Consumer Bureau Launches in Shark-Infested Waters

The Consumer Financial Protection Bureau (CFPB) throws open its doors to consumers this week, officially starting its mission to safeguard Americans from overly complex financial products and malignant banking practices. The bureau is the culmination of a national grassroots effort to hold the big banks accountable for the 2008 economic collapse caused by Wall Street's insatiable appetite for dangerous mortgage products.

The Consumer Financial Protection Bureau (CFPB) throws open its doors to consumers this week, officially starting its mission to safeguard Americans from overly complex financial products and malignant banking practices. The bureau is the culmination of a national grassroots effort to hold the big banks accountable for the 2008 economic collapse caused by Wall Street's insatiable appetite for dangerous mortgage products. Millions of Americans signed petitions to create the bureau and new polling shows that 74% of Americans think it is a terrific idea.

But the CFPB launches in perilous waters. On the day the bureau opened its doors, the House of Representatives took up H.R. 1315 the "Consumer Financial Protection Safety and Soundness Improvement Act" - a name that would make George Orwell blush. This bill, authored by neophyte Rep. Sean Duffy of Wisconsin (the man who complains about his $174,000 Congressional salary at town hall meetings), is one of a dozen bills that have been introduced by Republicans eager for Wall Street campaign contributions to defund, dismantle, and destroy the new bureau.

Why is this little agency so dangerous?

According to the Center for Responsive Politics, Wall Street and the financial services lobby spent an eye-popping $1,400,000,000 between 2008 and 2010 to kill financial reform. The U.S. Chamber of Commerce has a whole unit dedicated to killing it. This year, the those same forces spent $156 million on lobbying in the first quarter. The big banks are fighting the implementation of the Dodd-Frank Wall Street reform bill with a stable of willing Congressmen and an army of lobbyists fanned out across a dozen federal agencies where Dodd-Frank rulemaking is underway.

When it comes to the CFPB, the big banks want to take power away from the agency's director (a post long slated for presidential adviser Elizabeth Warren) and to give control of the bureau's budget to Congress (taking it away from the Federal Reserve where it is insulated it from partisan funding fights). A win on this later issue would ensure that the CFPB suffered a slow strangulation, a fate that befell the Consumer Product Safety Commission over a 40-year period.

The new bureau was created to police consumer financial products such as mortgages, credit cards, and payday loans while also working to clarifying their prices and risks to consumers. While this job description sounds fairly limited and commonsensical, the complete hysteria engendered by its birth proves something that Warren has long known--our entire financial system is founded on the practice of ripping off consumers. Fraud it not a byproduct of bad actors, it is the life blood of the entire system. A bureau with real teeth and an activist director is Jamie Dimon's worst nightmare.

Warren disappointment

President Obama chose not to nominate his top adviser, Elizabeth Warren, to serve as the bureau's permanent director, to the disappointment of millions who signed petitions urging her appointment. The agency was Warren's idea, and she has worked tirelessly as the bureau's de facto head, building a talented staff and creating the structures needed to make the agency responsive and effective.

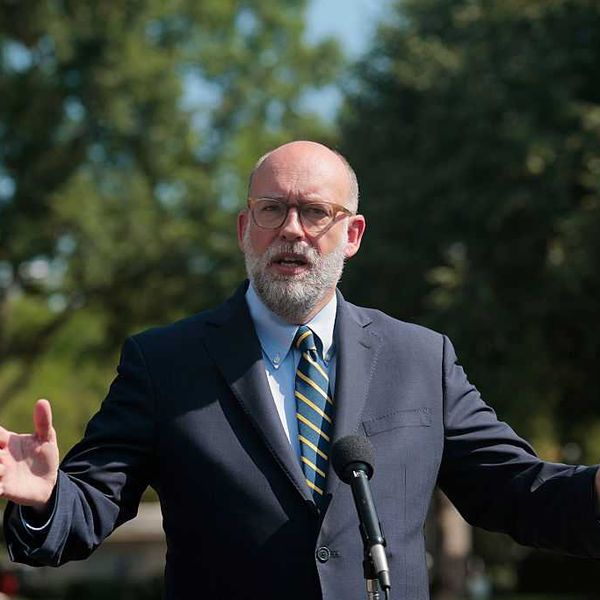

Instead, Obama tapped former Ohio Attorney General Richard Cordray as CFPB head. Cordray is a strong contender. As Ohio's attorney general he cracked down on big, mortgage-lending banks for constructing a "business model built on fraud," and he was picked by Warren as her top cop at the CFPB. Warren will continue building the bureau, while Cordray is racked by Congress.

But it is hard to see Obama's winning strategy here. Today, Republican Senator Richard Shelby pronounced Crodray "dead on arrival" in the Wall Street Journal. A down and dirty confirm battle of over the bureau's first director would be a terrific tool to remind folks of just who collapsed our economy the first place and raise the profile of the small bureau. Since Obama will only get a bureau chief via a recess appointment, why not appoint Warren and let all hell break lose? We can only hope that there is some truth to rumors that she is considering a run for U.S. Senate in Massachusetts against Republican Senator Scott Brown in 2012.

While Obama has not stood behind Warren, he has stood behind the agency and has promised to veto any bill to weaken it, giving the small agency of some 500 employees the chance to get its sea legs.

Consumers are the fuel

So the agency is ours. With millions of calls, letter, postcards, videos and emails, we created it and without our involvement it simply wont work. Since the consumer agency is the first born in the era of the Internet activist and web 2.0 tools, it is not surprising that it is using these tools to reach out and involve consumers across the country. This month they are collecting complaints about credit cards. Check out the bureau's new website, ConsumerFinance.gov, send them a note on their interactive blog, "friend" the bureau on Facebook, check out its Twitter stream, Flickr and YouTube channels. Make a note of its tip line: 1-855-411-CFPB (2372) in the home address book.

The bureau recently used new high-tech tools to garner 14,000 public comments on a revised federal mortgage form intended to steer people away from dangerous mortgage products. A small step, but encouraging that so many Americans took the time to help out. The next step would be a fully public data-base of complaints like the one operated by the Consumer Product Safety Commission and the car safety commission. Such a data-base "would not only help consumers make better choices, but public shaming will stop some bad practices and allow the bureau to more effectively steer its enforcement resources to the tougher cases," says Ed Mierzwinski of U.S. PIRG.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The Consumer Financial Protection Bureau (CFPB) throws open its doors to consumers this week, officially starting its mission to safeguard Americans from overly complex financial products and malignant banking practices. The bureau is the culmination of a national grassroots effort to hold the big banks accountable for the 2008 economic collapse caused by Wall Street's insatiable appetite for dangerous mortgage products. Millions of Americans signed petitions to create the bureau and new polling shows that 74% of Americans think it is a terrific idea.

But the CFPB launches in perilous waters. On the day the bureau opened its doors, the House of Representatives took up H.R. 1315 the "Consumer Financial Protection Safety and Soundness Improvement Act" - a name that would make George Orwell blush. This bill, authored by neophyte Rep. Sean Duffy of Wisconsin (the man who complains about his $174,000 Congressional salary at town hall meetings), is one of a dozen bills that have been introduced by Republicans eager for Wall Street campaign contributions to defund, dismantle, and destroy the new bureau.

Why is this little agency so dangerous?

According to the Center for Responsive Politics, Wall Street and the financial services lobby spent an eye-popping $1,400,000,000 between 2008 and 2010 to kill financial reform. The U.S. Chamber of Commerce has a whole unit dedicated to killing it. This year, the those same forces spent $156 million on lobbying in the first quarter. The big banks are fighting the implementation of the Dodd-Frank Wall Street reform bill with a stable of willing Congressmen and an army of lobbyists fanned out across a dozen federal agencies where Dodd-Frank rulemaking is underway.

When it comes to the CFPB, the big banks want to take power away from the agency's director (a post long slated for presidential adviser Elizabeth Warren) and to give control of the bureau's budget to Congress (taking it away from the Federal Reserve where it is insulated it from partisan funding fights). A win on this later issue would ensure that the CFPB suffered a slow strangulation, a fate that befell the Consumer Product Safety Commission over a 40-year period.

The new bureau was created to police consumer financial products such as mortgages, credit cards, and payday loans while also working to clarifying their prices and risks to consumers. While this job description sounds fairly limited and commonsensical, the complete hysteria engendered by its birth proves something that Warren has long known--our entire financial system is founded on the practice of ripping off consumers. Fraud it not a byproduct of bad actors, it is the life blood of the entire system. A bureau with real teeth and an activist director is Jamie Dimon's worst nightmare.

Warren disappointment

President Obama chose not to nominate his top adviser, Elizabeth Warren, to serve as the bureau's permanent director, to the disappointment of millions who signed petitions urging her appointment. The agency was Warren's idea, and she has worked tirelessly as the bureau's de facto head, building a talented staff and creating the structures needed to make the agency responsive and effective.

Instead, Obama tapped former Ohio Attorney General Richard Cordray as CFPB head. Cordray is a strong contender. As Ohio's attorney general he cracked down on big, mortgage-lending banks for constructing a "business model built on fraud," and he was picked by Warren as her top cop at the CFPB. Warren will continue building the bureau, while Cordray is racked by Congress.

But it is hard to see Obama's winning strategy here. Today, Republican Senator Richard Shelby pronounced Crodray "dead on arrival" in the Wall Street Journal. A down and dirty confirm battle of over the bureau's first director would be a terrific tool to remind folks of just who collapsed our economy the first place and raise the profile of the small bureau. Since Obama will only get a bureau chief via a recess appointment, why not appoint Warren and let all hell break lose? We can only hope that there is some truth to rumors that she is considering a run for U.S. Senate in Massachusetts against Republican Senator Scott Brown in 2012.

While Obama has not stood behind Warren, he has stood behind the agency and has promised to veto any bill to weaken it, giving the small agency of some 500 employees the chance to get its sea legs.

Consumers are the fuel

So the agency is ours. With millions of calls, letter, postcards, videos and emails, we created it and without our involvement it simply wont work. Since the consumer agency is the first born in the era of the Internet activist and web 2.0 tools, it is not surprising that it is using these tools to reach out and involve consumers across the country. This month they are collecting complaints about credit cards. Check out the bureau's new website, ConsumerFinance.gov, send them a note on their interactive blog, "friend" the bureau on Facebook, check out its Twitter stream, Flickr and YouTube channels. Make a note of its tip line: 1-855-411-CFPB (2372) in the home address book.

The bureau recently used new high-tech tools to garner 14,000 public comments on a revised federal mortgage form intended to steer people away from dangerous mortgage products. A small step, but encouraging that so many Americans took the time to help out. The next step would be a fully public data-base of complaints like the one operated by the Consumer Product Safety Commission and the car safety commission. Such a data-base "would not only help consumers make better choices, but public shaming will stop some bad practices and allow the bureau to more effectively steer its enforcement resources to the tougher cases," says Ed Mierzwinski of U.S. PIRG.

The Consumer Financial Protection Bureau (CFPB) throws open its doors to consumers this week, officially starting its mission to safeguard Americans from overly complex financial products and malignant banking practices. The bureau is the culmination of a national grassroots effort to hold the big banks accountable for the 2008 economic collapse caused by Wall Street's insatiable appetite for dangerous mortgage products. Millions of Americans signed petitions to create the bureau and new polling shows that 74% of Americans think it is a terrific idea.

But the CFPB launches in perilous waters. On the day the bureau opened its doors, the House of Representatives took up H.R. 1315 the "Consumer Financial Protection Safety and Soundness Improvement Act" - a name that would make George Orwell blush. This bill, authored by neophyte Rep. Sean Duffy of Wisconsin (the man who complains about his $174,000 Congressional salary at town hall meetings), is one of a dozen bills that have been introduced by Republicans eager for Wall Street campaign contributions to defund, dismantle, and destroy the new bureau.

Why is this little agency so dangerous?

According to the Center for Responsive Politics, Wall Street and the financial services lobby spent an eye-popping $1,400,000,000 between 2008 and 2010 to kill financial reform. The U.S. Chamber of Commerce has a whole unit dedicated to killing it. This year, the those same forces spent $156 million on lobbying in the first quarter. The big banks are fighting the implementation of the Dodd-Frank Wall Street reform bill with a stable of willing Congressmen and an army of lobbyists fanned out across a dozen federal agencies where Dodd-Frank rulemaking is underway.

When it comes to the CFPB, the big banks want to take power away from the agency's director (a post long slated for presidential adviser Elizabeth Warren) and to give control of the bureau's budget to Congress (taking it away from the Federal Reserve where it is insulated it from partisan funding fights). A win on this later issue would ensure that the CFPB suffered a slow strangulation, a fate that befell the Consumer Product Safety Commission over a 40-year period.

The new bureau was created to police consumer financial products such as mortgages, credit cards, and payday loans while also working to clarifying their prices and risks to consumers. While this job description sounds fairly limited and commonsensical, the complete hysteria engendered by its birth proves something that Warren has long known--our entire financial system is founded on the practice of ripping off consumers. Fraud it not a byproduct of bad actors, it is the life blood of the entire system. A bureau with real teeth and an activist director is Jamie Dimon's worst nightmare.

Warren disappointment

President Obama chose not to nominate his top adviser, Elizabeth Warren, to serve as the bureau's permanent director, to the disappointment of millions who signed petitions urging her appointment. The agency was Warren's idea, and she has worked tirelessly as the bureau's de facto head, building a talented staff and creating the structures needed to make the agency responsive and effective.

Instead, Obama tapped former Ohio Attorney General Richard Cordray as CFPB head. Cordray is a strong contender. As Ohio's attorney general he cracked down on big, mortgage-lending banks for constructing a "business model built on fraud," and he was picked by Warren as her top cop at the CFPB. Warren will continue building the bureau, while Cordray is racked by Congress.

But it is hard to see Obama's winning strategy here. Today, Republican Senator Richard Shelby pronounced Crodray "dead on arrival" in the Wall Street Journal. A down and dirty confirm battle of over the bureau's first director would be a terrific tool to remind folks of just who collapsed our economy the first place and raise the profile of the small bureau. Since Obama will only get a bureau chief via a recess appointment, why not appoint Warren and let all hell break lose? We can only hope that there is some truth to rumors that she is considering a run for U.S. Senate in Massachusetts against Republican Senator Scott Brown in 2012.

While Obama has not stood behind Warren, he has stood behind the agency and has promised to veto any bill to weaken it, giving the small agency of some 500 employees the chance to get its sea legs.

Consumers are the fuel

So the agency is ours. With millions of calls, letter, postcards, videos and emails, we created it and without our involvement it simply wont work. Since the consumer agency is the first born in the era of the Internet activist and web 2.0 tools, it is not surprising that it is using these tools to reach out and involve consumers across the country. This month they are collecting complaints about credit cards. Check out the bureau's new website, ConsumerFinance.gov, send them a note on their interactive blog, "friend" the bureau on Facebook, check out its Twitter stream, Flickr and YouTube channels. Make a note of its tip line: 1-855-411-CFPB (2372) in the home address book.

The bureau recently used new high-tech tools to garner 14,000 public comments on a revised federal mortgage form intended to steer people away from dangerous mortgage products. A small step, but encouraging that so many Americans took the time to help out. The next step would be a fully public data-base of complaints like the one operated by the Consumer Product Safety Commission and the car safety commission. Such a data-base "would not only help consumers make better choices, but public shaming will stop some bad practices and allow the bureau to more effectively steer its enforcement resources to the tougher cases," says Ed Mierzwinski of U.S. PIRG.