The report highlights Republicans' so-called One Big Beautiful Bill Act (OBBBA), which slashed various benefits for US families, and their refusal to extend Affordable Care Act (ACA) subsidies that helped over 20 million Americans afford health insurance.

The OBBBA's $1 trillion Medicaid cut "is devastating for small businesses," the document declares, noting that 630,000 owners and more than 7.5 million workers at such companies rely on the federal program for healthcare coverage. Additionally, over 10 million owners and employees relied on the ACA tax credits that expired at the end of last year.

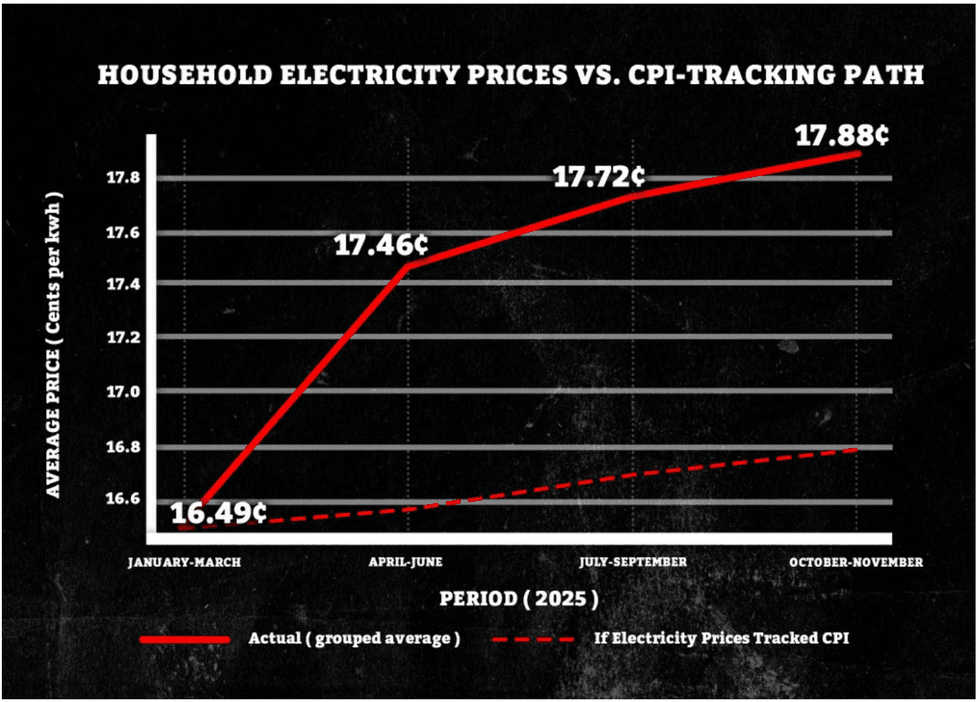

The publication also points to the president's attacks on clean energy and support for the planet-wrecking fossil fuel industry that helped him secure a second term. It says that "household electric bills have increased by 11.5%, and commercial electric bills have increased by 9%," stressing that such costs have climbed "more than three times faster than the overall rate of inflation."

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)

The report also spotlights the "whiplash and cost of Trump's reckless tariffs," emphasizing that while the president often claims foreign countries are paying for his import taxes, "analysis by the Kiel Institute for the World Economy found that 96% of Trump's tariffs are being paid by American importers and consumers."

Specifically, since last March, US small businesses have shelled out more than $63.1 billion because of Trump tariffs. California—the world's fifth-largest economy—leads the state-by-state breakdown, at $14.3 billion, followed by Texas ($7 billion), New York ($4.9 billion), New Jersey ($4.1 billion), Georgia ($3.9 billion), Florida ($3.6 billion), Illinois ($2.3 billion), Ohio ($2 billion), Michigan ($1.7 billion), and South Carolina ($1.6 billion).

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)

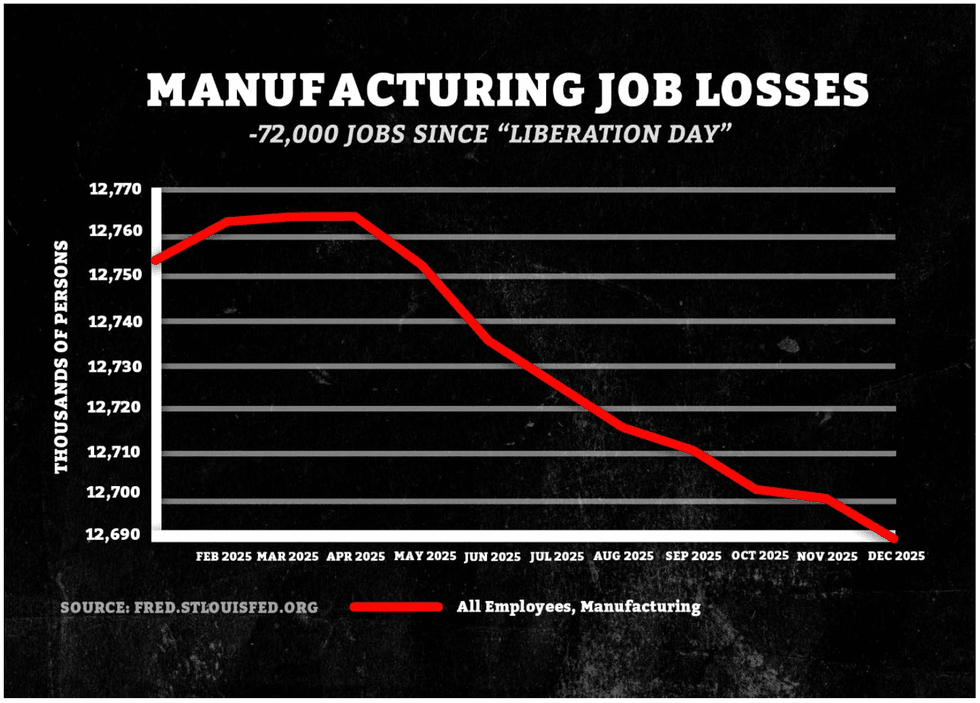

The president also claims that his tariffs are spurring a "manufacturing renaissance," but "approximately 98% of manufacturers in the United States employ fewer than 500 workers, with 75% of manufacturers employing fewer than 20," the report states. "US manufacturing shrank for the 10th consecutive month in December, and US factories have shed 72,000 jobs since Trump's 'liberation day' in April."

Adding to the evidence of Trump's negative impact, the Bureau of Labor Statistics announced Wednesday that across all sectors, US employers added just 181,000 jobs last year, far below its initial estimate of 584,000, and the country's economy has more than a million fewer jobs than previously reported.

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)

Markey's staff further found that "soaring rents have left a record 22.6 million renters—approximately 50% of all renters in the US—struggling to afford their rent," 70% of families said last year that raising children is too expensive, and Trump's deportation agenda is estimated to reduce the number of immigrant and US-born workers by more than 5 million.

"Small businesses don't have Mar-a-Lago memberships, golden gifts, or ballroom invitations granting them special exemptions from Trump’s reckless economic policies, including his tariff taxes," Markey said in a statement announcing the report.

"Since Inauguration Day, Trump has made life more expensive for Americans—driving up costs on everything from healthcare, electricity, and groceries to childcare and housing—all while giving tax cuts to CEO billionaires and currying favors with big business," he continued. "As Trump's affordability crisis wreaks havoc on Main Street, we must fight back to protect small businesses, working families, and communities in Massachusetts and across the country."

As part of that fight, Markey has tried to pass multiple pieces of legislation that would exempt small businesses from Trump's tariffs, but both chambers of Congress remain narrowly controlled by the president's Republican Party.

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street) (Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street) (Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)

(Image from Senate Committee on Small Business and Entrepreneurship report Pain Street)