SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

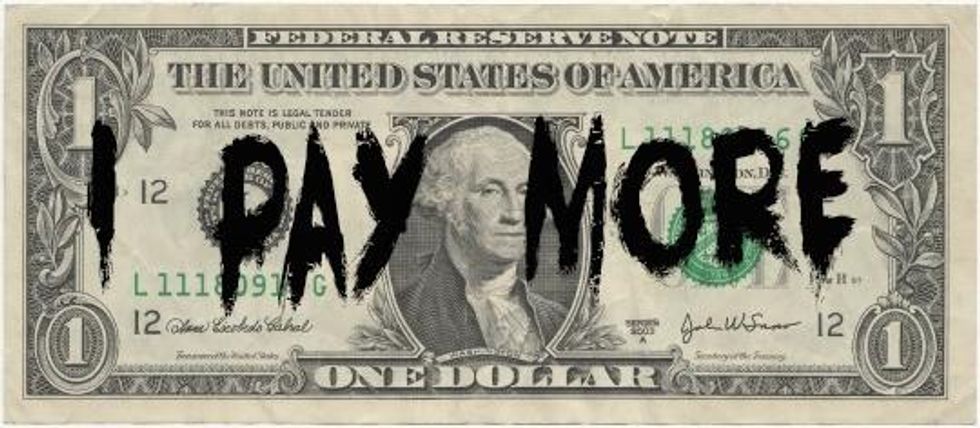

After I pinned a dollar bill on my jacket lapel with "I PAY MORE" written on it in black marker, I've had countless conversations during my travels across the United States that went something like this:

Them: "I pay more? What does that mean?"

Me: "This dollar bill right here is $1 more than General Electric, Bank of America, Wells Fargo, Citibank, and a bunch of other big corporations paid in federal taxes, since 2008, combined."

Them: "What? That's not right. I pay my taxes! Too much, actually."

Me: "But I bet you don't hire a bunch of lobbyists to make sure Congress keeps writing in more loopholes like they do, right?"

Them: "Well, no. I don't have that kind of money."

Me: "So you pay more. Pass it on."

Regardless of political persuasion, there isn't one person I've met who isn't infuriated by the fact that they pay more in federal taxes than a combined majority of most billion-dollar corporations. But what's even more infuriating is that under the Budget Control Act that was passed after our austerity- crazed Congress forced it into being during the Summer-long debt negotiations of 2011, budgets for numerous essential social programs will be cut to the bone this January, under the false guise that our country is too broke to pay the bills.

Starting on January 3rd, the first $110 billion cut of the mandated $1.5 trillion deemed appropriate by Congress will go into effect. $55 billion will be cut from the Pentagon, while budgets for non-defense programs will be cut across the board by another $55 billion--8 percent for "discretionary" programs and 7.2 percent for "non-discretionary" programs. Under a similar $38 billion budget cut passed in Summer of 2011 to avert a government shutdown, nearly $1 billion was cut from clean drinking water funds, along with almost $1 billion from FEMA assistance for disaster victims, and hundreds of millions of dollars for nuclear waste cleanup and low-income heating assistance for poor families who don't have enough to keep warm. The latest round of cuts coming in early 2013 will affect Medicare.

While our government is forcing poor people to go cold and older folks to go without health care, they're doing absolutely nothing about the estimated $70-100 billion we lose every year to corporate tax dodging overseas, due to loopholes that have been successfully written into the tax code by corporate lobbyists. There still isn't any legislation on the table that would do something about the $32 trillion that's estimated to be stashed by the 0.001% in overseas, tax-free bank accounts. That money, by the way, is actually more than the combined national debt of both the European Union and the United States.

But by simply passing Sen. Carl Levin's CUT (Cut Unjustified Tax) Loopholes Act, which would reap $13 billion in new tax revenue every year for a decade by simply closing some of the more egregious loopholes, these major corporations would actually have to pay above a 0% effective corporate tax rate. None of January's budget cuts would be necessary. If you asked most Americans if they'd rather see their grandparents afford their health care or see Bank of America keep a few billion more in profits, I bet most Americans would go with grandma and grandpa.

One reason the Quebec student movement was so successful was its use of a unifying symbol as a visual aid- the red felt square. Student protesters in Quebec, along with allies worldwide, all pinned a red felt square to their shirts, jackets, coats and hoodies to symbolize the fact that America's students were all "in the red," and carrying their debt around with them everywhere they went. While corporate tax and budgetary issues in America remain complicated issues, I believe a simple visual aid- the "I PAY MORE" dollar- will go a long way.

So write "I PAY MORE" in black marker on a $1 bill. Make sure no federal officials see you doing it, since the act could technically be construed as a federal crime of defacing currency. Safety pin the dollar to your jacket, and have as many conversations as you can with your bank tellers, store cashiers, classmates, coworkers, churchgoers, family and friends. After you tell them what it means, tell them to do the same thing.

I pay more. So do you. Either as a percentage of our income, as an effective federal tax rate, and even as a dollar amount compared to our corporate counterparts. Let's put an end to these cuts by illustrating how unjust it is to make us pay for the cunning tax practices of the 1% and their lobbyists on Capitol Hill with a pound of flesh taken from our own future.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

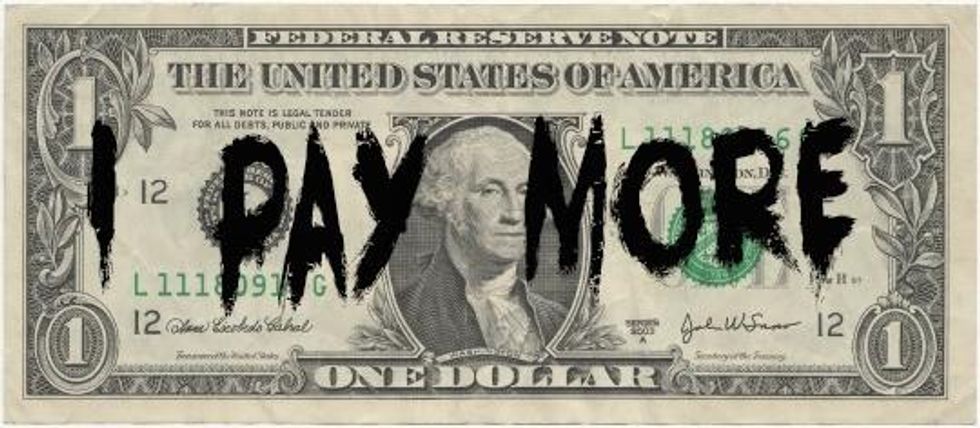

Them: "I pay more? What does that mean?"

Me: "This dollar bill right here is $1 more than General Electric, Bank of America, Wells Fargo, Citibank, and a bunch of other big corporations paid in federal taxes, since 2008, combined."

Them: "What? That's not right. I pay my taxes! Too much, actually."

Me: "But I bet you don't hire a bunch of lobbyists to make sure Congress keeps writing in more loopholes like they do, right?"

Them: "Well, no. I don't have that kind of money."

Me: "So you pay more. Pass it on."

Regardless of political persuasion, there isn't one person I've met who isn't infuriated by the fact that they pay more in federal taxes than a combined majority of most billion-dollar corporations. But what's even more infuriating is that under the Budget Control Act that was passed after our austerity- crazed Congress forced it into being during the Summer-long debt negotiations of 2011, budgets for numerous essential social programs will be cut to the bone this January, under the false guise that our country is too broke to pay the bills.

Starting on January 3rd, the first $110 billion cut of the mandated $1.5 trillion deemed appropriate by Congress will go into effect. $55 billion will be cut from the Pentagon, while budgets for non-defense programs will be cut across the board by another $55 billion--8 percent for "discretionary" programs and 7.2 percent for "non-discretionary" programs. Under a similar $38 billion budget cut passed in Summer of 2011 to avert a government shutdown, nearly $1 billion was cut from clean drinking water funds, along with almost $1 billion from FEMA assistance for disaster victims, and hundreds of millions of dollars for nuclear waste cleanup and low-income heating assistance for poor families who don't have enough to keep warm. The latest round of cuts coming in early 2013 will affect Medicare.

While our government is forcing poor people to go cold and older folks to go without health care, they're doing absolutely nothing about the estimated $70-100 billion we lose every year to corporate tax dodging overseas, due to loopholes that have been successfully written into the tax code by corporate lobbyists. There still isn't any legislation on the table that would do something about the $32 trillion that's estimated to be stashed by the 0.001% in overseas, tax-free bank accounts. That money, by the way, is actually more than the combined national debt of both the European Union and the United States.

But by simply passing Sen. Carl Levin's CUT (Cut Unjustified Tax) Loopholes Act, which would reap $13 billion in new tax revenue every year for a decade by simply closing some of the more egregious loopholes, these major corporations would actually have to pay above a 0% effective corporate tax rate. None of January's budget cuts would be necessary. If you asked most Americans if they'd rather see their grandparents afford their health care or see Bank of America keep a few billion more in profits, I bet most Americans would go with grandma and grandpa.

One reason the Quebec student movement was so successful was its use of a unifying symbol as a visual aid- the red felt square. Student protesters in Quebec, along with allies worldwide, all pinned a red felt square to their shirts, jackets, coats and hoodies to symbolize the fact that America's students were all "in the red," and carrying their debt around with them everywhere they went. While corporate tax and budgetary issues in America remain complicated issues, I believe a simple visual aid- the "I PAY MORE" dollar- will go a long way.

So write "I PAY MORE" in black marker on a $1 bill. Make sure no federal officials see you doing it, since the act could technically be construed as a federal crime of defacing currency. Safety pin the dollar to your jacket, and have as many conversations as you can with your bank tellers, store cashiers, classmates, coworkers, churchgoers, family and friends. After you tell them what it means, tell them to do the same thing.

I pay more. So do you. Either as a percentage of our income, as an effective federal tax rate, and even as a dollar amount compared to our corporate counterparts. Let's put an end to these cuts by illustrating how unjust it is to make us pay for the cunning tax practices of the 1% and their lobbyists on Capitol Hill with a pound of flesh taken from our own future.

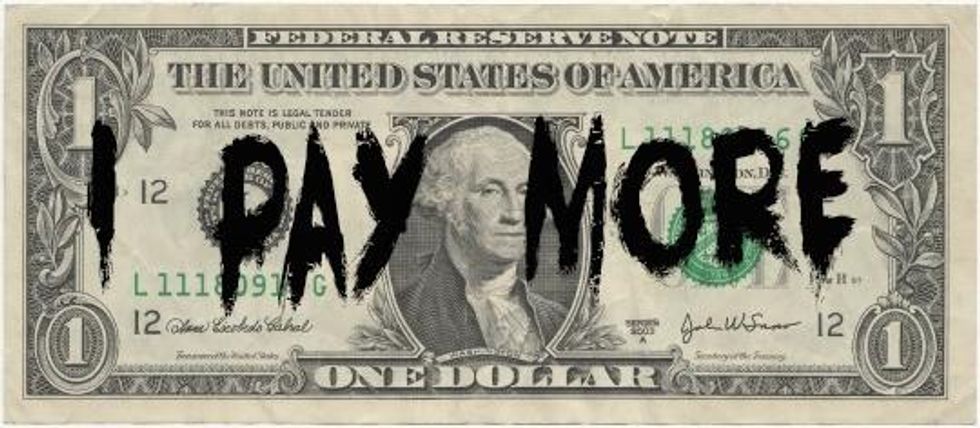

Them: "I pay more? What does that mean?"

Me: "This dollar bill right here is $1 more than General Electric, Bank of America, Wells Fargo, Citibank, and a bunch of other big corporations paid in federal taxes, since 2008, combined."

Them: "What? That's not right. I pay my taxes! Too much, actually."

Me: "But I bet you don't hire a bunch of lobbyists to make sure Congress keeps writing in more loopholes like they do, right?"

Them: "Well, no. I don't have that kind of money."

Me: "So you pay more. Pass it on."

Regardless of political persuasion, there isn't one person I've met who isn't infuriated by the fact that they pay more in federal taxes than a combined majority of most billion-dollar corporations. But what's even more infuriating is that under the Budget Control Act that was passed after our austerity- crazed Congress forced it into being during the Summer-long debt negotiations of 2011, budgets for numerous essential social programs will be cut to the bone this January, under the false guise that our country is too broke to pay the bills.

Starting on January 3rd, the first $110 billion cut of the mandated $1.5 trillion deemed appropriate by Congress will go into effect. $55 billion will be cut from the Pentagon, while budgets for non-defense programs will be cut across the board by another $55 billion--8 percent for "discretionary" programs and 7.2 percent for "non-discretionary" programs. Under a similar $38 billion budget cut passed in Summer of 2011 to avert a government shutdown, nearly $1 billion was cut from clean drinking water funds, along with almost $1 billion from FEMA assistance for disaster victims, and hundreds of millions of dollars for nuclear waste cleanup and low-income heating assistance for poor families who don't have enough to keep warm. The latest round of cuts coming in early 2013 will affect Medicare.

While our government is forcing poor people to go cold and older folks to go without health care, they're doing absolutely nothing about the estimated $70-100 billion we lose every year to corporate tax dodging overseas, due to loopholes that have been successfully written into the tax code by corporate lobbyists. There still isn't any legislation on the table that would do something about the $32 trillion that's estimated to be stashed by the 0.001% in overseas, tax-free bank accounts. That money, by the way, is actually more than the combined national debt of both the European Union and the United States.

But by simply passing Sen. Carl Levin's CUT (Cut Unjustified Tax) Loopholes Act, which would reap $13 billion in new tax revenue every year for a decade by simply closing some of the more egregious loopholes, these major corporations would actually have to pay above a 0% effective corporate tax rate. None of January's budget cuts would be necessary. If you asked most Americans if they'd rather see their grandparents afford their health care or see Bank of America keep a few billion more in profits, I bet most Americans would go with grandma and grandpa.

One reason the Quebec student movement was so successful was its use of a unifying symbol as a visual aid- the red felt square. Student protesters in Quebec, along with allies worldwide, all pinned a red felt square to their shirts, jackets, coats and hoodies to symbolize the fact that America's students were all "in the red," and carrying their debt around with them everywhere they went. While corporate tax and budgetary issues in America remain complicated issues, I believe a simple visual aid- the "I PAY MORE" dollar- will go a long way.

So write "I PAY MORE" in black marker on a $1 bill. Make sure no federal officials see you doing it, since the act could technically be construed as a federal crime of defacing currency. Safety pin the dollar to your jacket, and have as many conversations as you can with your bank tellers, store cashiers, classmates, coworkers, churchgoers, family and friends. After you tell them what it means, tell them to do the same thing.

I pay more. So do you. Either as a percentage of our income, as an effective federal tax rate, and even as a dollar amount compared to our corporate counterparts. Let's put an end to these cuts by illustrating how unjust it is to make us pay for the cunning tax practices of the 1% and their lobbyists on Capitol Hill with a pound of flesh taken from our own future.