SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

A recent report on citizen-driven initiatives found that people in red and blue states vote for policies that are egalitarian and economically redistributive.

On the evening of November 5, 2024, I sat at a gathering of organizers and volunteers from the campaign to pass Proposition 139, a citizen-driven initiative in Arizona seeking to enshrine abortion access in the state constitution.

After an hour or so of waiting with bated breath, the bulk of Arizona’s ballot initiative results had been counted and posted online. Our hard work had paid off! Prop 139 had amassed 66% voter support (a number that would decrease to a still impressive 61% by the final tally.) After a significant round of applause and the shedding of a few tears, the party settled into a pleasant thrum.

At first I expected shouting, screaming, and crying—we had won a massive victory! But I quickly understood that the celebration was more subdued than expected because the results were exactly what the lead organizers of the campaign hadanticipated: a win.

Healthcare Rising and Prop 139 won because they refused to partake in party politics and instead tailored their campaign toward fighting for issues that were resonant and supported in their constituency and across the political spectrum.

Ultimately, it was unsurprising that this initiative to enshrine abortion access passed in Arizona, despite voters in the state supporting anti-abortion candidate and now U.S. President Donald Trump, because reproductive freedom itself as a policy has proven to be overwhelmingly popular when put to a vote by the electorate.

A recent report from our team at the Center for Work and Democracy uses data from citizen-driven initiatives—ballot initiatives that are drafted, petitioned, and voted on by citizens themselves—from the last 15 years to see where patterns in voting emerge. Put very briefly, we found that people vote for policies that are egalitarian and economically redistributive.

Egalitarian measures—which equalize rights, resources, and decision-making power in society—pass at a rate of 65.63% across blue and red states alike. Initiatives supporting reproductive rights, for example, are considered egalitarian and prove to be extremely successful at the polls. Despite a difficult loss in Florida in the 2024 election and a complicated voting stalemate in Nebraska, abortion access has been protected by voters in 14 out of 17 cases since the fall of Roe v. Wade.

Redistributive measures are a subsect of egalitarian initiatives that specifically focus on the redistribution of wealth from the rich to the poor, like raising the minimum wage. With an even greater passage rate than other egalitarian measures, redistributive ballot measures clock in with an impressive win rate of 75%. In red states, this number rises all the way to a whopping 92% compared to 61.29% in blue states. (We found that blue states’ averages are skewed down by California’s initiative results, which are far less progressive than the state’s image.)

When Healthcare Rising Arizona and the other co-organizers of the campaign for Prop 139 set out to get the initiative on the ballot and enshrined in the state constitution, they knew that party politics were not going to help their cause. From day one, the campaign for 139 was clear that their organizing would be strictly nonpartisan because they knew that abortion as a policy was more popular than any individual Democratic candidates, despite those Democrats being vocally pro-choice.

The strategy worked. The Arizona for Abortion Access Act passed with 417,427 more votes than former Vice President Kamala Harris received in Arizona, proving that egalitarian policies like reproductive rights are simply more popular than pro-choice candidates.

Healthcare Rising and Prop 139 won because they refused to partake in party politics and instead tailored their campaign toward fighting for issues that were resonant and supported in their constituency and across the political spectrum.

Our data tells us that egalitarian and redistributive measures are exceedingly popular with red and blue voters alike. So if Republican and Democrat voters both want many of the same things—policies that equalize rights, break down wealth inequality, and support the decision-making power of everyday people—why won’t politicians just give the people what they want?

Families including Elon Musk, Jeff Bezos, and Mark Zuckerberg now control a combined $2.6 trillion in wealth, according to renowned economist Gabriel Zucman.

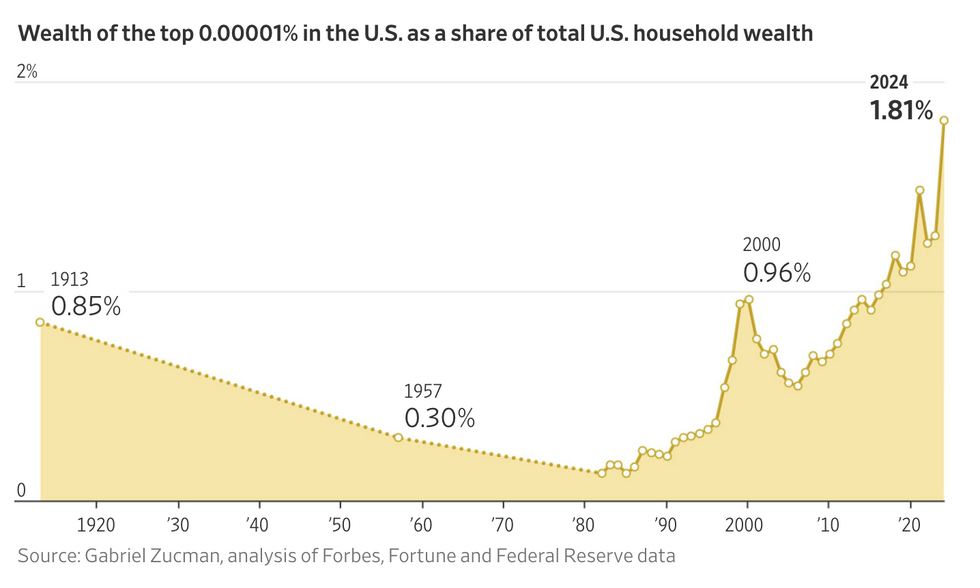

A new analysis by a leading chronicler of the United States' exploding inequality shows that the 19 richest American households added $1 trillion to their collective fortunes last year and saw their share of the nation's wealth jump at a record-shattering pace.

The analysis by Gabriel Zucman, a professor of economics at the University of California, Berkeley, estimates that the 19 wealthiest U.S. families now control 1.8%—or $2.6 trillion—of the nation's total household wealth.

In 2024, those ultrarich households saw the largest single-year wealth increase on record.

The Wall Street Journalnoted in its Wednesday write-up of Zucman's analysis—based on data from Forbes, Fortune, and the Federal Reserve—that the families in his "research on the top 0.00001% in the U.S. are worth at least $45 billion per household and include Elon Musk, Jeff Bezos, Mark Zuckerberg, Bill Gates, Warren Buffett, and private-equity investor Stephen Schwarzman."

Their wealth is largely tied up in the U.S. stock market, which rose more than 23% in 2024. The richest 10% of U.S. households control 93% of stock market wealth, according to the Federal Reserve.

Zucman, whose analysis dates back to 1913, told the Journal that the U.S. has recently seen a "dramatic acceleration in the rise of the share of wealth owned by the truly superwealthy"—a trend that would continue if President Donald Trump and the Republican-controlled Congress pass tax legislation largely benefiting the rich.

"If there's one glimmer of hope it is this," Zucman wrote on social media last month, pointing to a packed "Fighting Oligarchy" rally held in Denver by Sen. Bernie Sanders (I-Vt.) and Rep. Alexandria Ocasio-Cortez (D-N.Y.).

"There is a strong anti-oligarchic current in America, and it has a formidable champion," Zucman added. "Fight!"

The Journal reported Wednesday that "a household in the top 0.1%—roughly 133,000 households each worth at least $46.3 million—accumulated an average of $3.4 million a year since the third quarter of 1990, in 2024 dollars."

"In comparison, the wealth of the rest of the top 1%—roughly 1.2 million households each worth at least $11.2 million—grew by an average of $450,000 per household, per year," the Journal added.

Meanwhile, families at the bottom of the U.S. income and wealth distribution have struggled due to what the Economic Policy Institute recently described as "policy-induced wage suppression."

A February working paper by the think tank RAND estimated that the bottom 90% of U.S. workers would have earned $3.9 trillion more in 2023 alone had the income distribution been more even rather than flowing disproportionately to the top.

"Since 1975, nearly $80 trillion in wealth has been redistributed from the bottom 90% of Americans to the top 1%," Sanders said last month in response to the paper. "The massive income and wealth inequality in America today is not only morally unjust, it is profoundly damaging to our democracy."

Is it possible that by promising to end “death by bureaucracy,” he has willfully sowed the seeds of his own political demise?

On Saturday, April 5 hundreds of thousands gathered across the United States rallying under the banner of “hands off.” The protest was against the devastation wielded by the Trump government on public services, consumer protections, public healthcare, and trade freedom. The protesters’ ire turned especially to Elon Musk’s work with the Department of Government Efficiency( DOGE) radically downsizing U.S. government spending. “Hey! Hey! Ho! Ho! Elon Musk has to go!” They chanted

The scenes of public dissent were in sharp contrast to the image of Musk, just a few months ago, taking the stage at the Conservative Political Action Conference in Washington raising a chainsaw high in the air with boyish glee. “This is the chainsaw for bureaucracy,” he extolled, referring to his aggressively ruthless ambition to ax $2 trillion from the U.S. federal budget.

The April protests are a sign that Musk’s fresh-faced jubilance and billionaire-funded political luck might be running out at the hands of his own destructive impulses. As Musk wantonly fights against what he calls “civilizational suicidal empathy,” is it possible that by promising to end “death by bureaucracy,” he has willfully sowed the seeds of his own political demise?

He represents a very particular marriage of politics and capitalism that has no respect for the law, believing that the masters of industry should also be the masters of the world, unencumbered by stuffy bureaucrats trying to stymie their pursuit of greatness.

Musk portrays himself as the billionaire version of the classic vigilante: the man (almost always) who takes the law into his own hands in search of a self-styled brand of justice and effectiveness. A significant part of Musk’s cultural cache is that he exploits the vigilante myth, portraying himself as the savior of an America dream destroyed by corrupt and inefficient democratic institutions.

President Donald Trump described Musk’s vigilante appeal well: “Elon is doing a great job, but I would like to see him get more aggressive. Remember, we have a country to save.” Destruction, redemption, and emancipation driven by masculine emotion is at the heart of Musk’s DOGE endeavor.

Vigilantes achieve their ambitions through self-justified law breaking, reflected in Musk’s DOGE being condemned as illegal. With unwavering confidence in their own convictions, vigilantes feel justified in using whatever powers they have to ensure what they think is right is enforced—and in Musk’s case that is a lot of power.

Unlike the vigilantes we see on television or in the movies, Musk is not a violent avenger seeking justice through the barrel of a gun (or even at the end of chain saw). His weapons are not firearms but money and power. He is portrayed as “the DOGEfather” in vigilante reference to Don Corleone, the eponymous anti-hero of 1972 gangster film The Godfather.

Musk acts out billionaire vigilantism par excellence. He represents a very particular marriage of politics and capitalism that has no respect for the law, believing that the masters of industry should also be the masters of the world, unencumbered by stuffy bureaucrats trying to stymie their pursuit of greatness.

The aggression of Musk’s ambition to slash government and upturn the institutions of democracy appears to be turning against up him. His popularity is nosediving as his unpredictable and conflict-ridden behavior escalates. Musk may have taken the stereotype of the vigilante to such extremes that he is exercising a death wish not just on his own political career but on very idea of the heroic billionaire savior.

The tides are certainly changing. Musk may have used his wealth to influence the presidential election last year, but this month his $25 million spend could not secure Trump’s preferred candidate Brad Schimel in the campaign for as seat in Wisconsin Supreme Court.

Tesla’s sales around the world have plummeted, with people seemingly embarrassed at the prospect of being seen to be associated with Musk. Many are putting bumper stickers on their cars with slogans such as “I Bought This Before We Knew Elon Was Crazy.” In Britain social media campaigners Everyone Hates Elon orchestrated a public art project where people took sledgehammers to a donated Tesla Model S. Their purpose was “to create a debate about wealth inequality.”

Employees are not far behind. Musk practically begged them not to sell Tesla stock holdings. Meanwhile investors are calling for Musk to resign as CEO of Tesla as he gets more and more embroiled in political controversy and Tesla’s market value stumbles. In the the not too recent past conservatives rallied behind the slogan “go woke, go broke.” This is rapidly turning around to “go MAGA, go broke.”

Musk’s outlandish death drive might end up killing the vigilante myth he trades on rather than killing American democracy. Time will tell, but for now there are plenty of reasons to hope that it will.