than 6 percent of childcare workers, an occupation that pays $26,680 per year, on average. Men make up just 13 percent of home health aides, who average $29,260 per year.

Sources: Bank diversity report indicators for 2021 and Bureau of Labor Statistics occupational data for 2022

Sources: Bank diversity report indicators for 2021 and Bureau of Labor Statistics occupational data for 2022

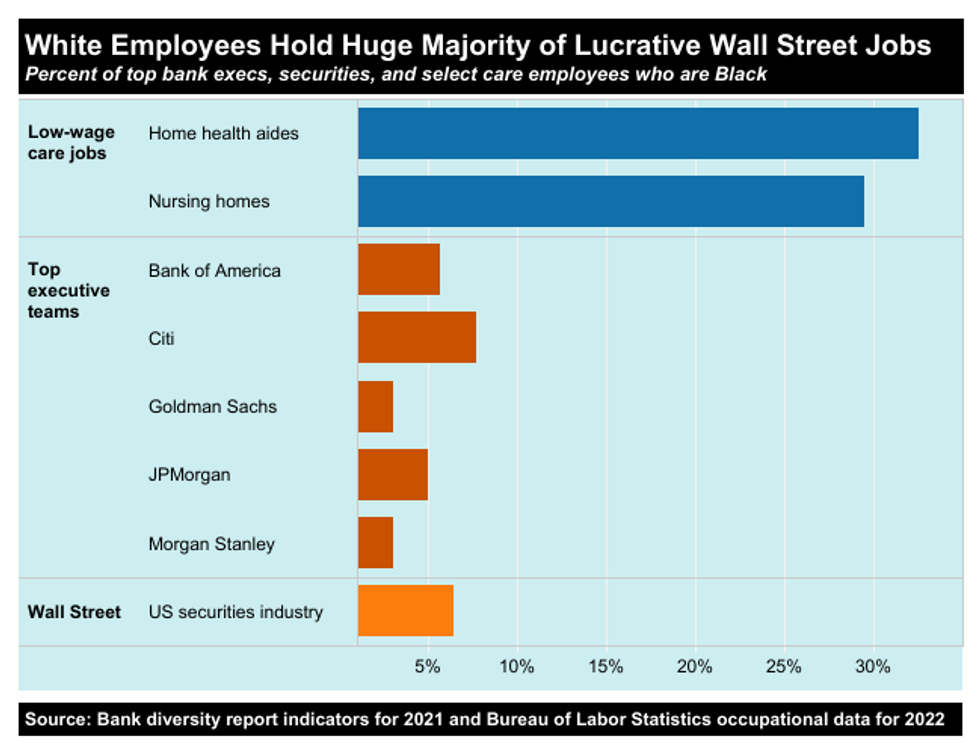

- At the five largest U.S. investment banks, the share of executives and top managers who are Black: JPMorgan Chase: 5%, Goldman Sachs: 3%, Bank of America: 6%, Morgan Stanley: 3%, and Citigroup: 8%.

- Nationally, Black workers hold just 6.4 percent of lucrative securities industry jobs but 32.5 percent of home health and 29.5 percent of nursing home jobs.

Source: Bank diversity report indicators for 2021 and Bureau of Labor Statistics occupational data for 2022

Source: Bank diversity report indicators for 2021 and Bureau of Labor Statistics occupational data for 2022

Regulators Fail to Rein in Wall Street Bonus Culture

The Comptroller’s bonus report comes amidst heightened scrutiny of Wall Street bonuses due to recent banking collapses. Silicon Valley Bank executives received their 2022 bonuses just hours before regulators seized control of the collapsing firm.

For more than a dozen years now, Wall Street and corporate lobbyists have blocked both financial executive pay restrictions and a federal minimum wage increase. This speaks volumes about who has influence in Washington — and who does not.

What Can Be Done to Rein in Excessive Wall Street Pay?

Wall Street’s bonus culture encouraged the high-risk behaviors that led to the 2008 financial crisis, costing millions of Americans their homes and livelihoods. In response, Congress inserted several compensation-related provisions in the post-crisis Dodd-Frank financial reform. These include Section 956, which bans Wall Street incentive pay that encourages “inappropriate” risk-taking. For more than a dozen years, regulators have failed to implement this rule, despite continued financial recklessness, as Public Citizen has documented.

Biden administration financial regulators should swiftly – and rigorously – enact the Dodd-Frank Wall Street pay restrictions that were supposed to have been enacted by May 2011. This new regulation should include:

- A ban on stock options at Wall Street banks

Options allow executives to buy company shares at a set price, offering all the benefits of share price increases with no downside risk. According to the bipartisan 2011 Financial Crisis Inquiry Commission, these pay structures create “incentives to increase both risk and leverage” in order to boost a company’s short-term stock price.

- Require Wall Street executives to set aside significant compensation for 10 years to pay potential misconduct fines – or make depositors whole in a crisis

If such a regulation had been in place before the SVB collapse, top executives would’ve automatically forfeited this deferred pay to help cover the cost of their recklessness. Former New York Federal Reserve Bank President William Dudley first proposed such collective funds in 2014, arguing that making executives put their own “skin in the game” would help change Wall Street’s dangerously risky culture.

- A ban on executive hedging of bonus pay

Any effort to reduce inappropriate risk-taking will be ineffective if employees can buy insurance to protect their compensation from the risk of poor company performance, as the AIG CEO was able to do in 2008.

Source: Institute for Policy Studies analysis of NY Comptroller and Bureau of Labor Statistics data

Source: Institute for Policy Studies analysis of NY Comptroller and Bureau of Labor Statistics data Sources: Bank diversity report indicators for 2021 and Bureau of Labor Statistics occupational data for 2022

Sources: Bank diversity report indicators for 2021 and Bureau of Labor Statistics occupational data for 2022 Source: Bank diversity report indicators for 2021 and Bureau of Labor Statistics occupational data for 2022

Source: Bank diversity report indicators for 2021 and Bureau of Labor Statistics occupational data for 2022