We hear a lot about corporations avoiding federal taxes. Less well known is their non-payment of state taxes, which along with local taxes make up 90% of U.S. education funding.

Pay Up Now just completed a

review of 2011-12 tax data from the

SEC filings of 155 of the largest U.S. corporations. The results show that the total cost of K-12 educational cutbacks in recent years is approximately equal to the amount of state taxes left unpaid by these companies.

Corporations Neglect Their State Tax Responsibilities

For 2011 and 2012, the 155 companies paid just 1.8 percent of their total income in state taxes, and 3.6 percent of their declared U.S. income. The average required rate for the 50 states is 6.56 percent.

Similar results were found in a Citizens for Tax Justice (CTJ) report on 2008-10 state taxes. In their evaluation of 265 large companies, CTJ determined that an average of 3% was paid in state taxes, less than half the average state tax rate. The results are summarized at Pay Up Now.

How much money is this? The 2011-12 underpayment, for just 155 top-earning companies, is about $14 billion per year. In the 2008-10 study, CTJ noted that "these 265 companies avoided a total of $42.7 billion in state corporate income taxes over the three years." That's also about $14 billion per year.

Unpaid State Taxes Are More Than ALL the K-12 Cuts

A comparison of the above results with educational cutbacks shows the devastating impact of tax avoidance on our children. A Center on Budget and Policy Priorities (CBPP) report revealed that total K-12 education cuts for fiscal 2012 were about $12.7 billion. A separate analysis of CBPP data shows total 2008-12 cutbacks of about $20 billion. According to the Census Bureau, K-12 funding rose about 5% a year from 1998 to 2008, after which it leveled off and began to decline.

More stunningly, higher education experienced a nearly $17 billion state appropriations cut in 2012-13, in comparison to 2007-8. Much of the shortfall was made up by tuition increases. As noted by the CBPP, "The entire increase in tuition at public colleges and universities over the last 25 years has gone to make up for declining state and local revenue." Tuition has risen almost 600% over those 25 years.

Games Corporations Play to Take Our State Funds

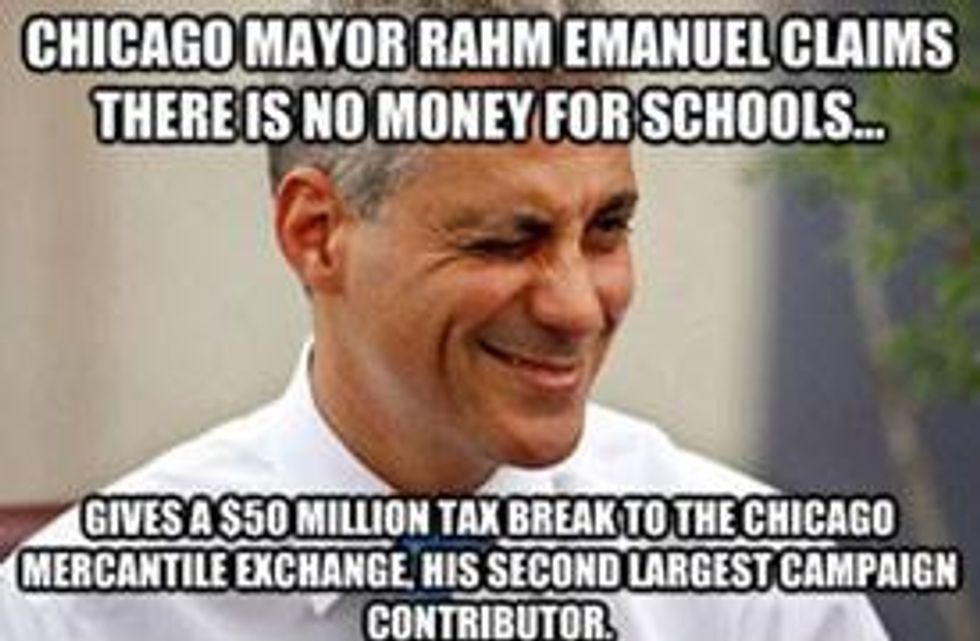

Maddening as this is, a look at behind-the-scenes corporate subterfuge makes it even worse. A Good Jobs First report describes how companies play one state against another, holding their home states hostage for tax breaks under the threat of bolting to other states, with the whole process masked in inspirational language: "business recruitment" and "retention incentives" instead of the more accurate description of transferring jobs to the state that offers the most generous subsidies. The report notes that "This is a net loss game, with footloose companies shrinking the tax base necessary for the education and infrastructure investments that benefit all employers."

Good Jobs First also reported on the personal income tax (PIT) subsidy, through which employers simply take the state tax paid by their workers. States are pressured into such agreements to keep corporations from moving out. Employees, as a result, are effectively "paying taxes to their boss."

The Impact on All of Us

The end result of this hostage-taking is a breakdown in public services, most notably in education. Schools are deemed to be "not working," and a frantic rush toward privatization leads to even more tax cuts for the business interests charged with the responsibility of "fixing" the broken system. But rarely are we informed that it's our self-serving business and political leaders who broke the system.