Trump's $2 Trillion Choice: Cut Health Coverage and Care for Millions; Cut Taxes for Wealthy

We've explained that President Trump's 2018 budget is the most radical, Robin-Hood-in-reverse budget that any modern President has ever proposed, and here's a perfect illustration: it cuts health coverage and care for poor and modest-income families by nearly $2 trillion over ten years, wh

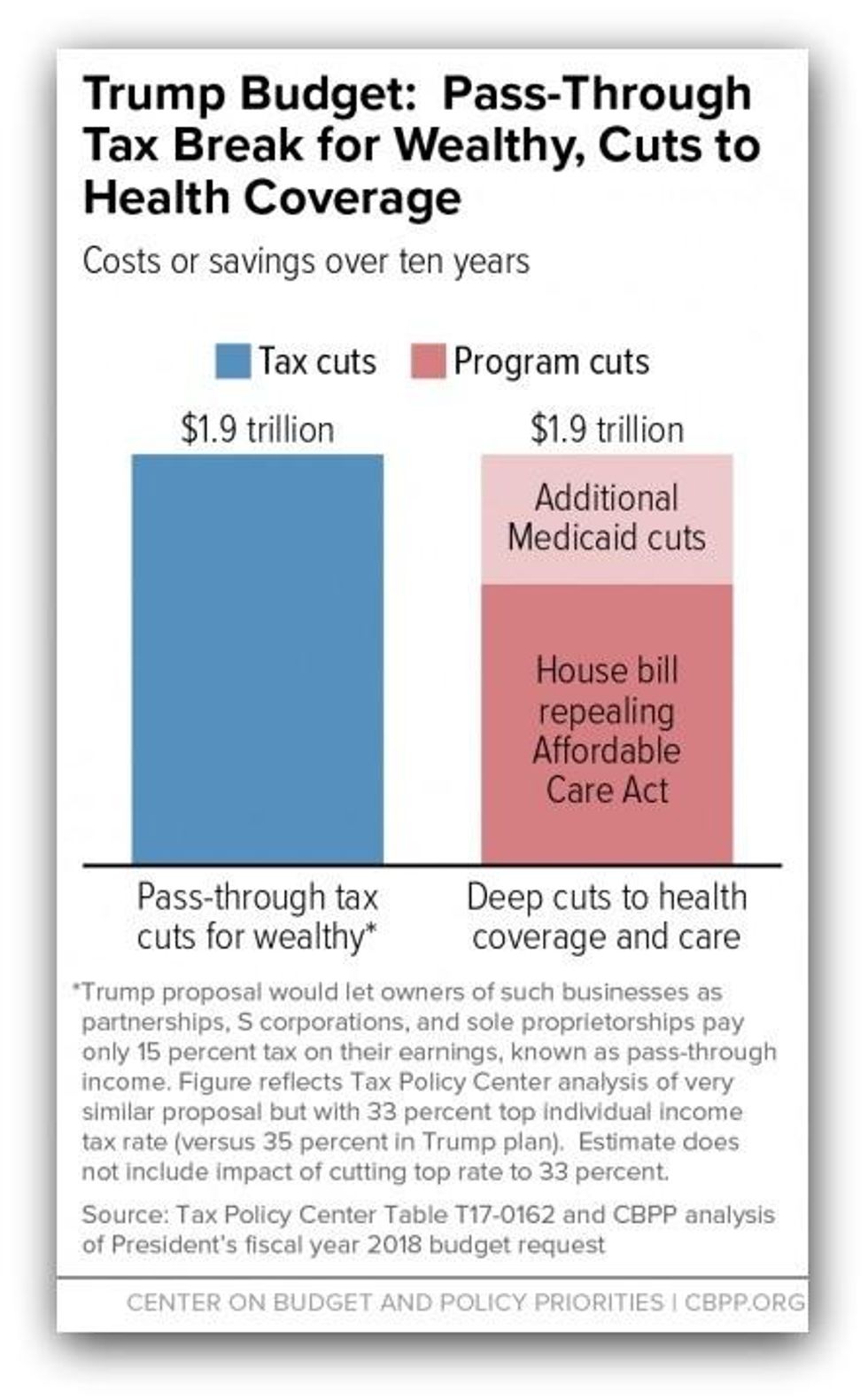

We've explained that President Trump's 2018 budget is the most radical, Robin-Hood-in-reverse budget that any modern President has ever proposed, and here's a perfect illustration: it cuts health coverage and care for poor and modest-income families by nearly $2 trillion over ten years, while giving high-income people a nearly $2 trillion tax break on "pass-through" business income. More than 20 million Americans would lose health coverage, even as the 400 highest-income taxpayers -- whose annual incomes average more than $300 million -- would get tax cuts averaging around $9 million apiece each year.

This combination of health care cuts and tax cuts for the wealthy not only underscores the Trump budget's harsh values and counterproductive priorities, it also conflicts sharply with what the President told voters he would do during his campaign.

Let's take a closer look:

A $1.9 trillion pass-through tax cut for the wealthy. Pass-throughs are businesses such as partnerships, S corporations, and sole proprietorships whose income is claimed on individual tax returns and now taxed at the same rates as wages and salaries. The President proposes setting a new, much lower top rate for pass-through income of 15 percent. That's far below the plan's 35 percent top rate for wages and salaries, and even further below the current 39.6 percent top rate, which applies to both wage and salary and pass-through income.

Although the budget doesn't specify the proposal's cost, the Tax Policy Center (TPC) estimated that a very similar proposal would cost $1.9 trillion over ten years. It would be heavilytilted to the wealthy: more than two-thirds of thetax cuton existing pass-through income would flow to households with incomes over $1 million. Their tax cutswould average more than $114,000 each year, boosting their after-tax incomes by more than 5 percent, while the impact on low- and middle-income owners of pass-through businesses would be basically zero. Wealthy people would also get massive additional tax cuts from other proposals in Trump's tax plan.

The pass-through proposal would also invite massive tax avoidance, creating a large new tax loophole that would give wealthy people a powerful incentive to re-classify their wages as pass-through income to get the much lower 15 percent rate. The President hasn't proposed any rules to prevent tax avoidance, and experts are highly skeptical that any rules would be effective. This new tax avoidance would cost $584 billion of the proposal's $1.9 trillion cost, TPC estimates, and would only benefit high earners.

Roughly $1.9 trillion in cuts to health care coverage and care. The budget embraces the House GOP health bill's approach to "repeal and replace" the Affordable Care Act (ACA), which would take health insurance away from more than 20 million people of modest means, radically restructure Medicaid by converting it to a per capita cap or block grant, raise out-of-pocket health costs for millions more, and substantially weaken key protections for people with pre-existing conditions, while providing very large tax cuts to those at the top.

Similar to the House-passed bill, the budget proposes $1.25 trillion over ten years in cuts from repealing and replacing the ACA, including dramatic cuts to Medicaid and subsidies that help people with modest incomes afford insurance. It then proposes $610 billion in additional Medicaid cuts. In total, this amounts to about $1.9 trillion in cuts to health care and coverage over 2018-2027, the bulk of it from Medicaid -- a critical source of coverage for seniors, people with disabilities, and families with children.

As a result, the Trump budget almost certainly would boost the number of uninsured even more than the House bill. States, facing even deeper Medicaid cost-shifts, would have no choice but to impose even more draconian cuts to Medicaid eligibility, benefits, and provider payments than under the House bill, so even more low-income seniors, people with disabilities, and children and families would become uninsured or go without needed care.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

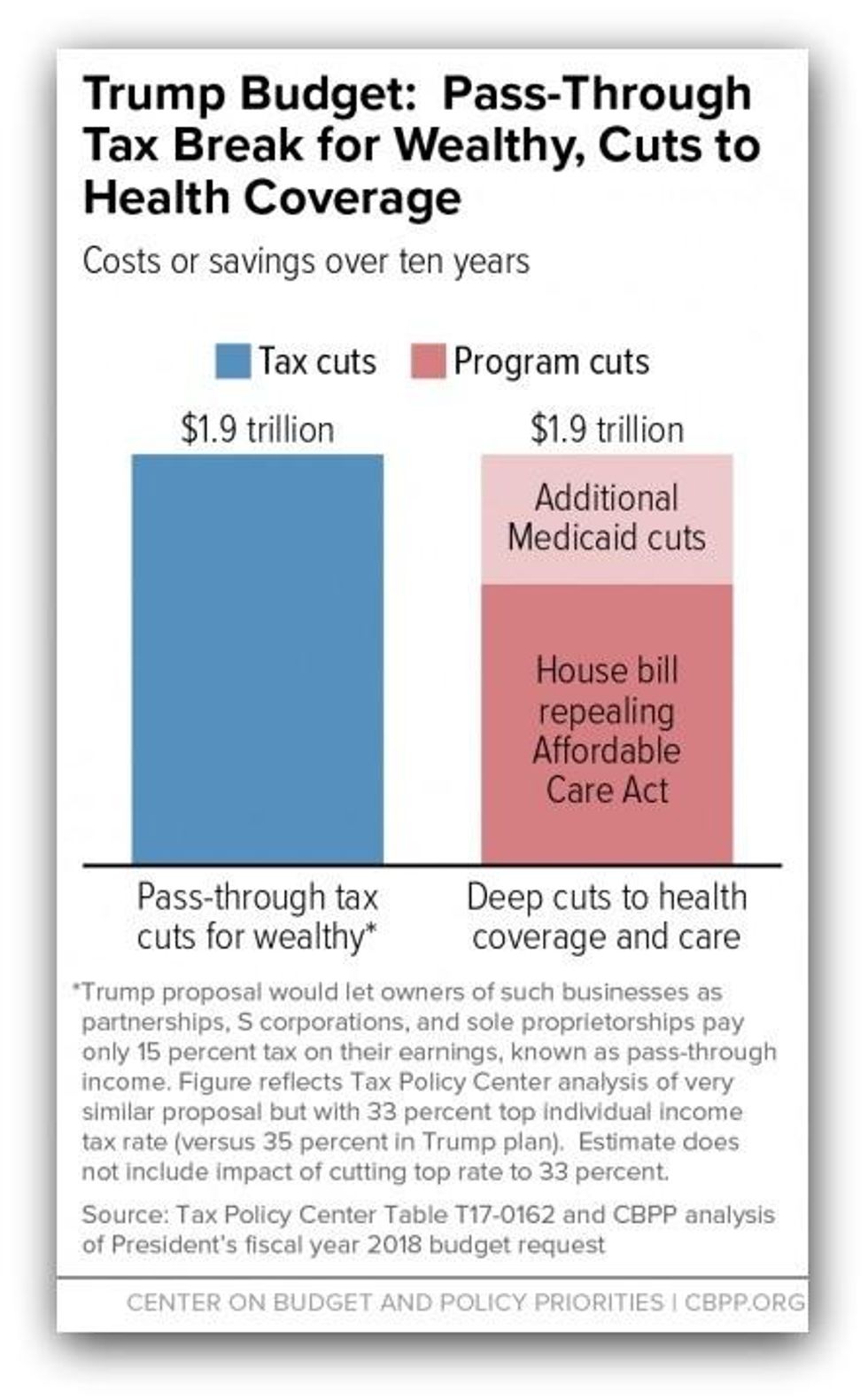

We've explained that President Trump's 2018 budget is the most radical, Robin-Hood-in-reverse budget that any modern President has ever proposed, and here's a perfect illustration: it cuts health coverage and care for poor and modest-income families by nearly $2 trillion over ten years, while giving high-income people a nearly $2 trillion tax break on "pass-through" business income. More than 20 million Americans would lose health coverage, even as the 400 highest-income taxpayers -- whose annual incomes average more than $300 million -- would get tax cuts averaging around $9 million apiece each year.

This combination of health care cuts and tax cuts for the wealthy not only underscores the Trump budget's harsh values and counterproductive priorities, it also conflicts sharply with what the President told voters he would do during his campaign.

Let's take a closer look:

A $1.9 trillion pass-through tax cut for the wealthy. Pass-throughs are businesses such as partnerships, S corporations, and sole proprietorships whose income is claimed on individual tax returns and now taxed at the same rates as wages and salaries. The President proposes setting a new, much lower top rate for pass-through income of 15 percent. That's far below the plan's 35 percent top rate for wages and salaries, and even further below the current 39.6 percent top rate, which applies to both wage and salary and pass-through income.

Although the budget doesn't specify the proposal's cost, the Tax Policy Center (TPC) estimated that a very similar proposal would cost $1.9 trillion over ten years. It would be heavilytilted to the wealthy: more than two-thirds of thetax cuton existing pass-through income would flow to households with incomes over $1 million. Their tax cutswould average more than $114,000 each year, boosting their after-tax incomes by more than 5 percent, while the impact on low- and middle-income owners of pass-through businesses would be basically zero. Wealthy people would also get massive additional tax cuts from other proposals in Trump's tax plan.

The pass-through proposal would also invite massive tax avoidance, creating a large new tax loophole that would give wealthy people a powerful incentive to re-classify their wages as pass-through income to get the much lower 15 percent rate. The President hasn't proposed any rules to prevent tax avoidance, and experts are highly skeptical that any rules would be effective. This new tax avoidance would cost $584 billion of the proposal's $1.9 trillion cost, TPC estimates, and would only benefit high earners.

Roughly $1.9 trillion in cuts to health care coverage and care. The budget embraces the House GOP health bill's approach to "repeal and replace" the Affordable Care Act (ACA), which would take health insurance away from more than 20 million people of modest means, radically restructure Medicaid by converting it to a per capita cap or block grant, raise out-of-pocket health costs for millions more, and substantially weaken key protections for people with pre-existing conditions, while providing very large tax cuts to those at the top.

Similar to the House-passed bill, the budget proposes $1.25 trillion over ten years in cuts from repealing and replacing the ACA, including dramatic cuts to Medicaid and subsidies that help people with modest incomes afford insurance. It then proposes $610 billion in additional Medicaid cuts. In total, this amounts to about $1.9 trillion in cuts to health care and coverage over 2018-2027, the bulk of it from Medicaid -- a critical source of coverage for seniors, people with disabilities, and families with children.

As a result, the Trump budget almost certainly would boost the number of uninsured even more than the House bill. States, facing even deeper Medicaid cost-shifts, would have no choice but to impose even more draconian cuts to Medicaid eligibility, benefits, and provider payments than under the House bill, so even more low-income seniors, people with disabilities, and children and families would become uninsured or go without needed care.

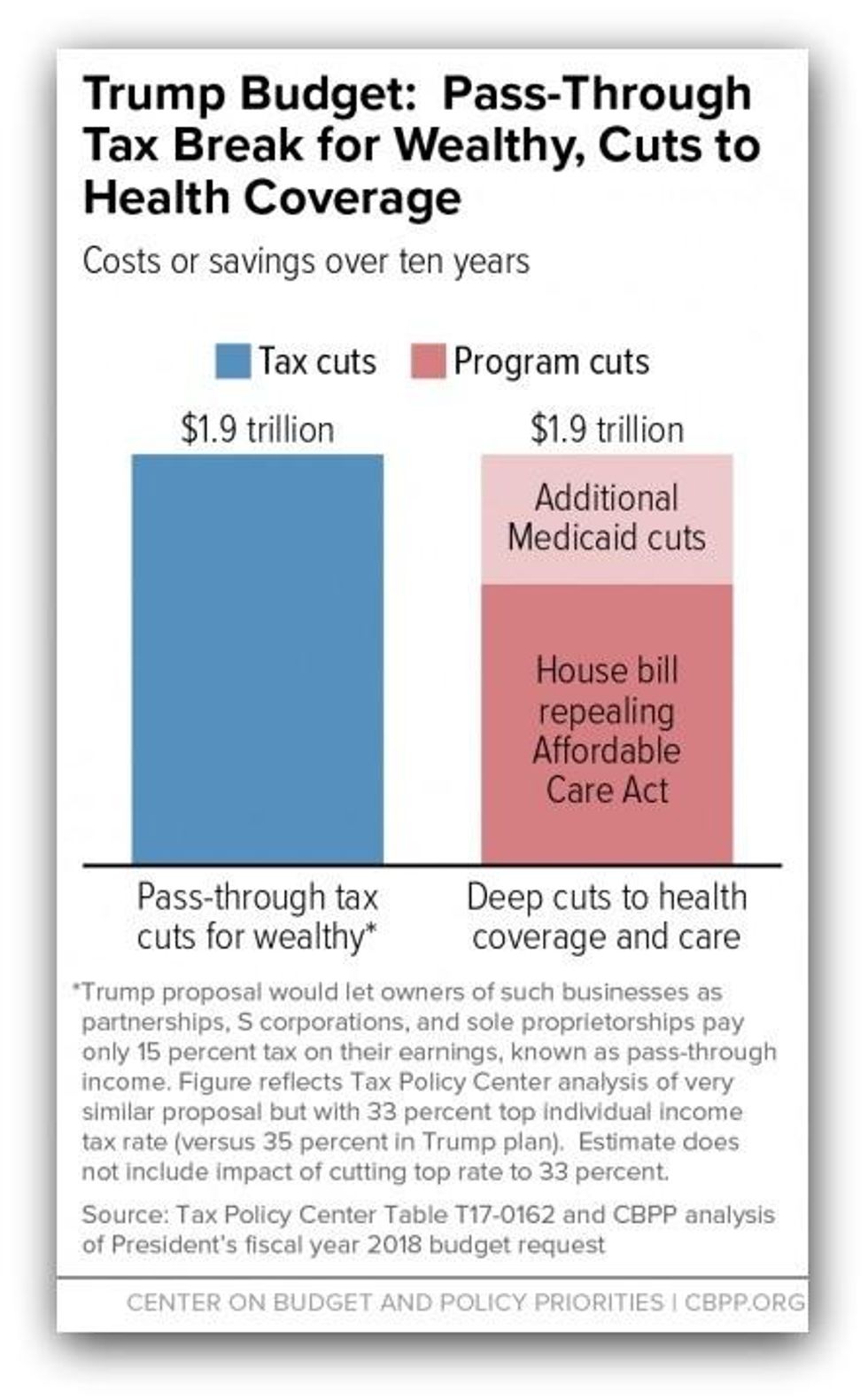

We've explained that President Trump's 2018 budget is the most radical, Robin-Hood-in-reverse budget that any modern President has ever proposed, and here's a perfect illustration: it cuts health coverage and care for poor and modest-income families by nearly $2 trillion over ten years, while giving high-income people a nearly $2 trillion tax break on "pass-through" business income. More than 20 million Americans would lose health coverage, even as the 400 highest-income taxpayers -- whose annual incomes average more than $300 million -- would get tax cuts averaging around $9 million apiece each year.

This combination of health care cuts and tax cuts for the wealthy not only underscores the Trump budget's harsh values and counterproductive priorities, it also conflicts sharply with what the President told voters he would do during his campaign.

Let's take a closer look:

A $1.9 trillion pass-through tax cut for the wealthy. Pass-throughs are businesses such as partnerships, S corporations, and sole proprietorships whose income is claimed on individual tax returns and now taxed at the same rates as wages and salaries. The President proposes setting a new, much lower top rate for pass-through income of 15 percent. That's far below the plan's 35 percent top rate for wages and salaries, and even further below the current 39.6 percent top rate, which applies to both wage and salary and pass-through income.

Although the budget doesn't specify the proposal's cost, the Tax Policy Center (TPC) estimated that a very similar proposal would cost $1.9 trillion over ten years. It would be heavilytilted to the wealthy: more than two-thirds of thetax cuton existing pass-through income would flow to households with incomes over $1 million. Their tax cutswould average more than $114,000 each year, boosting their after-tax incomes by more than 5 percent, while the impact on low- and middle-income owners of pass-through businesses would be basically zero. Wealthy people would also get massive additional tax cuts from other proposals in Trump's tax plan.

The pass-through proposal would also invite massive tax avoidance, creating a large new tax loophole that would give wealthy people a powerful incentive to re-classify their wages as pass-through income to get the much lower 15 percent rate. The President hasn't proposed any rules to prevent tax avoidance, and experts are highly skeptical that any rules would be effective. This new tax avoidance would cost $584 billion of the proposal's $1.9 trillion cost, TPC estimates, and would only benefit high earners.

Roughly $1.9 trillion in cuts to health care coverage and care. The budget embraces the House GOP health bill's approach to "repeal and replace" the Affordable Care Act (ACA), which would take health insurance away from more than 20 million people of modest means, radically restructure Medicaid by converting it to a per capita cap or block grant, raise out-of-pocket health costs for millions more, and substantially weaken key protections for people with pre-existing conditions, while providing very large tax cuts to those at the top.

Similar to the House-passed bill, the budget proposes $1.25 trillion over ten years in cuts from repealing and replacing the ACA, including dramatic cuts to Medicaid and subsidies that help people with modest incomes afford insurance. It then proposes $610 billion in additional Medicaid cuts. In total, this amounts to about $1.9 trillion in cuts to health care and coverage over 2018-2027, the bulk of it from Medicaid -- a critical source of coverage for seniors, people with disabilities, and families with children.

As a result, the Trump budget almost certainly would boost the number of uninsured even more than the House bill. States, facing even deeper Medicaid cost-shifts, would have no choice but to impose even more draconian cuts to Medicaid eligibility, benefits, and provider payments than under the House bill, so even more low-income seniors, people with disabilities, and children and families would become uninsured or go without needed care.