"Save Social Security" (Photo: John S. Quarterman)

To donate by check, phone, or other method, see our More Ways to Give page.

"Save Social Security" (Photo: John S. Quarterman)

Today is Social Security's 79th birthday, a good time to celebrate the nation's most effective anti-poverty program, which, especially after the housing crash and Great Recession, is crucial to the retirement security of middle- and working-class Americans.

But in about 20 years, Social Security will likely be able to pay only about 3/4 of promised benefits to retirees (if nothing's done to change the program). One way to make sure that this drop doesn't happen is to have our nation's wealthiest folks pay the same Social Security payroll tax rate as the rest of us.

Social Security is mostly funded by payroll taxes, paid by workers like you and me. Many people don't know that this tax doesn't apply to income over $117,000 per year (adjusted for inflation annually). In other words, a corporate executive making $1.2 million dollars per year pays less than 1/10th the payroll tax rate as the 94 percent of us who make under $117,000 per year.

Several members of Congress have proposed different ways to make the system more fair by having the wealthy pay the same, or at least closer to the same, payroll tax rates as the vast majority of American workers. Earlier today, Representative John B. Larson released details about the newest of these plans.

Mr. Larson's proposal has several different parts that combine to strengthen both the finances of Social Security and benefits for retirees. Applying the Social Security payroll tax to income over $400,000 per year is one part, and according to the Chief Actuary of Social Security, it would, on its own, eliminate 2/3 of the program's projected 75-year shortfall.

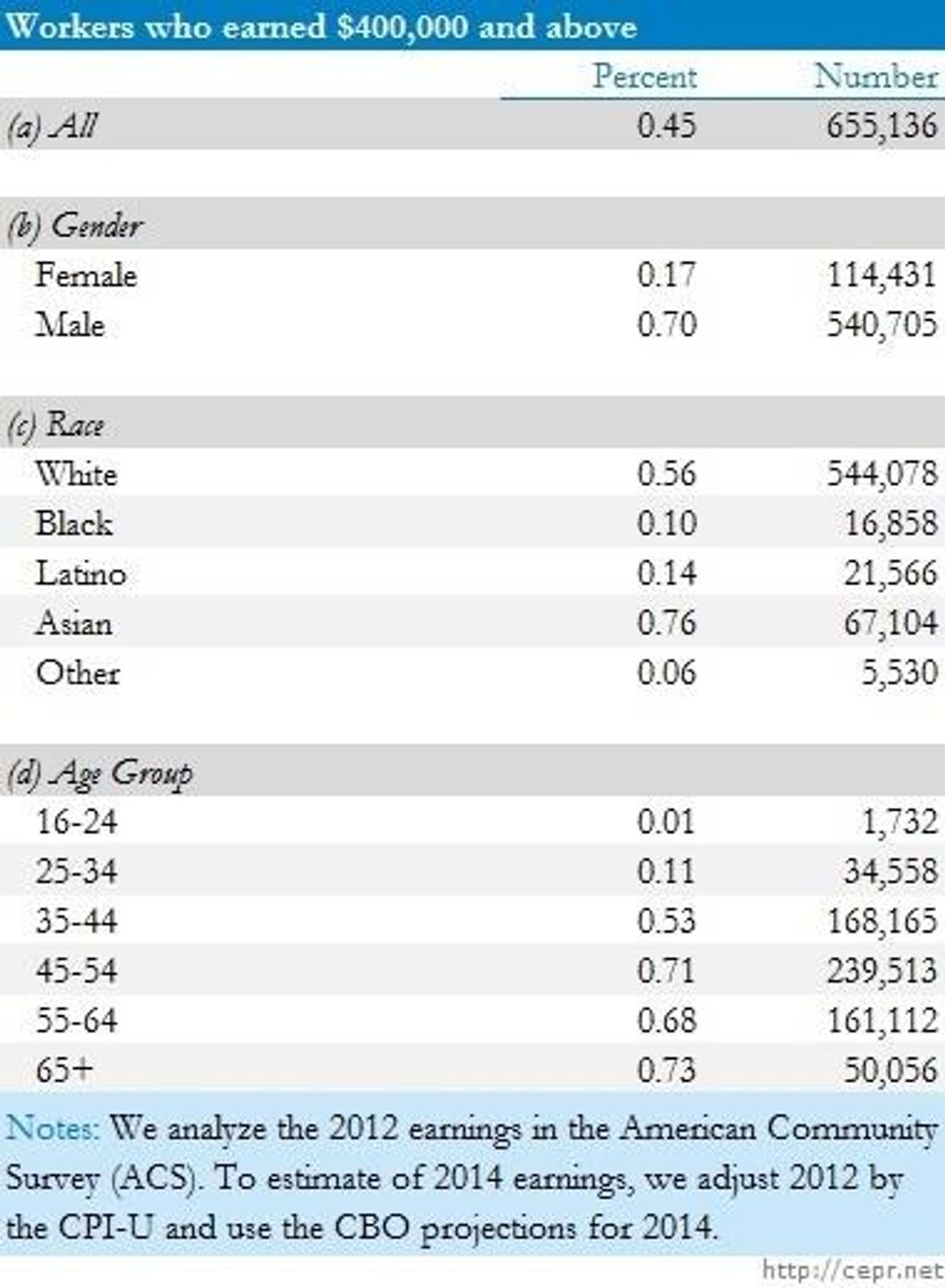

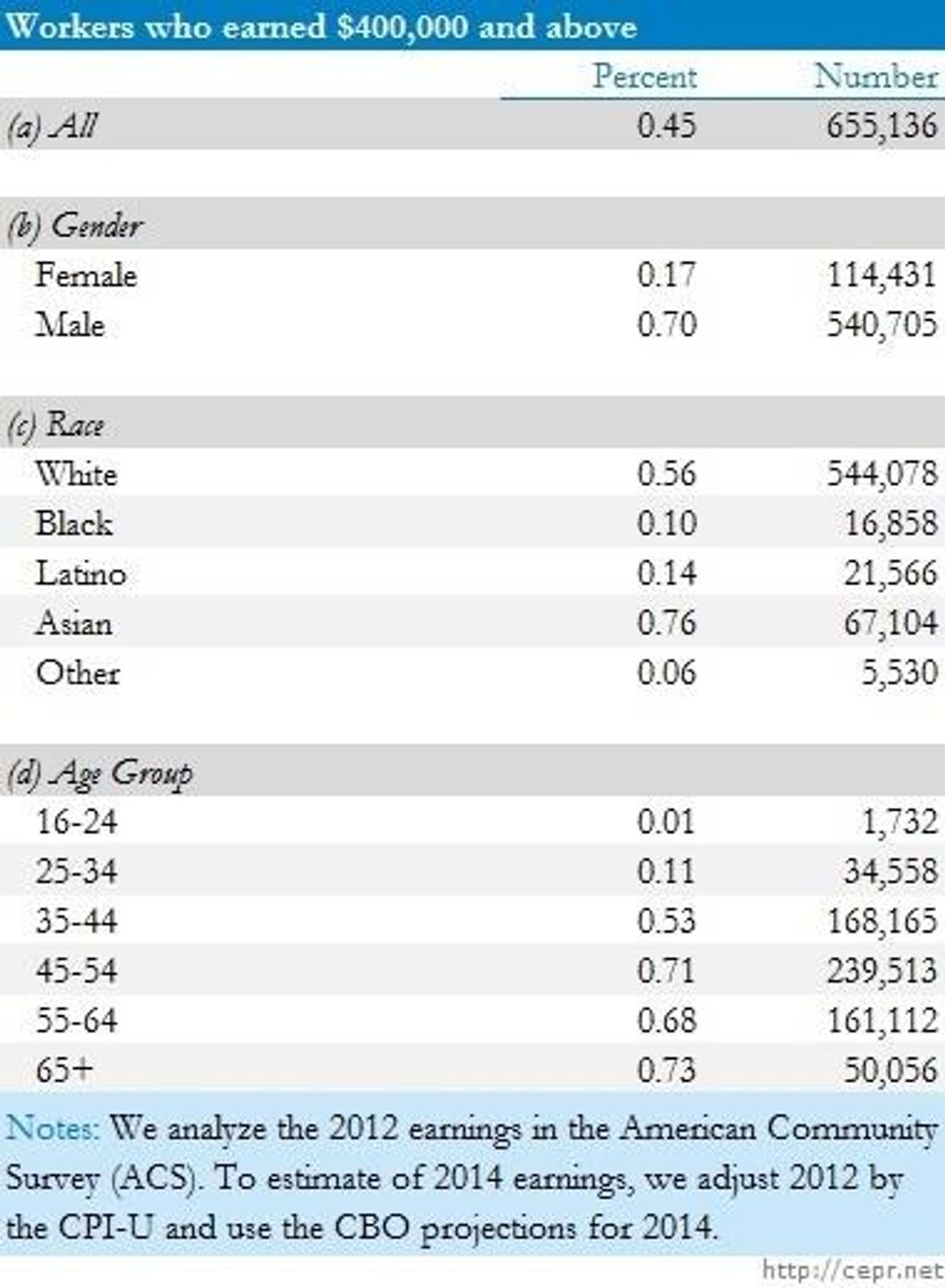

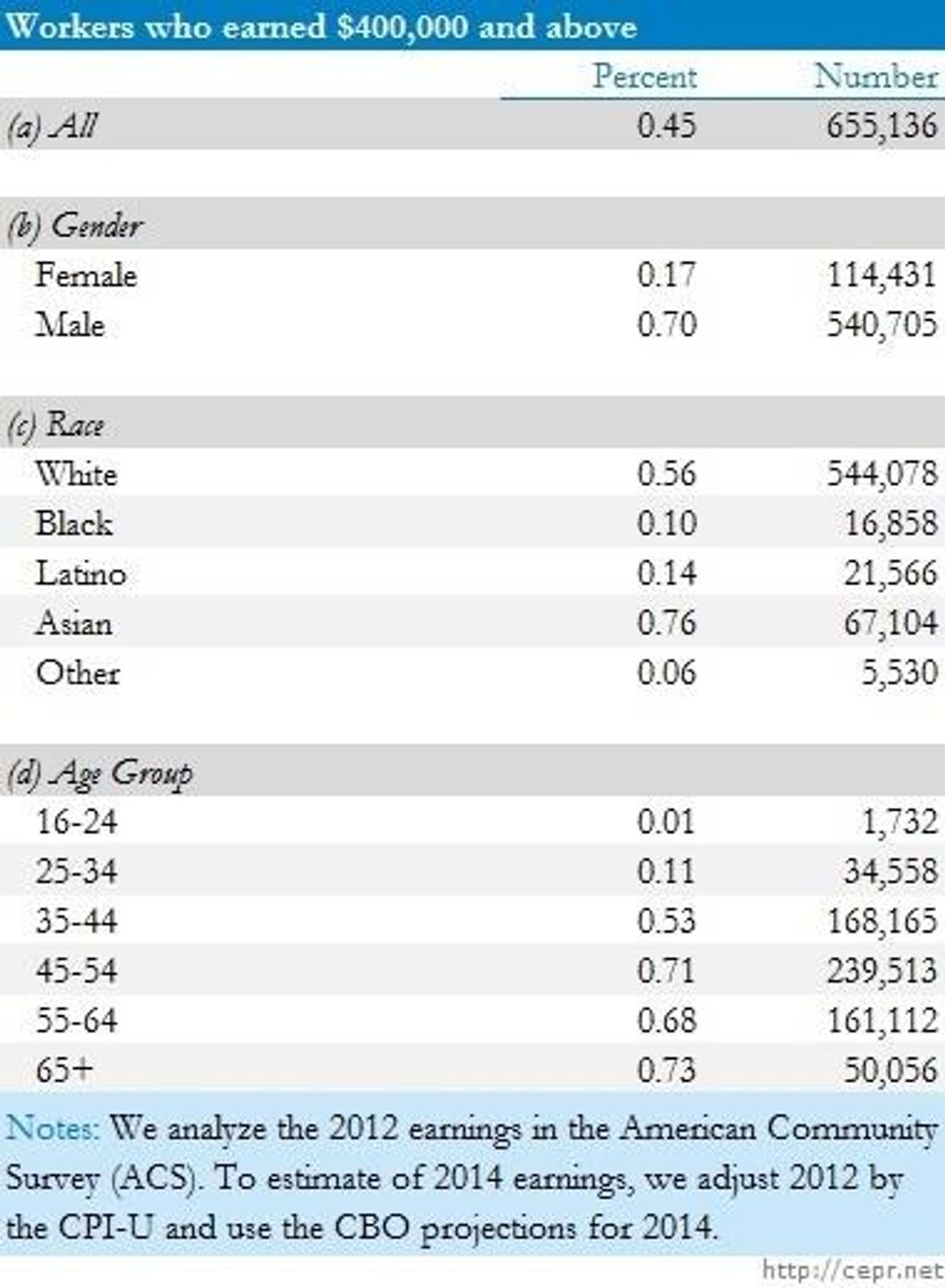

To get a sense of how few people would be affected by this part of this plan, take a look at the chart below. My colleagues here at CEPR have run the numbers, and only the richest 1 in 200 American workers make over $400,000 per year.

When you look at different demographic groups, the picture becomes even more stark. Less than 1 in 500 women make more than $400,000 per year. And only 1 in 1000 black workers earn above that threshold.

Let's remember that by raising the cap on Social Security payroll taxes, Mr. Larson's plan and similar proposals aren't asking the rich to pay a higher tax rate than middle-class Americans. Instead, they're simply asking the wealthiest among us to pay the same (or almost the same) rate as the 94 percent.

Which leads to the question: How old will Social Security be when the richest Americans pay the same payroll tax rate as the rest of us?

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Today is Social Security's 79th birthday, a good time to celebrate the nation's most effective anti-poverty program, which, especially after the housing crash and Great Recession, is crucial to the retirement security of middle- and working-class Americans.

But in about 20 years, Social Security will likely be able to pay only about 3/4 of promised benefits to retirees (if nothing's done to change the program). One way to make sure that this drop doesn't happen is to have our nation's wealthiest folks pay the same Social Security payroll tax rate as the rest of us.

Social Security is mostly funded by payroll taxes, paid by workers like you and me. Many people don't know that this tax doesn't apply to income over $117,000 per year (adjusted for inflation annually). In other words, a corporate executive making $1.2 million dollars per year pays less than 1/10th the payroll tax rate as the 94 percent of us who make under $117,000 per year.

Several members of Congress have proposed different ways to make the system more fair by having the wealthy pay the same, or at least closer to the same, payroll tax rates as the vast majority of American workers. Earlier today, Representative John B. Larson released details about the newest of these plans.

Mr. Larson's proposal has several different parts that combine to strengthen both the finances of Social Security and benefits for retirees. Applying the Social Security payroll tax to income over $400,000 per year is one part, and according to the Chief Actuary of Social Security, it would, on its own, eliminate 2/3 of the program's projected 75-year shortfall.

To get a sense of how few people would be affected by this part of this plan, take a look at the chart below. My colleagues here at CEPR have run the numbers, and only the richest 1 in 200 American workers make over $400,000 per year.

When you look at different demographic groups, the picture becomes even more stark. Less than 1 in 500 women make more than $400,000 per year. And only 1 in 1000 black workers earn above that threshold.

Let's remember that by raising the cap on Social Security payroll taxes, Mr. Larson's plan and similar proposals aren't asking the rich to pay a higher tax rate than middle-class Americans. Instead, they're simply asking the wealthiest among us to pay the same (or almost the same) rate as the 94 percent.

Which leads to the question: How old will Social Security be when the richest Americans pay the same payroll tax rate as the rest of us?

Today is Social Security's 79th birthday, a good time to celebrate the nation's most effective anti-poverty program, which, especially after the housing crash and Great Recession, is crucial to the retirement security of middle- and working-class Americans.

But in about 20 years, Social Security will likely be able to pay only about 3/4 of promised benefits to retirees (if nothing's done to change the program). One way to make sure that this drop doesn't happen is to have our nation's wealthiest folks pay the same Social Security payroll tax rate as the rest of us.

Social Security is mostly funded by payroll taxes, paid by workers like you and me. Many people don't know that this tax doesn't apply to income over $117,000 per year (adjusted for inflation annually). In other words, a corporate executive making $1.2 million dollars per year pays less than 1/10th the payroll tax rate as the 94 percent of us who make under $117,000 per year.

Several members of Congress have proposed different ways to make the system more fair by having the wealthy pay the same, or at least closer to the same, payroll tax rates as the vast majority of American workers. Earlier today, Representative John B. Larson released details about the newest of these plans.

Mr. Larson's proposal has several different parts that combine to strengthen both the finances of Social Security and benefits for retirees. Applying the Social Security payroll tax to income over $400,000 per year is one part, and according to the Chief Actuary of Social Security, it would, on its own, eliminate 2/3 of the program's projected 75-year shortfall.

To get a sense of how few people would be affected by this part of this plan, take a look at the chart below. My colleagues here at CEPR have run the numbers, and only the richest 1 in 200 American workers make over $400,000 per year.

When you look at different demographic groups, the picture becomes even more stark. Less than 1 in 500 women make more than $400,000 per year. And only 1 in 1000 black workers earn above that threshold.

Let's remember that by raising the cap on Social Security payroll taxes, Mr. Larson's plan and similar proposals aren't asking the rich to pay a higher tax rate than middle-class Americans. Instead, they're simply asking the wealthiest among us to pay the same (or almost the same) rate as the 94 percent.

Which leads to the question: How old will Social Security be when the richest Americans pay the same payroll tax rate as the rest of us?