In a reasonable world, in which we recognized the culpability of big-time D.C. politicians and bureaucrats who allowed Wall Street hyper-speculation to run wild and eventually cause the 2008-09 crash and Great Recession, Jacob Lew would be understood as a terrible choice as President Obama's second-term Treasury Secretary, replacing Timothy Geithner. The outstanding journalist Robert Sheer gives us the basic background in a recent Nation article. Sheer writes:

I suppose that he can't be much worse than Timothy Geithner, but that should be scant cause for cheer over the news that the president has nominated Jack Lew as Treasury secretary. Both championed the financial deregulation craze of the Clinton administration, and both are acolytes of Robert Rubin, the former Clinton Treasury secretary who unfettered Wall Street greed and then took his own considerable cut of the action.

But because we are not living in a reasonable world, at least in terms of D.C.-insider debates on economic policy, Lew's nomination apparently faces opposition from Republicans because he appears insufficiently committed to an austerity budget that could push the economy back into recession while also devastating spending for Social Security, education, health care, family support, and unemployment insurance.

It is clear that debate over the fiscal deficit and austerity will dominate Lew's confirmation hearings and at least his initial period in office, if he ends up getting confirmed. But without pursuing any deep explorations about who should be taxed more or less, or whether 47 percent of U.S. citizens are indeed freeloaders, I would just propose that Lew be willing to recognize three sets of very simple, irrefutable facts about the current U.S. fiscal condition. Here they are:

Fact #1: The U.S. government is not facing a fiscal crisis.

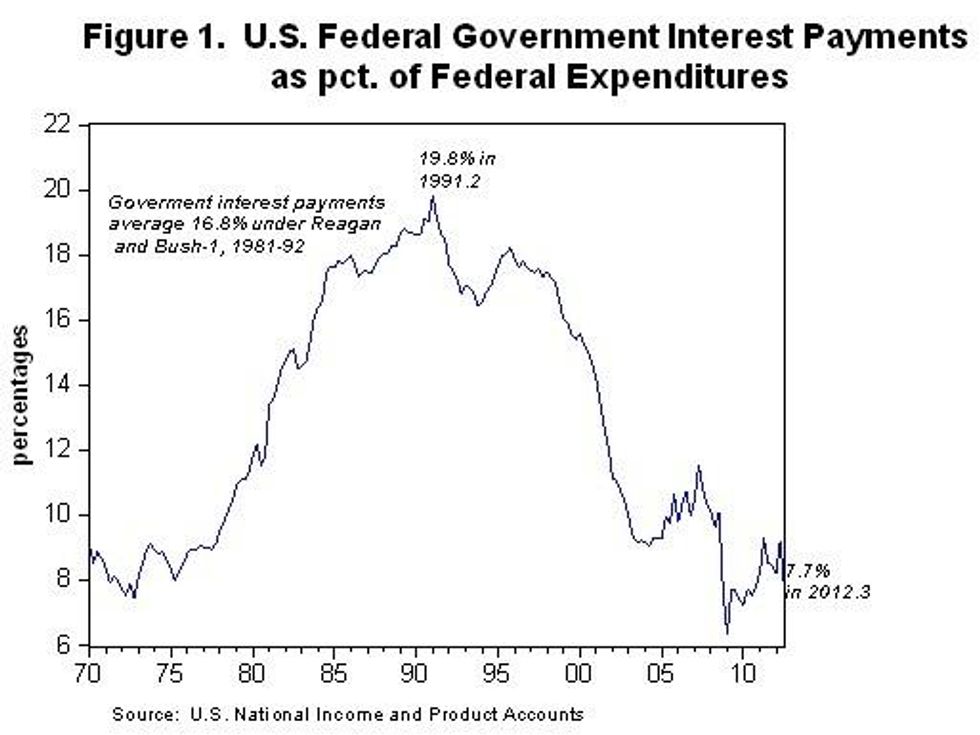

In any common sense meaning of the term "fiscal crisis," we would be referring to the government's inability to make its forthcoming payments to its creditors. By that common sense definition, the U.S. federal government is in just about the best shape it has ever been. Figure 1 below tells the story.

According to the most recent data from the third quarter of 2012 (which we term "2012.3"), the federal government spent 7.7 percent of its total expenditures on interest to its creditors. As the figure shows, that figure is less than half of the average figure under the full 12 years of Republican Presidents Reagan and Bush, when the government paid, on average, 16.8 percent of the total budget to cover interest payments. Right now, as we see, government interest payments are at near historic lows, not highs. As Treasury Secretary-designate, Lew needs to just state this obvious, and highly relevant point. To my knowledge, it has been heretofore completely left out of the insider-D.C. fiscal cliff debates, by Lew, Obama, and Geithner, to say nothing of the Republicans.

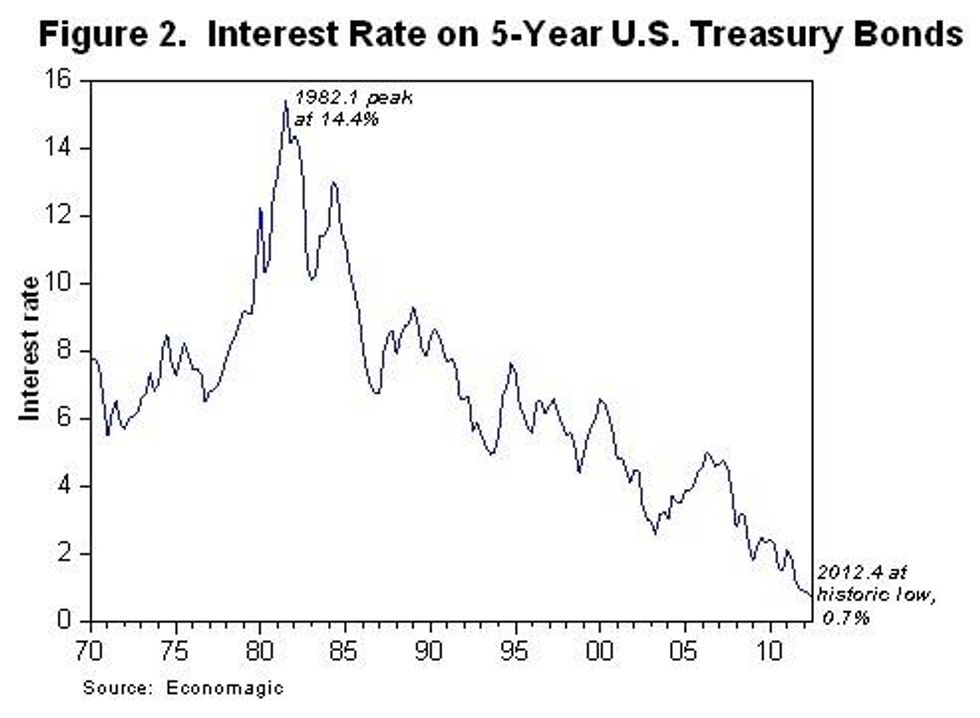

Fact #2: Interest rates on government bonds are at historic lows.

Figure 2 tells this story, which is well-known, but is not being given proper recognition in the deficit debates. As the figure shows, at the end of 2012, the U.S. government was borrowing at 0.7 percent on its 5-year Treasury Bonds.

It is precisely because the federal government can borrow so cheaply that our interest payments are corresponding low. Deficit hawks--economists and politicians alike--have been insisting for years that the rates are about to spike back up. Of course, interest rates will rise back up, at some point. We need to be vigilant about that. But this hasn't happened over the full four year period since the onset of the Great Recession. This enables the U.S. government to maintain stimulus levels of spending, to get the economy onto a healthy growth trajectory. In other words, we have no reason to submit to an austerity agenda now. We should expect Jacob Lew to at least state the obvious here: that the deficit hawks have been wrong about an impending interest rate spike for four years running.

Fact #3: Current large government deficits are due to the recession, not out-of-control spending.

This is so obvious it should be barely worth mentioning. But simple facts are ignored repeatedly in the fiscal deficit debates. No doubt during the Lew hearings, there will be more discussion about the current crisis being due to the 47 percent freeloading population who, as Mitt Romney put it after his defeat, "want stuff" from the government. As we see in Figure 3, the government's fiscal deficit spiked at 10.1 percent of GDP in 2009, immediately after the onset of the recession.

But does anybody want to seriously claim that the pattern of fiscal deficits that we see in Figure 3 is due to the fact that people didn't want too much stuff as of 2007 or 2008, then all of the sudden, that demand for stuff soared in 2009, which was just coincidentally exactly when the Wall Street crash brought the economy to its knees?

The deficit has fallen modestly since 2009, to 8.5 percent of GDP in 2012. But the single most important thing we can do to lower the fiscal deficit further is to push unemployment down. This will generate increased government revenues with people paying more in income and sales taxes, and it will reduce government payments on unemployment insurance and supplemental aid for health care and family support. The U.S. has the capacity to pursue a stimulus agenda now quite easily, precisely because interest rates and interest payments to creditors remain historically low.

It shouldn't be any stretch at all for Jacob Lew to acknowledge these three simple, irrefutable points. But will he do it? My guess is that he will not. If I am right in this guess, it will provide only further evidence as to the dismal state of the economic policy debate in official Washington, including Democrats like Lew here as well as Republicans.