SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Today President Obama is joining college students at a White House event launching a new push to keep student loan rates from doubling in July. Among the various plans offered, Sen. Elizabeth Warren's plan is the most affordable for students, while the Republican plan tries to "make money" off of students using fluctuating "market rates."

Today President Obama is joining college students at a White House event launching a new push to keep student loan rates from doubling in July. Among the various plans offered, Sen. Elizabeth Warren's plan is the most affordable for students, while the Republican plan tries to "make money" off of students using fluctuating "market rates."

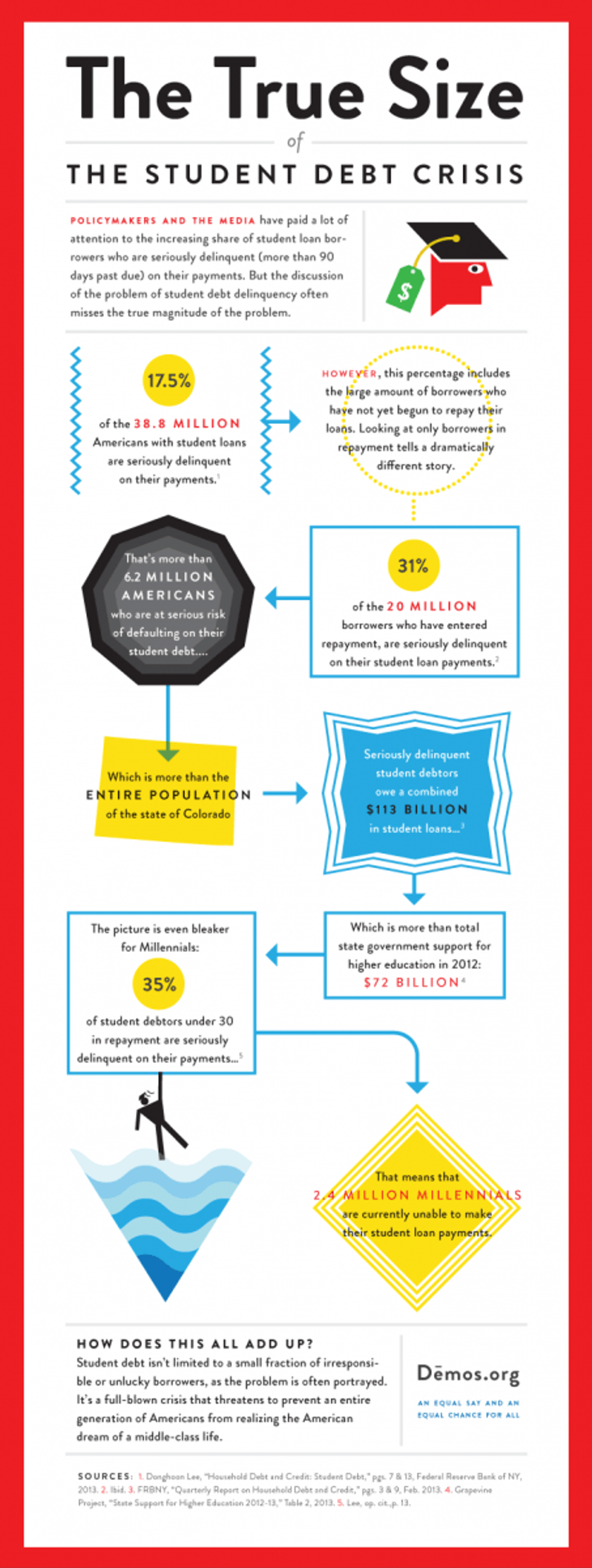

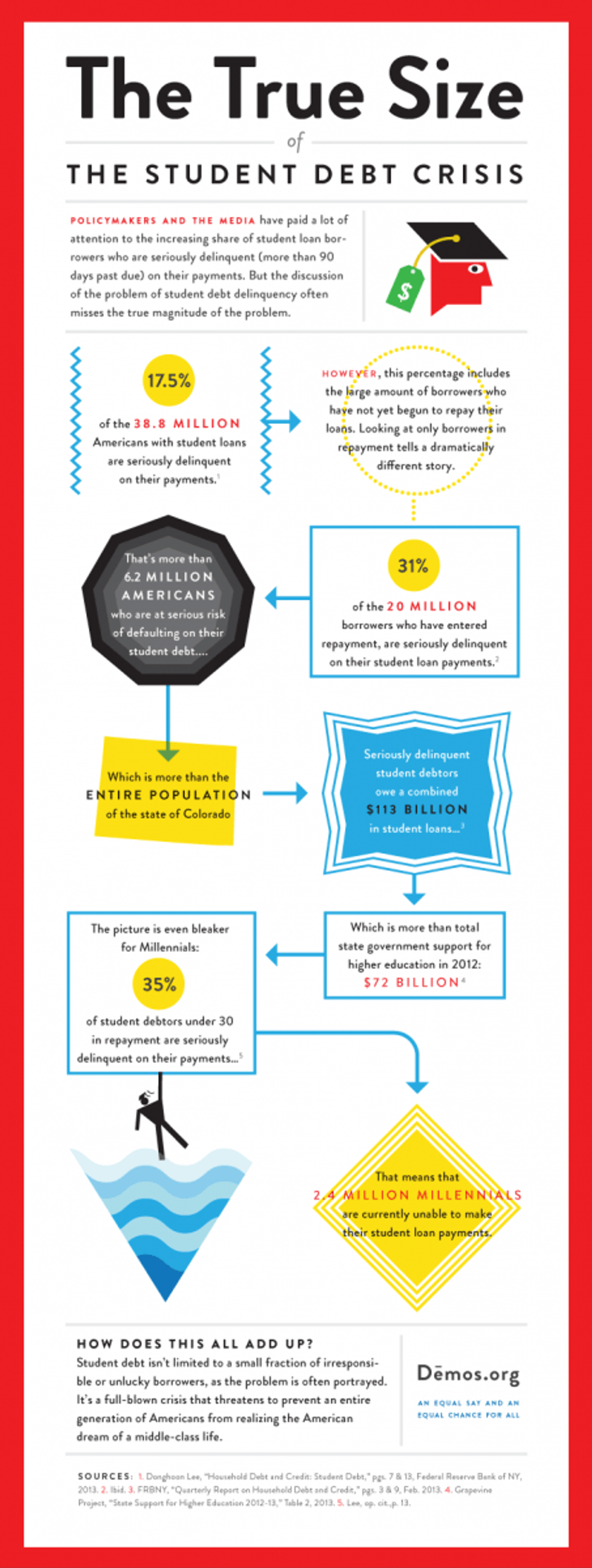

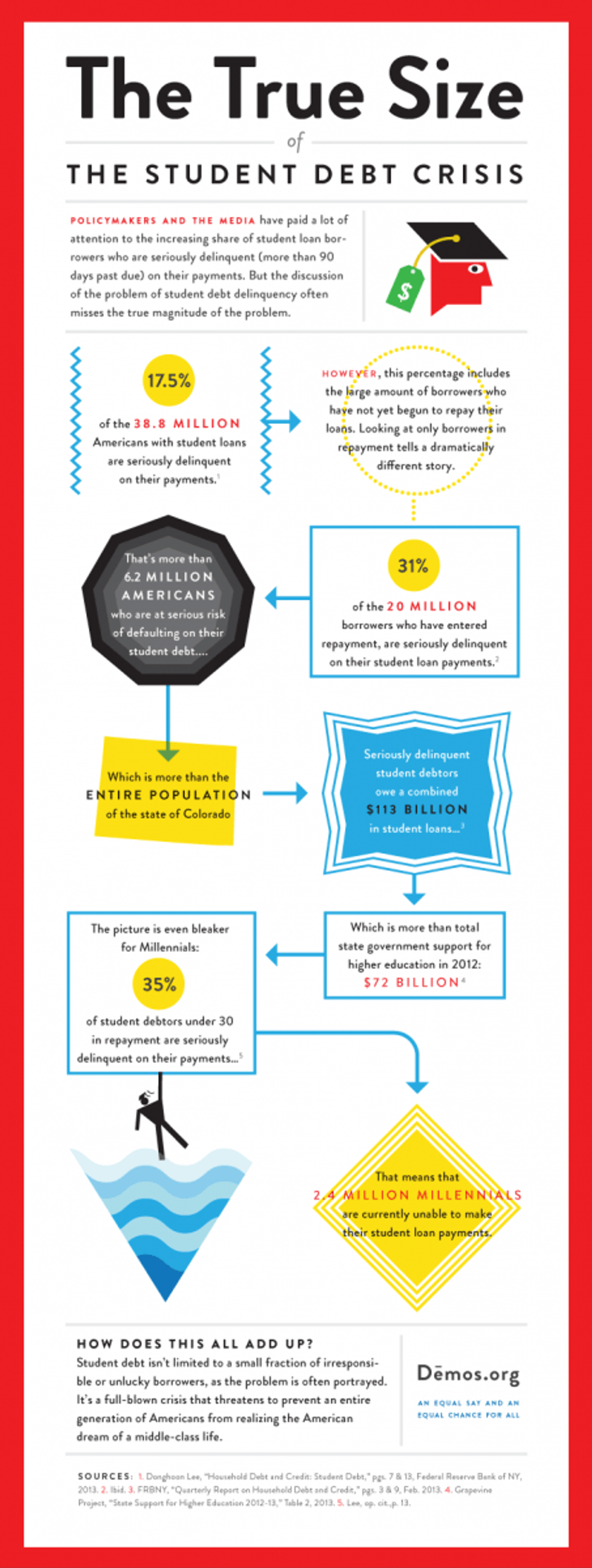

Student Loan Rates Set To Double

Student loan rates for more than 7.4 million students with federal "Stafford loans" are scheduled to double July 1 from 3.4 percent to 6.8 percent if nothing is done. The amount of student loan debt is massive. U.S. students currently owe almost $1.1 trillion in student loan debt, and this amount is increasing at a rate of about $2,853.88 per second. This amount is greater than total credit card debt currently owed. Thirty-five percent of people under 30 are near default on their student loans, and approximately 32 percent of those are between the ages of 30 and 49.

In 2005 average student loan debt was just over $17,000. By 2012 it was above $27,250. This was a 58 percent increase in just seven years. This debt creates a drag on the U.S. economy - home ownership and car ownership have declined for young households.

This infographic shows the extent of the problem:

There are various plans before the Congress to avoid the July 1 rate-doubling. But Republicans are holding this hostage with their bill that makes a college education much more expensive. It is going right down to the July 1 wire, and students don't know what their rates will be.

Republican Plan And Obama Plan

House Republicans passed the "Smarter Solutions for Students Act," that lets loan rates fluctuate yearly, pegged to the 10-year rate plus 2.5 percent, but capping the rate at 8.5 percent (loans for parents and graduate students would have a 10.5 percent cap). This means that rates even on existing loans will go up as rates climb, likely all the way to the 8.5 percent cap as the economy recovers. This is more than if the Congress does nothing and just lets rates double July 1. The Congressional Budget Office (CBO) projects rates would rise to 7.7 percent in 2023, which is more than double the current rate. Many are calling the Republican plan the "Bill to Make College More Expensive."

Republicans say students should pay "market rates," regardless of what people need or how much it does for the country and economy to have a better-educated population. Republicans want rates high because the government makes a profit off of the student loans, reducing the need to ask the wealthy and corporations to pay higher tax rates. Shahien Nasiripour points out at The Huffington Post that the Education Department is forecast to generate a $51 billion profit this year from lending to college students and their families - more than Exxon Mobil's 2012 profits. So cutting these payments will "grow the deficit."

President Obama has offered a similar plan that sets a fixed (once a student has the loan, the rate doesn't change) rate to the 10-year Treasury note plus 0.9 percent, with no interest rate cap. However, repayment obligations are restricted to 10 percent of income. The President's plan is focused on being "budget neutral."

The Warren Plan

Sen. Elizabeth Warren, D-Mass., has introduced The Bank on Students Loan Fairness Act that lets students borrow money at a rate of 0.75 percent - matching the rate that the Federal Reserve lets banks borrow at. The Warren plan is backed by a number of organizations and members of Congress. (See a fact sheet of the bill and the bill text.)

Watch as Sen. Warren introduces and explains the Bank on Students Loan Fairness Act:

Economist Joseph Stiglitz endorsed the Warren bill:

College graduation has become a big factor in whether students succeed later in life, Stiglitz says. "The life chances of a young American are more dependent on the income and education of their parents than in other industrial countries."

Most other industrialized nations make paying for college easier, Stiglitz says. For example, Australia's loan program caps payments as a percentage of income, essentially enabling most people to pay for college without going bankrupt. Many European countries directly subsidize college, although those subsidies have fallen due to the financial crisis.

Other Plans

Senators Jack Reed, D-R.I., and Tom Harkin, D-Iowa, have introduced the Reed-Harkin Student Loan Affordability Act of 2013 (S. 953) which keeps the current 3.4 percent rate in place for two more years. The bill "pays for" this by closing corporate tax loopholes.

Sen. Kirsten Gillibrand, D-N.Y., has a bill, the Federal Student Loan Refinancing Act, to allow students to renegotiate into fixed, 4-percent loans. Approximately 90 percent of federal (not private) student loans - 37 million borrowers - would be affected by the Gillibrand bill.

In "Proposals to Bring Student-Loan Interest Rates Under Control," the Center for American Progress compares different plans to address the student loan rate problem.

Support The Warren Plan To Give Students The Same Break Banks Get

Click here to Give Students The Same Break Banks Get:

Sen. Elizabeth Warren has a great, simple idea, and she's made it her first bill. Give students the same loan rates that the big banks get:

"Right now, a big bank can get a loan through the Federal Reserve discount window at a rate of about 0.75%. But this summer a student who is trying to get a loan to go to college will pay almost 7%. In other words, the federal government is going to charge students interest rates that are nine times higher than the rates for the biggest banks-the same banks that destroyed millions of jobs and nearly broke this economy. That isn't right."

What's Wrong With Free?

We are stuck arguing about how much of a crushing debt burden students take on to get educated because ideology dictates what we provide "market solutions" (aka "make bankers richer(er)") instead of just being able to go to college if that's the right path for them. We the People should just provide an education that makes people's lives better and helps both the country and our larger economy at the same time. Is our government supposed to be about making our lives better, or making bankers richer?

P.S.: Here Is What Speaker Boehner's Spokesperson Said

House Speaker Boehner's spokesperson responded to the new student loan initiative saying that Obama's efforts to continue governing the country is a "cynical event" and a "PR stunt" that is intended "to change the subject from its growing list of scandals."

Political revenge. Mass deportations. Project 2025. Unfathomable corruption. Attacks on Social Security, Medicare, and Medicaid. Pardons for insurrectionists. An all-out assault on democracy. Republicans in Congress are scrambling to give Trump broad new powers to strip the tax-exempt status of any nonprofit he doesn’t like by declaring it a “terrorist-supporting organization.” Trump has already begun filing lawsuits against news outlets that criticize him. At Common Dreams, we won’t back down, but we must get ready for whatever Trump and his thugs throw at us. Our Year-End campaign is our most important fundraiser of the year. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. By donating today, please help us fight the dangers of a second Trump presidency. |

Today President Obama is joining college students at a White House event launching a new push to keep student loan rates from doubling in July. Among the various plans offered, Sen. Elizabeth Warren's plan is the most affordable for students, while the Republican plan tries to "make money" off of students using fluctuating "market rates."

Student Loan Rates Set To Double

Student loan rates for more than 7.4 million students with federal "Stafford loans" are scheduled to double July 1 from 3.4 percent to 6.8 percent if nothing is done. The amount of student loan debt is massive. U.S. students currently owe almost $1.1 trillion in student loan debt, and this amount is increasing at a rate of about $2,853.88 per second. This amount is greater than total credit card debt currently owed. Thirty-five percent of people under 30 are near default on their student loans, and approximately 32 percent of those are between the ages of 30 and 49.

In 2005 average student loan debt was just over $17,000. By 2012 it was above $27,250. This was a 58 percent increase in just seven years. This debt creates a drag on the U.S. economy - home ownership and car ownership have declined for young households.

This infographic shows the extent of the problem:

There are various plans before the Congress to avoid the July 1 rate-doubling. But Republicans are holding this hostage with their bill that makes a college education much more expensive. It is going right down to the July 1 wire, and students don't know what their rates will be.

Republican Plan And Obama Plan

House Republicans passed the "Smarter Solutions for Students Act," that lets loan rates fluctuate yearly, pegged to the 10-year rate plus 2.5 percent, but capping the rate at 8.5 percent (loans for parents and graduate students would have a 10.5 percent cap). This means that rates even on existing loans will go up as rates climb, likely all the way to the 8.5 percent cap as the economy recovers. This is more than if the Congress does nothing and just lets rates double July 1. The Congressional Budget Office (CBO) projects rates would rise to 7.7 percent in 2023, which is more than double the current rate. Many are calling the Republican plan the "Bill to Make College More Expensive."

Republicans say students should pay "market rates," regardless of what people need or how much it does for the country and economy to have a better-educated population. Republicans want rates high because the government makes a profit off of the student loans, reducing the need to ask the wealthy and corporations to pay higher tax rates. Shahien Nasiripour points out at The Huffington Post that the Education Department is forecast to generate a $51 billion profit this year from lending to college students and their families - more than Exxon Mobil's 2012 profits. So cutting these payments will "grow the deficit."

President Obama has offered a similar plan that sets a fixed (once a student has the loan, the rate doesn't change) rate to the 10-year Treasury note plus 0.9 percent, with no interest rate cap. However, repayment obligations are restricted to 10 percent of income. The President's plan is focused on being "budget neutral."

The Warren Plan

Sen. Elizabeth Warren, D-Mass., has introduced The Bank on Students Loan Fairness Act that lets students borrow money at a rate of 0.75 percent - matching the rate that the Federal Reserve lets banks borrow at. The Warren plan is backed by a number of organizations and members of Congress. (See a fact sheet of the bill and the bill text.)

Watch as Sen. Warren introduces and explains the Bank on Students Loan Fairness Act:

Economist Joseph Stiglitz endorsed the Warren bill:

College graduation has become a big factor in whether students succeed later in life, Stiglitz says. "The life chances of a young American are more dependent on the income and education of their parents than in other industrial countries."

Most other industrialized nations make paying for college easier, Stiglitz says. For example, Australia's loan program caps payments as a percentage of income, essentially enabling most people to pay for college without going bankrupt. Many European countries directly subsidize college, although those subsidies have fallen due to the financial crisis.

Other Plans

Senators Jack Reed, D-R.I., and Tom Harkin, D-Iowa, have introduced the Reed-Harkin Student Loan Affordability Act of 2013 (S. 953) which keeps the current 3.4 percent rate in place for two more years. The bill "pays for" this by closing corporate tax loopholes.

Sen. Kirsten Gillibrand, D-N.Y., has a bill, the Federal Student Loan Refinancing Act, to allow students to renegotiate into fixed, 4-percent loans. Approximately 90 percent of federal (not private) student loans - 37 million borrowers - would be affected by the Gillibrand bill.

In "Proposals to Bring Student-Loan Interest Rates Under Control," the Center for American Progress compares different plans to address the student loan rate problem.

Support The Warren Plan To Give Students The Same Break Banks Get

Click here to Give Students The Same Break Banks Get:

Sen. Elizabeth Warren has a great, simple idea, and she's made it her first bill. Give students the same loan rates that the big banks get:

"Right now, a big bank can get a loan through the Federal Reserve discount window at a rate of about 0.75%. But this summer a student who is trying to get a loan to go to college will pay almost 7%. In other words, the federal government is going to charge students interest rates that are nine times higher than the rates for the biggest banks-the same banks that destroyed millions of jobs and nearly broke this economy. That isn't right."

What's Wrong With Free?

We are stuck arguing about how much of a crushing debt burden students take on to get educated because ideology dictates what we provide "market solutions" (aka "make bankers richer(er)") instead of just being able to go to college if that's the right path for them. We the People should just provide an education that makes people's lives better and helps both the country and our larger economy at the same time. Is our government supposed to be about making our lives better, or making bankers richer?

P.S.: Here Is What Speaker Boehner's Spokesperson Said

House Speaker Boehner's spokesperson responded to the new student loan initiative saying that Obama's efforts to continue governing the country is a "cynical event" and a "PR stunt" that is intended "to change the subject from its growing list of scandals."

Today President Obama is joining college students at a White House event launching a new push to keep student loan rates from doubling in July. Among the various plans offered, Sen. Elizabeth Warren's plan is the most affordable for students, while the Republican plan tries to "make money" off of students using fluctuating "market rates."

Student Loan Rates Set To Double

Student loan rates for more than 7.4 million students with federal "Stafford loans" are scheduled to double July 1 from 3.4 percent to 6.8 percent if nothing is done. The amount of student loan debt is massive. U.S. students currently owe almost $1.1 trillion in student loan debt, and this amount is increasing at a rate of about $2,853.88 per second. This amount is greater than total credit card debt currently owed. Thirty-five percent of people under 30 are near default on their student loans, and approximately 32 percent of those are between the ages of 30 and 49.

In 2005 average student loan debt was just over $17,000. By 2012 it was above $27,250. This was a 58 percent increase in just seven years. This debt creates a drag on the U.S. economy - home ownership and car ownership have declined for young households.

This infographic shows the extent of the problem:

There are various plans before the Congress to avoid the July 1 rate-doubling. But Republicans are holding this hostage with their bill that makes a college education much more expensive. It is going right down to the July 1 wire, and students don't know what their rates will be.

Republican Plan And Obama Plan

House Republicans passed the "Smarter Solutions for Students Act," that lets loan rates fluctuate yearly, pegged to the 10-year rate plus 2.5 percent, but capping the rate at 8.5 percent (loans for parents and graduate students would have a 10.5 percent cap). This means that rates even on existing loans will go up as rates climb, likely all the way to the 8.5 percent cap as the economy recovers. This is more than if the Congress does nothing and just lets rates double July 1. The Congressional Budget Office (CBO) projects rates would rise to 7.7 percent in 2023, which is more than double the current rate. Many are calling the Republican plan the "Bill to Make College More Expensive."

Republicans say students should pay "market rates," regardless of what people need or how much it does for the country and economy to have a better-educated population. Republicans want rates high because the government makes a profit off of the student loans, reducing the need to ask the wealthy and corporations to pay higher tax rates. Shahien Nasiripour points out at The Huffington Post that the Education Department is forecast to generate a $51 billion profit this year from lending to college students and their families - more than Exxon Mobil's 2012 profits. So cutting these payments will "grow the deficit."

President Obama has offered a similar plan that sets a fixed (once a student has the loan, the rate doesn't change) rate to the 10-year Treasury note plus 0.9 percent, with no interest rate cap. However, repayment obligations are restricted to 10 percent of income. The President's plan is focused on being "budget neutral."

The Warren Plan

Sen. Elizabeth Warren, D-Mass., has introduced The Bank on Students Loan Fairness Act that lets students borrow money at a rate of 0.75 percent - matching the rate that the Federal Reserve lets banks borrow at. The Warren plan is backed by a number of organizations and members of Congress. (See a fact sheet of the bill and the bill text.)

Watch as Sen. Warren introduces and explains the Bank on Students Loan Fairness Act:

Economist Joseph Stiglitz endorsed the Warren bill:

College graduation has become a big factor in whether students succeed later in life, Stiglitz says. "The life chances of a young American are more dependent on the income and education of their parents than in other industrial countries."

Most other industrialized nations make paying for college easier, Stiglitz says. For example, Australia's loan program caps payments as a percentage of income, essentially enabling most people to pay for college without going bankrupt. Many European countries directly subsidize college, although those subsidies have fallen due to the financial crisis.

Other Plans

Senators Jack Reed, D-R.I., and Tom Harkin, D-Iowa, have introduced the Reed-Harkin Student Loan Affordability Act of 2013 (S. 953) which keeps the current 3.4 percent rate in place for two more years. The bill "pays for" this by closing corporate tax loopholes.

Sen. Kirsten Gillibrand, D-N.Y., has a bill, the Federal Student Loan Refinancing Act, to allow students to renegotiate into fixed, 4-percent loans. Approximately 90 percent of federal (not private) student loans - 37 million borrowers - would be affected by the Gillibrand bill.

In "Proposals to Bring Student-Loan Interest Rates Under Control," the Center for American Progress compares different plans to address the student loan rate problem.

Support The Warren Plan To Give Students The Same Break Banks Get

Click here to Give Students The Same Break Banks Get:

Sen. Elizabeth Warren has a great, simple idea, and she's made it her first bill. Give students the same loan rates that the big banks get:

"Right now, a big bank can get a loan through the Federal Reserve discount window at a rate of about 0.75%. But this summer a student who is trying to get a loan to go to college will pay almost 7%. In other words, the federal government is going to charge students interest rates that are nine times higher than the rates for the biggest banks-the same banks that destroyed millions of jobs and nearly broke this economy. That isn't right."

What's Wrong With Free?

We are stuck arguing about how much of a crushing debt burden students take on to get educated because ideology dictates what we provide "market solutions" (aka "make bankers richer(er)") instead of just being able to go to college if that's the right path for them. We the People should just provide an education that makes people's lives better and helps both the country and our larger economy at the same time. Is our government supposed to be about making our lives better, or making bankers richer?

P.S.: Here Is What Speaker Boehner's Spokesperson Said

House Speaker Boehner's spokesperson responded to the new student loan initiative saying that Obama's efforts to continue governing the country is a "cynical event" and a "PR stunt" that is intended "to change the subject from its growing list of scandals."