SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

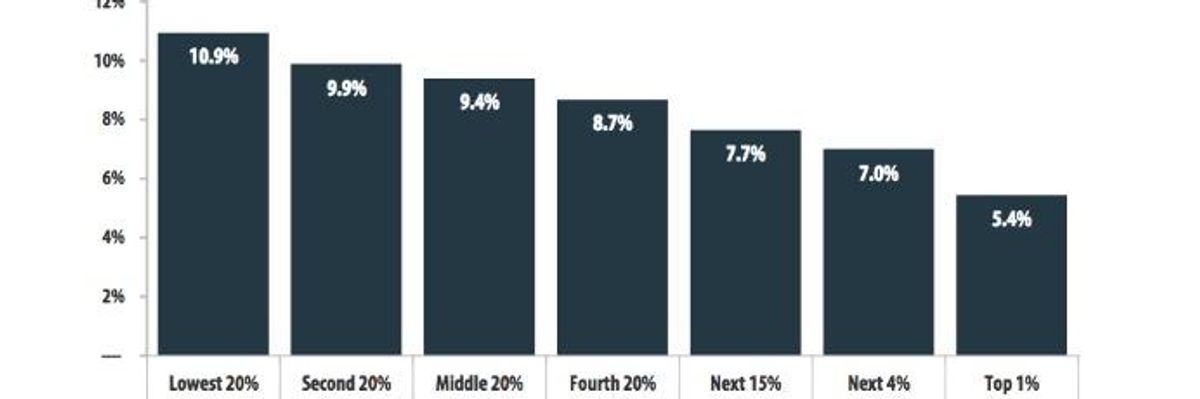

The American tax system, in which those with the least pay the most. Figure represents 50 state (and District of Columbia) average for total state and local taxes paid as a share of 2012 income, post- federal offset. (Source: Institute on Taxation & Economic Policy)

Before taxes on the rich are cut and social programs decimated, uninformed conservatives should consider who really benefits from U.S. tax laws and assistance programs.

Before taxes on the rich are cut and social programs decimated, uninformed conservatives should consider who really benefits from U.S. tax laws and assistance programs.

The Wealthiest Americans Pay Very Little Tax On Their Full Income

When ALL forms of taxes and income are considered, poor Americans pay higher tax rates than the richest 1%.

The analysis starts with state and local taxes, which are often ignored by apologists for big-income tax cuts. According to The Institute on Taxation and Economic Policy, the state and local tax rate for the poorest 20 percent of individuals is DOUBLE that of the top 1 percent (10.9 percent vs. 5.4 percent). New data from Thomas Piketty, Emmanuel Saez, and Gabriel Zucman allows us to go further: When unrealized capital gains are included in the wealth-building of the richest 1%, the OVERALL tax rates plunge for the super-rich, causing the poorest Americans to pay the highest rates.

What is the justification for adding unrealized capital gains to one's income? The 16th Amendment gives Congress the power "to lay and collect taxes on incomes, from whatever source derived." Thus, under an original definition of income developed by the American economists Robert M. Haig and Henry C. Simons in the 1920s and still utilized by financial economists, an increase in the value of a stock or other asset would be subject to taxation even if it's not sold.

With this more accurate guide to income measurement, the real tax rates paid by the 1% can be calculated. Details can be found here. The bottom line is that poor Americans pay about 25 percent in total taxes, while the 1% pays anywhere from 18 to 23 percent.

Rich Americans Benefit as Much as the Poor from the Safety Net

Piketty and Saez and Zucman calculate government transfers to three groups: the richest 10%, the middle 40%, and the poorest 50%. Each group is evaluated for total transfers, including Social Security, as a percent of average national income.

Surprisingly, the middle 40% receives more government assistance than the bottom 50%, with a benefit equivalent to 23 percent of national income (see Figure S.13).

More surprisingly, the richest 10% as a group receives almost as much government assistance as the poorest 50%.

The critics of poor Americans should be informed that even after transfers, income for the working-age bottom 50% has not improved since 1979. And they should be reminded that the cost of the entire Safety Net is only about ONE-SIXTH of the $2.2 trillion in tax breaks and tax avoidance that primarily benefit the rich.

The Super-Rich Don't Pay Much for All Their Benefits from Society

Most of society's benefits go to THE SUPER-RICH and their businesses:

Financial Assistance: The stock markets, the legal system, patent and copyright systems, intellectual property, contract law.

The Military: National defense, local police forces, the National Guard, the Coast Guard.

Infrastructure: In the physical form of highways, railroads, airports; the energy grid; and in the form of communications though the airwaves, especially the Internet.

Federal Agencies: The Federal Reserve, SEC, FTC, SBA, FAA, NASA. Research at the Department of Defense, the Air Force, NASA, and public universities.

National Wealth Does Not Belong To The 1%

Today the taking of our national wealth can be tax-deferred indefinitely. A just society should have some form of wealth tax, as recommended by Piketty, perhaps as a modified version of the Haig-Simons call for taxing annual stock gains. Then millions of non-stockholders would rightfully get a piece of our 70 years of national prosperity.

Trump and Musk are on an unconstitutional rampage, aiming for virtually every corner of the federal government. These two right-wing billionaires are targeting nurses, scientists, teachers, daycare providers, judges, veterans, air traffic controllers, and nuclear safety inspectors. No one is safe. The food stamps program, Social Security, Medicare, and Medicaid are next. It’s an unprecedented disaster and a five-alarm fire, but there will be a reckoning. The people did not vote for this. The American people do not want this dystopian hellscape that hides behind claims of “efficiency.” Still, in reality, it is all a giveaway to corporate interests and the libertarian dreams of far-right oligarchs like Musk. Common Dreams is playing a vital role by reporting day and night on this orgy of corruption and greed, as well as what everyday people can do to organize and fight back. As a people-powered nonprofit news outlet, we cover issues the corporate media never will, but we can only continue with our readers’ support. |

Before taxes on the rich are cut and social programs decimated, uninformed conservatives should consider who really benefits from U.S. tax laws and assistance programs.

The Wealthiest Americans Pay Very Little Tax On Their Full Income

When ALL forms of taxes and income are considered, poor Americans pay higher tax rates than the richest 1%.

The analysis starts with state and local taxes, which are often ignored by apologists for big-income tax cuts. According to The Institute on Taxation and Economic Policy, the state and local tax rate for the poorest 20 percent of individuals is DOUBLE that of the top 1 percent (10.9 percent vs. 5.4 percent). New data from Thomas Piketty, Emmanuel Saez, and Gabriel Zucman allows us to go further: When unrealized capital gains are included in the wealth-building of the richest 1%, the OVERALL tax rates plunge for the super-rich, causing the poorest Americans to pay the highest rates.

What is the justification for adding unrealized capital gains to one's income? The 16th Amendment gives Congress the power "to lay and collect taxes on incomes, from whatever source derived." Thus, under an original definition of income developed by the American economists Robert M. Haig and Henry C. Simons in the 1920s and still utilized by financial economists, an increase in the value of a stock or other asset would be subject to taxation even if it's not sold.

With this more accurate guide to income measurement, the real tax rates paid by the 1% can be calculated. Details can be found here. The bottom line is that poor Americans pay about 25 percent in total taxes, while the 1% pays anywhere from 18 to 23 percent.

Rich Americans Benefit as Much as the Poor from the Safety Net

Piketty and Saez and Zucman calculate government transfers to three groups: the richest 10%, the middle 40%, and the poorest 50%. Each group is evaluated for total transfers, including Social Security, as a percent of average national income.

Surprisingly, the middle 40% receives more government assistance than the bottom 50%, with a benefit equivalent to 23 percent of national income (see Figure S.13).

More surprisingly, the richest 10% as a group receives almost as much government assistance as the poorest 50%.

The critics of poor Americans should be informed that even after transfers, income for the working-age bottom 50% has not improved since 1979. And they should be reminded that the cost of the entire Safety Net is only about ONE-SIXTH of the $2.2 trillion in tax breaks and tax avoidance that primarily benefit the rich.

The Super-Rich Don't Pay Much for All Their Benefits from Society

Most of society's benefits go to THE SUPER-RICH and their businesses:

Financial Assistance: The stock markets, the legal system, patent and copyright systems, intellectual property, contract law.

The Military: National defense, local police forces, the National Guard, the Coast Guard.

Infrastructure: In the physical form of highways, railroads, airports; the energy grid; and in the form of communications though the airwaves, especially the Internet.

Federal Agencies: The Federal Reserve, SEC, FTC, SBA, FAA, NASA. Research at the Department of Defense, the Air Force, NASA, and public universities.

National Wealth Does Not Belong To The 1%

Today the taking of our national wealth can be tax-deferred indefinitely. A just society should have some form of wealth tax, as recommended by Piketty, perhaps as a modified version of the Haig-Simons call for taxing annual stock gains. Then millions of non-stockholders would rightfully get a piece of our 70 years of national prosperity.

Before taxes on the rich are cut and social programs decimated, uninformed conservatives should consider who really benefits from U.S. tax laws and assistance programs.

The Wealthiest Americans Pay Very Little Tax On Their Full Income

When ALL forms of taxes and income are considered, poor Americans pay higher tax rates than the richest 1%.

The analysis starts with state and local taxes, which are often ignored by apologists for big-income tax cuts. According to The Institute on Taxation and Economic Policy, the state and local tax rate for the poorest 20 percent of individuals is DOUBLE that of the top 1 percent (10.9 percent vs. 5.4 percent). New data from Thomas Piketty, Emmanuel Saez, and Gabriel Zucman allows us to go further: When unrealized capital gains are included in the wealth-building of the richest 1%, the OVERALL tax rates plunge for the super-rich, causing the poorest Americans to pay the highest rates.

What is the justification for adding unrealized capital gains to one's income? The 16th Amendment gives Congress the power "to lay and collect taxes on incomes, from whatever source derived." Thus, under an original definition of income developed by the American economists Robert M. Haig and Henry C. Simons in the 1920s and still utilized by financial economists, an increase in the value of a stock or other asset would be subject to taxation even if it's not sold.

With this more accurate guide to income measurement, the real tax rates paid by the 1% can be calculated. Details can be found here. The bottom line is that poor Americans pay about 25 percent in total taxes, while the 1% pays anywhere from 18 to 23 percent.

Rich Americans Benefit as Much as the Poor from the Safety Net

Piketty and Saez and Zucman calculate government transfers to three groups: the richest 10%, the middle 40%, and the poorest 50%. Each group is evaluated for total transfers, including Social Security, as a percent of average national income.

Surprisingly, the middle 40% receives more government assistance than the bottom 50%, with a benefit equivalent to 23 percent of national income (see Figure S.13).

More surprisingly, the richest 10% as a group receives almost as much government assistance as the poorest 50%.

The critics of poor Americans should be informed that even after transfers, income for the working-age bottom 50% has not improved since 1979. And they should be reminded that the cost of the entire Safety Net is only about ONE-SIXTH of the $2.2 trillion in tax breaks and tax avoidance that primarily benefit the rich.

The Super-Rich Don't Pay Much for All Their Benefits from Society

Most of society's benefits go to THE SUPER-RICH and their businesses:

Financial Assistance: The stock markets, the legal system, patent and copyright systems, intellectual property, contract law.

The Military: National defense, local police forces, the National Guard, the Coast Guard.

Infrastructure: In the physical form of highways, railroads, airports; the energy grid; and in the form of communications though the airwaves, especially the Internet.

Federal Agencies: The Federal Reserve, SEC, FTC, SBA, FAA, NASA. Research at the Department of Defense, the Air Force, NASA, and public universities.

National Wealth Does Not Belong To The 1%

Today the taking of our national wealth can be tax-deferred indefinitely. A just society should have some form of wealth tax, as recommended by Piketty, perhaps as a modified version of the Haig-Simons call for taxing annual stock gains. Then millions of non-stockholders would rightfully get a piece of our 70 years of national prosperity.