SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

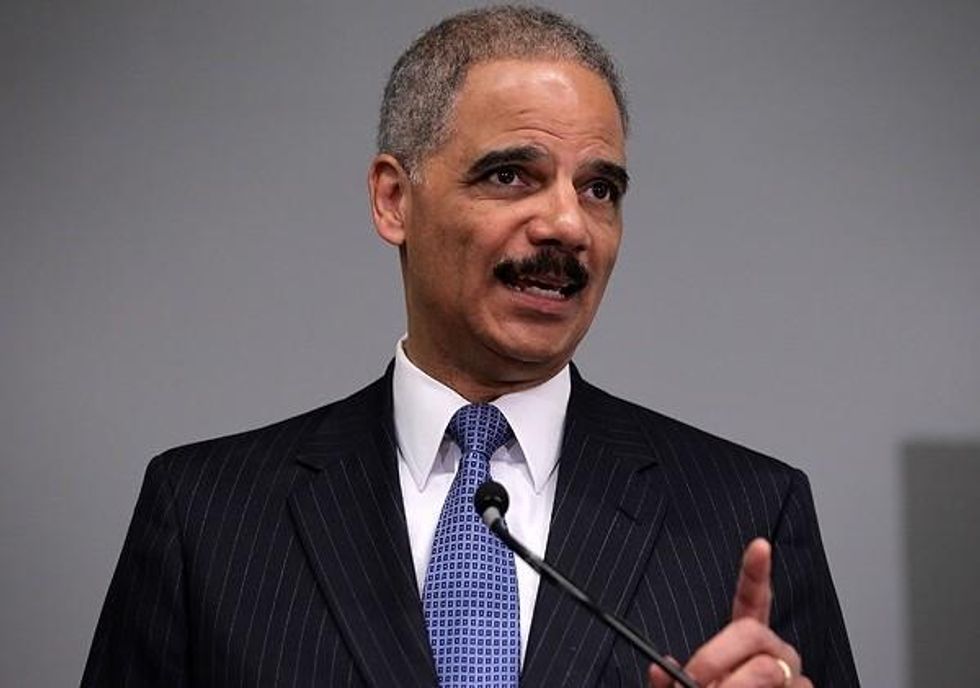

I've been on deadline in the past week or so, so I haven't had a chance to weigh in on Eric Holder's predictable decision to not pursue criminal charges against Goldman, Sachs for any of the activities in the report prepared by Senators Carl Levin and Tom Coburn two years ago.

I've been on deadline in the past week or so, so I haven't had a chance to weigh in on Eric Holder's predictable decision to not pursue criminal charges against Goldman, Sachs for any of the activities in the report prepared by Senators Carl Levin and Tom Coburn two years ago.

Last year I spent a lot of time and energy jabbering and gesticulating in public about what seemed to me the most obviously prosecutable offenses detailed in the report - the seemingly blatant perjury before congress of Lloyd Blankfein and other Goldman executives, and the almost comically long list of frauds committed by the company in its desperate effort to unload its crappy "cats and dogs" mortgage-backed inventory.

In the notorious Hudson transaction, for instance, Goldman claimed, in writing, that it was fully "aligned" with the interests of its client, Morgan Stanley, because it owned a $6 million slice of the deal. What Goldman left out is that it had a $2 billion short position against the same deal.

If that isn't fraud, Mr. Holder, just what exactly is fraud?

Still, it wasn't surprising that Holder didn't pursue criminal charges against Goldman. And that's not just because Holder has repeatedly proven himself to be a spineless bureaucrat and obsequious political creature masquerading as a cop, and not just because rumors continue to circulate that the Obama administration - supposedly in the interests of staving off market panic - made a conscious decision sometime in early 2009 to give all of Wall Street a pass on pre-crisis offenses.

No, the real reason this wasn't surprising is that Holder's decision followed a general pattern that has been coming into focus for years in American law enforcement. Our prosecutors and regulators have basically admitted now that they only go after the most obvious and easily prosecutable cases.

If the offense committed doesn't fit the exact description in the relevant section of the criminal code, they pass. The only white-collar cases they will bring are absolute slam-dunk situations where some arrogant rogue commits a blatant crime for individual profit in a manner thoroughly familiar to even the non-expert portion of the jury pool/citizenry.

In other words, they'll take on somebody like Raj Rajaratnam, who stacked his illegal insider trades so brazenly and carelessly that his case almost reads like a finance version of Jeff Dahmer tripping over bodies in his Milwaukee apartment. Or they'll pursue Bernie Madoff on the tenth or eleventh time he crosses their desk, after years of nonaction, and after he breaks down weeping and confessing. Basically, if someone backs a dump truck up to the DOJ and unloads the entire case, gift-wrapped, a contrite and confessing criminal included, a guy like Eric Holder might, after much agonizing deliberation, decide to prosecute.

But here's the thing: most of the crimes Wall Street people commit involve highly specific, highly individualized transactions that won't fit Eric Holder's bag of cookie-cutter statutory definitions. That is not the same thing as saying they're not crimes. They are: the crimes of the crisis period were and are very basic crimes like fraud, theft, perjury, and tax evasion, only they're dressed up in millions of pages of camouflaging verbiage.

Or, even more often, the crimes have also been sanctified in advance by "reputable" law and accounting firms, who (for huge fees) offered their clients opinions that, if X and Y are signed in accordance with Z, and A and B are stipulated by the parties, and everyone's sitting Indian-style and facing the moon when the deal is agreed to, then it's not fucked up and illegal when Goldman Sachs tells you it's a co-investor in your deal when it's actually got $2 billion bet against you.

You know that look a dog gives you when you show it something confusing, like an electric razor or a lawn sprinkler? That's the look federal prosecutors give when companies like Goldman wave their attorneys' sanctifying opinions at them. They scratch their heads and say: "Oh, wow, well since this was signed in Australia by three millionaire lawyers wearing magic invisibility cloaks, it really isn't fraud! They're right!"

As one high-profile attorney currently working on a closely-watched case involving a Wall Street bank put it to me yesterday: "With these Justice guys, everything the Wall Street lawyers say makes perfect sense to them, no matter how dumb it is."

You can almost feel the relief emanating from Washington when these prosecutors decide against matching wits with the wizened 60 year-old legal Sith Lords from Harvard and Yale who've seen everything, know every judge by his or her first name, and in a trial would be basically bringing absolutely everything a lawyer can bring to the table, except consciences of course.

It's political, sure, these decisions not to go after the Goldmans of the world, but more than that what usually rules the day is just pure intellectual fear - appropriate in many cases, since any prosecutor who buys for a second any of the high-priced excuses being shoveled at them from corporate defense firms like Davis Polk or criminal defense mercenaries like Reid Weingarten (retained to defend Blankfein against possible criminal charges) probably really is no match, intellectually, for Wall Street's lawyers.

They're also no match morally. Wall Street firms pay their lawyers millions of dollars for their creativity, for their willingness to fight. They say to their lawyers, as Lehman Brothers said before it crashed: "We'd like to book $50 million in loans as sales. Find a way for us to call that legal."

As it happens Lehman couldn't find even one American law firm to go for that one, so they went to England and got a firm called Linklaters to find a way, which they did. The Linklaters opinion was just a duller version of the, "It's legal if we're all sitting Indian style and facing the moon" defense. Here's the New York Times explanation:

Enter Linklaters, which grounded its legal brief in English, rather than American, law. The firm explicitly said: "This opinion is limited to English law as applied by the English courts and is given on the basis that it will be governed by and construed in accordance with English law."

Otherwise, Linklaters provided Lehman with exactly what it wanted to hear. The law firm decreed in its briefs, at least as outlined in the 2006 iteration obtained by Mr. Valukas, that intent matters. If two parties intend to exchange assets for cash, and then later the party receiving the assets decides to hand back "equivalent assets (such as securities of the same series and nominal value) rather than the very assets that were originally delivered," that amounts to a sale.

That's how law works on Wall Street. The bank walks into the room with the sordid activity, and the law firm's partners huddle up and whip their associates - for hundreds and hundreds of billable hours straight, if necessary - until a way is found to call stealing or tax evasion or accounting fraud or whatever legal.

That's the way it should work on the prosecutorial side, too. You should start with a simple moral premise - this group of crooks ripped off X group of victims for fifty million dollars - and then you should bury yourself in law books until you find a way to put them all in jail. If Linklaters gets paid to be creative, well, Mr. Holder, we're paying you to be creative, too.

Again, though, Holder didn't need to be creative in the Goldman case. Levin gift-wrapped the whole thing for him. He could have had a dozen easy convictions just on the evidence in that report, and if he had been creative, if he had used his vast power to roll up the guilty and flip them into more revelations, then he'd have had enough cases to last the AG's office the next decade.

But the Holders of the world do not want to be creative when the targets are politically influential rich people. Instead, they use their creativity against Roger Clemens, Barry Bonds, immigrant housekeepers, and guys who knock over liquor stores. They like to flex muscles against bank robbers, celebrity tax evaders (we can't have Wesley Snipes on the loose!), truck hijackers, and drug dealers. As Gene Wilder would say, "You know - morons."

Holder's non-decision on Goldman is more than unsurprising. It amounts to an official announcement that the government is no longer in the business or prosecuting smart criminals. It's pathetic. The one thing you pay any lawyer to have is balls, and our nation's top attorney has none.

Political revenge. Mass deportations. Project 2025. Unfathomable corruption. Attacks on Social Security, Medicare, and Medicaid. Pardons for insurrectionists. An all-out assault on democracy. Republicans in Congress are scrambling to give Trump broad new powers to strip the tax-exempt status of any nonprofit he doesn’t like by declaring it a “terrorist-supporting organization.” Trump has already begun filing lawsuits against news outlets that criticize him. At Common Dreams, we won’t back down, but we must get ready for whatever Trump and his thugs throw at us. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. By donating today, please help us fight the dangers of a second Trump presidency. |

I've been on deadline in the past week or so, so I haven't had a chance to weigh in on Eric Holder's predictable decision to not pursue criminal charges against Goldman, Sachs for any of the activities in the report prepared by Senators Carl Levin and Tom Coburn two years ago.

Last year I spent a lot of time and energy jabbering and gesticulating in public about what seemed to me the most obviously prosecutable offenses detailed in the report - the seemingly blatant perjury before congress of Lloyd Blankfein and other Goldman executives, and the almost comically long list of frauds committed by the company in its desperate effort to unload its crappy "cats and dogs" mortgage-backed inventory.

In the notorious Hudson transaction, for instance, Goldman claimed, in writing, that it was fully "aligned" with the interests of its client, Morgan Stanley, because it owned a $6 million slice of the deal. What Goldman left out is that it had a $2 billion short position against the same deal.

If that isn't fraud, Mr. Holder, just what exactly is fraud?

Still, it wasn't surprising that Holder didn't pursue criminal charges against Goldman. And that's not just because Holder has repeatedly proven himself to be a spineless bureaucrat and obsequious political creature masquerading as a cop, and not just because rumors continue to circulate that the Obama administration - supposedly in the interests of staving off market panic - made a conscious decision sometime in early 2009 to give all of Wall Street a pass on pre-crisis offenses.

No, the real reason this wasn't surprising is that Holder's decision followed a general pattern that has been coming into focus for years in American law enforcement. Our prosecutors and regulators have basically admitted now that they only go after the most obvious and easily prosecutable cases.

If the offense committed doesn't fit the exact description in the relevant section of the criminal code, they pass. The only white-collar cases they will bring are absolute slam-dunk situations where some arrogant rogue commits a blatant crime for individual profit in a manner thoroughly familiar to even the non-expert portion of the jury pool/citizenry.

In other words, they'll take on somebody like Raj Rajaratnam, who stacked his illegal insider trades so brazenly and carelessly that his case almost reads like a finance version of Jeff Dahmer tripping over bodies in his Milwaukee apartment. Or they'll pursue Bernie Madoff on the tenth or eleventh time he crosses their desk, after years of nonaction, and after he breaks down weeping and confessing. Basically, if someone backs a dump truck up to the DOJ and unloads the entire case, gift-wrapped, a contrite and confessing criminal included, a guy like Eric Holder might, after much agonizing deliberation, decide to prosecute.

But here's the thing: most of the crimes Wall Street people commit involve highly specific, highly individualized transactions that won't fit Eric Holder's bag of cookie-cutter statutory definitions. That is not the same thing as saying they're not crimes. They are: the crimes of the crisis period were and are very basic crimes like fraud, theft, perjury, and tax evasion, only they're dressed up in millions of pages of camouflaging verbiage.

Or, even more often, the crimes have also been sanctified in advance by "reputable" law and accounting firms, who (for huge fees) offered their clients opinions that, if X and Y are signed in accordance with Z, and A and B are stipulated by the parties, and everyone's sitting Indian-style and facing the moon when the deal is agreed to, then it's not fucked up and illegal when Goldman Sachs tells you it's a co-investor in your deal when it's actually got $2 billion bet against you.

You know that look a dog gives you when you show it something confusing, like an electric razor or a lawn sprinkler? That's the look federal prosecutors give when companies like Goldman wave their attorneys' sanctifying opinions at them. They scratch their heads and say: "Oh, wow, well since this was signed in Australia by three millionaire lawyers wearing magic invisibility cloaks, it really isn't fraud! They're right!"

As one high-profile attorney currently working on a closely-watched case involving a Wall Street bank put it to me yesterday: "With these Justice guys, everything the Wall Street lawyers say makes perfect sense to them, no matter how dumb it is."

You can almost feel the relief emanating from Washington when these prosecutors decide against matching wits with the wizened 60 year-old legal Sith Lords from Harvard and Yale who've seen everything, know every judge by his or her first name, and in a trial would be basically bringing absolutely everything a lawyer can bring to the table, except consciences of course.

It's political, sure, these decisions not to go after the Goldmans of the world, but more than that what usually rules the day is just pure intellectual fear - appropriate in many cases, since any prosecutor who buys for a second any of the high-priced excuses being shoveled at them from corporate defense firms like Davis Polk or criminal defense mercenaries like Reid Weingarten (retained to defend Blankfein against possible criminal charges) probably really is no match, intellectually, for Wall Street's lawyers.

They're also no match morally. Wall Street firms pay their lawyers millions of dollars for their creativity, for their willingness to fight. They say to their lawyers, as Lehman Brothers said before it crashed: "We'd like to book $50 million in loans as sales. Find a way for us to call that legal."

As it happens Lehman couldn't find even one American law firm to go for that one, so they went to England and got a firm called Linklaters to find a way, which they did. The Linklaters opinion was just a duller version of the, "It's legal if we're all sitting Indian style and facing the moon" defense. Here's the New York Times explanation:

Enter Linklaters, which grounded its legal brief in English, rather than American, law. The firm explicitly said: "This opinion is limited to English law as applied by the English courts and is given on the basis that it will be governed by and construed in accordance with English law."

Otherwise, Linklaters provided Lehman with exactly what it wanted to hear. The law firm decreed in its briefs, at least as outlined in the 2006 iteration obtained by Mr. Valukas, that intent matters. If two parties intend to exchange assets for cash, and then later the party receiving the assets decides to hand back "equivalent assets (such as securities of the same series and nominal value) rather than the very assets that were originally delivered," that amounts to a sale.

That's how law works on Wall Street. The bank walks into the room with the sordid activity, and the law firm's partners huddle up and whip their associates - for hundreds and hundreds of billable hours straight, if necessary - until a way is found to call stealing or tax evasion or accounting fraud or whatever legal.

That's the way it should work on the prosecutorial side, too. You should start with a simple moral premise - this group of crooks ripped off X group of victims for fifty million dollars - and then you should bury yourself in law books until you find a way to put them all in jail. If Linklaters gets paid to be creative, well, Mr. Holder, we're paying you to be creative, too.

Again, though, Holder didn't need to be creative in the Goldman case. Levin gift-wrapped the whole thing for him. He could have had a dozen easy convictions just on the evidence in that report, and if he had been creative, if he had used his vast power to roll up the guilty and flip them into more revelations, then he'd have had enough cases to last the AG's office the next decade.

But the Holders of the world do not want to be creative when the targets are politically influential rich people. Instead, they use their creativity against Roger Clemens, Barry Bonds, immigrant housekeepers, and guys who knock over liquor stores. They like to flex muscles against bank robbers, celebrity tax evaders (we can't have Wesley Snipes on the loose!), truck hijackers, and drug dealers. As Gene Wilder would say, "You know - morons."

Holder's non-decision on Goldman is more than unsurprising. It amounts to an official announcement that the government is no longer in the business or prosecuting smart criminals. It's pathetic. The one thing you pay any lawyer to have is balls, and our nation's top attorney has none.

I've been on deadline in the past week or so, so I haven't had a chance to weigh in on Eric Holder's predictable decision to not pursue criminal charges against Goldman, Sachs for any of the activities in the report prepared by Senators Carl Levin and Tom Coburn two years ago.

Last year I spent a lot of time and energy jabbering and gesticulating in public about what seemed to me the most obviously prosecutable offenses detailed in the report - the seemingly blatant perjury before congress of Lloyd Blankfein and other Goldman executives, and the almost comically long list of frauds committed by the company in its desperate effort to unload its crappy "cats and dogs" mortgage-backed inventory.

In the notorious Hudson transaction, for instance, Goldman claimed, in writing, that it was fully "aligned" with the interests of its client, Morgan Stanley, because it owned a $6 million slice of the deal. What Goldman left out is that it had a $2 billion short position against the same deal.

If that isn't fraud, Mr. Holder, just what exactly is fraud?

Still, it wasn't surprising that Holder didn't pursue criminal charges against Goldman. And that's not just because Holder has repeatedly proven himself to be a spineless bureaucrat and obsequious political creature masquerading as a cop, and not just because rumors continue to circulate that the Obama administration - supposedly in the interests of staving off market panic - made a conscious decision sometime in early 2009 to give all of Wall Street a pass on pre-crisis offenses.

No, the real reason this wasn't surprising is that Holder's decision followed a general pattern that has been coming into focus for years in American law enforcement. Our prosecutors and regulators have basically admitted now that they only go after the most obvious and easily prosecutable cases.

If the offense committed doesn't fit the exact description in the relevant section of the criminal code, they pass. The only white-collar cases they will bring are absolute slam-dunk situations where some arrogant rogue commits a blatant crime for individual profit in a manner thoroughly familiar to even the non-expert portion of the jury pool/citizenry.

In other words, they'll take on somebody like Raj Rajaratnam, who stacked his illegal insider trades so brazenly and carelessly that his case almost reads like a finance version of Jeff Dahmer tripping over bodies in his Milwaukee apartment. Or they'll pursue Bernie Madoff on the tenth or eleventh time he crosses their desk, after years of nonaction, and after he breaks down weeping and confessing. Basically, if someone backs a dump truck up to the DOJ and unloads the entire case, gift-wrapped, a contrite and confessing criminal included, a guy like Eric Holder might, after much agonizing deliberation, decide to prosecute.

But here's the thing: most of the crimes Wall Street people commit involve highly specific, highly individualized transactions that won't fit Eric Holder's bag of cookie-cutter statutory definitions. That is not the same thing as saying they're not crimes. They are: the crimes of the crisis period were and are very basic crimes like fraud, theft, perjury, and tax evasion, only they're dressed up in millions of pages of camouflaging verbiage.

Or, even more often, the crimes have also been sanctified in advance by "reputable" law and accounting firms, who (for huge fees) offered their clients opinions that, if X and Y are signed in accordance with Z, and A and B are stipulated by the parties, and everyone's sitting Indian-style and facing the moon when the deal is agreed to, then it's not fucked up and illegal when Goldman Sachs tells you it's a co-investor in your deal when it's actually got $2 billion bet against you.

You know that look a dog gives you when you show it something confusing, like an electric razor or a lawn sprinkler? That's the look federal prosecutors give when companies like Goldman wave their attorneys' sanctifying opinions at them. They scratch their heads and say: "Oh, wow, well since this was signed in Australia by three millionaire lawyers wearing magic invisibility cloaks, it really isn't fraud! They're right!"

As one high-profile attorney currently working on a closely-watched case involving a Wall Street bank put it to me yesterday: "With these Justice guys, everything the Wall Street lawyers say makes perfect sense to them, no matter how dumb it is."

You can almost feel the relief emanating from Washington when these prosecutors decide against matching wits with the wizened 60 year-old legal Sith Lords from Harvard and Yale who've seen everything, know every judge by his or her first name, and in a trial would be basically bringing absolutely everything a lawyer can bring to the table, except consciences of course.

It's political, sure, these decisions not to go after the Goldmans of the world, but more than that what usually rules the day is just pure intellectual fear - appropriate in many cases, since any prosecutor who buys for a second any of the high-priced excuses being shoveled at them from corporate defense firms like Davis Polk or criminal defense mercenaries like Reid Weingarten (retained to defend Blankfein against possible criminal charges) probably really is no match, intellectually, for Wall Street's lawyers.

They're also no match morally. Wall Street firms pay their lawyers millions of dollars for their creativity, for their willingness to fight. They say to their lawyers, as Lehman Brothers said before it crashed: "We'd like to book $50 million in loans as sales. Find a way for us to call that legal."

As it happens Lehman couldn't find even one American law firm to go for that one, so they went to England and got a firm called Linklaters to find a way, which they did. The Linklaters opinion was just a duller version of the, "It's legal if we're all sitting Indian style and facing the moon" defense. Here's the New York Times explanation:

Enter Linklaters, which grounded its legal brief in English, rather than American, law. The firm explicitly said: "This opinion is limited to English law as applied by the English courts and is given on the basis that it will be governed by and construed in accordance with English law."

Otherwise, Linklaters provided Lehman with exactly what it wanted to hear. The law firm decreed in its briefs, at least as outlined in the 2006 iteration obtained by Mr. Valukas, that intent matters. If two parties intend to exchange assets for cash, and then later the party receiving the assets decides to hand back "equivalent assets (such as securities of the same series and nominal value) rather than the very assets that were originally delivered," that amounts to a sale.

That's how law works on Wall Street. The bank walks into the room with the sordid activity, and the law firm's partners huddle up and whip their associates - for hundreds and hundreds of billable hours straight, if necessary - until a way is found to call stealing or tax evasion or accounting fraud or whatever legal.

That's the way it should work on the prosecutorial side, too. You should start with a simple moral premise - this group of crooks ripped off X group of victims for fifty million dollars - and then you should bury yourself in law books until you find a way to put them all in jail. If Linklaters gets paid to be creative, well, Mr. Holder, we're paying you to be creative, too.

Again, though, Holder didn't need to be creative in the Goldman case. Levin gift-wrapped the whole thing for him. He could have had a dozen easy convictions just on the evidence in that report, and if he had been creative, if he had used his vast power to roll up the guilty and flip them into more revelations, then he'd have had enough cases to last the AG's office the next decade.

But the Holders of the world do not want to be creative when the targets are politically influential rich people. Instead, they use their creativity against Roger Clemens, Barry Bonds, immigrant housekeepers, and guys who knock over liquor stores. They like to flex muscles against bank robbers, celebrity tax evaders (we can't have Wesley Snipes on the loose!), truck hijackers, and drug dealers. As Gene Wilder would say, "You know - morons."

Holder's non-decision on Goldman is more than unsurprising. It amounts to an official announcement that the government is no longer in the business or prosecuting smart criminals. It's pathetic. The one thing you pay any lawyer to have is balls, and our nation's top attorney has none.

"We now have a president-elect who, the weekend before inauguration, is launching new businesses along with promises to deregulate... those sectors in a way to just blatantly profit off his own presidency."

U.S. President-elect Donald Trump faced a flood of criticism throughout the weekend for launching a cryptocurrency token as the world prepared for his Monday inauguration and policies expected to benefit the industry that helped Republicans take control of the White House and Congress.

"It is literally cashing in on the presidency—creating a financial instrument so people can transfer money to the president's family in connection with his office," Campaign Legal Center executive director Adav Noti told The New York Times. "It is beyond unprecedented."

Jordan Libowitz, vice president for communications at Citizens for Responsibility and Ethics in Washington, also contrasted Trump's move with behaviors of past presidents, telling Politico, "It is absolutely wild."

"After decades of seeing presidents-elect spend the time leading up to inauguration separating themselves from their finances to show that they don't have any conflicts of interest, we now have a president-elect who, the weekend before inauguration, is launching new businesses along with promises to deregulate... those sectors in a way to just blatantly profit off his own presidency," said Libowitz.

The president-elected announced the $TRUMP meme coin, hosted on the Solana blockchain, via his Truth social media platform and X—owned by Elon Musk, his ally and the richest person on the planet—on Friday, declaring that "it's time to celebrate everything we stand for: WINNING!"

He linked to a website that explains "there are 200 million $TRUMP available on day one and will grow to a total of 1 billion $TRUMP over three years." It also states that "Trump Memes are intended to function as an expression of support for, and engagement with, the ideals and beliefs embodied by the symbol '$TRUMP' and the associated artwork, and are not intended to be, or to be the subject of, an investment opportunity, investment contract, or security of any type."

Forbes reported that "the remaining 80% of tokens that have yet to be publicly released are owned by the Trump Organization affiliate CIC Digital LLC and Fight Fight Fight LLC, a company formed in Delaware on January 7, according to state filings, and both companies will receive an undisclosed amount of revenue derived from trading activity."

The president-elect's son Eric Trump, who helps run Trump Organization, told the Times that "this is just the beginning."

"I am extremely proud of what we continue to accomplish in crypto," he said in a statement. "$TRUMP is currently the hottest digital meme on Earth."

In an article simply headlined, "Donald Trump, crypto billionaire," Axios noted that by Sunday morning, "Trump's crypto holdings were worth as much as $58 billion on paper, enough—with his other assets—to make him one of the world's 25 richest people."

Responding to Axios' report, Wa'el Alzayat, who served as a Middle East policy expert at the U.S. Department of State for a decade, said that "when I was in government I couldn't accept a lunch over $20. Now anyone can give our next president millions."

Predicting that "this is going to end VERY badly for everyone except Donald Trump and his cronies," journalist Jeff St. John said that "it is a scandal and an outrage."

The meme coin announcement came as "the elite of the crypto world" gathered in Washington, D.C. for the first-ever Crypto Ball.

The president-elect did not attend the event, but House Speaker Mike Johnson (R-La.) and the nominees for commerce and treasury secretary, Howard Lutnick and Scott Bessent, were there. Reporting on the gala, Reuters pointed out that the Trump "courted crypto campaign cash with promises to be a 'crypto president,' and is expected next week to issue executive orders aimed at reducing crypto regulatory roadblocks and promoting widespread adoption of digital assets."

Trump is no stranger to ethics scandals. As Mother Jones detailed:

The meme coin is just the latest in a bizarre line of grifty, super-weird takes on "merch." Last February, Trump showed off gold "Never Surrender High-Tops" for $399 at Sneaker Con, which had Fox News applauding his appeal to Black voters. In March, he began endorsing the $59.99 "God Bless the USA Bible," which includes the Constitution, the Bill of Rights, and handwritten lyrics to the chorus of Lee Greenwood's "God Bless the USA." (Trump's inaugural committee has confirmed that he will not be using one of these Bibles to swear the presidential oath of office on Monday.) In August, Trump released a new round of his "baseball card" NFTs.

S.V. Dáte, a senior White House correspondent at HuffPost, highlighted Sunday that during the Republican's first term, "Trump's D.C. hotel was a convenient way for foreign and domestic lobbyists to put cash directly into his pocket."

"This crypto thing is next level. Anyone on the planet can put money directly into his pocket. Huge," Dáte added. "The efficiency here is a thing of beauty. With a hotel, you have all the costs of owning the property as well as paying cleaning staff, front desk staff, and so on. This selling of fake money is almost pure profit."

The Trump Organization sold the D.C. hotel in 2022, but The Wall Street Journal reported earlier this month that his "real estate company is in talks to reclaim" the property.

"The Democratic Party setting up Trump to play the part of the zoomer savior after Trump got this all rolling in the first place is... the sort of self-inflicted wound that only the Democratic Party could accomplish."

After starting Sunday with a Truth Social post declaring " SAVE TIKTOK!" U.S. President-elect Donald Trump announced plans for an executive order delaying a nationwide ban on the global video-sharing platform—which some political observers framed as a "win" for the Republican that was made possible by Democrats in Washington, D.C.

Trump actually kicked off efforts to force TikTok's Chinese parent company ByteDance to divest with an August 2020 executive order, citing national security concerns. Three months later, he lost an election to Democratic President Joe Biden, who ultimately reversed the order. However, Biden then signed the legislation currently impeding the platform's availability in the United States.

"Congratulations, Democrats," said Nina Turner, a former Democratic congressional candidate from Ohio, as the platform began informing U.S. users that it was no longer available late Saturday. "This could've been avoided had you listened to progressives last year when this bill was being forced through Congress."

U.S. Reps. Mike Gallagher (R-Wis.) and Rep. Raja Krishnamoorthi (D-Ill.) last March

led a bipartisan coalition that introduced a bill targeting TikTok's parent company—the Protecting Americans from Foreign Adversary Controlled Applications Act—in the House of Representatives, where it swiftly approved in a 352-65 vote.

A version of the bill—which forces ByteDance to sell TikTok to a non-Chinese company or face a U.S. ban—ultimately passed both chambers with bipartisan support as a rider to a $95 billion military assistance package for Ukraine, Taiwan, and Israel, as it waged a genocidal war against Palestinians in Gaza. Biden signed it in April.

The resulting legal battle reached the U.S. Supreme Court, which on Friday unanimously upheld the law, "giving the executive branch unprecedented power to silence speech it doesn't like, increasing the danger that sweeping invocations of 'national security' will trump our constitutional rights," in the words of ACLU National Security Project deputy director Patrick Toomey.

The court's decision meant TikTok would "go dark" on Sunday without action from Biden, who declined to give ByteDance a 90-day extension to sell or accept the ban, despite pressure from First Amendment advocates like the ACLU, the platform's 170 million American users—including content creators and small businesses facing financial impacts—and some lawmakers.

In a Friday statement, White House Press Secretary Karine Jean-Pierre

pointed to Trump's Monday inauguration, saying that "given the sheer fact of timing, this administration recognizes that actions to implement the law simply must fall to the next administration."

Late Saturday, TikTok users in the United States began seeing a pop-up message that the platform was unavailable, stating: "A law banning TikTok has been enacted in the U.S. Unfortunately, that means you can't use TikTok for now. We are fortunate that President Trump has indicated that he will work with us on a solution to reinstate TikTok once he takes office. Please stay tuned!"

In response to former Obama administration staffer and podcaster Tommy Vietor calling TikTok's message an advertisement from the Chinese Communist Party, leftist political commentator Hasan Piker highlighted Trump's opportunity to restore access to the platform, saying that "the Democrats handed him the easiest w of all time if he's smart enough to seize it."

Others were also critical of the Democratic Party—which is wrapped up in debates over how to move forward from devastating electoral losses in November—with independent journalist Ken Klippenstein saying that "this reminds me of when Trump put his name on the stimulus checks but Biden didn't. Historic own goal by the Democrats here."

Jacobin podcast host Daniel Denvir similarly said on X—the platform owned by Trump ally Elon Musk, the world's richest person—that "the Democratic Party setting up Trump to play the part of the zoomer savior after Trump got this all rolling in the first place is... the sort of self-inflicted wound that only the Democratic Party could accomplish."

Lynese Wallace—who was the chief of staff for former Rep. Cori Bush (D-Mo.), a progressive who opposed the law— said that "the TikTok ban was always bad policy and bad politics. Let's not forget it was folded into a $95 billion foreign aid package passed in the last Congress—and has since paved way for Trump to now 'save' it, despite his own support for a ban during his first term. So dumb."

Seizing the opportunity, Trump said Sunday on his Truth social media platform that "I'm asking companies not to let TikTok stay dark! I will issue an executive order on Monday to extend the period of time before the law's prohibitions take effect, so that we can make a deal to protect our national security. The order will also confirm that there will be no liability for any company that helped keep TikTok from going dark before my order."

Although Trump can't take action before he is sworn in, he continued:

Americans deserve to see our exciting Inauguration on Monday, as well as other events and conversations.

I would like the United States to have a 50% ownership position in a joint venture.

By doing this, we save TikTok, keep it in good hands and allow it to [stay] up. Without U.S. approval, there is no TikTok. With our approval, it is worth hundreds of billions of dollars—maybe trillions.

Therefore, my initial thought is a joint venture between the current owners and/or new owners whereby the U.S. gets a 50% ownership in a joint venture set up between the U.S. and whichever purchase we so choose.

Responding with a statement on X, TikTok said that "in agreement with our service providers, TikTok is in the process of restoring service. We thank President Trump for providing the necessary clarity and assurance to our service providers that they will face no penalties [for] providing TikTok to over 170 million Americans and allowing over 7 million small businesses to thrive. It's a strong stand for the First Amendment and against arbitrary censorship. We will work with President Trump on a long-term solution that keeps TikTok in the United States."

Even before Trump's post, Musk—who is expected to co-lead a presidential advisory commission— said on X that "I have been against a TikTok ban for a long time, because it goes against freedom of speech. That said, the current situation where TikTok is allowed to operate in America, but X is not allowed to operate in China is unbalanced. Something needs to change."

ByteDance's Chinese version of TikTok, called Douyin, was introduced in China in September 2016. The New York Times reported last April that "TikTok has more users on its platform, but Douyin is ByteDance's cash cow. Roughly 80% of ByteDance's $54 billion revenue in the first half of [2023] came from China."

Critics of bipartisan efforts to ban TikTok in the United States have blasted lawmakers for their priorities throughout the process.

"America: Where it's OK to ban TikTok, books, and abortions, but not OK to ban assault weapons, bombs for genocides, or student debt," said Warren Gunnels, Democratic staff director for the Senate Health, Education, Labor, and Pensions Committee under the chairmanship of Sen. Bernie Sanders (I-Vt.), who voted against the TikTok legislation.

Just hours ahead of a cease-fire taking effect in Gaza, Turner, who co-chaired Sanders' 2020 presidential campaign, also emphasized that "they really banned TikTok before they banned sending weapons to Israel during a genocide."

"If Congress actually gave a damn about our data privacy," she added, "they would've passed a sweeping data privacy bill, not a bill targeting TikTok."

In a Sunday email to supporters, Rep. Alexandria Ocasio-Cortez (D-N.Y.)—who also voted against the law—agreed, stressing that "the answer is not just playing endless whack-a-mole with apps."

"We should have real privacy legislation in the United States," she said. "We should help people have greater agency over their personal information so that they're not being spied on all the time, whether it's a domestic company or a foreign company."

"To which, of course, Big Tech and their lobbies are going to fight against," she warned. "So they just target an

app instead of targeting the problem."

Israeli forces killed at least 19 Palestinians during the delay, on top of nearly 47,000 others slaughtered since October 2023.

Israeli forces killed at least 19 Palestinians across the Gaza Strip on Sunday morning during a three-hour delay in implementing a cease-fire and hostage-release deal that Israel's Cabinet finally approved the previous day.

After over 15 months of a U.S.-backed military assault for which Israel faces a genocide case at the International Court of Justice, Israel Defense Forces (IDF) strikes on Gaza were set to stop at 8:30 am local time, due to a three-phase agreement negotiated by Egypt, Qatar, and the outgoing Biden and incoming Trump administrations.

They did not, with deadly results. Mahmoud Basal, a spokesperson for Gaza's Civil Defense, said Sunday that at least 19 people were killed and over 36 were injured from 8:30 am to 11:30 am. That's on top of the tens of thousands of people the Israeli assault and restrictions on humanitarian aid have killed since the Hamas-led October 7, 2023 attack on Israel.

As of midnight Saturday, the Gaza Ministry of Health put the official death toll in the besieged Palestinian enclave at 46,913, with another 110,750 people injured and over 10,000 others missing in the rubble of former homes, hospitals, schools, and mosques, though experts warn the number of deaths is likely far higher.

At 9:17 am on Sunday, the IDF said that it was "continuing to operate and strike terrorist targets in Gaza," adding: "A short while ago, IDF artillery and aircraft struck a number of terrorist targets in northern and central Gaza. The IDF remains ready in offense and defense and will not allow any harm to the citizens of Israel."

Muhammad Shehada, a Gazan writer, called the delay a "last-minute trick" by Israeli Prime Minister Benjamin Netanyahu, and explained on social media that it was "under the pretext that Hamas hasn't submitted the list of three captives it'll release today."

As Shehada detailed:

Israel also reneged on the arrangement needed for Hamas to be able to submit such list; suspending surveillance drones and bombardment in the hours preceding the cease-fire so that it becomes logistically possible for Hamas' members on the ground and abroad to contact each other and figure out which hostages are alive and where without compromising their whereabouts and risking being bombed or raided by the IDF.

Hamas was forced to submit the list under fire and spy drones, which meant Israel exploited this to try to locate and snatch some captives last minute. Israel now succeeded in reaching the body of the soldier Oron Shaul, whom Hamas had been holding captive since 2014.

Ultimately, Hamas submitted the list and the pause in fighting took effect—at least for now—enabling displaced Palestinians to start returning to what is left of their communities and the process of releasing captives to begin with three Israelis and 90 Palestinians. During the deal's first 42-day phase, there are plans to free 33 Israelis taken hostage by Palestinian militants, 737 Palestinians imprisoned in Israel, and 1,167 Palestinians detained by Israeli forces in Gaza.

The three Israeli hostages—Emily Damari, Romi Gonen, and Doron Steinbrecher—were transfered to the International Committee of the Red Cross at a square in central Gaza City. The IDF confirmed that the Red Cross was bringing the women to Israeli troops.

The Associated Press on Sunday obtained from Hamas a list of the first 90 Palestinian prisoners set to be freed. They included 15-year-old Mahmoud Aliowat; 53-year-old Dalal Khaseeb, the sister of former Hamas second-in-command Saleh Arouri; 62-year-old Khalida Jarrar, a Popular Front for the Liberation of Palestine leader; and 68-year-old Abla Abdelrasoul, the wife of detained PFLP leader Ahmad Saadat.