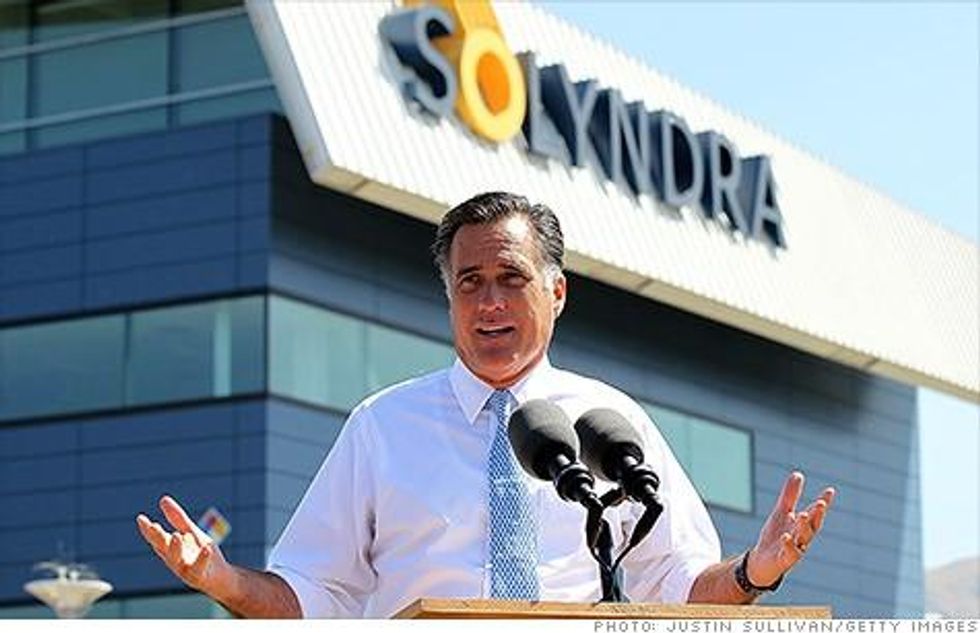

Republicans have launched a full-scale attack on clean energy, and Solyndra always seems to be exhibit A in their assault. Recently, Romney went so far as to fabricate tales of Obama showing favoritism in this Bush-initiated loan - a whopper even by Romney's record of complete disregard for the truth.

It's worth reexamining this whole thing, because Solyndra is actually exhibit A in how the Republican Party manufactures failure out of whole cloth, and what it costs us when they aren't confronted by Democrats or held accountable by the media.

To understand the full treachery of Republican attacks on Solyndra funding, it's necessary to understand a little about venture capital investments.

VC-type investments are always part of a portfolio, never a single investment in a single company. VC investors expect - indeed, design for -- most of their bets within a portfolio to fail. VC expert, R. Morely, for example, found that a typical target R/R (risk/reward) ratio for private VC investments anticipates about an 80% failure rate. VC funds - that is, collective investment instruments - require a lower overall risk portfolio. Fred Wilson, a principal in the Union Square Ventures Fund, tells prospective investors to expect a success rate of only about 33%.

This makes sense. If the investments were low risk, companies could raise capital in more conventional - and less costly - ways. For example, less risky ventures can get conventional loans from a bank, or they can issue an IPO.

In short, VC investors make their money on relatively few successes out of a portfolio that contains a lot of investments that will fail.

The Loan Guarantee Program has a nearly 99% success rate and Soyndra's failure - one of only two so far -- amounts to less than 1.3% of the program. Yet Republicans are in a frenzy of indignation and clamoring to kill this loan program, as well as nearly all clean energy and clean air initiatives.

Seen in this light, a failure like Solyndra is not only possible, it is inevitable.

But Republicans object to the government playing any role in start-up funding, successful or not, claiming that government is no good at picking winners and has no right to risk taxpayer money trying to do so.

Contrary to conservative talking points, there are compelling reasons for government to fill the role of VC investors in certain instances, and strong evidence that government is pretty good at it.

Let's first look at why government has a legitimate role in VC-type funding assistance.

For starters, economy-wide there is a scarcity of VC capital, so without government funds many good ventures would go unfunded. Moreover, foreign competitors frequently subsidize new industries, putting our domestic manufacturing at a significant disadvantage. Even if these were the only justifications, it is pretty easy to argue that government VC funding in a global economy is both necessary and appropriate.

But the case is even more compelling with clean energy.

Overall, it's the fastest growing energy sector, and solar is the fastest growing renewable. Failing to get a piece of the action would doom the US to importing solar technology in much the same way we now must import oil.

Moreover, clean energy is not only an economic opportunity. It also has enormous ancillary benefits that accrue to the public at large.

It's a better job creator than conventional energy. Studies show that each dollar spent on renewable energy creates 3 times as many jobs as a dollar invested in fossil fuels, and that clean energy jobs pay more. Viewed from this perspective, contrary to what Republicans claim, every dollar we invest in fossil fuels instead of renewables is a job killer, not a job creator.

Clean energy investments also prevent pollution, save lives, and help avoid some $2 trillion in health care costs.

Finally, they also contribute to the nation's energy security and lower our trade balance, by moving us away from dependency upon foreign sources.

None of these benefits would be fully realized if we didn't have government investments in clean energy start-ups. There simply isn't enough private VC to handle it, and there simply is too much subsidized competition from abroad.

Fortunately, the US Congress wasn't always dedicated to proving government "cain't do nothin' right."

Recognizing the benefits of clean energy, Congress passed a bi-partisan bill supporting creation of a loan guarantee for energy ventures under Bush, and it was extended by Obama under the Recovery Act, with a greater focus on clean energy.

It's too soon to predict the final outcome of this program, but as a portfolio so far it's performing far better than equivalent private funds.

The facts are clear: The Loan Guarantee Program has a nearly 99% success rate and Soyndra's failure - one of only two so far -- amounts to less than 1.3% of the program.

This is a success rate that any private VC fund would die for. Yet Republicans are in a frenzy of indignation and clamoring to kill this loan program, as well as nearly all clean energy and clean air initiatives.

Why? Two words: fossil fuels. As wholly-owned subsidiaries of the fossil fuel industry, they are firmly committed to foul air, a faded future, and a failed government, if it means more profit for their patrons.

Or maybe these ardent capitalists really don't have a clue about how VC investing works. It's possible.

But on thing is clear, if the Republicans' assault on clean energy succeeds, we'll end up buying oil from the usual suspects, and buying renewables from China, Germany and Denmark.