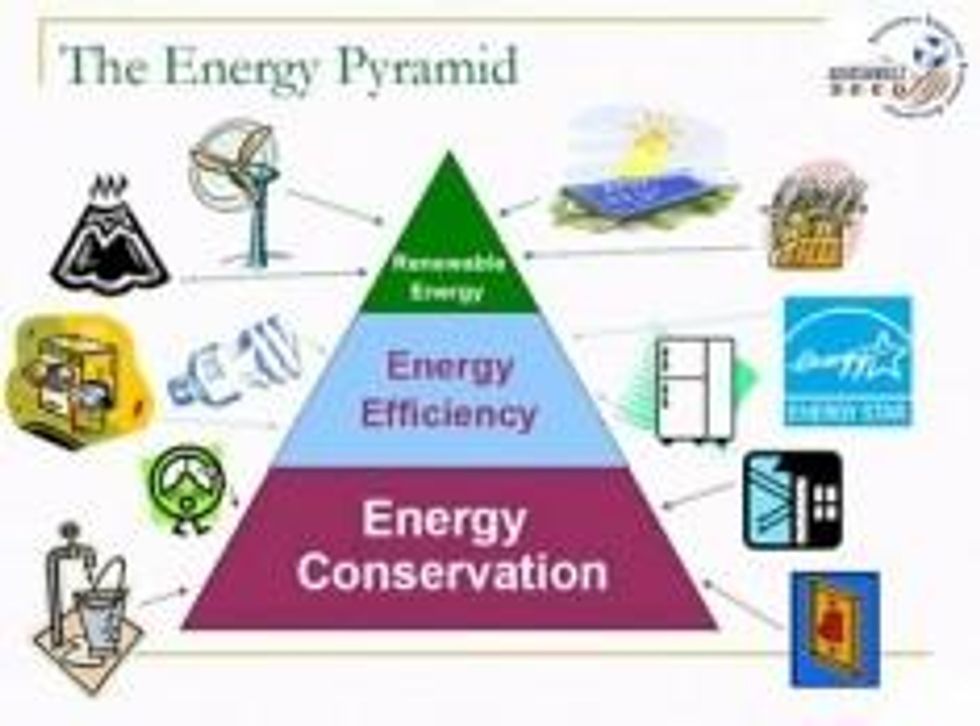

Decentralized renewable energy projects are highly effective at reducing energy poverty. Energy conservation and efficiency improvements are the cheapest way to close the gap between energy demand and supply. Too bad such measures don't fit the business model of the World Bank, the world's most important energy financier.

Under a project supported by the World Bank and the Swedish government, the Vietnamese electricity utility in recent years sold one million efficient CFL light bulbs and installed thousands of electricity meters. The

project was an "extremely cost effective" part of an energy conservation and efficiency program that reduced the country's electricity demand by 700 megawatts.

The International Energy Agency has estimated that developing countries could save three dollars in investment for power plants for every dollar they invest in efficiency improvements. According to the Agency, such investments "stand out as the cheapest and fastest way to curb demand and emissions growth in the near term".

The

World Bank's experience with energy efficiency projects confirms this assessment. On average, such projects are considerably more economic than new power stations. Unlike power plants, they don't degrade the environment and displace local communities. In spite of such benefits, energy efficiency improvements receive short shrift at the World Bank: From 1991 to 2007, the Bank devoted only about 5 percent of its total energy finance to such projects.

In 2010, the World Bank approved $3.75 billion dollars for the giant Medupi coal power plant in South Africa, even though

energy conservation and efficiency programs would have been cheaper. The Bank currently considers support for a polluting lignite coal power plant in Kosovo and two large hydropower plants on the Zambezi, even though

energy efficiency measures have again been shown to be cheaper.

What's the problem? Comparing the energy efficiency program in Vietnam with the Gilgel Gibe I Dam in Ethiopia may help to explain. Per dollar of cost, the efficiency program

saves about three times as much electricity as the dam generates - and without displacing any people. Yet per dollar of loan disbursement, the administrative overhead of the complex efficiency program is about ten times bigger. In terms of development impact, the efficiency program scores higher. In terms of institutional self-interest, it loses out.

A

World Bank evaluation found in 2009 that "internal Bank incentives work against [efficiency] projects because they are often small in scale, demanding of staff time and preparation funds, and may require persistent client engagement over a period of years". "This", the report concluded, "makes them less attractive to managers and agencies that use disbursement as a measure of action and large turbines as a visible symbol of achievement".

The World Bank's business model has harmed project quality for decades. In 1992 the internal Wapenhans report found that a pervasive "pressure to lend" undermined project assessment. Five years later, the Bank's Quality Assurance Group castigated the institution's "pressure to lend", and pointed to the "fear that a realistic, and thus more modest, project would be dismissed as too small and inadequate in its impact". The World Bank's central problem is "a culture of loan approval, institutionalized in various perverse internal incentives", argues Bruce Rich in his forthcoming book,

Foreclosing the Future, about the Bank's environmental track record.

For the past 20 years, World Bank Presidents have promised to fix the institution's perverse incentives, and to increase support for energy efficiency projects. On July 16, the Bank management once again assured its Board of Directors it would address the issue through a new working group. This is window dressing. The energy directions paper which the Bank published on the same day limits lending for coal power plants, but continues to focus on large gas and hydropower projects. An

earlier draft of the paper explains that "the high ratio of preparation and supervision costs to total project size is a considerable disincentive" for Bank managers to undertake effective but complex solar, micro-hydropower or energy efficiency projects.

The member countries which fund the World Bank have so far been complacent in accepting a situation which suits the export interests of their equipment suppliers. If they are serious about promoting least-cost solutions to the world's energy and climate crisis, they need to redirect their funds towards institutions that are better equipped to support renewable energy, energy conservation and efficiency improvements.

Decentralized renewable energy projects are highly effective at reducing energy poverty. Energy conservation and efficiency improvements are the cheapest way to close the gap between energy demand and supply. Too bad such measures don't fit the business model of the World Bank, the world's most important energy financier.

Decentralized renewable energy projects are highly effective at reducing energy poverty. Energy conservation and efficiency improvements are the cheapest way to close the gap between energy demand and supply. Too bad such measures don't fit the business model of the World Bank, the world's most important energy financier.