SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

How do corporate attorneys sleep at night considering that with the power of their large corporate clients, they often crush the freedoms of workers, consumers and small communities who are trying to break out of a complex web of shackles?

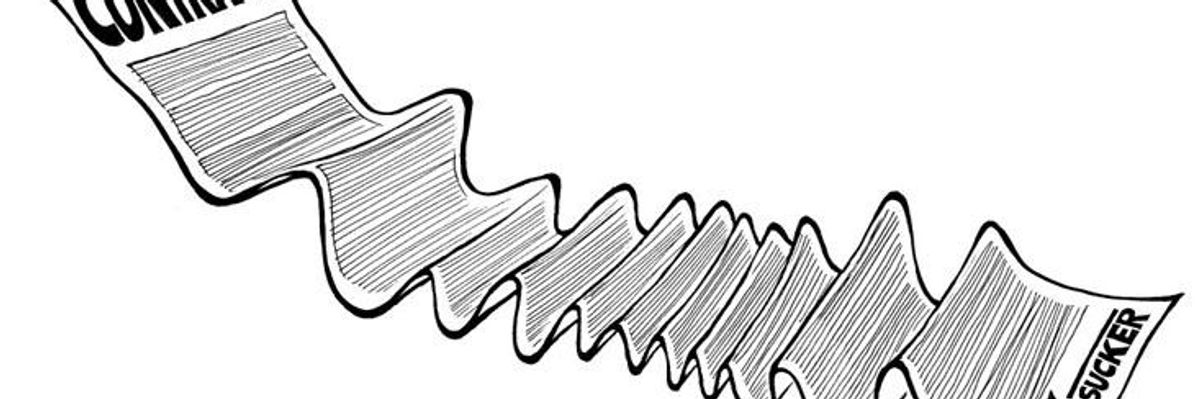

These highly paid power lawyers expertly weave an intricate system of controls into one-sided contracts enforced by laws garnished with the muscle of big business to wear down all but the most intrepid shoppers.

I am not only referring to the mass marketing scams, crams, deceptions and hidden frauds. Who can keep track of this proliferation in the credit, lending, insurance, cell phone, car, health care, home repair and mortgage businesses? Every year, books and manuals come out to show consumers how they can smartly protect themselves and their money. They are written in a clear, detailed and graphic manner, but they almost never become best sellers.

Vendors are trained to rip people off from a distance and make them feel good at the same time. That is one of the purposes of advertisements and packaging. Ripping off consumers is made easier because elementary and high schools neglect this subject. After twelve years of education, millions of students are unequipped with the needed knowledge that can enable them to make astute purchases and pursue remedies if they are cheated.

We need to focus on the incarcerating infrastructure that corporate attorneys build year after year to insulate their corporate paymasters from structural accountability under the rule of law.

Take the two main pillars of American law--contracts and torts. For half a century, power lawyers, backed by corporate campaign cash for legislators, have hacked at the roots of the legal protections for shoppers and for wrongfully injured people. Fine print contracts--called "mice print" by Senator Elizabeth Warren--block consumers from going to court and mandate compulsory arbitration. Other fine print lets the vendors change the contract any time without getting specific consent of the buyers. Internet fine print amounts to simply "clicking" and being instantly bound by a matrix of contract peonage. This victory for corporate lawyers is a defeat for the American people who lose their freedom of contract--a servitude that should arouse conservatives and liberals alike.

And, the other freedom to have safe products, services and environments is stripped away by "tort deform," euphemistically called tort reform by the insurance lobby and its corporate clients. Tort law is supposed to award adequate compensation for negligently or intentionally inflicted injuries upon innocent people. Shrinking by the decade in favor of the wrongdoers, tort law has been twisted to block the courtroom door for the most vulnerable of our population.

Corporate lobbyists have swarmed over state legislatures to pass rules that require courts to limit compensation by an arbitrary cap, restrict the evidence that juries can weigh, pulverize class actions and tie up the judges and juries who are the only ones actually receiving and evaluating the evidence.

An added burden is created by the domination of the credit economy that harnesses the rights of consumers by the unbridled controls known as secret credit ratings, the iron collar of credit scores and the very personal information collected on people in the computer age.

The credit economy also undermines peoples' control of their own money, thus facilitating an array of penalties and fees imposed by credit firms, banks, and pay day loan shops, along with growing charges for services unasked and unused by consumers known as cramming.

As if these and other controls over consumers are not enough, corporate lawyers are the architects of these notorious trade agreements such as NAFTA and GATT, which created the World Trade Organization (WTO). Americans are learning that these transnational autocratic forms of governance subordinate their labor, consumer and environment rights to the supremacy of international commerce. The WTO bypasses our domestic courts and agencies by processing disputes between nations before secret tribunals in Geneva, Switzerland (see https://www.citizen.org/trade/ for more information).

So if consumer safety or labeling standards in the U.S. are viewed as trade restrictive by nations that export such non-conforming products to the U.S., they can bring the case to Geneva where we will likely lose. These "pull down" trade agreements punish those nations that treat their workers fairly, safeguard their environments and protect their consumers, instead of going after the nations that sell unsafe products.

The patsy U.S. government under President Clinton even went along with allowing foreign companies to sue our government to compensate them for regulations such as chemical standards that might reduce their sales and profits.

The mounting privilege and immunities of giant global corporations go well beyond tax escapes, loan guarantees, and other abuses using our government to rig the market. Right wingers condemn these actions and refer to them as "crony capitalism." For example, patients pay higher drug prices because companies rig patent extensions through Congress or bring harassing law suits against competitors.

The political power of the "military-industrial complex" leads to sweetheart, single source contracts and the wholesale and expensive outsourcing of what were once governmental functions, such as feeding soldiers and providing health insurance under contract.

Corporations have succeeded in blocking, delaying or diluting long overdue regulation of corporate crime, fraud and abuse. They have made Congress keep law enforcement budgets so paltry, for example, that billing fraud in the health care industry alone amounts to about $270 billion a year, according to fraud expert Malcolm Sparrow of Harvard University (author of License to Steal).

It is the external infrastructure--trade agreements, credit scores, credit ratings, and the privatization of contract law and weakened dispute resolution--that strips consumers of control over their own money and purchases and make it difficult for such consumers to fight back in court.

Stay tuned. It is only going to get worse unless consumer groups rethink and regroup to move systemic shifts of power from sellers to buyers through community-based economies, group buying, cooperatives, and political power leading to updated law and order. (See https://www.yesmagazine.org/ and https://www.ilsr.org/ for more information.)

Encouraging schools to adopt experiential instruction in detecting consumer fraud and using small claims court to secure inexpensive justice is an easy first step on the long march to consumer justice.

Common Dreams is powered by optimists who believe in the power of informed and engaged citizens to ignite and enact change to make the world a better place. We're hundreds of thousands strong, but every single supporter makes the difference. Your contribution supports this bold media model—free, independent, and dedicated to reporting the facts every day. Stand with us in the fight for economic equality, social justice, human rights, and a more sustainable future. As a people-powered nonprofit news outlet, we cover the issues the corporate media never will. |

How do corporate attorneys sleep at night considering that with the power of their large corporate clients, they often crush the freedoms of workers, consumers and small communities who are trying to break out of a complex web of shackles?

These highly paid power lawyers expertly weave an intricate system of controls into one-sided contracts enforced by laws garnished with the muscle of big business to wear down all but the most intrepid shoppers.

I am not only referring to the mass marketing scams, crams, deceptions and hidden frauds. Who can keep track of this proliferation in the credit, lending, insurance, cell phone, car, health care, home repair and mortgage businesses? Every year, books and manuals come out to show consumers how they can smartly protect themselves and their money. They are written in a clear, detailed and graphic manner, but they almost never become best sellers.

Vendors are trained to rip people off from a distance and make them feel good at the same time. That is one of the purposes of advertisements and packaging. Ripping off consumers is made easier because elementary and high schools neglect this subject. After twelve years of education, millions of students are unequipped with the needed knowledge that can enable them to make astute purchases and pursue remedies if they are cheated.

We need to focus on the incarcerating infrastructure that corporate attorneys build year after year to insulate their corporate paymasters from structural accountability under the rule of law.

Take the two main pillars of American law--contracts and torts. For half a century, power lawyers, backed by corporate campaign cash for legislators, have hacked at the roots of the legal protections for shoppers and for wrongfully injured people. Fine print contracts--called "mice print" by Senator Elizabeth Warren--block consumers from going to court and mandate compulsory arbitration. Other fine print lets the vendors change the contract any time without getting specific consent of the buyers. Internet fine print amounts to simply "clicking" and being instantly bound by a matrix of contract peonage. This victory for corporate lawyers is a defeat for the American people who lose their freedom of contract--a servitude that should arouse conservatives and liberals alike.

And, the other freedom to have safe products, services and environments is stripped away by "tort deform," euphemistically called tort reform by the insurance lobby and its corporate clients. Tort law is supposed to award adequate compensation for negligently or intentionally inflicted injuries upon innocent people. Shrinking by the decade in favor of the wrongdoers, tort law has been twisted to block the courtroom door for the most vulnerable of our population.

Corporate lobbyists have swarmed over state legislatures to pass rules that require courts to limit compensation by an arbitrary cap, restrict the evidence that juries can weigh, pulverize class actions and tie up the judges and juries who are the only ones actually receiving and evaluating the evidence.

An added burden is created by the domination of the credit economy that harnesses the rights of consumers by the unbridled controls known as secret credit ratings, the iron collar of credit scores and the very personal information collected on people in the computer age.

The credit economy also undermines peoples' control of their own money, thus facilitating an array of penalties and fees imposed by credit firms, banks, and pay day loan shops, along with growing charges for services unasked and unused by consumers known as cramming.

As if these and other controls over consumers are not enough, corporate lawyers are the architects of these notorious trade agreements such as NAFTA and GATT, which created the World Trade Organization (WTO). Americans are learning that these transnational autocratic forms of governance subordinate their labor, consumer and environment rights to the supremacy of international commerce. The WTO bypasses our domestic courts and agencies by processing disputes between nations before secret tribunals in Geneva, Switzerland (see https://www.citizen.org/trade/ for more information).

So if consumer safety or labeling standards in the U.S. are viewed as trade restrictive by nations that export such non-conforming products to the U.S., they can bring the case to Geneva where we will likely lose. These "pull down" trade agreements punish those nations that treat their workers fairly, safeguard their environments and protect their consumers, instead of going after the nations that sell unsafe products.

The patsy U.S. government under President Clinton even went along with allowing foreign companies to sue our government to compensate them for regulations such as chemical standards that might reduce their sales and profits.

The mounting privilege and immunities of giant global corporations go well beyond tax escapes, loan guarantees, and other abuses using our government to rig the market. Right wingers condemn these actions and refer to them as "crony capitalism." For example, patients pay higher drug prices because companies rig patent extensions through Congress or bring harassing law suits against competitors.

The political power of the "military-industrial complex" leads to sweetheart, single source contracts and the wholesale and expensive outsourcing of what were once governmental functions, such as feeding soldiers and providing health insurance under contract.

Corporations have succeeded in blocking, delaying or diluting long overdue regulation of corporate crime, fraud and abuse. They have made Congress keep law enforcement budgets so paltry, for example, that billing fraud in the health care industry alone amounts to about $270 billion a year, according to fraud expert Malcolm Sparrow of Harvard University (author of License to Steal).

It is the external infrastructure--trade agreements, credit scores, credit ratings, and the privatization of contract law and weakened dispute resolution--that strips consumers of control over their own money and purchases and make it difficult for such consumers to fight back in court.

Stay tuned. It is only going to get worse unless consumer groups rethink and regroup to move systemic shifts of power from sellers to buyers through community-based economies, group buying, cooperatives, and political power leading to updated law and order. (See https://www.yesmagazine.org/ and https://www.ilsr.org/ for more information.)

Encouraging schools to adopt experiential instruction in detecting consumer fraud and using small claims court to secure inexpensive justice is an easy first step on the long march to consumer justice.

How do corporate attorneys sleep at night considering that with the power of their large corporate clients, they often crush the freedoms of workers, consumers and small communities who are trying to break out of a complex web of shackles?

These highly paid power lawyers expertly weave an intricate system of controls into one-sided contracts enforced by laws garnished with the muscle of big business to wear down all but the most intrepid shoppers.

I am not only referring to the mass marketing scams, crams, deceptions and hidden frauds. Who can keep track of this proliferation in the credit, lending, insurance, cell phone, car, health care, home repair and mortgage businesses? Every year, books and manuals come out to show consumers how they can smartly protect themselves and their money. They are written in a clear, detailed and graphic manner, but they almost never become best sellers.

Vendors are trained to rip people off from a distance and make them feel good at the same time. That is one of the purposes of advertisements and packaging. Ripping off consumers is made easier because elementary and high schools neglect this subject. After twelve years of education, millions of students are unequipped with the needed knowledge that can enable them to make astute purchases and pursue remedies if they are cheated.

We need to focus on the incarcerating infrastructure that corporate attorneys build year after year to insulate their corporate paymasters from structural accountability under the rule of law.

Take the two main pillars of American law--contracts and torts. For half a century, power lawyers, backed by corporate campaign cash for legislators, have hacked at the roots of the legal protections for shoppers and for wrongfully injured people. Fine print contracts--called "mice print" by Senator Elizabeth Warren--block consumers from going to court and mandate compulsory arbitration. Other fine print lets the vendors change the contract any time without getting specific consent of the buyers. Internet fine print amounts to simply "clicking" and being instantly bound by a matrix of contract peonage. This victory for corporate lawyers is a defeat for the American people who lose their freedom of contract--a servitude that should arouse conservatives and liberals alike.

And, the other freedom to have safe products, services and environments is stripped away by "tort deform," euphemistically called tort reform by the insurance lobby and its corporate clients. Tort law is supposed to award adequate compensation for negligently or intentionally inflicted injuries upon innocent people. Shrinking by the decade in favor of the wrongdoers, tort law has been twisted to block the courtroom door for the most vulnerable of our population.

Corporate lobbyists have swarmed over state legislatures to pass rules that require courts to limit compensation by an arbitrary cap, restrict the evidence that juries can weigh, pulverize class actions and tie up the judges and juries who are the only ones actually receiving and evaluating the evidence.

An added burden is created by the domination of the credit economy that harnesses the rights of consumers by the unbridled controls known as secret credit ratings, the iron collar of credit scores and the very personal information collected on people in the computer age.

The credit economy also undermines peoples' control of their own money, thus facilitating an array of penalties and fees imposed by credit firms, banks, and pay day loan shops, along with growing charges for services unasked and unused by consumers known as cramming.

As if these and other controls over consumers are not enough, corporate lawyers are the architects of these notorious trade agreements such as NAFTA and GATT, which created the World Trade Organization (WTO). Americans are learning that these transnational autocratic forms of governance subordinate their labor, consumer and environment rights to the supremacy of international commerce. The WTO bypasses our domestic courts and agencies by processing disputes between nations before secret tribunals in Geneva, Switzerland (see https://www.citizen.org/trade/ for more information).

So if consumer safety or labeling standards in the U.S. are viewed as trade restrictive by nations that export such non-conforming products to the U.S., they can bring the case to Geneva where we will likely lose. These "pull down" trade agreements punish those nations that treat their workers fairly, safeguard their environments and protect their consumers, instead of going after the nations that sell unsafe products.

The patsy U.S. government under President Clinton even went along with allowing foreign companies to sue our government to compensate them for regulations such as chemical standards that might reduce their sales and profits.

The mounting privilege and immunities of giant global corporations go well beyond tax escapes, loan guarantees, and other abuses using our government to rig the market. Right wingers condemn these actions and refer to them as "crony capitalism." For example, patients pay higher drug prices because companies rig patent extensions through Congress or bring harassing law suits against competitors.

The political power of the "military-industrial complex" leads to sweetheart, single source contracts and the wholesale and expensive outsourcing of what were once governmental functions, such as feeding soldiers and providing health insurance under contract.

Corporations have succeeded in blocking, delaying or diluting long overdue regulation of corporate crime, fraud and abuse. They have made Congress keep law enforcement budgets so paltry, for example, that billing fraud in the health care industry alone amounts to about $270 billion a year, according to fraud expert Malcolm Sparrow of Harvard University (author of License to Steal).

It is the external infrastructure--trade agreements, credit scores, credit ratings, and the privatization of contract law and weakened dispute resolution--that strips consumers of control over their own money and purchases and make it difficult for such consumers to fight back in court.

Stay tuned. It is only going to get worse unless consumer groups rethink and regroup to move systemic shifts of power from sellers to buyers through community-based economies, group buying, cooperatives, and political power leading to updated law and order. (See https://www.yesmagazine.org/ and https://www.ilsr.org/ for more information.)

Encouraging schools to adopt experiential instruction in detecting consumer fraud and using small claims court to secure inexpensive justice is an easy first step on the long march to consumer justice.