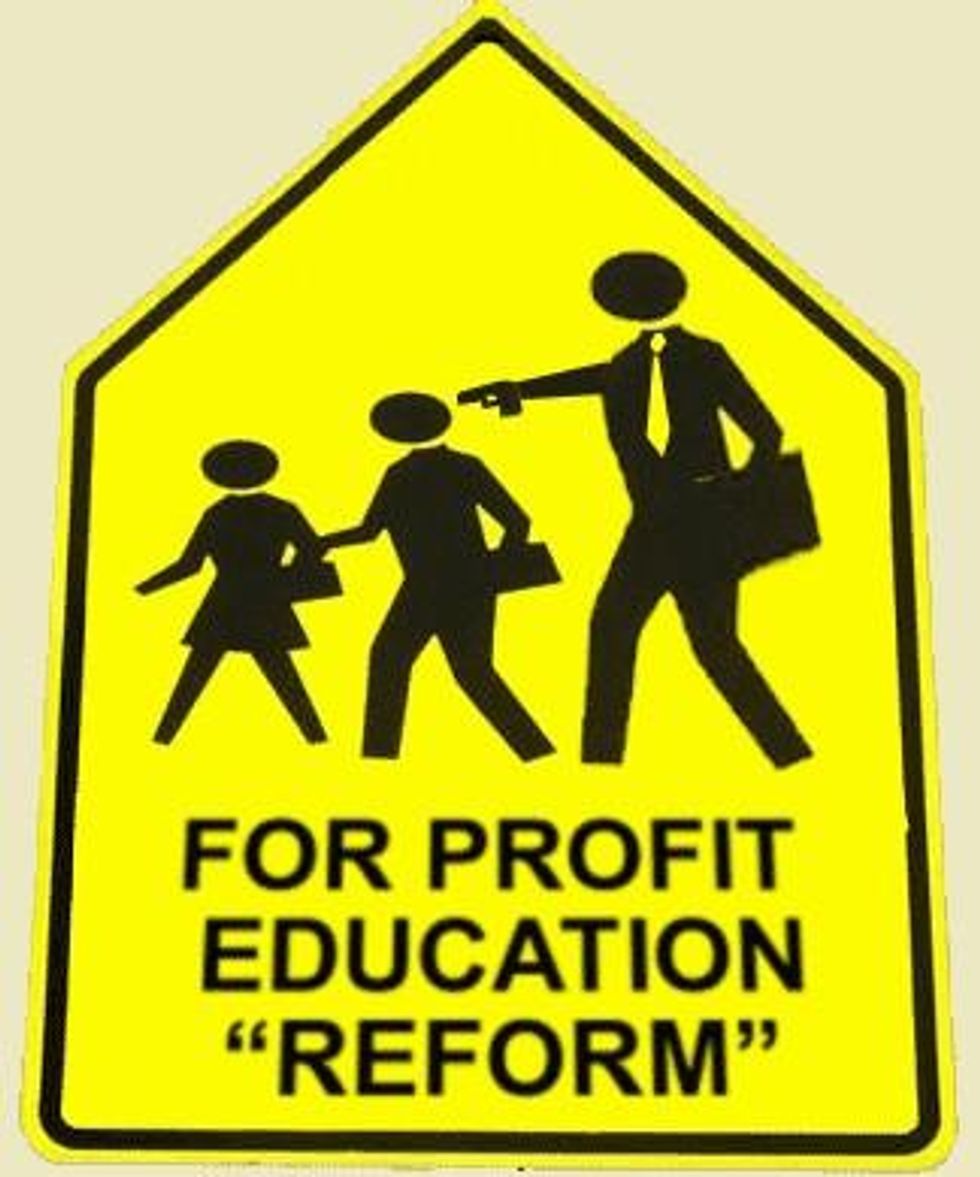

The end of the Chicago teachers' strike was but a temporary regional truce in the civil war that plagues the nation's public schools. There is no end in sight, in part because--as often happens in wartime--the conflict is increasingly being driven by profiteers.

The familiar media narrative tells us that this is a fight over how to improve our schools. On the one side are the self-styled reformers, who argue that the central problem with American K-12 education is low-quality teachers protected by their unions. Their solution is privatization, with its most common form being the privately run but publicly financed charter school. Because charter schools are mostly unregulated, nonunion and compete for students, their promoters claim they will, ipso facto, perform better than public schools.

On the other side are teachers and their unions who are cast as villains. The conventional plot line is that they resist change, blame poverty for their schools' failings and protect their jobs and turf.

It is well known, although rarely acknowledged in the press, that the reform movement has been financed and led by the corporate class. For more than 20 years large business oriented foundations, such as Gates (Microsoft), Walton (Walmart) and Broad (Sun Life) have poured billions into charter school start-ups, sympathetic academics and pundits, media campaigns (including Hollywood movies) and sophisticated nurturing of the careers of privatization promoters who now dominate the education policy debate from local school boards to the U.S. Department of Education.

In recent years, hedge fund operators, leverage-buy-out artists and investment bankers have joined the crusade. They finance schools, sit on the boards of their associations and the management companies that run them, and--most important--have made support of charter schools one of the criteria for campaign giving in the post-Citizens United era. Since most Republicans are already on board for privatization, the political pressure has been mostly directed at Democrats.

Thus, for example, when Andrew Cuomo wanted to get the support of hedge fund managers for his run for governor of New York, he was told to talk to Joe Williams, director of Democrats for Education Reform, a group set up to lobby liberals on privatization. Cuomo is now a champion of charter schools. As Joanne Barkan noted in a Dissent Magazine report, privatizers are even targeting school board elections, in one case spending over $630,000 to elect two members in a local school board race last year in Colorado.

Wall Street's involvement in the charter school movement--when the media acknowledges it--is presented as an act of philanthropy. Perhaps, as critics claim, hedge funders are meddling in an area they know nothing about. But their motives are worthy. Indeed, since they send their own children to the best private schools, their concern for other people's children seems remarkably altruistic. "Wall Street has always put its money where its interests of beliefs lie," observed this New York Times article, "But it is far less common that so many financial heavyweights would adopt a social cause like charter schools and advance it with a laser-like focus in the political realm."

Yet, with the wide variety of social causes and charitable needs--poverty, health, housing, global warming, the arts, etc.--why would so many Wall Streeters focus laser-like on this particular issue? The Times suggest two answers. One is that the money managers are hard-nosed, data-driven investors "drawn to the business-like way in which many charter schools are run; their focus on results primarily measured by test scores."

Twenty years ago, one might have reasonably believed that the private charter schools, which are managed to produce the numbers, would produce better outcomes--as measured by the numbers. But the overwhelming evidence is that they do not. The single most comprehensive study, by researchers at Stanford University, found that 17 percent of charter school students performed better than their public school counterparts, 46 percent no better and 37 percent worse. Stanford's conclusions have been reinforced by virtually all of the serious research, including those at the University of California, the Economic Policy Institute and the policy research firm Mathematica.

Nor do charter schools seem more efficient. Those promoted as the most successful examples have been heavily subsidized by foundations and Wall Street donors. The film, Waiting for Superman that portrays a heroic charter school organizer fighting a selfish teachers union was widely hyped in the media--including popular TV shows like Oprah Winfrey's. Yet, as Diane Ravitch, an assistant secretary of education under George H.W. Bush and a former charter school supporter turned critic, noted, the film neglected to report that the hero educator kicked out the entire first class of the school because their test scores were too low, that the school was heavily subsidized by the pro-reform foundations and that the hero took an annual salary of $400,000.

Neither do the data on international comparisons support either privatization in general or charter schools in particular. The foreign education systems that out score America's are government-run, unionized, monopolies. Ravitch asks: "I look around the world and I don't see any country doing this but us. Why is that?"

Good question. Although the data do not support the supposedly data-driven privatizers' claims, their enthusiasm is undiminished. In response to an op-ed by Bill Gates that crudely misrepresented the statistics on school performance, education policy analyst Richard Rothstein observed: "It is remarkable that someone associated with technology and progress should have such a careless disregard for accuracy when it comes to the education policy in which he is now so deeply involved."

The Times' other guess about Wall Street's motives was that hedge funders are attracted to the anti-union character of the charter schools. This is undoubtedly true; the attack on the pubic schools is clearly a part of the broad conservative campaign to discredit government.

Wall Street has always loathed the labor movement. And in the last decade it has had even more of a reason since corporate profits now depend more on cost cutting and less on the creation of new products. The Chief Finance Officer of JP Morgan reports that some 75 percent of the net increase in corporate profits between 2000 and 2007--before the financial crash--was a result of cuts in workers' wages and benefits. Given that unions are the only serious vehicles for resistance to the corporate low-wage strategy, Wall Street's antipathy has become even stronger.

But today unions represent less than seven percent of private sector workers. And the influence of public sector unions on the bargaining position of workers in profit-making corporations is, certainly in the short run, negligible. So while hostility to unions plays a role, is it is not quite credible to believe that Wall Street profit maximizers would be spending so much of their time and money simply to beat up on a proxy for the private sector unions that they have already so beaten back.

As usual, when looking for what motivates capitalists in a market system, the answer is likely to have something to do with making money.

Having been rescued from the consequences of its own folly by the Bush/Obama bailouts with its de-regulated privileges intact, Wall Street is once more on the prowl for the new "big thing"--a new source of potential profits upon which to build the next lucrative asset bubble.

The landscape of the coming decade is not promising. Most forecasters see a near term future of slow growth, sluggish consumer spending and government retrenchment. Despite the Federal Reserve's commitment to low interest rates there is little demand for equities, indicating widespread investor pessimism about the future. As Bill Gross, the founder of global investment giant Pimco, wrote in August, "Boomers can't take risk. Gen X and Y believe in Facebook but not its stock. Gen Z has no money."

The financial bubble of the 1990s was driven by new business start-ups exploiting technologies whose development had been subsidized by the taxpayers. The bubble of the 2000's was built on the boom in subprime mortgages organized and subsidized by Federal housing programs. But with a virtual Washington consensus on cutting back public spending, investors have little expectation of new government money being poured into some dormant economic sector on a scale sufficient to generate widespread speculative excitement.

Education privatization would not, per se, create a net new stimulus for the economy. But by diverting large existing flows of money from the public to the private sector it would create new profit-making ventures that could be capitalized and transformed into stocks, derivatives and leveraged securities. The pot has been sweetened by a 39 percent federal tax credit for financing charter school construction that can double an investor's return in seven years. The prospect of new speculative opportunities could well recharge the animal spirits upon which Wall Street depends.

Some "liberal" privatization promoters claim that charter schools should not be considered private. But that's an argument the management companies that run the schools only use when they are asking for more government funding. At the same time they argue in courts and to legislatures that as private enterprises they should not be subject to government audits, labor laws and other restrictions.

These companies rent, buy, and sell buildings; make contracts for consulting, accounting and legal services, food concessions, and transportation; and pay their managers far more than public school principals earn. In cases where city governments have given land to charter schools, for profit real estate companies have ended up owning the subsidized land and buildings. In states where charter schools are required to be nonprofit, profit-making companies can still set them up and then organize a board of neighborhood residents who will give them the right to manage the school with little or no interference.

In 2008 Dennis Bakke, CEO of Imagine Schools, a private company that managed 71 schools in 11 states, sent an email to the firm's senior staff. It reminded his managers not to give school boards the "misconception" that they were "responsible for making decisions about budget matters, school policies, hiring of the principal, and dozens of other matters." The memo suggested that the community board members be required to sign undated letters of resignation. "It is our school, our money, and our risk," he wrote, "not theirs."

The potential for private profits from publicly funded education is not limited to K-12. Profit-making universities and vocational schools--increasingly substituting remote internet learning for classroom teachers--are among the fastest growing businesses in the country. The sector is rife with high-pressure sales tactics and shoddy training, which leaves students--many of them low-income--deeply in debt and no further up the job ladder. Most of their growth is financed by Federal aid and Federally guaranteed student loans.

"You start to see entire ecosystems of investment opportunity lining up," Rob Lytle, an business consultant earlier this year told a meeting of private equity investors interested in for-profit education companies. According to Stephanie Simon of Reuters, who reported on the event, investment in for profit education has already jumped from $13 million in 2005 to $389 million in 2011. Among others, Goldman Sachs and JP Morgan Chase have created multimillion-dollar funds for education investments.

These "data-driven" investors are not so much interested in students' scores, as in the opportunities to cut costs by using online technology. Ironically, while reformers insist their goal is to develop more skilled teachers, a goal of their financier allies is to get rid of them. The central question, says education entrepreneur John Katzman is "How do we use technology so that we require fewer qualified teachers?"

According to none other that Rupert Murdoch, the U.S. education industry represents a $500 billion dollar opportunity for investors. In 2010, he hired prominent reformer Joel Klein from his post as chancellor of the New York City Department of Education to run Murdoch's education technology company. A few months later the firm received a $2.7 million contract from the city.

Charter schools, for profit on-line universities and other forms of privatization may not in the end fulfill all the dreams of its Wall Street promoters. But there is clearly money to be made here. And where there is money to be made, we can be sure that there will be money to finance political campaigns, to support career ladders that move between government and business and to bribe the media into ignoring the data. So the war on public education will continue. All of course "for the sake of the children."