SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Republicans in the House of Representatives got their way this week: The final budget deal struck with President Barack Obama raises no additional revenues while cutting more than $2 trillion from public investments, defense, and government services that all Americans rely upon. That's a better outcome than a Tea Party-caused default but it's a bad deal for America's middle class.

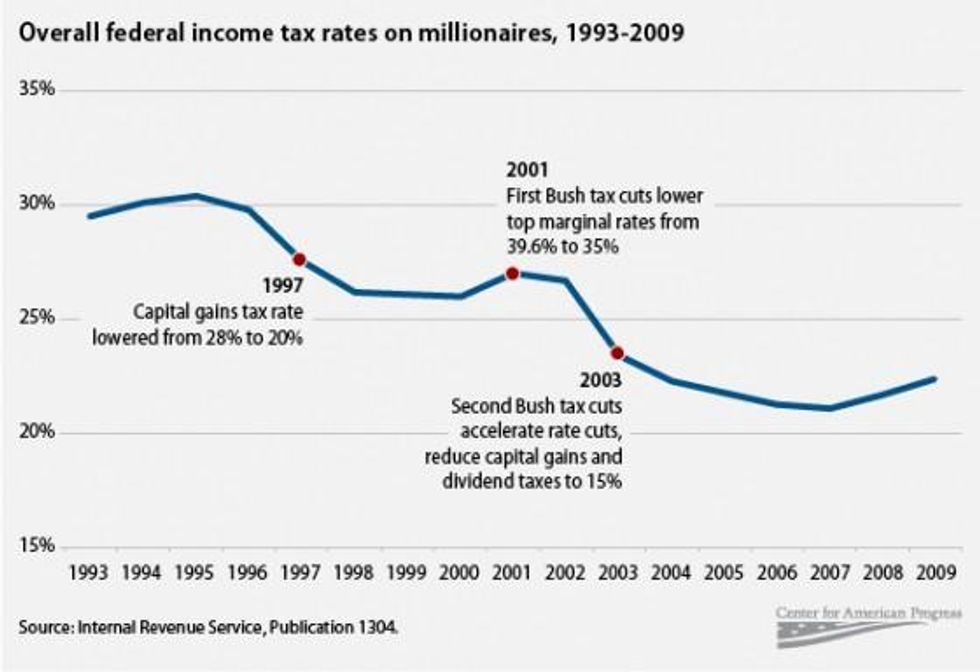

Meanwhile, America's millionaires won't be asked to contribute a single dime. That's unfortunate because they certainly can afford it. Not only have their incomes been skyrocketing but data released this week by the Internal Revenue Service reveal that their tax rates have plunged over the last two decades. As a percentage of their incomes, millionaires are now paying about one-quarter less of their income to federal taxes than they did in the mid-1990s.

Millionaires paid an average tax rate of 22.4 percent in 2009, down by a quarter since 1995, when they paid an average of 30.4 percent. (see chart)

So what's causing the tax bills of the wealthiest to drop? The average millionaire will pay $136,000 less this year because the Bush tax cuts are still in effect, according to the nonpartisan Tax Policy Center. The Bush tax cuts of 2001 and 2003 lowered the top marginal rate from the Clinton-era 39.6 percent to 35 percent. They also dropped the rates on capital gains and dividend income to a historically low 15 percent. (Capital gains rates had already been cut from 28 percent to 20 percent in 1997.)

That move was a boon to millionaires because they receive more than 60 percent of all income from long-term capital gains and nearly 40 percent of all income from tax-favored dividends.

And it was a super-boon to mega-millionaires and billionaires. IRS data show that the tax rates of the richest 400 Americans declined from 29.9 percent in 1995 to 18.1 percent in 2008, largely because that exclusive group derives two-thirds of its income from capital gains.

To be sure, tax rates on middle-class Americans have also declined. But their incomes have stagnated, which is decidedly not the case for millionaires.

Tax return data show that millionaires are now taking home one-tenth of all income in the country, even though they comprise only 0.2 percent (or 1 in 500) of all tax filers. That continues a troubling trend of growing inequality: From 1979 to 2007, pretax incomes of the richest 1 percent nearly tripled in real terms, while the income of the middle 20 percent of Americans grew by only one-quarter.

The budget deal requires Congress to convene a "Super Committee" to consider additional deficit reduction measures, and some members will undoubtedly push for far-reaching changes to Social Security and Medicare. But before cutting more of the programs that middle-class families rely on, the Super Committee should insist that millionaires pay taxes at the rates they did just a short time ago.

If millionaires were simply paying the same level of federal income taxes as they were in the mid-1990s, the federal government would have collected an additional $65 billion in revenues in 2009. That amount of revenue over 10 years, $650 billion, exceeds the cuts to domestic discretionary programs in the budget deal. Those $600 billion in cuts will result in reduced investment in infrastructure, education, housing, public health, food and drug safety, medical research, law enforcement, and other important areas.

Proponents of the Bush tax cuts argued that lower taxes on top earners would boost the economy. That didn't happen. The United States experienced real economic growth of 3.2 percent during the 10 years before the Bush tax cuts but only 1.7 percent since. (And this anemic growth was not just a result of the Great Recession; pre-recession growth from 2002 to 2007 averaged only 2.7 percent.) The IRS data also show the effect of the recession on middle-class families: Average income declined 14 percent from 2007 to 2009.

In the 1990s, when the tax rates on millionaires were higher, the United States grew its economy, closed large deficits, and started to pay down the debt. Alas, the Bush tax cuts and other policies set us on a different fiscal course.

Despite the fact that their taxes were higher, the 1990s were also a pretty good time for millionaires. The after-tax income of the richest 1 percent of the country grew by 77 percent in real terms during that decade--and it's now double what it was in 1996.

It's time to ask the people who have benefited the most from unequal income growth and round after round of tax cuts to help reduce the deficit.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Republicans in the House of Representatives got their way this week: The final budget deal struck with President Barack Obama raises no additional revenues while cutting more than $2 trillion from public investments, defense, and government services that all Americans rely upon. That's a better outcome than a Tea Party-caused default but it's a bad deal for America's middle class.

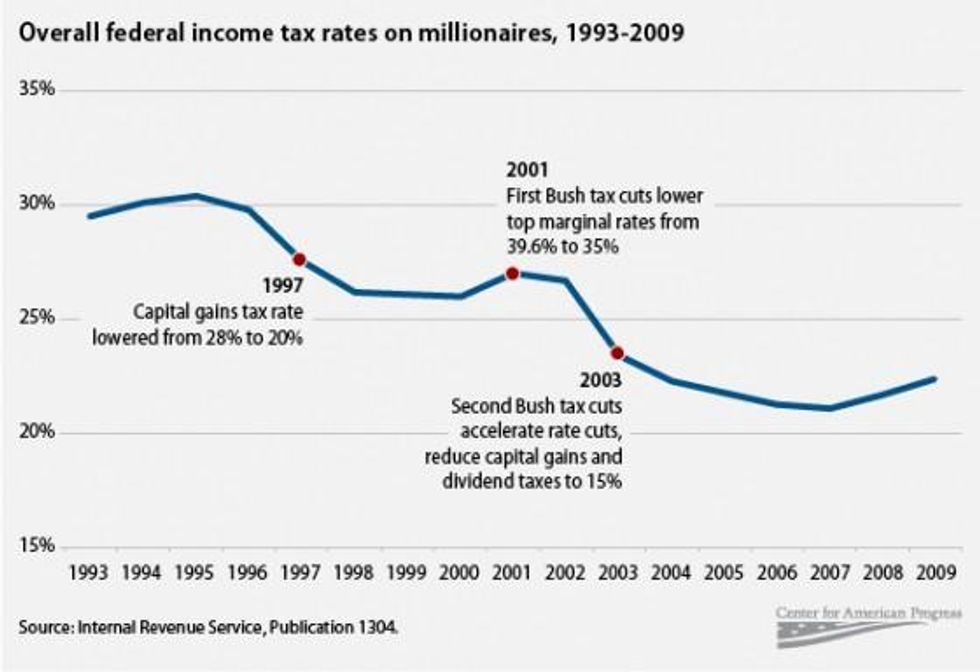

Meanwhile, America's millionaires won't be asked to contribute a single dime. That's unfortunate because they certainly can afford it. Not only have their incomes been skyrocketing but data released this week by the Internal Revenue Service reveal that their tax rates have plunged over the last two decades. As a percentage of their incomes, millionaires are now paying about one-quarter less of their income to federal taxes than they did in the mid-1990s.

Millionaires paid an average tax rate of 22.4 percent in 2009, down by a quarter since 1995, when they paid an average of 30.4 percent. (see chart)

So what's causing the tax bills of the wealthiest to drop? The average millionaire will pay $136,000 less this year because the Bush tax cuts are still in effect, according to the nonpartisan Tax Policy Center. The Bush tax cuts of 2001 and 2003 lowered the top marginal rate from the Clinton-era 39.6 percent to 35 percent. They also dropped the rates on capital gains and dividend income to a historically low 15 percent. (Capital gains rates had already been cut from 28 percent to 20 percent in 1997.)

That move was a boon to millionaires because they receive more than 60 percent of all income from long-term capital gains and nearly 40 percent of all income from tax-favored dividends.

And it was a super-boon to mega-millionaires and billionaires. IRS data show that the tax rates of the richest 400 Americans declined from 29.9 percent in 1995 to 18.1 percent in 2008, largely because that exclusive group derives two-thirds of its income from capital gains.

To be sure, tax rates on middle-class Americans have also declined. But their incomes have stagnated, which is decidedly not the case for millionaires.

Tax return data show that millionaires are now taking home one-tenth of all income in the country, even though they comprise only 0.2 percent (or 1 in 500) of all tax filers. That continues a troubling trend of growing inequality: From 1979 to 2007, pretax incomes of the richest 1 percent nearly tripled in real terms, while the income of the middle 20 percent of Americans grew by only one-quarter.

The budget deal requires Congress to convene a "Super Committee" to consider additional deficit reduction measures, and some members will undoubtedly push for far-reaching changes to Social Security and Medicare. But before cutting more of the programs that middle-class families rely on, the Super Committee should insist that millionaires pay taxes at the rates they did just a short time ago.

If millionaires were simply paying the same level of federal income taxes as they were in the mid-1990s, the federal government would have collected an additional $65 billion in revenues in 2009. That amount of revenue over 10 years, $650 billion, exceeds the cuts to domestic discretionary programs in the budget deal. Those $600 billion in cuts will result in reduced investment in infrastructure, education, housing, public health, food and drug safety, medical research, law enforcement, and other important areas.

Proponents of the Bush tax cuts argued that lower taxes on top earners would boost the economy. That didn't happen. The United States experienced real economic growth of 3.2 percent during the 10 years before the Bush tax cuts but only 1.7 percent since. (And this anemic growth was not just a result of the Great Recession; pre-recession growth from 2002 to 2007 averaged only 2.7 percent.) The IRS data also show the effect of the recession on middle-class families: Average income declined 14 percent from 2007 to 2009.

In the 1990s, when the tax rates on millionaires were higher, the United States grew its economy, closed large deficits, and started to pay down the debt. Alas, the Bush tax cuts and other policies set us on a different fiscal course.

Despite the fact that their taxes were higher, the 1990s were also a pretty good time for millionaires. The after-tax income of the richest 1 percent of the country grew by 77 percent in real terms during that decade--and it's now double what it was in 1996.

It's time to ask the people who have benefited the most from unequal income growth and round after round of tax cuts to help reduce the deficit.

Republicans in the House of Representatives got their way this week: The final budget deal struck with President Barack Obama raises no additional revenues while cutting more than $2 trillion from public investments, defense, and government services that all Americans rely upon. That's a better outcome than a Tea Party-caused default but it's a bad deal for America's middle class.

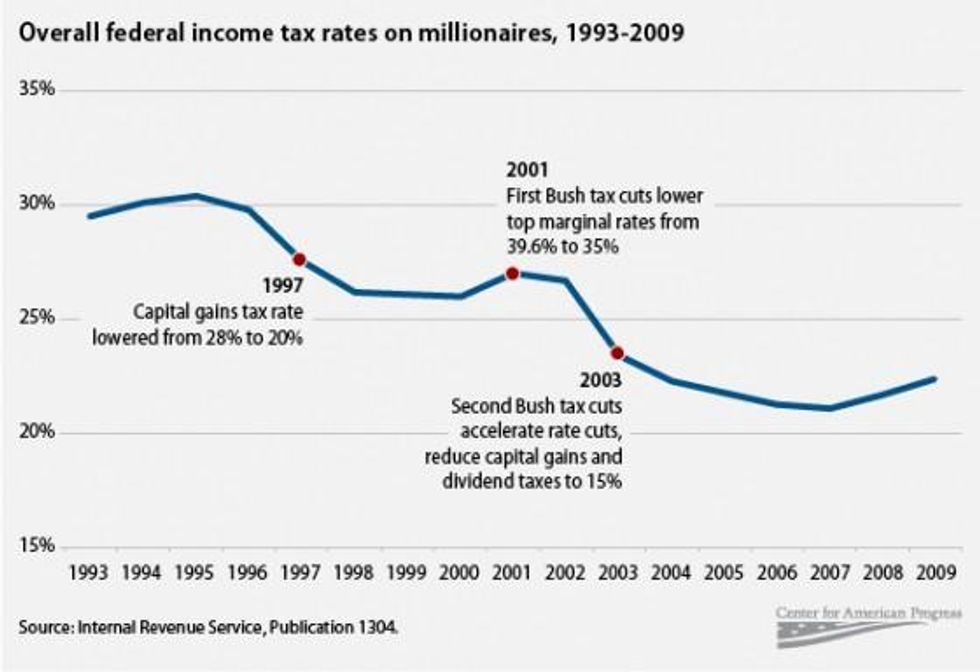

Meanwhile, America's millionaires won't be asked to contribute a single dime. That's unfortunate because they certainly can afford it. Not only have their incomes been skyrocketing but data released this week by the Internal Revenue Service reveal that their tax rates have plunged over the last two decades. As a percentage of their incomes, millionaires are now paying about one-quarter less of their income to federal taxes than they did in the mid-1990s.

Millionaires paid an average tax rate of 22.4 percent in 2009, down by a quarter since 1995, when they paid an average of 30.4 percent. (see chart)

So what's causing the tax bills of the wealthiest to drop? The average millionaire will pay $136,000 less this year because the Bush tax cuts are still in effect, according to the nonpartisan Tax Policy Center. The Bush tax cuts of 2001 and 2003 lowered the top marginal rate from the Clinton-era 39.6 percent to 35 percent. They also dropped the rates on capital gains and dividend income to a historically low 15 percent. (Capital gains rates had already been cut from 28 percent to 20 percent in 1997.)

That move was a boon to millionaires because they receive more than 60 percent of all income from long-term capital gains and nearly 40 percent of all income from tax-favored dividends.

And it was a super-boon to mega-millionaires and billionaires. IRS data show that the tax rates of the richest 400 Americans declined from 29.9 percent in 1995 to 18.1 percent in 2008, largely because that exclusive group derives two-thirds of its income from capital gains.

To be sure, tax rates on middle-class Americans have also declined. But their incomes have stagnated, which is decidedly not the case for millionaires.

Tax return data show that millionaires are now taking home one-tenth of all income in the country, even though they comprise only 0.2 percent (or 1 in 500) of all tax filers. That continues a troubling trend of growing inequality: From 1979 to 2007, pretax incomes of the richest 1 percent nearly tripled in real terms, while the income of the middle 20 percent of Americans grew by only one-quarter.

The budget deal requires Congress to convene a "Super Committee" to consider additional deficit reduction measures, and some members will undoubtedly push for far-reaching changes to Social Security and Medicare. But before cutting more of the programs that middle-class families rely on, the Super Committee should insist that millionaires pay taxes at the rates they did just a short time ago.

If millionaires were simply paying the same level of federal income taxes as they were in the mid-1990s, the federal government would have collected an additional $65 billion in revenues in 2009. That amount of revenue over 10 years, $650 billion, exceeds the cuts to domestic discretionary programs in the budget deal. Those $600 billion in cuts will result in reduced investment in infrastructure, education, housing, public health, food and drug safety, medical research, law enforcement, and other important areas.

Proponents of the Bush tax cuts argued that lower taxes on top earners would boost the economy. That didn't happen. The United States experienced real economic growth of 3.2 percent during the 10 years before the Bush tax cuts but only 1.7 percent since. (And this anemic growth was not just a result of the Great Recession; pre-recession growth from 2002 to 2007 averaged only 2.7 percent.) The IRS data also show the effect of the recession on middle-class families: Average income declined 14 percent from 2007 to 2009.

In the 1990s, when the tax rates on millionaires were higher, the United States grew its economy, closed large deficits, and started to pay down the debt. Alas, the Bush tax cuts and other policies set us on a different fiscal course.

Despite the fact that their taxes were higher, the 1990s were also a pretty good time for millionaires. The after-tax income of the richest 1 percent of the country grew by 77 percent in real terms during that decade--and it's now double what it was in 1996.

It's time to ask the people who have benefited the most from unequal income growth and round after round of tax cuts to help reduce the deficit.