SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

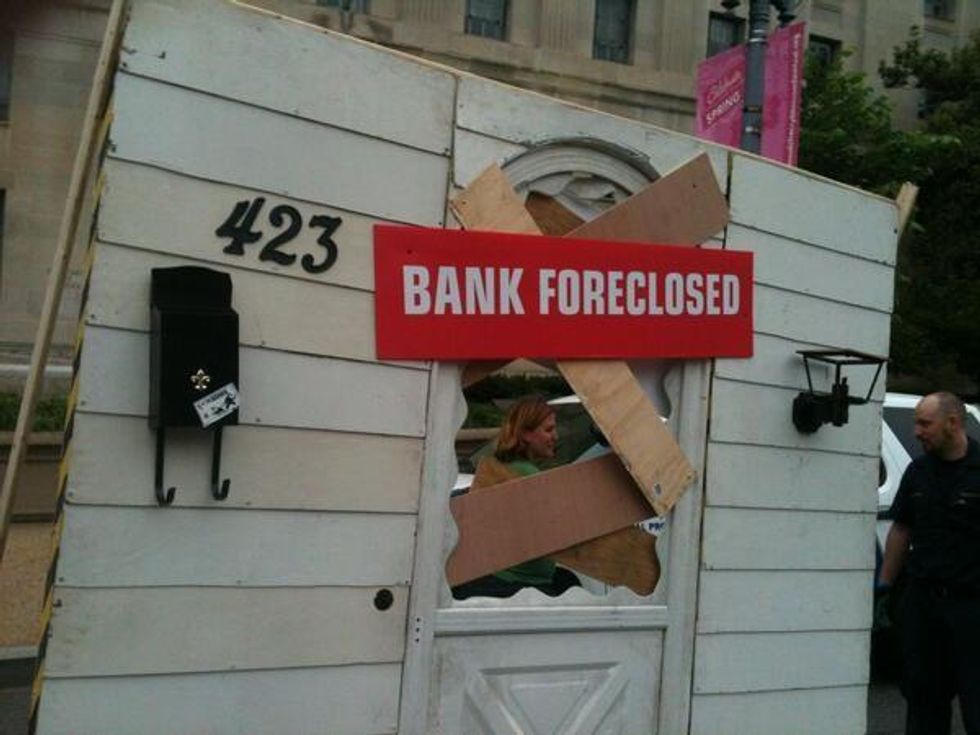

Homeowners and former homeowners rallied in front of the Department of Justice Monday to demand the Attorney General Eric Holder hold banks accountable for foreclosures. The groups are asking the Department of Justice to prosecute banks and to protect the 13 million homeowners who struggle today with underwater mortgages.

But these demands appear to be a long shot. The protest comes several months after Attorney General Eric Holder said that some banks may too big to prosecute.

"I am concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them," Holder said in March.

He recently clarified his comments during a congressional hearing. "Let me be very, very, very clear: banks are not too big to jail."

But actions may speak louder than these most recent words.

Prosecutions for financial fraud hit 20-year low after the financial collapse. Instead, state and federal regulators have punished banks responsible for the foreclosure crisis with several dozen settlements, but as we've learned in recent months, these agreements often left those who lost homes with nearly nothing. Three million of the four million foreclosure victims who got payments though the largest of these efforts received checks of less than $500, ProPublica reports. And the Washington Post reports that banks have paid out less than half of the $5.7 billion the institutions agreed to pay in over 30 settlements.

Black and Latino families have been hit the hardest by the foreclosure losses. As Colorlines.com's Imara Jones wrote last week about a new report released by The Alliance for a Just Society:

Despite recent headlines trumpeting a return of America's real estate market to its boom-time highs, a report released today by the Alliance for a Just Society shows how little of that has trickled into communities of color. The document, entitled "Wasted Wealth," is a sobering reminder of the gap between top-line economic cheerleading and the reality of what's happening on the ground.

As "Wasted Wealth" lays out, close to 2.5 million families lost homes in just three years. Communities that were majority people of color saw foreclosures take place at almost twice the rate as white communities, with an average loss of wealth 30 percent higher per household.

This foreclosure tidal wave is why wealth for blacks and Latinos is at the lowest level ever recorded. Housing is the leading wealth asset for these two communities.

Although the real estate market overall has regained $16 trillion in wealth lost during the recession, these gains are largely driven by a frenzy for high-end properties at the very top of the market. "Wasted Wealth" contrasts these highs with the fact that more than 13 million homes continue to remain at risk for foreclosure.

For more on the protesters demands, check out their May 13 letter to Eric Holder.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Homeowners and former homeowners rallied in front of the Department of Justice Monday to demand the Attorney General Eric Holder hold banks accountable for foreclosures. The groups are asking the Department of Justice to prosecute banks and to protect the 13 million homeowners who struggle today with underwater mortgages.

But these demands appear to be a long shot. The protest comes several months after Attorney General Eric Holder said that some banks may too big to prosecute.

"I am concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them," Holder said in March.

He recently clarified his comments during a congressional hearing. "Let me be very, very, very clear: banks are not too big to jail."

But actions may speak louder than these most recent words.

Prosecutions for financial fraud hit 20-year low after the financial collapse. Instead, state and federal regulators have punished banks responsible for the foreclosure crisis with several dozen settlements, but as we've learned in recent months, these agreements often left those who lost homes with nearly nothing. Three million of the four million foreclosure victims who got payments though the largest of these efforts received checks of less than $500, ProPublica reports. And the Washington Post reports that banks have paid out less than half of the $5.7 billion the institutions agreed to pay in over 30 settlements.

Black and Latino families have been hit the hardest by the foreclosure losses. As Colorlines.com's Imara Jones wrote last week about a new report released by The Alliance for a Just Society:

Despite recent headlines trumpeting a return of America's real estate market to its boom-time highs, a report released today by the Alliance for a Just Society shows how little of that has trickled into communities of color. The document, entitled "Wasted Wealth," is a sobering reminder of the gap between top-line economic cheerleading and the reality of what's happening on the ground.

As "Wasted Wealth" lays out, close to 2.5 million families lost homes in just three years. Communities that were majority people of color saw foreclosures take place at almost twice the rate as white communities, with an average loss of wealth 30 percent higher per household.

This foreclosure tidal wave is why wealth for blacks and Latinos is at the lowest level ever recorded. Housing is the leading wealth asset for these two communities.

Although the real estate market overall has regained $16 trillion in wealth lost during the recession, these gains are largely driven by a frenzy for high-end properties at the very top of the market. "Wasted Wealth" contrasts these highs with the fact that more than 13 million homes continue to remain at risk for foreclosure.

For more on the protesters demands, check out their May 13 letter to Eric Holder.

Homeowners and former homeowners rallied in front of the Department of Justice Monday to demand the Attorney General Eric Holder hold banks accountable for foreclosures. The groups are asking the Department of Justice to prosecute banks and to protect the 13 million homeowners who struggle today with underwater mortgages.

But these demands appear to be a long shot. The protest comes several months after Attorney General Eric Holder said that some banks may too big to prosecute.

"I am concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them," Holder said in March.

He recently clarified his comments during a congressional hearing. "Let me be very, very, very clear: banks are not too big to jail."

But actions may speak louder than these most recent words.

Prosecutions for financial fraud hit 20-year low after the financial collapse. Instead, state and federal regulators have punished banks responsible for the foreclosure crisis with several dozen settlements, but as we've learned in recent months, these agreements often left those who lost homes with nearly nothing. Three million of the four million foreclosure victims who got payments though the largest of these efforts received checks of less than $500, ProPublica reports. And the Washington Post reports that banks have paid out less than half of the $5.7 billion the institutions agreed to pay in over 30 settlements.

Black and Latino families have been hit the hardest by the foreclosure losses. As Colorlines.com's Imara Jones wrote last week about a new report released by The Alliance for a Just Society:

Despite recent headlines trumpeting a return of America's real estate market to its boom-time highs, a report released today by the Alliance for a Just Society shows how little of that has trickled into communities of color. The document, entitled "Wasted Wealth," is a sobering reminder of the gap between top-line economic cheerleading and the reality of what's happening on the ground.

As "Wasted Wealth" lays out, close to 2.5 million families lost homes in just three years. Communities that were majority people of color saw foreclosures take place at almost twice the rate as white communities, with an average loss of wealth 30 percent higher per household.

This foreclosure tidal wave is why wealth for blacks and Latinos is at the lowest level ever recorded. Housing is the leading wealth asset for these two communities.

Although the real estate market overall has regained $16 trillion in wealth lost during the recession, these gains are largely driven by a frenzy for high-end properties at the very top of the market. "Wasted Wealth" contrasts these highs with the fact that more than 13 million homes continue to remain at risk for foreclosure.

For more on the protesters demands, check out their May 13 letter to Eric Holder.