SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

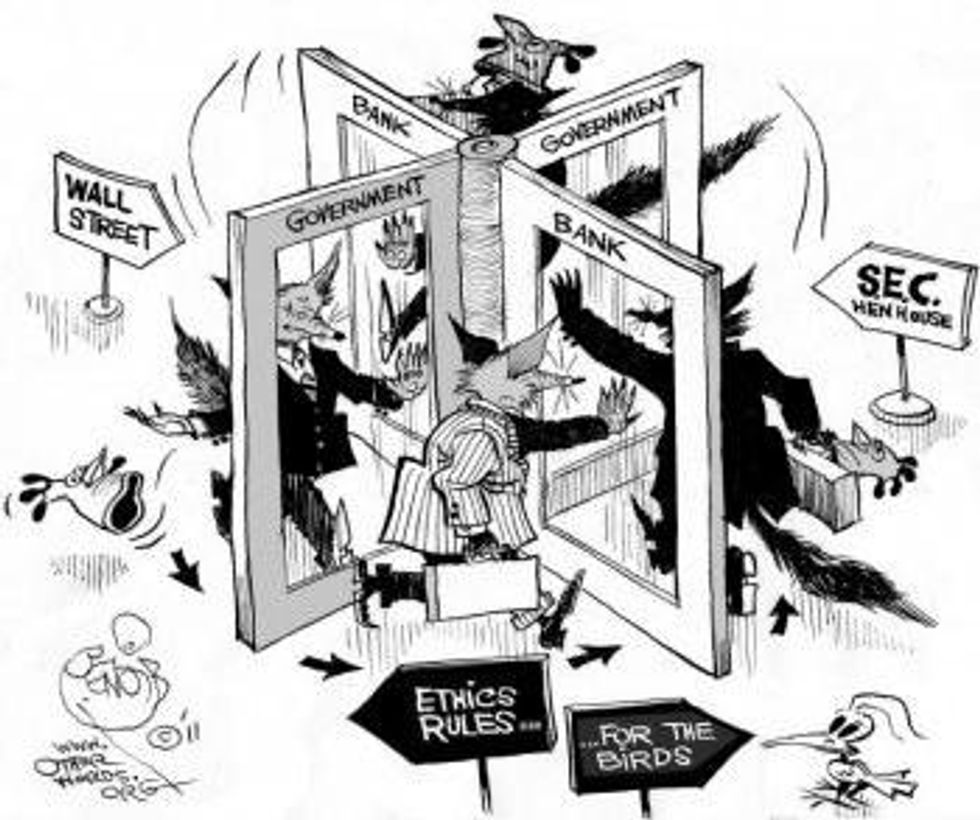

If you're looking for evidence of the revolving door that spins between the federal government and Wall Street, look no further than Daniel Gallagher, President Barack Obama's recently announced nominee for Securities and Exchange Commission commissioner.

Gallagher certainly appears qualified for the job. He previously worked at the SEC as a counsel to then-Chairman Christopher Cox, and later played a key role in organizing the SEC's response to the financial crisis. Yet Obama's nomination of Gallagher to help lead the agency during a critical time in its history is also the latest example of the agency's coziness to the industry it oversees.

Gallagher is currently a partner at WilmerHale. The pricey law firm's high-profile clients have included Goldman Sachs, JPMorgan Chase, Citigroup, and other Wall Street giants regulated by the SEC. If the Senate confirms him, this would be Gallagher's second spin through the revolving door -- he previously left WilmerHale to join the SEC in January 2006, only to return to the firm in 2010. And he would be the latest on an ever-expanding list of WilmerHale alumni at the SEC, including the current general counsel, deputy general counsel, associate general counsel, corporation finance division director, enforcement division chief counsel, and deputy secretary.

Of course, the revolving door spins in both directions. Many former SEC employees leave the agency to join WilmerHale and other legal, accounting, and consulting firms that represent clients in the securities industry. Several recent reports by the SEC Inspector General have raised troubling questions about whether the promise of future employment representing Wall Street causes some SEC officials to treat potential employers and their clients with a lighter touch.

The Project On Government Oversight (POGO), where I work as an investigator, just released a new report and database showing that hundreds of former SEC employees have recently taken jobs representing clients before the SEC.

All told, POGO's database shows that 219 former SEC employees filed 789 statements between 2006 and 2010 announcing their intent to appear before the SEC or communicate with its staff on behalf of private clients. One former employee had to file 20 statements during this time period in order to disclose all his clients and the issues on which he expected to appear before the SEC. Another former employee filed his first statement just two days after leaving the agency.

Last year, the SEC Inspector General issued a report on the agency's botched investigation of Allied Capital, which was represented by none other than WilmerHale. Two of the WilmerHale attorneys who represented Allied were former senior officials in the SEC's enforcement division. The Inspector General found that a current associate director in the SEC's compliance office who knew one of the WilmerHale attorneys said he declined to refer the Allied matter to the enforcement division because, "If you've known somebody or even if they didn't really know them but you know they worked here... Well, they should hopefully be doing the right thing."

A few months after the report was issued, the Inspector General told Sen. Charles Grassley (R-IA) that his office had opened another investigation into allegations that the SEC may have failed to take appropriate action in a matter involving a law firm that has recruited numerous former SEC employees.

Congress and the SEC must strengthen and simplify the ethics rules for the agency's former employees, including making all post-employment statements publicly available online, and extend the same post-employment regulations to other financial watchdog agencies.

Now that the SEC has been given even greater authority to protect investors and markets from the next financial crisis, it's more important than ever for the public to see whose interests the agency is truly representing.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

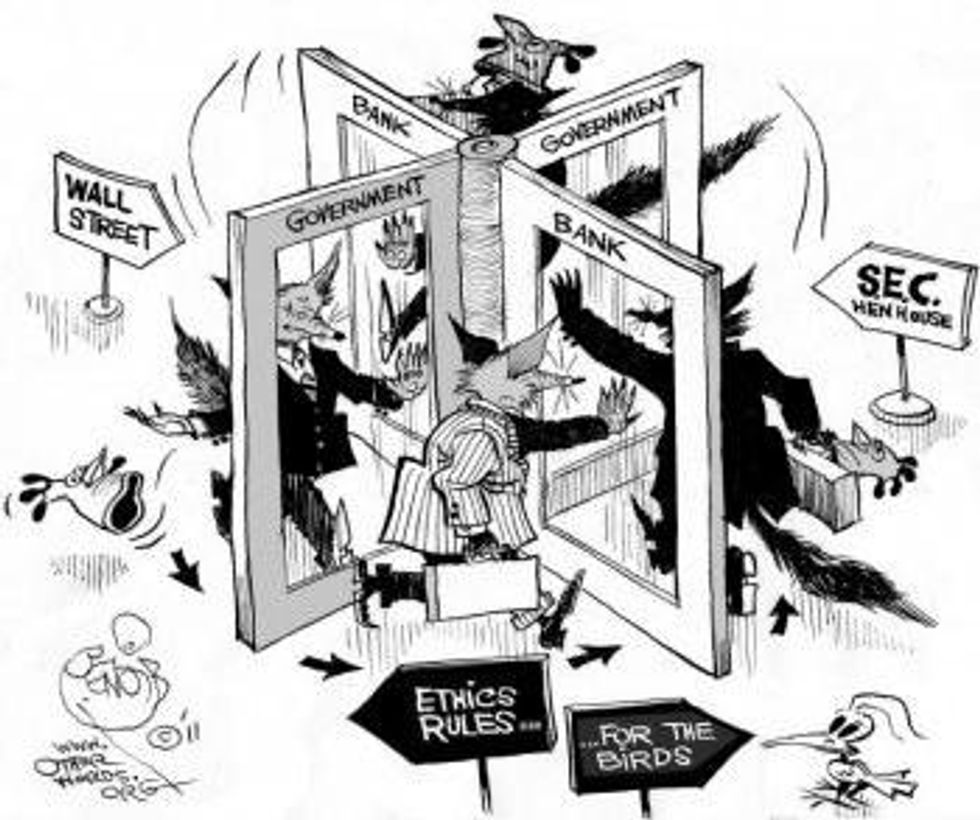

If you're looking for evidence of the revolving door that spins between the federal government and Wall Street, look no further than Daniel Gallagher, President Barack Obama's recently announced nominee for Securities and Exchange Commission commissioner.

Gallagher certainly appears qualified for the job. He previously worked at the SEC as a counsel to then-Chairman Christopher Cox, and later played a key role in organizing the SEC's response to the financial crisis. Yet Obama's nomination of Gallagher to help lead the agency during a critical time in its history is also the latest example of the agency's coziness to the industry it oversees.

Gallagher is currently a partner at WilmerHale. The pricey law firm's high-profile clients have included Goldman Sachs, JPMorgan Chase, Citigroup, and other Wall Street giants regulated by the SEC. If the Senate confirms him, this would be Gallagher's second spin through the revolving door -- he previously left WilmerHale to join the SEC in January 2006, only to return to the firm in 2010. And he would be the latest on an ever-expanding list of WilmerHale alumni at the SEC, including the current general counsel, deputy general counsel, associate general counsel, corporation finance division director, enforcement division chief counsel, and deputy secretary.

Of course, the revolving door spins in both directions. Many former SEC employees leave the agency to join WilmerHale and other legal, accounting, and consulting firms that represent clients in the securities industry. Several recent reports by the SEC Inspector General have raised troubling questions about whether the promise of future employment representing Wall Street causes some SEC officials to treat potential employers and their clients with a lighter touch.

The Project On Government Oversight (POGO), where I work as an investigator, just released a new report and database showing that hundreds of former SEC employees have recently taken jobs representing clients before the SEC.

All told, POGO's database shows that 219 former SEC employees filed 789 statements between 2006 and 2010 announcing their intent to appear before the SEC or communicate with its staff on behalf of private clients. One former employee had to file 20 statements during this time period in order to disclose all his clients and the issues on which he expected to appear before the SEC. Another former employee filed his first statement just two days after leaving the agency.

Last year, the SEC Inspector General issued a report on the agency's botched investigation of Allied Capital, which was represented by none other than WilmerHale. Two of the WilmerHale attorneys who represented Allied were former senior officials in the SEC's enforcement division. The Inspector General found that a current associate director in the SEC's compliance office who knew one of the WilmerHale attorneys said he declined to refer the Allied matter to the enforcement division because, "If you've known somebody or even if they didn't really know them but you know they worked here... Well, they should hopefully be doing the right thing."

A few months after the report was issued, the Inspector General told Sen. Charles Grassley (R-IA) that his office had opened another investigation into allegations that the SEC may have failed to take appropriate action in a matter involving a law firm that has recruited numerous former SEC employees.

Congress and the SEC must strengthen and simplify the ethics rules for the agency's former employees, including making all post-employment statements publicly available online, and extend the same post-employment regulations to other financial watchdog agencies.

Now that the SEC has been given even greater authority to protect investors and markets from the next financial crisis, it's more important than ever for the public to see whose interests the agency is truly representing.

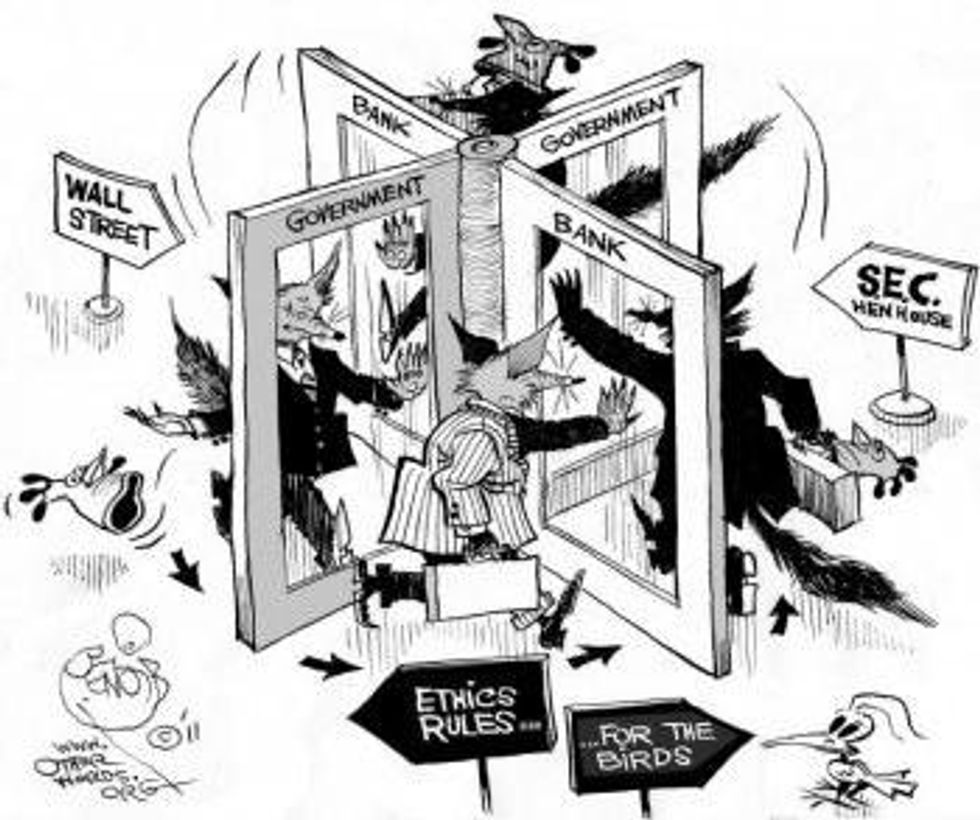

If you're looking for evidence of the revolving door that spins between the federal government and Wall Street, look no further than Daniel Gallagher, President Barack Obama's recently announced nominee for Securities and Exchange Commission commissioner.

Gallagher certainly appears qualified for the job. He previously worked at the SEC as a counsel to then-Chairman Christopher Cox, and later played a key role in organizing the SEC's response to the financial crisis. Yet Obama's nomination of Gallagher to help lead the agency during a critical time in its history is also the latest example of the agency's coziness to the industry it oversees.

Gallagher is currently a partner at WilmerHale. The pricey law firm's high-profile clients have included Goldman Sachs, JPMorgan Chase, Citigroup, and other Wall Street giants regulated by the SEC. If the Senate confirms him, this would be Gallagher's second spin through the revolving door -- he previously left WilmerHale to join the SEC in January 2006, only to return to the firm in 2010. And he would be the latest on an ever-expanding list of WilmerHale alumni at the SEC, including the current general counsel, deputy general counsel, associate general counsel, corporation finance division director, enforcement division chief counsel, and deputy secretary.

Of course, the revolving door spins in both directions. Many former SEC employees leave the agency to join WilmerHale and other legal, accounting, and consulting firms that represent clients in the securities industry. Several recent reports by the SEC Inspector General have raised troubling questions about whether the promise of future employment representing Wall Street causes some SEC officials to treat potential employers and their clients with a lighter touch.

The Project On Government Oversight (POGO), where I work as an investigator, just released a new report and database showing that hundreds of former SEC employees have recently taken jobs representing clients before the SEC.

All told, POGO's database shows that 219 former SEC employees filed 789 statements between 2006 and 2010 announcing their intent to appear before the SEC or communicate with its staff on behalf of private clients. One former employee had to file 20 statements during this time period in order to disclose all his clients and the issues on which he expected to appear before the SEC. Another former employee filed his first statement just two days after leaving the agency.

Last year, the SEC Inspector General issued a report on the agency's botched investigation of Allied Capital, which was represented by none other than WilmerHale. Two of the WilmerHale attorneys who represented Allied were former senior officials in the SEC's enforcement division. The Inspector General found that a current associate director in the SEC's compliance office who knew one of the WilmerHale attorneys said he declined to refer the Allied matter to the enforcement division because, "If you've known somebody or even if they didn't really know them but you know they worked here... Well, they should hopefully be doing the right thing."

A few months after the report was issued, the Inspector General told Sen. Charles Grassley (R-IA) that his office had opened another investigation into allegations that the SEC may have failed to take appropriate action in a matter involving a law firm that has recruited numerous former SEC employees.

Congress and the SEC must strengthen and simplify the ethics rules for the agency's former employees, including making all post-employment statements publicly available online, and extend the same post-employment regulations to other financial watchdog agencies.

Now that the SEC has been given even greater authority to protect investors and markets from the next financial crisis, it's more important than ever for the public to see whose interests the agency is truly representing.